Where Is Retained Earnings On The Balance Sheet – 2020-09-03 00:00:00 2023-07-31 00:00:00 https:///ca/resources/accounting/what-are-retained-earnings/ Accounting English Retained earnings are defined as the net income of accumulated is made by the company held by the company at a certain time. https://oidam/intuit/sbseg/en_ca/blog/images/sbseg-retained-earnings.jpeg https://https:///ca/resources/accounting/what-are-retained-earnings/ What are retained earnings ? | Canada Blog

Retained earnings are an important part of any business. Without it, many companies will have to borrow heavily from banks, or falter in the market. If you’re starting a business and need knowledge about retained earnings, we’ve got you covered.

Where Is Retained Earnings On The Balance Sheet

At the end of the accounting period, after dividends have been paid to owners (sole proprietors, or partnerships) or shareholders (in corporations), whatever remains of the business’s net income is known as retained earnings.

Preparing Financial Statements

As the name suggests, these are the profits that are retained by the company while all other profits are distributed where they should go. Retained earnings are a component of owner’s equity or stockholders’ equity and are classified as such.

The purpose of these profits is to reinvest the money to pay for more assets of the company, to continue its operations and growth. So companies spend their retained earnings on assets and operations that drive the business forward.

Businesses calculate their retained earnings at the end of each accounting period – usually monthly, quarterly and annually. The formula is as follows.

This accounting formula subtracts the prior period’s retained earnings, plus the company’s net income, minus all dividends paid to owners and shareholders, to calculate the current period’s earnings.

Retained Earnings: Everything You Need To Know About Retained Earnings

Net income and retained earnings are not the same thing. However, net income, along with net loss and dividends, directly affect retained earnings. Net income is the total amount a company makes after taxes and expenses.

A company is taxed on its net income. Retained earnings are the amount a company receives after tax on its net income. Therefore, retained earnings are not taxed as the amount in income is already taxed.

Dividend refers to the distribution of money by a company to its shareholders. Many corporations make their dividend policy public so that interested investors can understand how shareholders are paid.

Dividends are usually paid out in cash to shareholders – to do this successfully, the company first needs sufficient cash, as well as fairly high profits. In other cases, corporations may decide to distribute additional shares of their company stock as dividends. These are known as stock dividends because they issue common stock to existing common stockholders.

Statement Of Retained Earnings Gaap Vs Ifrs: Differences And Similarities

Retained earnings can be found on the right side of the balance sheet, along with liabilities and stockholders’ equity. Take a look at the sample balance sheet below.

A balance sheet is a snapshot in time that shows the current financial position of a business. At the end of the accounting period, the income statement is first created and then the company can decide where to allocate the cash and profits.

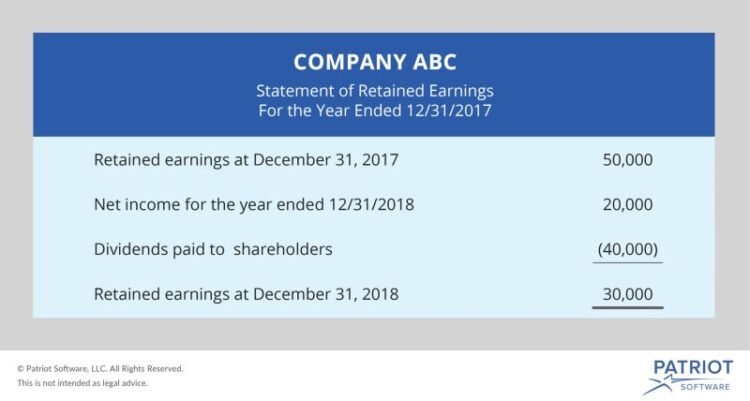

Depending on the management of the company, they will either prepare a separate statement of retained earnings or sometimes a combined statement of income and profit. A statement of retained earnings shows what comes in and out of the retained earnings account. It reflects the accumulation of profits and the distribution of those profits to the owner or shareholders.

This statement is an important indicator of the overall financial condition of the company. A high carrying amount usually indicates that the company is in good financial health, while a long-term negative carrying amount can be a sign of financial distress. It also shows all dividends – cash and stock – paid to shareholders for the accounting period.

Retained Earnings In Accounting And What They Can Tell You

An initial retained earnings figure is required to calculate actual earnings for any given accounting period. You can find this information on your business balance sheet.

To calculate a business’s growth in retained earnings, you must first divide the retained earnings of a given accounting period by the retained earnings from the beginning of the same period. Then multiply this number by 100 to find the percentage increase in your earnings over that period.

Thanks to the professional accounting software available, retained earnings can be calculated automatically, ensuring fewer errors and an accurate description of the financial position of your business. With the reporting function, companies can easily see and understand their finances thanks to the balance sheet summary and reporting features available. Try it today for free!

Intuit, , QB, TurboTax, Profile and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing and service options are subject to change without notice. One of the most important success factors for beginners studying accounting is to understand how the elements of financial statements relate to each of the financial statements. That is, after transactions are categorized into elements, it is important to know what to do next. This is the beginning of the process of preparing financial statements. It is important to note that the financial statements are discussed in the order in which the statements are presented.

Lo 2.3 Prepare An Income Statement, Statement Of Retained Earnings, And Balance Sheet

When we think about the relationship between elements and financial statements, we can think of a baking analogy: the elements represent the components, and the financial statements represent the finished product. Like baking a cake (see Figure 1), knowing the components (elements) and how each component relates to the final product (financial statements) is important to the study of accounting.

(Figure 1) Baking requires understanding the different ingredients, how the ingredients are used, and how the ingredients will affect the final product (a). If used correctly, the final product will be as beautiful and, more importantly, as delicious as the cake shown in (b). Similarly, the study of accounting requires understanding how accounting elements relate to the final product – financial statements. (Credit (A): “US Navy Chef Seaman Robert Fritschy mixes cake batter aboard the amphibious command ship USS Blue Ridge (LCC 19) underway in the Solomon Sea 130807-N-NN332-04.” MC3 Jared Harrell / via Wikimedia Commons, Public Domain; credit (b): “Easter Cake with Colorful Filling” modified by kaboompix.com/Pexels, CC0

To help accountants prepare financial statements and better understand users, the profession describes what are known as financial statement components, which are the categories or accounts that accountants use to record transactions and prepare financial statements. There are eight components of financial statements, and we have discussed most of them.

Now it’s time to bake the cake (that is, prepare the financial statements). We have all the components (components of the financial statements) ready, so now let’s go back to the financial statements. Let’s use a fictional company called Cheesy Chuck’s Classic Corn as an example. The company is a small retail store that makes and sells a variety of gourmet popcorn flavors. It’s an exciting time as the store opened in June this month.

Intermediate Accounting Solution: P3 4

Suppose that as part of your summer job at Cheesy Chuck’s, the owner—you guessed it, Chuck—asked you to take over for a former employee who graduated from college and took an accounting job in New York City. In addition to your duties of making and selling popcorn at Cheesy Chuck’s, part of your responsibility will be to account for the business. The owner, Chuck, hears you’re studying accounting and could really use your help since he spends most of his time developing new popcorn flavors.

The former employee did a good job of keeping the accounting records, so you can focus on your first task of preparing the June financial statements that Chuck can’t wait to see. (Figure 2) shows Cheesy Chuck’s financial information (as of June 30).

(Figure 2) Account status for Cheesy Chuck’s classic corn. Accountants record and summarize accounting information in accounts, which help track, summarize, and prepare accounting information. This table is a variation of what accountants call a “trial balance.” A trial balance is a summary of accounts and helps accountants prepare financial statements.

We should note that we are oversimplifying some things in this example. First, the amounts in the account were given. We have not explained how the amount will be received. This process is explained starting with the analysis and recording of transactions. Second, we ignore the timing of certain cash flows such as rent, purchase, and other upfront costs. In fact, businesses must invest money to prepare the store, train employees, and obtain the necessary equipment and supplies to open. These costs will be before the sale of goods and services.

The Four Core Financial Statements

Let’s create an income statement so we can see how Cheesy Chuck did for the month of June (remember, the income statement is

) see (Figure 3). Our first step is to determine how much the business has earned. For a certain period of time, goods and services are offered, how much are they sold for? This is the flow to the business, and because the flow is related to the primary purpose of the business (making and selling popcorn), we classify those items as revenue, sales, or fees earned. For this example, we use sales revenue. Cheesy Chuck’s earnings for the month