Difference Between Ebit And Operating Income – Gross profit, operating profit and net income are reflected on a company’s income statement, and each measurement shows profitability over a different cycle of production and revenue.

While income refers to positive cash flow in a business, net income is a complex calculation. Profit usually refers to the money left over after paying expenses, but gross profit and operating profit are determined when certain revenues and Expenses are calculated.

Difference Between Ebit And Operating Income

All three financial measures, gross profit, operating profit and net income, are listed on a company’s income statement, and the order in which they appear indicates their importance and relationship.

Net Operating Income

The top line of the income statement shows the company’s total revenue or income from the sale of goods or services. Using income projections, various expenses and alternative sources of income are added to arrive at different levels.

Gross profit, also known as cost of goods sold (COGS), is total revenue minus the direct costs incurred to produce goods for sale. COGS represents manufacturing costs associated with direct labor, direct materials or raw materials, and manufacturing facilities.

COGS does not include indirect costs such as corporate office expenses. COGS directly affects a company’s gross profit, which represents the revenue left to support the business after accounting for production costs. Gross profit does not include debt, taxes or other expenses necessary to run the company.

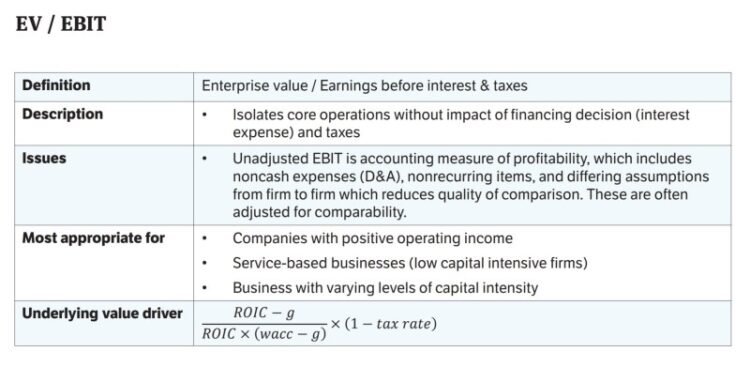

Operating profit is the residual income obtained from gross profit after including all expenses. Operating profit is also called earnings or earnings before interest and taxes (EBIT). EBIT may include non-operating income, which is not included in operating profit. If a company has no non-operating income, EBIT and operating profit will be equal.

What Is A Profit And Loss (p&l): Examples For 2023

COGS includes fixed costs such as rent and insurance and variable costs such as transportation and freight, salaries and utilities, and asset depreciation and amortization. Operating profit does not include interest payments on debt, tax expenses or additional investment income.

The profit of a company is called net income or net profit. Since net income is the last line of the income statement, it is also called the bottom line. Net income reflects the total residual income after accounting for all positive and negative cash flows.

Using operating profit projections, one-time debt expenses such as interest on loans, taxes and non-recurring expenses such as purchases of goods are subtracted. A lump sum payment is added to account for all additional income from secondary work or investments and things like the sale of property.

Net income is the most important financial measure that reflects a company’s ability to generate profits for owners and shareholders.

Ebit (earnings Before Interest, Taxes); Meaning, Importance, Calculation

For business owners, net income can provide information about how profitable their company is and what business expenses can be reduced. For investors looking to invest in a company, net income can be used to determine the company’s stock price. Helps in.

Operating income is the total revenue of a company minus operating expenses and other business-related expenses such as depreciation. The difference between EBIT and operating income is that EBIT includes non-operating income, non-operating expenses, and other income.

The bottom line is the company’s net income and the final number on the company’s income statement. The final point is the company’s revenue after subtracting all expenses from revenue.

Gross profit, operating profit and net income appear on a company’s income statement, and each measurement represents profit at different points in the product cycle. Gross profit is gross revenue minus cost of goods sold (COGS). Gross profit, operating profit or operating income is the income remaining after accounting for all expenses and COGS. Net income is the bottom line, or a company’s earnings after all cash flows, positive and negative, are subtracted.

Operating Profit: Definition, Formula, And Examples

When you visit the Site, Dotdash Meredith and its partners may store or access information in your browser, typically in the form of cookies. Cookies collect information about your preferences and device and are used to make the site work as you expect, understand how you interact with the site, and display advertising targeted to your interests. . You can learn more about our use, change your default settings and give your consent in the future by visiting our cookie settings. ) and operating income are often used interchangeably, although there is a significant difference between the two, which can lead to different numerical results. The main difference between EBIT and operating income is that operating income does not include non-operating income, operating expenses, and other income.

Earnings before interest and taxes (EBIT) is a company’s net income before interest, less income tax expenses. EBIT is often treated the same as operating income, although there are exceptions.

Investors and creditors use EBIT to analyze a company’s core operating performance before taxes and capital formation costs. EBIT is calculated as:

Since net income includes interest expense and tax expense, they must be added back to net income to calculate EBIT.

Investeps↑ Indicator About Profitability On Equity Investment

Operating income is the total income that a company earns after deducting operating expenses and other expenses necessary to run the business. Operating income shows how much profit a company makes before interest and tax expenses. Operating income is calculated as follows:

Operating expenses include selling, general and administrative expenses (SG&A), depreciation, amortization and other operating expenses. Operating income does not include taxes and interest expenses, that is why it is called EBIT. However, there are times when operating income may differ from EBIT.

Both EBIT and operating income are important metrics to analyze the financial performance of a company. However, EBIT and operating income may differ. For example, a company may have interest income that accounts for EBIT, such as Debt financing, but operating income does not account for interest income.

Furthermore, EBIT does not include debt expense (or interest expense), which is subtracted from net income. By adding interest expense to net income to arrive at EBIT, we can see the net income without debt expense. This can be useful when comparing the profitability of two similar companies, one with debt and the other without debt.

What Is Operating Profit

Operating income is also important because it shows the company’s income and expenses before operating income or expenses such as taxes, interest expense and interest income. Management earnings help investors determine how well the management team is running the company and allow comparisons with similar companies in the same industry.

It is good to use multiple metrics such as EBT, operating income and net income to analyze the profitability of a company. It is useful to compare multiple quarters or years when determining whether there is a trend in a company’s financial performance.

In the company’s annual 10-K filing for December 31, 2022, Tesla Inc. (TSLA) Income statements for the years ending 2021 and 2020 are below.

In the above example, we can see that 2022 operating income of $13.910 billion was less than the EBIT of $13.656 billion. The reason for the difference is that operating income does not include non-operating income such as interest income and other income, but is included in net income, which is used as the starting point in the EBIT formula. The difference between the two numbers reflects the importance of assuming that operating income will always equal EBIT.

Operating Income Vs. Ebitda: What’s The Difference?

In 2021, EBIT was $6.714 billion or $5.644 billion (net income) + $699 million (taxes) + $371 million (interest). The EBIT estimate for 2021 was significantly lower than that for 2022, mainly due to the spread of the coronavirus. We can see that operating income for 2021 was $6.523 billion, which is significantly lower than 2022’s $13.656 billion.

EBIT stands for earnings before interest and taxes and represents a company’s net income (or profit) before deducting debt interest and income tax expenses.

Operating income is the income after deducting operating expenses and other expenses from a company’s gross income. Operating income refers to the income from a company’s activities. EBIT is basically net income plus interest and tax expenses which are debt and taxes. Ensures the overall profitability of the company excluding expenses. However, EBIT includes interest income and other income, while operating income does not.

Operating income is not used in the EBIT calculation, but interest expense is included. Both interest and tax expenses are added to net income because those expenses are subtracted from net income to arrive at net income.

Term: Earnings Before Interest And Taxes: Ebit

EBIT is different from EBITDA, which means earnings before interest, taxes, depreciation and amortization. EBITDA also includes depreciation and net income in addition to EBIT to measure the financial performance of a company.

Authors are required to use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. Where appropriate, we cite original research from other reputable publishers. You can provide accurate, You can learn more about the steps we take to create unbiased content