Where To Invest 401k Money – A few weeks ago I talked about why we should invest. Today I want to talk about company-sponsored retirement plans, which is how most people try to invest. Especially how I choose which investments to make.

Investing in your first 401k (or 403b/457 for nonprofits and government) can be overwhelming. Everyone tells you you should do this, but no one tells you

Where To Invest 401k Money

Get it right. You’ve read all about “asset allocation” and how “index funds” are great. Conducting research is a good first step, but for most of us, it’s a different story when you want to apply knowledge to real-life situations. Because when you first log into your 401k account to set it up, you’ll be faced with an alphabet soup of:

Solo 401k Investments

With so many 401k funds to choose from, how do you know which ones to choose? If you can’t explain all the gobbledygook in a chart, how do you know which numbers to listen to, and what exactly are the smokescreens?

Once upon a time, I was in the same boat as you. I am excited to participate in my first 401k. It’s easy for me to think of what I have to offer. But then I had to think about which currency to choose. I was armed with a PDF called a “prospectus” that had all my options explained to me, and I spent hours going over each option trying to figure out which one would make me the most money.

But I stopped wasting time exploring all the options. I now focus on specific features and narrow down my choices through a process of elimination. It takes about 15 minutes in total.

Today I’m going to walk you through the process using real money examples that we can look at. I’m not going to explain all the terms because I really don’t think you need to know them all to do a good job. However, I didn’t.

How I Pick My 401k Funds In Just 15 Minutes

Disclaimer: I am not a financial expert. This article describes the factors I personally consider when choosing investment options. Do your research before making an investment decision.

Ninety-nine percent of the time I ask you to be my mother. This is the only time I would advise you not to do this.

My heart sank when I realized my mother had invested 100% of her 401k in money market funds for years. That’s right – invest in zero stocks. Someone equally notorious in the industry must have been guarding the box for him. Money market funds are the most conservative investment option and are similar to investments in terms of yield. It’s heart-wrenching to think about how much that money is.

If you invest in a 401k, you plan for retirement, which I imagine is decades from now. When the market falls, you have time to recover, so you can handle more risk.

What Is A Roth 401(k)?

Is it listed as “Short-term” in the asset class section? I declined, or I didn’t invest much money.

You can’t control what your money is used for, but you can control how much you pay to invest. Yes, investing costs money. You pay an annual fee based on the number of items, which is the “cash price.” That’s why I don’t look at statistics like past performance and ratings and just focus on the price ratio column (the green part below).

Looking at the chart, it looks like paying 0.84% tax is nothing at all, while the most expensive option in the example, 1.02%, looks perfect. But taxes can have a big impact on your results.

When you compare fund balances, be sure to pay attention to these 10 pages as well. At first glance, 0.7% and 0.07% may look similar.

Productive Ways To Use 401k To Invest In Real Estate

Let’s compare how these funds have performed over time. If you start with $10,000 and invest $5,000 per year for 30 years at a 6% return, here’s how much each will pay you.

A difference of 0.63% can pay you up to $50,000 over 30 years. For me, anything above 1% is fine.

. Generally speaking, my benchmarks are those that cost less than 0.5%, but it all depends on what options you have in your 401k plan. If most of them are expensive, your 401k plan is probably terrible.

In addition to payment fees, you may also pay other fees, such as shipping and cancellation fees, but these are not included in this example. Anyway, I avoid those too.

Should I Invest My 401(k) In Individual Stocks?

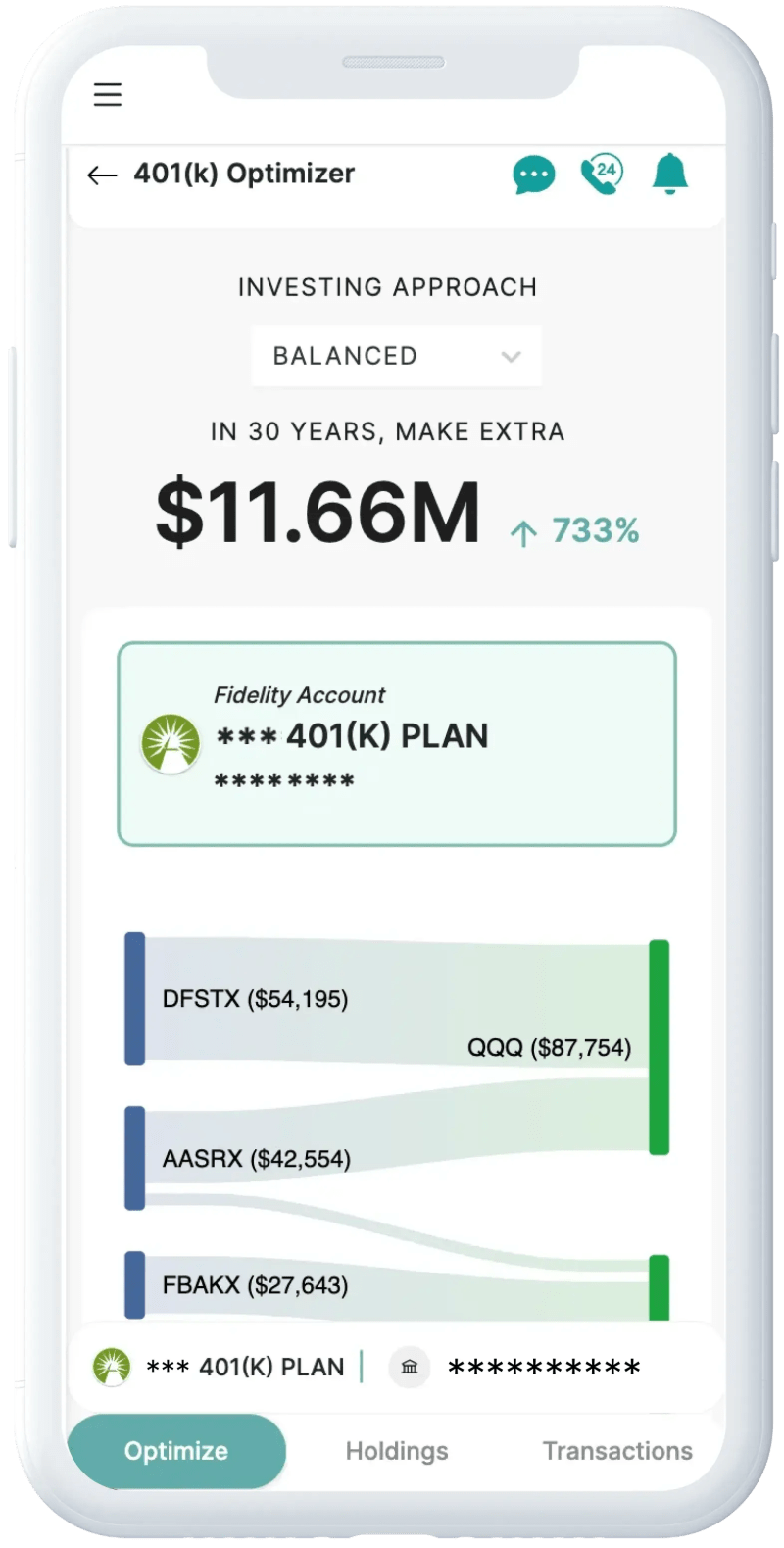

Tax calculations can be tricky, so all of my investment accounts are connected to Personal Capital, which has a nifty retirement analysis tool. Below you can see what I pay each year for each asset.

Below is another screenshot of my Personal Capital account, where you can see my annual income compared to a benchmark, as well as my losses over long periods of time.

Ignoring the top selection, we are now left with about 7 coins from the original 30. I particularly like the four highlighted in green. These are called index funds. Funds can be “directly managed” or “actively managed”. Index funds are randomly held and not only are more expensive, but they always outperform mutual funds.

How to tell which one is just an index fund? They typically have lower fees, less than 0.1%, and have the word “index” in the fund’s name.

Options With Your 401(k) When Switching Jobs — Vision Retirement

Looking at the Asset Class and Industry columns, we now have three different types of stock funds and one remaining bond fund:

Now you need to allocate the shares into the currency of your choice. You can select a single item or a combination as long as they add up to 100%. How you allocate your portfolio is an important part of your strategy and depends on your level of risk.

To illustrate this, the graph below shows the results based on different ratios. The left side is the most conservative and 100% short-term investing (that’s what my mom does). Conservative portfolios don’t earn average returns. The right side is the most aggressive, mostly domestic stocks and some foreign stocks. Having 100% of your portfolio in stocks will give you tremendous growth opportunities…

Going back to our four options and comparing their components to the chart, we have two domestic stock indexes, a foreign stock index, and a bond index to mix and match.

Should I Even Consider This 401k Investment Options?

Note: I used the chart as a guide, not actual quantities to put together my kit.

A common tip is to make sure your portfolio contains both stocks and bonds. There are plenty of questions to help you figure out how to allocate your portfolio, such as this one from CNN , although I find most of them to be conservative.

Since I still have decades to go before I have money, I will be doing some aggressive growth. Since I value simplicity, I only choose a small amount. Here are my options:

Most people will invest in some foreign stocks, but I prefer to use separate accounts for these investments. With my 401k, I like to keep it simple because the options are limited.

What To Do After Maxing Out Your 401(k) Plan

Choosing your own risk allocation can be difficult. As I said, there are issues like the one I linked to CNN above, or you can link your investment account to Capital Capital which can facilitate your allocations, below.

By focusing on a few key points, investing doesn’t have to be as difficult as it seems. If you can do the math for your 401k, you can also do the math for the investment accounts you open yourself. In summary, there are some things to consider:

I hope this article was helpful! If you want to try the Personal Capital app I mentioned for free, you can sign up here and we’ll both get a $20 bonus. Win-win.

There’s no right or wrong way to invest, so I’m interested in learning about the different approaches. What factors do you consider when choosing a 401k investment? A 401(k) plan is a retirement savings plan offered by many U.S. employers that provides tax benefits to savers. It is named after a section of the U.S. Internal Revenue Code (IRC).

K) Changes That Help You Retire Richer

Employees who sign up for a 401(k) agree to have a portion of each paycheck deposited directly into a savings account. Employers can match some or all of the contributions. Employees can choose from a variety of investment options, usually mutual funds.

401(k) plans are designed to encourage Americans to save for retirement. One of the benefits they offer is tax savings. There are two main options: traditional and Roth, each with specific tax benefits.

With a traditional 401(k) plan, employee contributions are deducted from gross income. This means money is coming

Where to invest 401k funds, how to invest 401k, how to invest 401k money, where to invest 401k money now, how to invest my 401k, where to invest your 401k, where to invest 401k now, where to invest money, after 401k where to invest, how to invest in 401k, where to invest my 401k, 401k where to invest