How Does Acorn Investing Work – Let’s be real: Investing in the stock market can be difficult from scratch But it’s the best way to build wealth – especially if you start young!

So if the thought of using an investment app like Acorns is exciting to you, we totally understand! The Acorns app makes it easy to start investing with very little money and a basic understanding of how the stock market works.

How Does Acorn Investing Work

Nor is it the only option for a new-friendly investing app That’s why in this Acorns review, we’ll help you decide if you want to use Acorns to invest:

Acorns Review 2023: A Great App To Begin Investing

Disclaimer: Now, it is important to know that the information we are sharing here is for educational purposes only It should not be taken as financial advice For this you need to talk to a professional financial advisor Our blog posts may also contain affiliate links that may earn you a small commission at no cost.

But if you decide to give Acorns a try, we’ll also guide you through signing up for Acorns and using the platform to invest. But first, let’s talk a little more about this…

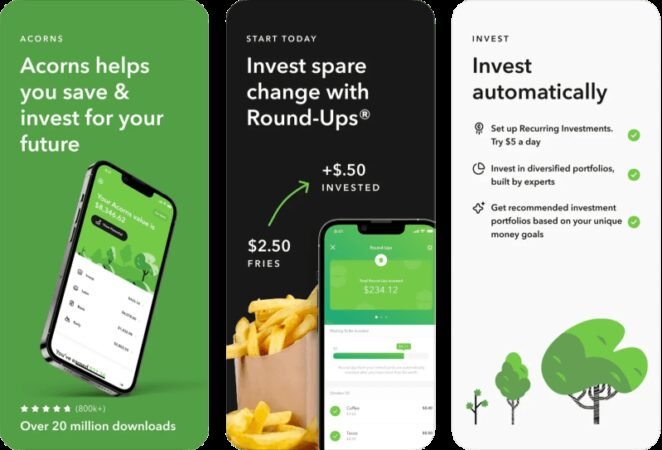

With over 4.7 million users, Acorns is one of the most popular investment apps on the market. One of its important features is that it helps you save and invest spare change

For example, if you have an extra $0.50, Acorns can help you invest in a portfolio of ETFs (exchange-traded funds).

Best Micro Investing Apps Of 2023: Stash, Sofi, Acorns, Public

Now, if you know how much a stock is worth, you also know that $0.50 is usually not enough to invest anywhere. But with Acorns, you can So…

Acorns’ premise is simple: The app turns your credit or debit card purchases so you can invest your extra money in the stock market.

For example, let’s say your lunch tomorrow costs $12.50 The Acorns app rounds your purchase up to $13 and adds $0.50 to your investment account.

When your Earnings Round-Up® reaches or exceeds $5, Round-Up Investments are transferred from your checking account to your Savings Investment Account. But you can deposit money directly into your Acorns investment account to get started right away

Acorns Squirrels Away $300m Series F After Scrapping Spac, Now Worth Nearly $2b

Micro-investing is an investment strategy that allows you to invest small amounts in stocks, bonds, ETFs and other securities. When you invest in micro, you don’t need enough money to buy a whole lot of stocks. Instead, you buy fractional shares

A fractional share is a share of a company When you buy fractional shares, you buy a percentage of the shares instead of the whole share

It may not seem like much, but these fractions can add up over time! And that’s where the Acorns app comes in… for a while it might feel like you’ve invested enough money But if you stick with it, you’ll (hopefully) see your account balance grow over time.

You should be aware that any investment strategy, instrument or application involves risk There is no way to guarantee that you will invest in the stock market Why? The stock market is always changing, which means stock prices can go up or down without warning

Investing With Acorns: Acorns Review

So what does this mean for you and Acorn Apps? It’s important to remember that when you use Acorns (or any other investment instrument), your investment is exposed to market risk. It means you may suffer financial loss But still, it means that you can make money

Acorns charges a monthly subscription fee, and the price depends on the subscription you choose Your options are an individual plan or a family plan

There is no right way to start investing You may need to experiment a bit to find the method that works best for you Here are the main pros and cons of the Acorns app to help you decide if it’s the right investment tool for your financial goals.

This is a great way to start investing in the stock market even if you don’t have a lot of money The Acorns app rounds your change to the nearest dollar and invests the money for you You can start for as little as $5

Acorns $20 Sign Up Bonus Promotion Link

Once you’ve set up your account and filled out your investment profile, the Acorns app can do the rest for you. It recommends a portfolio based on your goals, automatically invests your money when selected and rebalances the portfolio as needed.

Acorns app is a great way to learn the basics of investing You will see how the stock market works and how investing works

Even if you have no investment experience, it’s easy for you to view your account activity, evaluate your performance and add to your investment information.

One of the great things about the Acorns app is that you can withdraw money at any time without any fees. This is great if you want to use your money for urgent or unexpected expenses (Holdings in your portfolio may have sales tax implications. Ask your tax advisor for questions about your personal tax treatment.)

Acorns Safety Review: Perfect For New Investors

While the Acorns app has some great features, it is not perfect and may not be the right investment app for you. The Acorns app has one of its biggest drawbacks

However, there are fees associated with your Acorns account And while monthly subscription fees are relatively low ($3 or $5 a month, depending on the tier you choose), they can add up if you only use Acorns for small investments.

In the Acorns app, you can only invest in a limited number of investment options You can’t pick individual stocks, which means you have less control over your money Of course, Acorns made it possible to invest in Bitcoin-linked ETFs!

The Acorns app does not provide more personalized investment advice If you’re new to investing, you may not know where to start, which investment strategy is best for your goals, or how much risk you should accept. In such cases, you may want to talk to people’s financial advisors

I Used Acorns, Robinhood, And Stash For 2 Years. This Is What I Learned And Earned.

Savings accounts also don’t offer tax loss harvesting, which is a way to reduce your taxes by selling investments that are losing money and using those losses.

There really isn’t a definitive answer because it depends on your individual circumstances If you’re just starting out and want to break into the world of investing, Acorns could be a great way to do it. The application is very simple and easy to understand

However, if you are looking for more features and customization, you may want to look at other investment options, such as traditional brokerage firms.

If you’ve decided to open an Acorns investment account, here are all the steps you need to complete to get started. It’s very simple and only takes 5 minutes!

Acorns Review: Easy And Safe App To Start Investing Today

You must confirm whether you want to register an individual or family account Once you’ve decided on your account type, you’ll be asked to enter the email address of your choice and create a password.

You can also do this with the Acorn app, which you can download from the Google Play Store or the Apple App Store.

You must enter your bank login information and linked credit or debit card details. This way, Acorns can connect to your linked account and begin withdrawing excess change from your purchase. You can also use your joint bank account to fund your investment account

Next, you need to verify the phone number you shared in step 3. You will be sent a verification code via SMS.

Investing Options For Roth Iras From Acorns

You will then be prompted to create a security question These are used to verify your identity if you need to change your password

Now you need to answer some questions about your current financial situation, investment goals and risk tolerance. This helps Acorns get to know you better and give you better investment recommendations

Based on the information you provide, Acorns will recommend an ETF portfolio that best suits your goals. You can choose to skip this recommendation after the registration process

The final step is to sign and accept the referral notice This way you know that another account can be redeemed if you sign up for the app using a referral link.

How The Ceo Of Acorns Uses Behavioral Economics To Make Its Users Feel Emotionally Invested

And all! You have now successfully created your Acorns account and can start investing Of course, you may still think…

Now that you’ve created your account, it’s time to think about how to make your first investment There are a few options And if you’ve never invested before, it can be confusing So let’s take a look at two basic steps to get you started!

When you first open your account, your balance will be $0 It’s a lot