Canadian Us Dollar Conversion Rate – During the week, the Canadian dollar-US dollar peg remained one-way, with volumes limited due to mixed economic signals and the US Thanksgiving holiday on Thursday.

Earlier this week, Statistics Canada released Canadian CPI numbers that showed inflation slowed a bit more than expected.

Canadian Us Dollar Conversion Rate

Late this week, Bank of Canada Governor Tiff Macklem indicated that he believed interest rates were “restrictive enough” to keep inflation within the target range. Mr Macklem also pointed out that while it was too early to talk about a rate cut, the bank did not have to wait until inflation fell to its 2 per cent target before cutting rates. At the moment, most economists and market watchers agree that the bank will start cutting interest rates in the second half of 2024.

Foreign Exchange Rates

The general consensus is that the Bank of Canada has led the developed world in raising rates early and often, and thus often in the pace of rate cuts.

Other factors weighing on the USD/CAD exchange rate include a decline in global investor sentiment and a rebound in falling oil prices, both of which are working to weaken the Canadian dollar.

February 27, 2024 USD to CAD Update: Canadian dollar steady but several key events on the horizon this week

If you have a USD bank account in Canada and want to switch your bank account for a better rate than your bank offers, this service is for you.

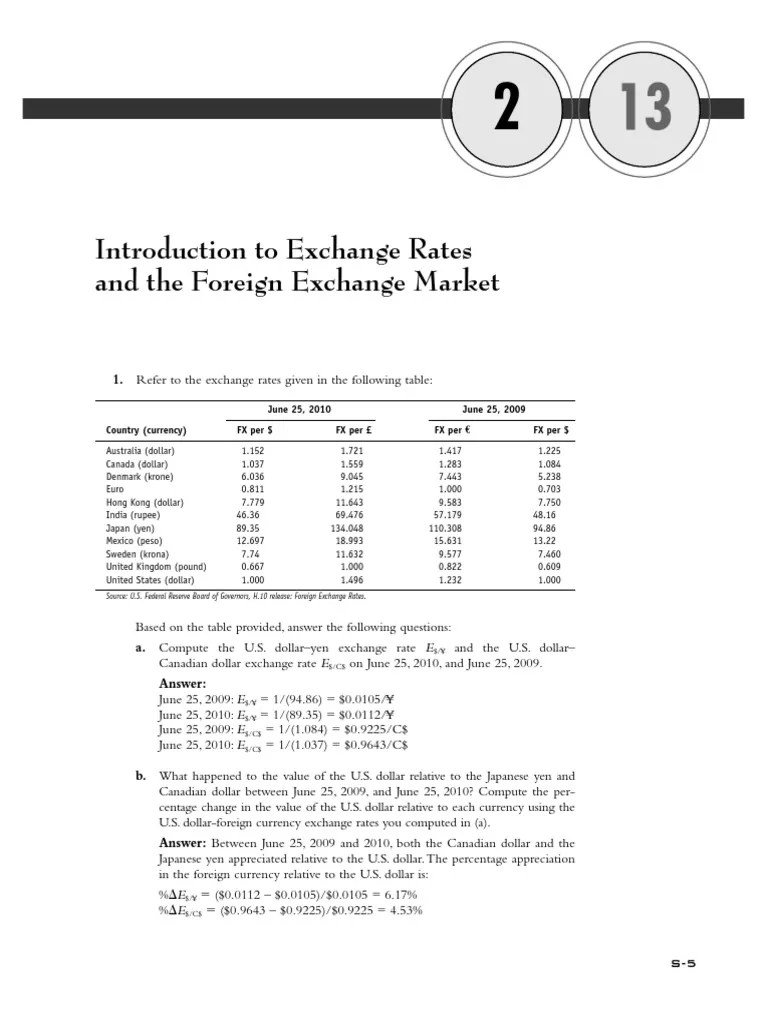

Answered: Suppose The U.s. Dollar Per Currency…

If you’re transferring money abroad or receiving money from abroad, we can also help you save money with our great exchange rates. Global Payments – Foreign currency, international payments and transfers. Buying and selling foreign currency. 100+ tradable foreign currencies.

World Money Pay® – A trusted FINTRAC regulated MSB licensed to offer over 100 foreign currencies with the best exchange rates and secure money transfers worldwide. Buying and selling foreign currency, international transfers and payments.

World Money Pay Currency Exchange customers in Toronto, Mississauga, Brampton, Oakville, Burlington, Caledon, Bolton, Concord, Vaughan, Woodbridge, Etobicoke, Ajax, Pickering, Scarborough, Oshawa, Hamilton, Niagara Falls, St. Catharines, Montreal, Calgary, Edmonton, Saskatoon, Winnipeg, Vancouver, Victoria, Banff, Whistler, Pickering, Barrie, Lethbridge, Stony Creek, Grimsby, Burnaby, Cambridge, Kingston, Surrey, Windsor, Richarvon, Halifax, Kitchener, London, Cornwall , Brantford, Peterborough, Milton, for foreign currency.

World Money Pay® is a trusted FINTRAC regulated MSB licensed to provide the most secure money transfers worldwide.

Why Pay International Invoices In Local Currencies?

Staying safe when transacting online comes with risks. World Money Pay® is a trusted FINTRAC regulated MSB licensed to issue over 100 foreign currencies with security.

Transfer funds from your credit card and send money abroad. Payment in foreign currency with standard credit cards.

“Happiness lies not only in the possession of money, but also in the joy of success and the excitement of creative endeavours.”

Buy when everyone else is selling and hold until everyone else is buying. It’s not just a catchy slogan. This is the essence of successful investing.

Us Dollar Index Falls, Canadian Dollar, Euro, Yen Gain

How many millionaires do you know who got rich by investing in savings accounts? My argument is over.

I’m going to tell you the secret to getting rich on Wall Street. You try to be greedy when others are afraid. You try to be fearful when others are greedy.

Money has never made a person happy and never will. The more one has, the more one wants. Rather than filling a void, it is a. Foreign Exchange Forecasts 2020-2021: CIBC Forecasts for Pound Sterling, Euro, Yen, Swiss Franc, US and Canadian Dollars. Posted by Tim Clayton in Exchange Rate Forecasts , Institutional Currency Forecasts , – February 25, 2020 1:33 pm

In its latest monthly report, CIBC said a softer Canadian dollar economy could trigger a rate cut by the Bank of Canada in April. While cautious from a UK perspective, the GBP/CAD exchange rate is expected to hit a three-year high in 2020 and weaken the US dollar. The US current account deficit has dominated market sentiment in recent days with heightened volatility across all asset classes as risk appetite has hurt the US dollar. The rise in global cases has fueled demand for defenses amid fears of wider damage to the global economy. A sharp drop in Chinese demand could have a negative impact on growth conditions in Japan and the Eurozone, while also affecting Swiss exports. In this context, the US economy is expected to outperform other major economies. CIBC notes; “In currency markets, during the recent risk-on sentiment, we have seen investors chase the US dollar, as opposed to other major markets, traditionally safe-haven currencies such as the yen or the Swiss franc.” . The bank still expects the dollar to weaken in the medium term, but that potential weakening has been delayed by the coronavirus and continued weakness in Europe. “The dollar should regain some of that strength over the next few months until the coronavirus scare subsides.” An important reason for the expected drop in the dollar is the current account balance, which may be related to investors’ concerns about the budget deficit. Currency markets are often dominated by yield factors, where investors allocate funds to high-yielding instruments. However, structural factors are also important, and current account deficits can weaken the currency if capital inflows decrease. With the US dollar considered too expensive to attract international capital, valuation factors will be important. The US will have a current account deficit of more than 2% of GDP in 2020 and an EU surplus of 4%. Image: Currency Accounts “In the long run, the poor US current account balance relative to other countries such as Europe and Japan should favor these currencies, resulting in a weaker dollar”. The Canadian dollar forecast shows the Canadian dollar weakening significantly more than CIBC’s consensus forecast. “If the coronavirus scare subsides and sentiment eventually improves, oil prices will recover and the ride will pull back. Therefore, the C$ should be slightly stronger than its current level in Q1 with the USDCAD around 1.32′. However, after , labor market strength weakens and aggregate CIBC is more pessimistic with expectations that GDP growth will moderate CIBC says “there may be good reason for the Bank of Canada to cut rates by 25 basis points in April” Fixed income markets don’t price in Bank of Canada interest rate moves and any rate cut will weaken the currency. The rate forecast cut is a key component of CIBC, which expects the Canadian currency to weaken and the USDCAD to reach 1.34 by the end of the second quarter. CIBC expects further weakness in the second half of 2020 with USD/CAD forecast at 1, 36 at the end of 2020. It is expected to fall to 1.30 by the end of the year, which is significantly weaker than the consensus forecast. CIBC expects a broader decline in the US dollar with a significantly weaker Canadian dollar at key meetings. A strengthening of the British pound is needed to support the pound sterling budget. As for the pound sterling, CIBC is generally cautious on the GBP outlook. “As consumers and businesses continue to be reluctant to spend and invest – at least until we see clarity in trade negotiations – fiscal stimulus will continue to be important.” The Bank therefore believes that higher fiscal spending is needed to support the growth outlook rather than stimulate a significant improvement in the growth outlook. Overall, CIBC expects the euro-pound exchange rate to move higher by the end of the year, unchanged from current levels in the second quarter of this year. Year-end GBP/CAD forecast is 1.82, up from 1.72 currently, which would be the strongest level since March 2018. In 2021, CIBC expects CBP/CAD to trade above 1.90, the highest level since December 2015 Image: GBP to CAD Exchange Rate Chart Eurozone Recovery – Looking at the Euro, CIBC believes that four factors have been key to the recent decline; “Poor demand data from Germany and Q4 looming outside the eurozone, growing political unrest in Germany, Brexit-related uncertainties and the impact of the coronavirus on China and its economy.” The Bank expects some relief this year with underlying pressures on the economy that will inevitably require expansionary fiscal policy. Economic data is expected to gradually improve, although underperformance against the US will continue. CIBC still expects EUR/USD exchange rates to rise over the course of 2020, although it has reduced the details of the forecast, giving a weaker-than-expected outlook for the eurozone. Bank of Japan regulation protects Japanese yen CIBC maintains lack of confidence in Japan’s outlook, but politics

Dollar(usd) To Naira Black Market Exchange Rate Today(abokifx) March 01, 2024

Canadian us dollar conversion, canadian us dollar exchange rate, us dollar to canadian conversion rate, conversion rate for us dollar to canadian, canadian dollar conversion rate, us canadian dollar conversion rate, us dollar conversion rate today, us dollar conversion rate, euro us dollar conversion rate, us canadian conversion rate calculator, conversion rate dollar to canadian, us dollar rupee conversion rate