Retained Earnings On Balance Sheet – More than 1.8 million professionals use CFI for accounting, financial analysis, modeling and more. Get started with a free account to explore 20+ permanent free courses and hundreds of financial templates and cheat sheets.

Retained Earnings (RE) is the portion of retained earnings that are not distributed to shareholders as dividends, but are instead retained for reinvestment. Generally, these funds are allocated to purchase capital and fixed assets (capital expenditure) or repay debt obligations.

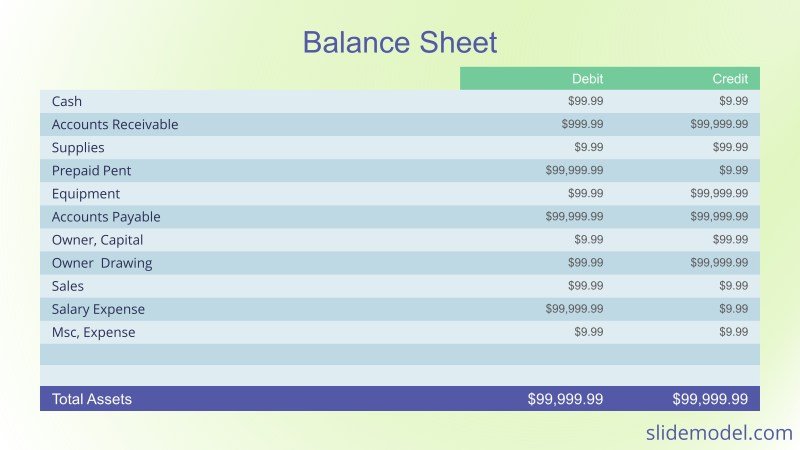

Retained Earnings On Balance Sheet

Retained earnings are reported in the stockholders’ equity section of the balance sheet at the end of each accounting period. To calculate RE, the opening RE balance is added to net income or reduced by net loss and then dividend payments are deducted. A summary report called the statement of retained earnings shows the changes in RE for a particular period

How To Read A Balance Sheet

Retained earnings represent a useful link between the income statement and the balance sheet because they are recorded in stockholders’ equity, consolidating the two statements. The purpose of retaining these earnings can vary and may include purchasing new equipment and machinery, spending on research and development, or other activities that generate growth for the company. The company aims to make this investment more profitable in the future.

If the company does not believe it can earn enough from those earnings (that is, earnings greater than its cost of capital), it usually distributes those earnings to shareholders as dividends or buys back shares.

At the end of each accounting period, the accumulated earnings of the previous year (including the current year’s earnings) minus dividends paid to shareholders are placed on the balance sheet. In the next accounting cycle, the RE ending balance from the previous accounting period is converted to the opening balance of current retained earnings.

The RE balance is not always a positive number, as it indicates that the current net loss is greater than the initial RE balance. Alternatively, dividend distributions larger than retained earnings balances may result in negative returns.

Retained Earnings Explained

Any change or movement in net income directly affects RE balance Factors like increase or decrease in net income and net loss convert the business into profit or loss. However, the same factors that affect net income affect RE as the retained earnings account may become negative due to large, consolidated net losses.

Examples of these items include sales revenue, cost of goods sold, depreciation and other operating expenses.The account also includes non-cash items such as accruals or impairments and stock-based compensation.

Dividends can be distributed to shareholders in the form of cash or stock Both types can reduce the cost of doing business for RE Cash dividends represent cash inflows and are recorded as a decrease in the cash account. These reduce the company’s balance sheet size and asset value because the company no longer has part of its liquid assets

But stock dividend does not require cash. Instead, they allocate a portion of their RE to common stock and additional paid-in capital accounts. This split does not affect the overall size of the company’s balance sheet, but it lowers the company’s stock price.

Retained Earnings In A Merger: 6 Things To Know

At the end of the period, you can calculate your ending earnings balance by taking the beginning period, adding the net income or net loss, and subtracting any dividends.

In this example, we don’t know the amount of dividends paid by XYZ, so using information from the balance sheet and income statement, we deduce the formula: RE – RE + Net Income (-Loss) = Dividends.

We can confirm that this is true using the formula RE + Net Income (Loss) – Dividend = Ending.

So we have $77,232 + 5,297 – 3,797 = $78,732, which is actually the ending retained earnings figure.

The Accounting Equation

Below is a brief video explanation to understand the importance of retained earnings from an accounting perspective

Financial models should have a separate scheme for modeling retained earnings The balance sheet uses a close calculation, where the opening balance of the current period equals the closing balance of the previous period. Between the opening and closing balances, the net profit/loss for the current period is added and any dividend is deducted. Finally, the closing balance of the project is linked to the balance sheet which helps you complete the task of linking the 3 financial statements in Excel.

This is the CFI’s Guide to Retained Earnings Check out the following additional CFI resources to help you develop your career:

Financial Modeling Tutorials CFI’s free financial modeling tutorials cover model design, model building blocks, and general tips, tricks, and…

How To Prepare A Balance Sheet: A Step By Step Guide

SQL Data Types What are SQL Data Types? Structured Query Language (SQL) includes a variety of data types that allow you to store different…

Structured Query Language (SQL) What is Structured Query Language (SQL)? Structured Query Language (also known as SQL) is a programming language used to interact with a database.

Upgrading to a paid membership gives you access to our plug-and-play templates designed to increase your productivity, as well as CFI’s full catalog and accredited certification programs.

Get unlimited access to over 250 performance templates, CFI’s complete course catalog and accredited certification programs, hundreds of resources, expert reviews and support, access to real financial and research tools, and more. Residual earnings is an important component of a company’s financial health, showing accumulated earnings or net income after accounting for any dividend payments made to shareholders. These earnings are considered “reserved” because they are not distributed to shareholders as dividends, but instead are held by the company for future use.

Retained Earnings Balance

For investors and financial analysts, retained earnings are important because they provide a deeper understanding of a company’s long-term growth potential. A company with a high level of retained earnings indicates that it is generating stable income that can be reinvested in the business or financed for future growth opportunities.

The retained earnings formula provides a way to calculate a company’s expected earnings at the end of a specified period:

Closing Estimated Earnings (RE) = Opening Period Estimated Income (BP) + Net Income (or Loss) – Cash Dividends (C) – Stock Dividends (S)

By subtracting cash and stock dividends from net income, the formula calculates the company’s retained earnings at the end of the period. A positive result means that the company adds to its target income balance while a negative result indicates a decrease in target income.

What Are Retained Earnings ?

You’ll want to find the financial statements section of the company’s annual report to find all the supporting figures you need to complete the company’s retained earnings balance and calculations.

Retained earnings provide valuable insight into a company’s financial health and future. When a business earns a surplus, it can distribute a portion to shareholders as dividends or reinvest the balance as retained earnings.

In all cases, investors want maximum return on investment, and if they trust management’s ability and know that the company has profitable investment opportunities, companies want to retain more earnings to generate more income. If a company does not have strong growth prospects, investors will want a dividend. Therefore, the company should retain earnings for dividend declaration and expansion

Retained earnings can be used to measure a company’s financial strength When lenders and investors evaluate a business, they often look at monthly net income figures and focus on retained earnings. Because retained earnings provide a comprehensive view of a company’s financial stability and long-term growth potential

Balance Sheet Overview

Unlike net income, which is affected by a variety of factors and can change significantly over time, retained earnings provide a consistent and reliable indicator of a business’s financial health. A strong retained earnings ratio indicates that a company is generating revenue and reinvesting it in the business to drive future growth and profitability.

The level of retained earnings helps businesses make important investment decisions If retained earnings are low, it may be wise to use them as a financial cushion against unexpected expenses or cash flow problems rather than holding cash and distributing it as dividends. However, if net income and projected income are significant, it is time to invest in expanding the business with new equipment, facilities or other growth opportunities.

A company’s retained earnings balance sheet can be found in the shareholder’s balance sheet (one of the 3 major financial statements), the company’s annual report, or website.

Strong financial and accounting skills are required when assessing financial capability

How To Find Negative Retained Earnings In A 10 K

Negative retained earnings balance sheet, where is retained earnings on balance sheet, retained earnings formula balance sheet, retained earnings balance sheet, appropriated retained earnings on balance sheet, are retained earnings on the balance sheet, retained earnings calculation balance sheet, calculation of retained earnings on balance sheet, retained earnings partnership balance sheet, retained earnings from balance sheet, retained earnings balance sheet example, calculate retained earnings balance sheet