Xoom Money Transfer From Us To India – In this article, I will share my experience of sending money from USA to India using different methods: Bank Transfer, Ria MoneyTransfer, MoneyGram, Wester Union, PayPal and TransferWise.

I have had to send small amounts of money from the US to relatives in India several times using traditional methods, online payment services and P2P money transfer methods.

Xoom Money Transfer From Us To India

Let’s analyze what it costs to send $500 from the US to India today, when the recipient receives the money in Indian Rupees, comparing three methods:

What’s The Best Way To Send Money To India?

For comparison, all calculations have been completed on 13 February 2021. The results are very similar whether you send Euros, Pounds or Australian Dollars.

First I have to say that for small amounts bank transfer is the worst way because the fees charged by the banks (both from the sending bank and the receiving bank in India) are usually very high. That’s why I stopped using wire transfers to send money to India many years ago because they are so expensive.

Ria Money Transfer or MoneyGram are companies specializing in sending money abroad. They have a large network of offices that I have used many times, but now they offer a money transfer service on their website.

Sending from USA to India via Ria Money Transfer includes an exchange rate of INR 72.52.

Best Ways To Send Money

This means if you send $500 to India today, the recipient in India will receive INR 36,260.00. Additionally, you have to pay a $4 fee.

PayPal is a payment method that almost everyone already knows, which allows you to make purchases from several websites and transfer money between users by email.

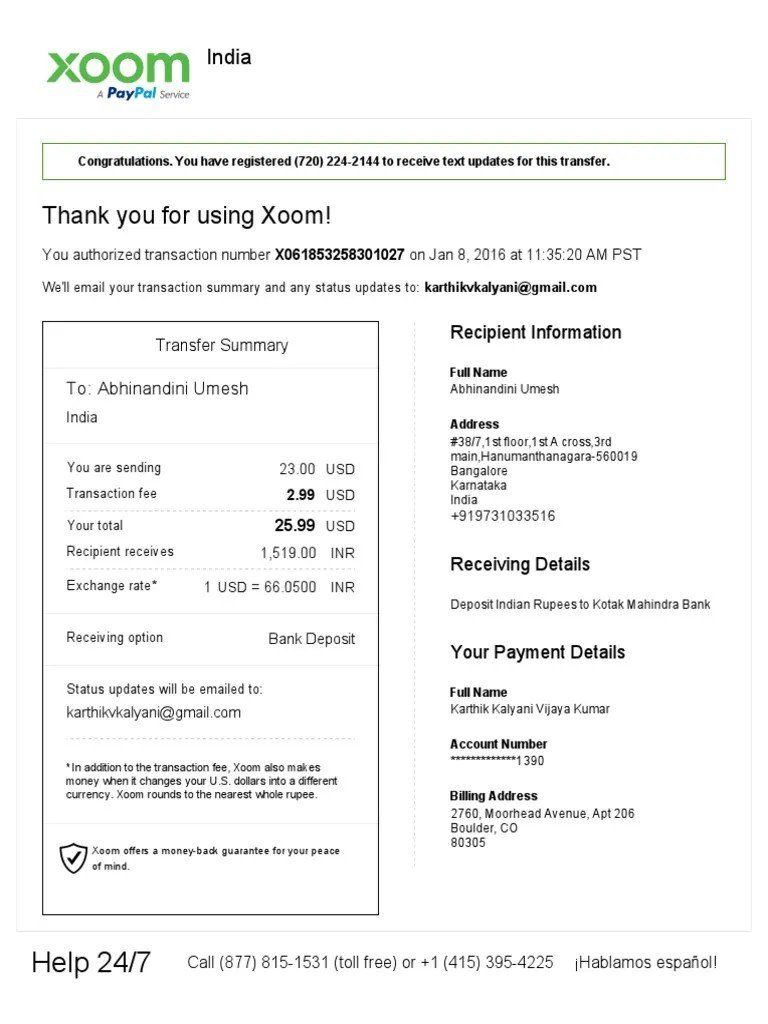

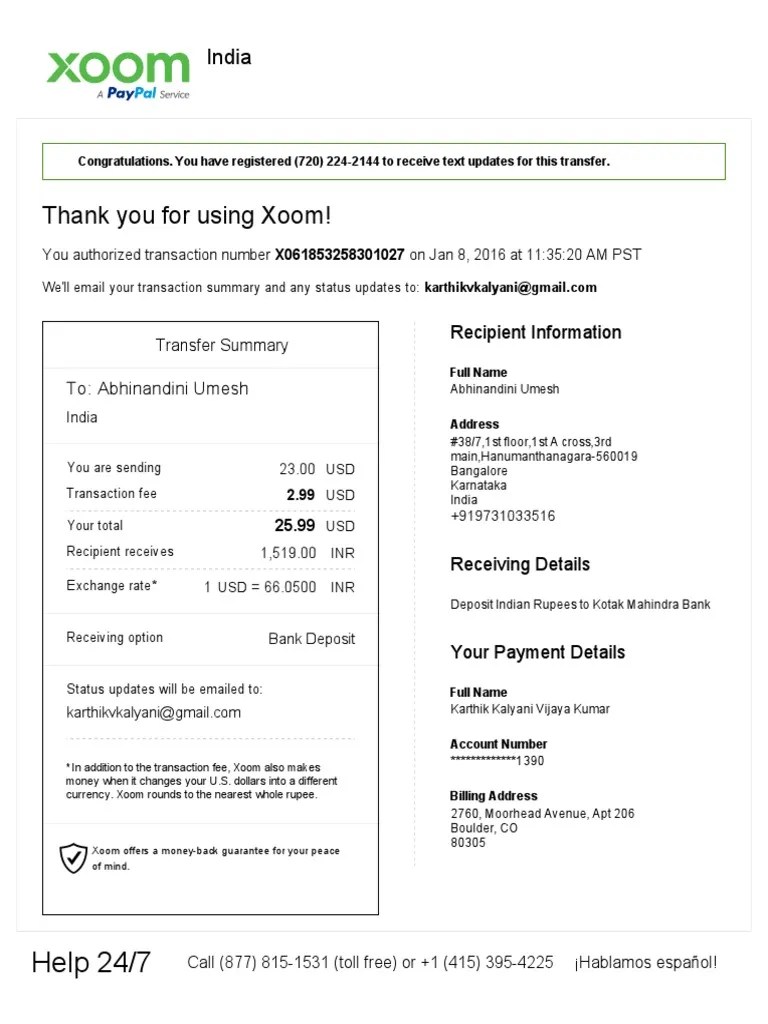

PayPal offers a service called Xoom. but sending money to India is not an economical way mainly for two reasons.

So if you send $500 to an Indian relative or friend, the commission will be at least $4.99, but your Indian friend or family member will receive a total of INR 35,890.00.

Xoom Global Money Transfer Reviews

Online services (P2P) have sprung up that offer money transfers with low commissions and currently use the real exchange rate. The most popular of all is TransferWise (from the creators of Skype).

For example, sending $500 from the US to India costs $5.09 today, but TransferWise has the advantage of charging a rate close to the actual exchange rate of 72.59 rupees to the dollar.

As a result, the recipient in India will already receive INR 35,927.99 less the applicable commission, unlike other methods where the commission is paid separately.

TransferWise’s great advantage is ease of use and good support in problem situations. That’s why I use this method.

Best Money Transfer Apps To Send Remittance Back Home

In my experience, the two best options for sending money from the US to India are TransferWise and RiaMoneyTransfer. Although Ria is slightly cheaper, TransferWise offers better support if something goes wrong.

Hi, my name is Irene. I was born in Russia in 1974, during the Soviet years. I have worked as a Russian teacher and translator and interpreter for the past 30 years. One of my main hobbies is traveling. I started this blog with one goal. to create the most comprehensive guide ever written to travel in Russia and beyond. Author of the guide “Russia 2024” (PDF).

If you have comments, questions, or concerns about the article you just read, join the community to get answers or leave feedback and comments. Finding a company that sends money to different countries around the world can be difficult. Many services that offer global coverage don’t give your beneficiary too much choice when it comes to receiving their money.

As one of the leading money transfer services, Xoom offers a wide network of money transfer options in more than 130 countries internationally. Recipients have several options for receiving their funds, and Xoom can even be used to pay utility bills in 10 countries.

Launch A Profitable Us To India Remittance Business

However, Xoom is not always open to exchange rate increases. Their fees can make them more expensive than many other online money transfer companies.

Choose how you want to pay for the transfer. You can pay with a bank account, debit or credit card.

Xoom converts your money into the recipient’s currency, allowing him to receive the money in the form he wants.

When you send money online with Xoom, you can pay for the transfer with a bank account, credit card or debit card.

Alternatives To Wise (formerly Transferwise): February 2024

Since Xoom is owned by PayPal, users can also pay for their transfers with bank accounts, credit cards and debit cards linked to their PayPal accounts. However, you cannot fund a Xoom transfer with your actual PayPal account balance.

With the basic Xoom profile, you can only transfer $2,999 per day. However, if you have verified your account and given Xoom additional credentials, your daily transfer limit will increase. With full confirmation, you can send up to $50,000 from the United States. Some of the verification information Xoom requires includes your social security number, driver’s license, and address.

Xoom lets your recipient choose how they want to receive their money. These methods include bank account deposits, cash withdrawals from various banks and partner sites, and cash delivery to their doorstep.

In addition, Xoom allows you to send money to recharge your prepaid mobile phone and transfer money to another country to pay bills.

Xoom Review: Tips & Tricks To Send Money Abroad

Xoom allows users to send money to over 130 countries worldwide. Xoom also has the option to send invoices to more than 70 countries, allowing users to pay their electricity bills and other obligations abroad.

Sending money through a bank account is the cheapest way to transfer money on Xoom, with payments starting at $4.99. However, Xoom is not the cheapest option in the industry.

For many, banks are considered a “safe” option for transferring money abroad. They are large, safe and backed by regulations and safeguards. However, banks have physical branches and must employ hundreds of people. This extensive infrastructure makes it more expensive to send money through a bank. In addition, having to go to a physical bank branch to send and receive money means much more limited access to money transfers. If you live in a country or region where your bank does not have a branch, you cannot send money easily. Xoom, on the other hand,is available anywhere you have internet, so you can send and receive money anywhere in the world. You can connect any bank account, credit card or payment card to Xoom, regardless of which account you keep. Recipients also have a better chance of receiving remittances through Xoom than through traditional banks. They can choose the most suitable way for them to receive the funds.

In an effort to compete with banks, money transfer companies such as Western Union, MoneyGram and Ria Money Transfer were founded. These companies have made money transfers more accessible by setting up branches in grocery stores and on street corners. This allowed more people to transfer money abroad, expanding the market. However, better access often means limited options for sending and receiving money. The fees charged by these traditional money transfer companies can also be exorbitant. This makes transfers more expensive for many. In comparison, the fees charged by Xoom and other online money transfer companies are often lower than those charged by traditional money transfer companies. They don’t need to maintain branches and employ thousands of people around the world.

Xoom Money Transfer: Fees For International Payments

Thanks to the widespread availability of the Internet, the online money transfer industry has made it easier and easier to send and receive money all over the world. Since these online services like Xoom, Transferwise, WorldRemit and , do not have physical branches, their overall costs are much lower. They don’t have to pay for physical office space or employ thousands of people. This allows them to maintain much lower operating costs and pass the savings on to customers. Online money transfer companies also establish relationships with banks, credit unions and credit card companies. This means consumers have more choice when it comes to sending and receiving money, making money transfers easier. When compared directly to its competitors online, Xoom charges higher fees than many others and raises its prices higher. However, compared to other services, Xoom offers more options for collecting funds or delivering cash. This makes it more affordable than some of its competitors.

Xoom interest rates are lower than the average market rate. The service raises its prices 1-3 percent higher than the average market price.

This benchmark makes Xoom a more expensive option for transferring money abroad. Many similar online money transfer services charge less than a 1% markup.

For example, if you send $1,000 through Xoom, Xoom can take $10 to $30 out of your transfer. If you sent

Send Money From Us To India

Xoom money transfer from us to india limit, xoom money transfer apk, xoom transfer to india, xoom money transfer from india to us, xoom money transfer from canada, xoom money transfer jamaica, xoom money transfer login, xoom money transfer app, xoom money transfer from usa to india, xoom money transfer to india, xoom money transfer from canada to india, xoom money transfer us to india