Transfer Money To Us Bank Account – Many of us now have multiple bank accounts. Maybe we opened one in college and it’s still in balance. Maybe another one is open to the job. Another is a joint account with a spouse. Another person bought a year’s worth of CDs at a great price. However, sometimes you may wonder how to transfer money from one bank to another.

In today’s technology-driven world, transferring money by cash, check, wire transfer, bank draft, or money order is a dinosaur. While these methods may not be as popular now as there are faster electronic ways to transfer money between traditional accounts, states, and even countries, that doesn’t mean the old methods aren’t still viable options. Additionally, if you are concerned about cost, there are cheaper transfer options available, and the cheapest option may vary depending on your particular situation.

Transfer Money To Us Bank Account

Bank representatives can help you set up many other transfer services, including transfers to another bank, state or country. If you want to transfer funds to an account at another financial institution, you’ll need your account number and the bank’s routing number to which you want to send the money. There are usually fees for transferring funds to other financial institutions.

Viral Video Bule Amerika Kagum Fungsi Atm Di Indonesia

Banks can help with many types of transfers. If you want to transfer funds from one account to another within the same financial institution, your bank can make it easy and free with an ACH transfer. You can withdraw funds from one account and deposit them at another branch or initiate a transfer online.

International transfers can also be made through your bank, but you usually need more information such as the name and address of the account holder, the financial institution to which the funds are sent, and the Society for Worldwide Interbank Financial Telecommunications (SWIFT). or International Bank Account Number (IBAN) of the beneficiary bank. International transfers in US dollars cost about $45. The cost of sending funds to a foreign currency is approximately $35. Interest rates are subject to change and may vary from bank to bank.

Founded in 2017, Zelle is one of the newest players in the payments space. The company is a US-based digital payment network that belongs to private financial services company Early Warning Services. To access this service, users (with funds deposited into their US bank accounts) must register an email address and US phone number through the Zelle app or the bank’s Zelle portal.

The sender then enters their preferred email address and recipient’s US phone number, who must have a US bank account. After the payment is made, the recipient will receive a notification with instructions on how to complete the payment. Zelle does not charge fees for sending or receiving money, but sometimes banks or other financial institutions offer the service to customers.

Wise Money Transfer Review [2023]

PayPal is an efficient way to transfer money. It allows individuals and businesses to send emails from one PayPal account to another. Sending money via PayPal is free, but the recipient will pay a fee to process the payment. Transfers under $3,000 are charged 2.9% and $0.30 per transaction.

Fees are slightly lower for larger businesses, and there are no fees for sending money to friends or family as long as the money comes from your bank account. International transaction fees are usually around 1%. Remember that you have to pay exchange rates when transferring funds to international funds.

Venmo (also owned by PayPal) is an easy-to-use money transfer app that allows peer-to-peer payments for free. Business expenses require a small fee, usually paid by the company.

Western Union and MoneyGram offer similar services that help you transfer money to another city, state, or country. They charge a flat transfer fee based on transfer speed, where you send the money, and the amount you send. Additionally, exchange rates apply when making international or international transfers. These money transfer services don’t always offer competitive exchange rates, which can lead to hidden fees when sending money abroad. However, the main advantage of these services is that they are generally very reliable and convenient.

Does Cash App Work Internationally? It’s Complicated

Example fees: A $200 transfer via Western Union to a location in the US or Canada costs about $12 for expedited transfers and about $8 for next-day transfers. Transfers to the UK cost about $22 if sent through a Western Union agent, or about $15 if transferred online. Fees are subject to change at any time.

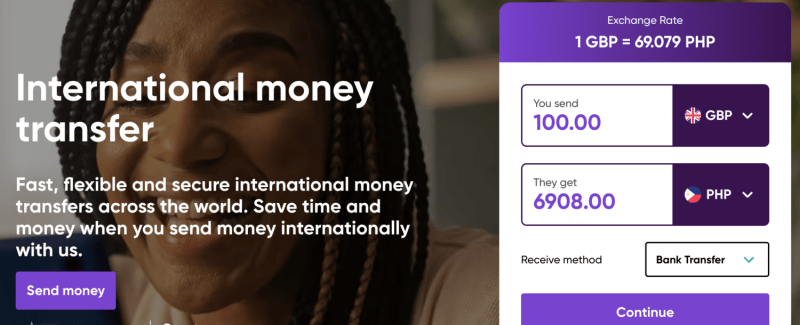

New fintech startups offering international money transfer services include Revolut, Wise (formerly Transfer) and Payoneer, which serve more than 150 countries.

Although this is considered the “old fashioned way” when transferring money, in some cases using cash can be very convenient.

If time is not a factor, taking cash and depositing it into an account at another bank is completely free! In most cases, deposits can be withdrawn immediately. Remember that sending cash by mail is discouraged. If the mail is lost, there is no way to get your money back.

How To Transfer Money From Forex Card To Us Bank Account?

As it becomes more popular and permeates the global financial system, it is now easier and cheaper to send money around the world using cryptocurrencies like Bitcoin. To send, you need to add some cryptocurrency to a digital wallet (the recipient also needs such a wallet or app). Cryptocurrency transfers are handled differently in different countries. So make sure the transfer is legal and cost-effective in your area.

Another low-cost option is to write a check and deposit it in another account, give it to someone, or mail it to a recipient in another city or state, especially if your bank offers free checks.

Things get a little trickier when sending surveys internationally. Sending US dollars abroad often delays the clearing of checks when the bank checks the deposit, and some banks may not even accept foreign checks. The recipient of the check must pay in cash and pay the exchange rate to convert the cash into local yuan. This method is safer than cash when sent by mail because you can cancel the check if it doesn’t reach its destination.

For actual foreign exchange transfers, you can purchase a money order in the destination’s currency and cash. Cheap money orders are available at most post offices. These money orders are generally cheaper than money orders purchased through a financial institution, ranging from $3 to $9. A bank money order usually costs around $10.

Send Money To Family And Friends Quickly

Money orders are generally used for smaller amounts than cashier’s checks. Therefore, the cost of buying a teller’s stock is usually higher than the cost of a money order. Although these types of money transfers may take longer, they are often a cheaper option than services such as bank transfers and can be tracked in case the funds do not reach their destination.

Some financial institutions, especially some of the larger banks in Canada, offer email forwarding services. This type of money transfer works like an electronic check. Funds are not actually transferred via e-mail, but transactions are initiated via e-mail, and the recipient is notified via e-mail of the availability of funds. A recipient’s bank account number is not required, but access to funds usually requires a security question to identify the recipient.

Sending funds by email usually only costs a few dollars and is a cheaper option if possible. Funding using this method is usually free. The service is also relatively reliable and fast, usually taking only a few days to reach the recipient’s account.

To avoid falling victim to phishing scams, only accept emails from people you know.

How To Track An International Wire Transfer

The ACATS system is an automated electronic method of transferring funds and assets between brokerage accounts. You can initiate a transfer from any broker to another broker. To do this, you’ll need to provide your personal and account information and specify which assets should be submitted.

Both Automated Clearing House (ACH) and Electronic Funds Transfers provide the convenience of sending or paying money from one bank to another via electronic transfer. ACH transfers are processed through a clearinghouse and can be used to process direct debits or direct deposits. Bank transfers allow direct transfers to bank accounts

Transfer money from us to uk bank account, transfer money to us bank, transfer money to bank account, transfer money from forex card to us bank account online, how to transfer money from us to indian bank account, us bank transfer money, transfer to us bank account, transfer money from us to canada bank account, how to transfer money from canada to us bank account, how to transfer money to us bank account, how to transfer money from us to uk bank account, transfer money from us to india bank account