Need A Quick Cash Loan – Fast Cash Loan | Apply quickly and easily with , we believe it is important to know that you can quickly get a quick cash loan for unexpected expenses. However, while convenient, easy online loans often come with high interest rates. It can help you to understand this loan and whether it is the right solution for your financial needs. Apply now

We all know what it’s like to be blindsided by unexpected car repairs, medical bills, school expenses, or home repairs. It’s not cheap and it’s not a fun experience. If you don’t have a lot of cash saved up, you might be wondering how to afford these expenses or get the quick cash loan or fast online lender you need.

Need A Quick Cash Loan

Here, we cover everything you need to know about quick cash loans, including the benefits, risks and options. Let’s dive in!

Cash Loan Repayment: How To Repay Cash Loan

These loans are short-term loan solutions specifically designed to help borrowers deal with immediate expenses or temporary cash crunches. Generally, this is the easiest option to apply for a loan. These loans are usually paid in a short period of time. They come in many forms, each with their own terms, conditions and eligibility criteria.

Payday loans are small dollar unsecured quick loans designed to tide borrowers over until their next quick payday. These quick cash loans usually last from two weeks to one month and are intended to help individuals with low credit scores or limited traditional credit.

Payday loans often come with high interest rates and fees, making them an expensive option for short-term loans. They also offer lower loan rates than other options.

A car title loan is another quick cash loan that requires the borrower to put up the title of the vehicle as collateral. The amount of the loan is determined based on the value of the vehicle, and the borrower retains ownership of the vehicle when the loan is paid off.

What Is A Quick Loan & Its Concept

If the borrower fails to repay the loan, the lender has the legal right to seize and sell the vehicle to recover the defaulted debt. Title loans are often offered with high interest rates and fees, making them a potentially expensive option for borrowers.

Personal loans are an alternative to payday loans and title loans and can offer online loans, same day fast cash options. These loans offer large loan amounts and long repayment periods, often from several months to several years.

Personal payday loans are usually unsecured, meaning they require no collateral. They often have lower interest rates than payday and home equity loans, making them a more affordable option for borrowers looking for a quick loan or quick cash.

Personal payday loans are available to individuals with a variety of credit scores, including those with imperfect credit for bad credit. And you can find them through online lenders (which usually have the easiest process), credit unions, or other reputable lenders.

Home Credit Online Loans Philippines: Get Cash In Minutes

A line of credit is another option for borrowers. Unlike traditional loans, lines of credit allow borrowers access to funds up to a certain credit limit. Borrowers can use this line of credit as needed and only pay interest on the amount used.

A line of credit provides flexibility, as borrowers can use the funds for a variety of purposes, such as covering unexpected expenses or managing cash flow issues. Interest rates on lines of credit can vary but are usually lower than payday and home equity loans. Getting a line of credit through a credit union can also save you money on interest.

Lower interest rates, more affordable, available for those with imperfect credit, sometimes faster pre-approval and same day online loans at the end of the day.

Lenders, banks or credit unions consider many factors when determining a borrower’s eligibility for a payday loan. Conditions may vary depending on the lender and the type of loan. However, there are some common criteria that most lenders consider when evaluating a borrower’s application.

Instant Cash Loans: Get Funds With Minimal Documents

These factors play an important role in determining the total cost of the loan and the affordable price for the borrower.

It’s important to compare different lenders and loan products to get the best deal possible. Be sure to consider not only the interest rate, but also the fees and other terms that may affect the total cost of the loan.

Repayment terms for payday loans can vary depending on the type of loan and the lender. Some loans, such as payday loans, require payment within a few weeks, usually by the borrower’s next payday. Title loans and payday personal loans can have repayment terms ranging from a few months to a few years.

Understanding loan repayment terms is important to avoid any surprises with your payday loan.

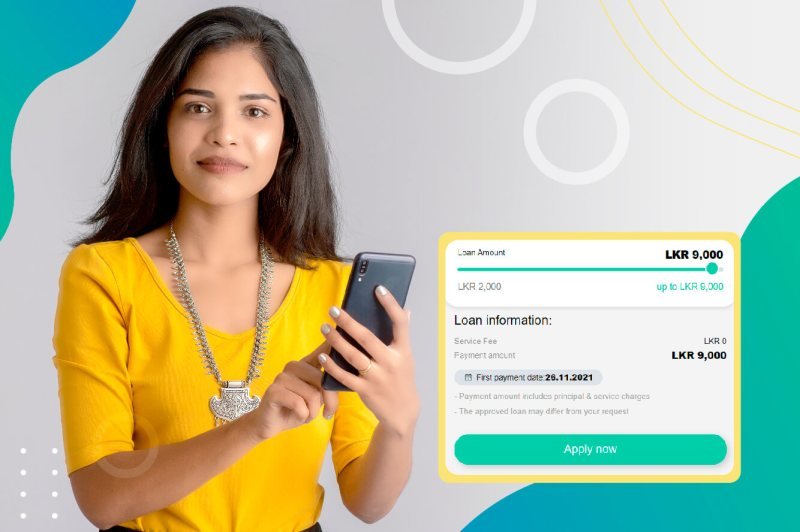

Instant Cash Loan App

Applying for a quick loan can be a simple process whether you apply online or in person – but online loans have the easiest and fastest process. To apply for a quick cash loan, be prepared to provide the following information during the application process:

After you apply for fast cash, the lender will review your information to determine if you qualify for the money. If you’re approved for a quick online loan, you can get the money in a few hours to a few business days, depending on the lender and the type of loan. Some lenders may be pre-approved instantly.

It’s important to understand the risks associated with quick or instant cash loans online, including high interest rates, fees and the possibility of falling into a debt cycle. Here is more information about the risks of quick loans:

Failure to repay the loan on time can result in a negative score on your credit report, which lowers your credit rating. A low credit score can make it harder for you to get credit in the future, including loans, credit cards, or rental properties.

Fast Cash Loan And Quick Money Website Page Template With Phone Screen And Coins, Flat Vector Illustration. Landing Page For Fast Credit And Mortgage. 17344406 Vector Art At Vecteezy

If you don’t pay off the loan, the lender may begin collection efforts, which may include contacting you by phone, letter, or email to ask you to pay back what you owe. This can be a stressful and uncomfortable experience for the borrower.

In some cases, lenders may take legal action against borrowers who default on their loans. This may result in wage garnishment, bank account taxes or property liens to repay the debt. Legal proceedings can be expensive and time-consuming for both parties.

Personal loans and quick financing options are available to get money quickly, but they serve different purposes and come with different terms.

Personal loans are usually offered by banks, credit unions and online lenders. They are usually unsecured, meaning they do not require collateral. Personal loans offer a fixed interest rate and a fixed repayment period, usually between one and seven years.

Choosing The Right Loan Term For Your Quick Cash Loan From Ml Home Loan Service

Interest rates on personal loans are usually lower than payday loans, especially if the borrower has a good credit score. These loans are often used for larger expenses such as home improvement or debt consolidation.

These loans are designed to provide money quickly. These loans are characterized by short repayment terms, usually two weeks, and very high interest rates. They are often used for emergencies or unexpected expenses.

Comparing the two, online personal loans offer a more cost-effective and manageable way to borrow money due to lower interest rates and longer repayment periods.

Online lenders often offer competitive personal loan rates and may have more flexible eligibility requirements than traditional financial institutions. However, the right choice depends on your financial situation, the amount you want and how quickly you can repay the loan.

Best 5 Instant Cash Advance Loans For Bad Credit No Credit Check

Consider the following tips to help you make an informed decision about a quick loan and avoid getting stuck in a cycle of debt.

Before taking out a quick cash loan, carefully assess your current financial situation and determine whether you can realistically afford the quick loan and its associated costs. Take into account your income, expenses and existing debts with a quick loan.

With a quick loan, it is important to borrow only as much money as is needed to cover immediate expenses. Borrowing more than you need can lead to higher interest rates and make it harder to pay off the loan quickly.

Compare different lenders and loan offers before taking out a quick cash loan. Find loans with lower interest rates, fees and better payment terms to save you money.

Loans Inc Cash Loans

Set up a quick loan repayment plan on time and in full. This may include setting aside a certain amount of money each month, cutting non-essential expenses to save money, or finding additional sources of income.

Review the loan agreement carefully and make sure you understand all the terms, including the interest rate, fees, and repayment terms. If you have any questions or concerns, don’t hesitate to ask the lender for clarification.

Your credit score is important when borrowing, including personal and quick cash loans. It shows creditworthiness and ability to repay. for personal

I need cash quick, need quick cash today, need a quick loan, i need a cash loan, need a quick personal loan, quick cash loan reviews, need quick cash now, i need a quick cash loan, quick cash payday loan, need quick cash loan, quick cash loan online, quick cash loan