Borrow Money From Friend Contract – A personal loan agreement is usually a good idea, whether you borrow money or borrow money from family or friends. This is one way to make sure both parties understand the terms of the loan. In addition, if something goes wrong, for example the borrower fails to pay, the personal loan agreement document can be enforced in court. Here’s what you need to know to write a personal loan agreement.

A personal loan agreement, sometimes called a personal loan agreement, is designed as a legally binding document to outline loan repayment terms, helping borrowers and lenders understand expectations.

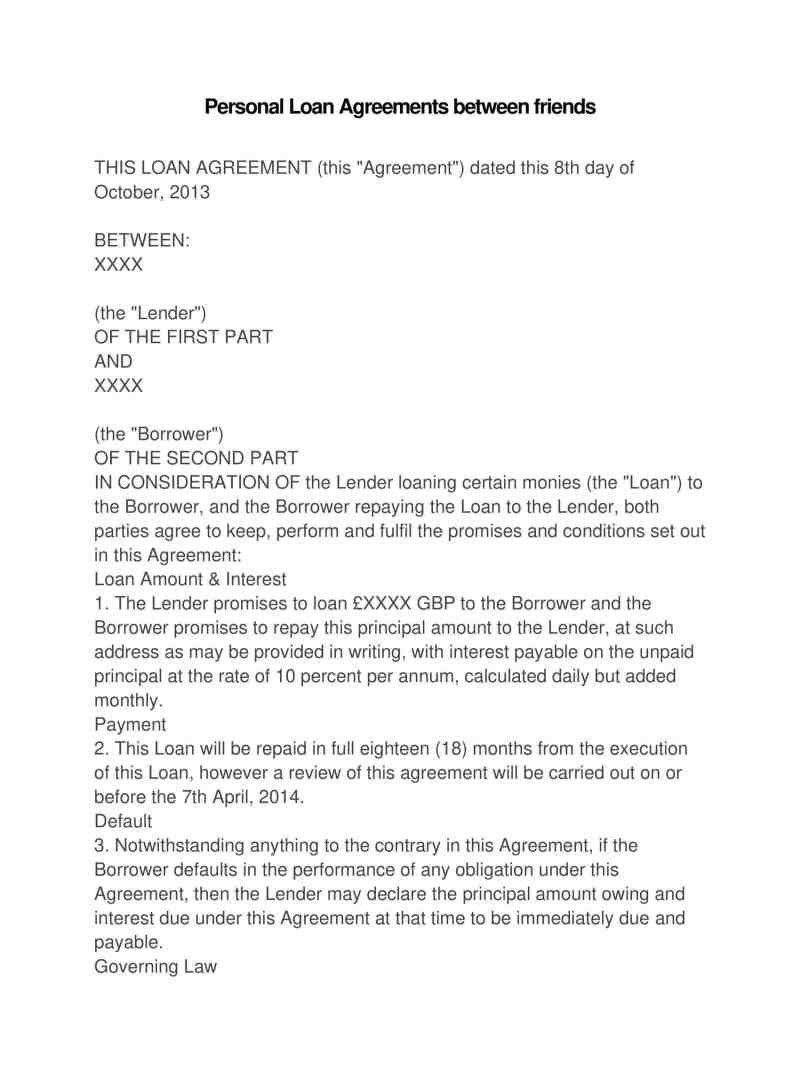

Borrow Money From Friend Contract

A personal loan agreement may also state whether the agreement includes a guarantee. While most personal loans are unsecured (meaning no assets are used to secure the loan), these offers may have collateral. A secured personal loan agreement should include a provision where the lender can make a claim on the valuables used to offset the risk of the loan.

Free Loan Agreement Template (2021 Updated)

Most personal loan agreement documents include information about the borrower and lender, loan amount, interest rate, fees, terms and payment schedule, how disputes are resolved, and the type of collateral (if any) that will secure the loan.

Personal loan documents are considered enforceable in court, so judgments such as liens or wage garnishments can be levied against borrowers who fail to meet their obligations.

A pre-negotiated contract is usually used when signing a personal loan agreement with a traditional lender. If you borrow or borrow from friends and family, you may need to write a personal loan agreement document.

If the amount is modest, a simple bill of exchange may suffice. However, in some cases, a more complex contract may be required. Here are some things to consider when making a personal loan agreement:

Free Loan Agreement Template For Every State

Although not required, it may be wiser to have someone else witness the signature (even the signature) or assign a notary to witness the signing.

While many personal loan documents are fairly simple, some can be more complicated due to additional terms often included in business or bank loans. Some of the items you may see include:

While you can write your own agreement from scratch, there are several templates that can make it easy to create a personal loan agreement document. Here are some examples of how to fill out parts of the template:

1. Parties: This Personal Loan Agreement (this “Agreement”), dated September 19, 2023 (“Effective Date”), made by and between Jane Doe (“Borrower”), whose mailing address is 123 Main Street, City. of Anytown.IN, in the State of Delaware, and John Doe (“Lender”), in the City of Anytown, in the State of New Jersey, with a mailing address of 123 Anne Street.

Things To Keep In Mind When Lending Money

2. Loan Amount: The amount forwarded by the Lender to the Borrower is: Ten Thousand Dollars ($10,000).

3. Payment: This Loan Agreement, which consists of the principal amount and accrued interest, will be paid and paid in the manner described below:

☐Single Payment: Loan, unpaid interest, and all other fees and charges must be paid: Upon Lender’s Request/On or before ______/_____/20____

Weekly installments of ☐__________ dollars ($________) begin on ____/_____/20___ and continue every 7 days until the entire balance is paid in full.

What Can You Do Legally When Someone Owes You Money?

X monthly installments of one hundred and eighty dollars ($188) will begin on 10/19/2023 and will continue each month until full payment of all balances.

Quarterly installments of ☐__________dollars ($________) begin on the ____ day of each quarter and continue each quarter until the entire balance is paid in full.

X This loan agreement costs an annual compound amount at a rate of 4.95% (4.95%). It must be equal or less than the maximum interest rate in the borrower’s situation.

☐ This loan agreement includes late fees. If the borrower does not make the payment within _________ days from the contract expiration date. In this situation, the borrower agrees to pay a late fee equal to ________% of the amount owed to the lender at the time of nonpayment.

Lending To Family And Friends

X This loan agreement can pay off the loan in full at any time without paying any fines or additional payments.

☐ The borrower will be charged an additional fee equal to ________% of the amount paid more than the agreed payment plan.

The Lender reserves the right to require verification of income from the Borrower. Such verification may include at least the following:

The occurrence of any of the following events shall constitute an “Accelerating Event” under this Loan Agreement:

Reasons Why You Need A Promissory Note When You Borrow Money From Family And Friends + Template

9. Acceleration: If any of the foregoing Acceleration Events occur, Lender may, at its sole and exclusive option, declare this Loan Agreement immediately due and payable.

10. Remedies: The Lender has the right to remedy any breach of this loan agreement. Lender’s delay or failure to exercise its rights under this Agreement shall not constitute a waiver of such rights. Furthermore, no omission, waiver or delay shall invalidate any of the stated terms, or prevent the Lender from enforcing this Agreement. Lender’s rights and remedies shall be cumulative and may be exercised individually, sequentially or simultaneously at Lender’s discretion.

11. Subordination: The borrower’s obligations under this loan agreement are subordinated to all other debts of the borrower, if any, to unaffiliated third party lenders.

12. Waiver: Lender will not be considered to have waived all rights in this loan agreement unless provided in writing. However, this will not be considered as a future waiver of such rights or other rights under these terms and conditions.

Free Loan Agreement Template

13. Legal Fees: If all payments made in this loan agreement are not made when due, the borrower agrees to pay, in addition to principal and interest, reasonable attorneys’ fees. The amount of such fees shall not exceed the maximum interest rate in the State of New Jersey on amounts owed by the Borrower under this Loan Agreement. This amount will be added to all other reasonable expenses incurred by the Lender in exercising its rights and remedies if the Borrower’s default.

14. Governing Law: This loan agreement shall be governed by and construed in accordance with the laws of the State of New Jersey.

15. Successor: This loan agreement binds the borrower and the borrower’s heirs, successors and assigns, however, the Lender cannot assign any of his rights or determine any of his obligations without the prior written consent of the owner of this agreement. .

16. Signature: In faith whereof the borrower has signed this Business on the day and year written above.

Contract Of Loan Fontanilla

The Securities and Exchange Commission (SEC) also has a template you can use to create a personal loan agreement.

No, there is usually no need to notarize a personal loan agreement. However, it may be helpful to keep an “official” record of the contract to encourage both parties to take the terms seriously.

Yes, it is possible to modify the original if all parties involved are willing to modify the agreement. However, there should be an agreed process to follow.

Generally, you should charge interest according to the prevailing market. However, you are only limited by state law (usually the opinion of the borrower). You may charge up to the amount permitted by state law.

Should You Take Legal Action If A Friend Borrowed Money And Won’t Return It?

A promissory note is often considered a type of loan agreement. However, many promissory notes are much simpler than full contracts, because they only state the amount of the loan and when it must be repaid.

Whenever you borrow or lend money, consider having a loan agreement to protect both parties and clarify the terms, especially when lending money to family and friends. Writing personal loan agreement documents can keep all parties informed and reduce misunderstandings about loan terms and repayments.

Authors are expected to use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. Where appropriate, we also reference original research from other reputable publishers. You can find out more about the standards we follow in producing accurate and impartial content in our Editorial Policy. If you find yourself with unexpected bills or debts, you may need a loan from a friend or family member. Maybe you need a loan to pay rent or medical bills. Sometimes, when an unexpected expense comes up and you don’t have any savings to spend, you need cash. When this happens, you may need to reach out to friends or family members for financial help.

Before you embark on this path, make sure you are on the right path financially. Also, check that you are trying to save at all costs. It’s rude to ask for money while still splurging on unnecessary items and travel. You should also find someone you are close to and have regular contact with. I am trying to ask my uncle for a loan

Memorandum Of Agreement

Borrow money from friend, friend borrow money, borrow money from a friend, contract to borrow money from family, borrow money from friend tax, borrow money contract, contract to borrow money, contract for borrowing money from a friend, borrow money from friend letter, contract for loaning money to friend, loan friend money contract, borrow money contract sample