Xoom Money Transfer To Usa From India – If you’re wondering how to send money from India to the US, this is the article you’ve been looking for.

Sending money to any foreign country is called remittance and the process comes with many rules and regulations. Especially if it is a large amount and the transfer is through a bank or other public financial institution. In this article, we will look at the different ways to send money to someone in the United States through banks or any other method available.

Xoom Money Transfer To Usa From India

TransferWyse is not a bank, it is an electronic transfer system that excels at one thing: sending money internationally. That’s why it’s cheaper than banks (which have commissions).

Xoom Money Transfer: The Disruptor That Wasn’t

As you can see, Transferwyse will provide you with the exchange rate on Google.com for that day.

They are a cheap way to exchange money around the world. The bank or service provider you choose will charge you the requested amount. They can be replaced if lost or stolen. However, they may delay the recipient receiving the money. It is a good option if you want to save money and are not in a hurry.

PayPal is a popular way to transfer money and buy products in different formats. It’s easy to transfer money from India to the US with PayPal. Create a PayPal account in India and link your bank account to it. The account number will be your email ID. Once you’re logged into your account, you can transfer money to another PayPal account in the US using the “Send Money” option.

The change depends on the date of the transfer. Recently, RBI has set strict rules for the use of PayPal in India. Please check with PayPal customer support before making a purchase.

About: Xoom Money Transfer (ios App Store Version)

RemitOut is India’s first online money transfer service and can currently be used to pay tuition fees for students studying at the university. to whom the money is to be paid. The transfer fee is $5 and the money reaches the recipient within two business days.

Funds can be received as a draft or bank account credit and the process can be tracked online.

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is the fastest way to transfer money offline through Indian banks. To make this transfer, you need to go to your bank and fill in the transfer form with information such as the recipient’s name, account number, bank address and swift code. After submitting this form, the funds will be deducted from your account and transferred. for the beneficiary it is 72 hours.

Money Gram is an international money transfer system similar to Western Union. It offers two types of services called Same Day service and Economy service. In the same-day service, the money is sent to the gram agent at your location and you can collect it the same day. In finance, the money is sent to your bank account and received within three days.

Paypal’s Xoom Adds Upi Payments Enabling Nris And Pios To Remit Money To India In Real Time

Replacement costs vary by job and quantity and can be found on the Cost Estimate page.

The Indian postal department has tie-ups with remittance agencies like Western Union, Money Gram etc. to send money abroad. It has a limit because the amount you earn is $2500 and you can only earn 12 of that per year. post and read more about the process.

Sending money through the necessary documents is the oldest and cheapest method and can be used if you have no other options. You can go to the bank where you have an account and create the documents you want to transfer.

The transaction will be done in dollars and the corresponding rupees will be debited from your account. The bank will charge Rs.200 to 600 for doing the registrations. The documents are sent by post and can reach the recipient within 7-10 working days. You have to pay shipping costs again and the package cannot be tracked.

Remitly Vs Xoom: What Are The Differences?

If the account is in the same bank in India and USA, you can use this transfer method. It is also called electronic transfer.

It is similar to how you transfer money to Indian bank accounts and the money is received within the same day or more than two days.

To send money online, visit their website and enter the USD amount you want to transfer and the reason for the transfer, to compare the different rates offered by RBI approved banks and brokers. Once you have selected a certain price, save it. Provide necessary documents for verification. After verification, the amount will be transferred to the nominated bank through NEFT/RTGS. The loan will be paid to the beneficiary within two working days.

To transfer money online from India to USA, visit their website and enter your bank details, recipient’s bank details, identity documents and other necessary confirmation. The money is transferred within two days. There are no fees associated with international transactions.

How Much Money Can Be Sent From The Usa To India?

Another option is to use your bank to send money to your loved ones in the US. Many banks offer remittance options including ICICI Bank, AXIS Bank and many more. You must always state the purpose of your presentation. For example, student loans, moving, family planning and more.

The annual limit for transferring money from India to the US is $125,000. You can transfer unlimited funds from your NRE account and a maximum of $1,25,000 per year from NRO accounts. Above this limit you need to get permission from RBI.

No, transfers from India to the US are not taxable. However, if it exceeds $100,000 in the current year, you must file Form 3520 with the IRS. This is a tax-free way to raise awareness. But if the money is donated, gift tax may be added in the US.

NO. Google Pay now allows customers in the US to send money to friends and family in India and Singapore. Not the other one.

Best Ways To Send Money To India

A separate tab (link / link) can be found in the “Payments and transfers” menu of the online banking platform (money transfer section).

For first-time users/participants in international transfers (foreign transfers) and adding beneficiaries, the sender must go to the “International Beneficiary” section of their profile.

So that’s it. More than ten ways for those looking for how to send money from India to USA. In this article, I will share my experience of sending money from USA to India using different methods: Bank Transfer, Ria MoneyTransfer, MoneyGram, Wester Union, PayPal and TransferWise.

Several times I have sent small amounts of money to relatives from the US to India using traditional methods, online payment services and P2P money transfer methods.

Xoom Money Transfer: Fees For International Payments

Let’s see how much it costs today to send $500 to India from the US, receive the money in Indian rupees, compare three methods:

For comparison purposes, all figures were taken on 13 February 2021. The results are very similar when sending Euros, Pounds or Australian Dollars.

The first thing I must say is that for small amounts, bank transfer is a very bad option, as the fees charged by banks (by the issuing bank and in India) are usually very high. For this reason, I stopped using wire transfers to send money to India several years ago because they were too expensive.

Ria Money Transfer or MoneyGram is a specialized company for sending money abroad. They have many offices, which I have used at various times, although they now offer money transfer services through their website.

Money Transfer Services Market Size ($110.8 Bn By 2032 At

Sending $500 to India from USA via Ria Money Transfer costs INR 72.52.

This means if you send $500 to India today, the recipient in India will receive INR 36,260.00. In addition, you must pay a fee of $4.

PayPal is a payment method already known to almost everyone, which allows you to make purchases on many websites, as well as transfer money between users via email.

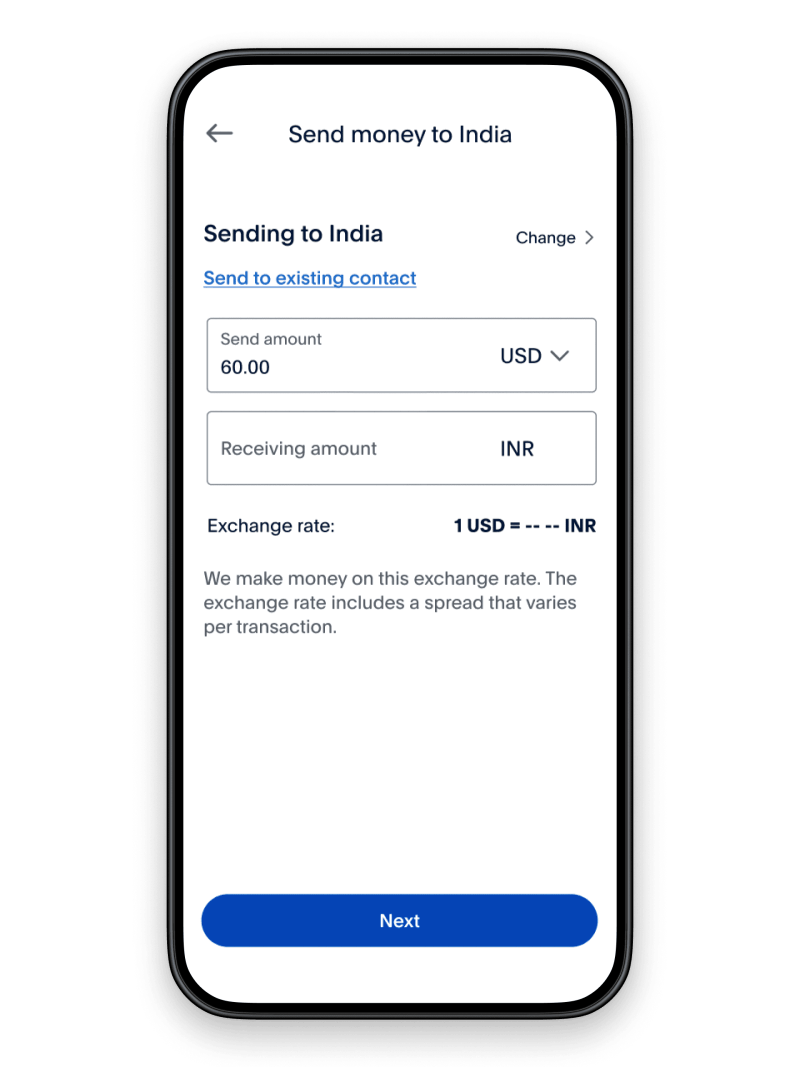

PayPal has a service called Xoom. but it is not a cheap way to send money to India, mainly for two reasons:

Remitly Vs Xoom Vs Wise (transferwise) Showdown: Which Is Better?

So if you send $500 to an Indian relative or friend, the transaction would be $4.99, but your Indian friend or relative would receive 35,890.00 Indian Rupees.

Online (P2P) services have emerged that offer exchange rates with low commissions and use real-time exchanges. The most popular of all is TransferWise (from the creators of Skype).

For example, sending $500 from the US to India today comes with a fee of $5.09, but

Xoom transfer money from india to usa, xoom money transfer to mexico, xoom money transfer app, xoom money transfer to usa, xoom money transfer from canada to india, xoom money transfer jamaica, xoom money transfer from canada, transfer money with xoom, xoom money transfer to brazil, xoom money transfer to pakistan, xoom money transfer login, xoom money transfer to india