Citibank Money Transfer To Other Bank – Step 3: Click on “Use Your Card Now”. If your card is activated, continue to the next step.

Managing multiple accounts and cards can sometimes be confusing, as account names are no longer an issue. Create an account name for easy identification and successful trading!

Citibank Money Transfer To Other Bank

Manage your transfers efficiently by setting up your favorite transfers and naming them for ease and convenience.

Citibank Review 2024: High Yield Savings Account, Cd Rates, Checking, And More

It is often not necessary to pay regular bills on time. With recurring payments, make one payment and leave the future to us!

To ensure that your user ID is unique and secure, your user ID and password must meet the following requirements:

Step 2: Click on “Create Your Card”. If your card is activated, continue to the next step.

Step 3: Your ID will appear on the screen. Click “Log in now” to log in to online banking with your current password. If you forgot your password, you can reset it below.

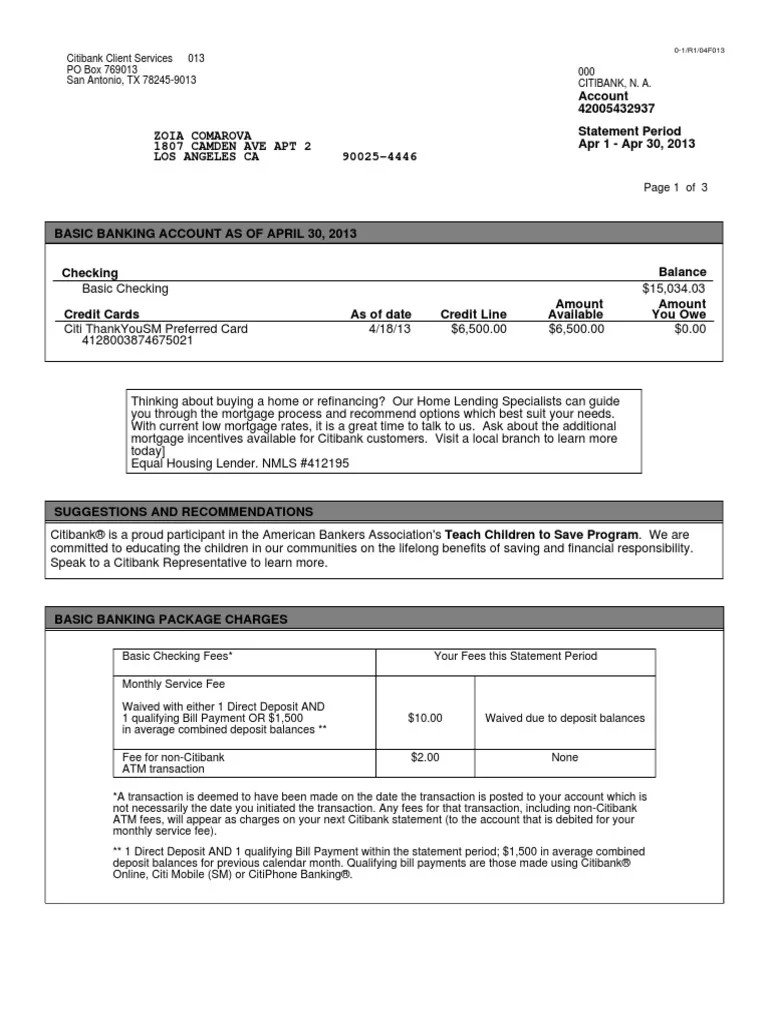

Citibank Banking Fees

Step 2: Your ID will appear on the screen. Click “Log in now” to log in to online banking with your current password. If you forgot your password, you can reset it below.

Step 3: The process is complete. Click “Log in now” to log in to online banking with your current password. Or if you don’t have an online bank account, click on “Register Online” to create an online bank account.

We do not recommend that you download the beta version, as it is experimental and may change significantly before release. Please download the latest version.

If you are not ready to update your browser or if you are not using one of the operating systems, you can visit our website. However, if the browser refuses, you should update the browser for free on the company’s website.

Citibank Net Banking: Manage Your Money Anytime, Anywhere

Transport Security (TLS) is a protocol that provides secure communications between computers or mobile applications and our servers. TLS is responsible for ensuring privacy and integrity when data is sent over the Internet.

Please note that to access CitiBusiness Online and the Citi Mobile® app, your operating system and browser on all your devices (desktop, mobile and tablet) must be compatible.

TLS 1.2. Some browsers do not support TLS 1.2 by default, and you may need to manually enable it in your browser’s Internet Options. Enable TLS 1.2 manually: FAST is an electronic service that allows you to securely transfer your money to your account.

It only takes a click to start sending money instantly to your checking and savings account to make a payment or send money to someone.

How To Remove / Unlink Citi Credit Card From Online Account

If it is a fast transfer to the receiving bank/institution, the FAST option will automatically appear under “Verification and Confirmation”.

Select an electronic payee from the “On account:” drop-down list to transfer or click “Add Payee”

Withdraw money from your other accounts in an online savings/checking account without logging into other bank websites to initiate the transfer.

This only applies if you have previously set up a debit account. Please note that there is currently no option to create a new debit account.

I Lost $1,600 When I Used My Citibank Account

There are many ways to pay for Citi Credit Cards and Citi Ready Accounts. The easiest way is through the Citi Mobile® app.

Click on the Citi Credit Card/Citi Ready credit card you want to pay under your account

Select your preferred account under ‘Account From’ to pay by Citi Credit Card/Prepaid Credit Card

Go to the Citi Credit Card / Citi Ready Credit Card you want to pay under your account and click “Pay”

Citi Can’t Have Its $900 Million Back

Under “Payments & Transfers”, select your preferred account under “Account From” to pay by Citi Credit Card/Prepaid Credit Card

Under payment information, select “Singapore Limited” as the payee and enter the following as the Account Number

Note: The steps may vary depending on the bank/institution and the bank/institution. If you have trouble adding/setting up a payee, please seek assistance from another bank/institution.

Forgot your bank account number! With PayNow, you can send and receive money almost instantly using your mobile phone number, NRIC/FIN, UEN or billing address.

Guide To Citi Thankyou Rewards Transfer Partners

To enjoy this convenience, link your mobile number or NRIC/FIN to your Citi account online or via the Citi mobile app now.

Please note that from 15 April 2019, Singapore Limited will work with the new SWIFT Bank Identifier Code (“BIC”) and bank code for SGD management. The new BIC and bank codes can be found in the table below.

To ensure that your transaction is successful, you must select the correct BIC when initiating new transfers to your Singapore account and/or wire transfers to your Singapore Limited account. These changes apply to global consumer bank transfers (asset management products and services, unsecured and secured products), Citi Business Banking accounts and Citi International Banking Bank accounts and apply to Fast and Fast Transfers (FAST). . ,

The City of Singapore has decided to keep separate accounts to deal with legal issues. Accordingly, Singapore Limited will issue a new SWIFT Bank Identifier Code (BIC) and a new bank code for SGD transactions. This means that you will need to use these new codes when making any SGD transactions in Singapore Limited (eye care products and services, non-insured products and insurance), International Private Accounts and Citi Business Accounts.

Payments And Transfers

All standard transfers will not be affected by changes to the BIC and bank code.

However, from 15 April 2019, when you initiate a new SGD transfer from your Singapore Limited account to another Singapore Limited and N.A., Singapore branch account, you must ensure that you select the correct BIC (see Table 1 above). No action is required in the form of payment.

If you are having trouble transferring money to your Singapore account, please delete the settings and re-enter new transfer instructions.

Effective April 15, 2019, the SWIFT Bank Identifier Code (BIC) will be changed to CITISGSL. This feature covers new SGD fund transfers (for SGD only) made through interbank payment systems such as Fast and Secure Transfer (“FAST”), GIRO Internet (“GIRO”), MAS Payment System (” GIRO”)”). MEPS”) and wire transfer (“TT”) to Singapore Limited.

Send Money From The United States

To process SGD incoming/outgoing payments (in SGD only) to your Singapore account(s), please provide the SWIFT Bank Identifier Code (BIC) as CITISGSL to the appropriate party.

Payments made to account(s) with an incorrect BIC will not be processed and you may be charged additional fees.

For transfers of income in other currencies, there is no change to the existing BIC code (CITISSGGCB) and bank code (7214).

4. Is there any change to my “Bill Payee” for another Singapore Limited account already set up in my account?

Citi Credit Cards Of March 2024

5. What if I want to add a new salary to another Singapore Limited account?

If you are adding a payee online or through the Citi Mobile App, select Account (Local) or “Electronic Transfer (GIRO/MEPS/FAST).

If you choose to pay SGD electronically, please ensure that you enter your SWIFT Bank Identifier Code (BIC) correctly.

6. What should I do if I send money to another person’s branch account in N.A., Singapore from 15 April 2019?

Citibank Review 2024

There will be no change in the legal entity name and bank identification code associated with the transfer to N.A. branch accounts in Singapore.

As such, you do not need to make any changes to the pre-paid accounts set up for normal transfers to N.A., Singapore branch accounts.

However, please note that now the various bank payment instruments (FAST, GIRO, MEPS, TT) will have two bank names when you initiate and/or receive a payment order as shown in table 1 above and the correct legal city name institution. and bank identification code.

Express (Fast and Secure Transfer) is a national money transfer service that allows users to pay almost instantly to anyone in Singapore. Start using this service by selecting “FAST Transfer” when transferring GIRO/MEPS/FAST payees online.

Best Balance Transfer Credit Cards Of January 2024

MEPS stands for Transfer through the Money Institution Singapore Payment System, which allows you to transfer S$5 from your account to other bank accounts in Singapore on the same day to a nominal amount.

GIRO is an electronic payment method that allows you to send money and takes 2 to 3 business days to process. This can be a form of transportation

Chase money transfer to other bank, transfer money to other bank, citibank credit card balance transfer to other credit card, how to transfer money from citibank credit card to other bank account, how to transfer money citibank, citibank how to transfer money to other bank, citibank fund transfer to other banks, citibank credit card fund transfer to other banks, how to transfer money other bank account, transfer money to citibank account, money transfer other bank, how to transfer money from citibank to other bank