Short Term Quick Cash Loans – Applying for a loan is an important step in achieving your financial goals. In this article, we explore the process of applying for your first loan with Mapova Finance, a reputable financial institution known for its hassle-free loan application process and competitive interest rates. In the fast-paced world we live in, financial emergencies can happen when we least expect it. Whether it’s an unexpected medical expense, vehicle repair, or a sudden opportunity that requires immediate funding, getting reliable short-term loans can be a life saver. Mapova Finance is a top choice when it comes to fast, hassle-free financing in South Africa, offering a range of benefits that make it a trusted name in the industry.

Quick Decision: When time is of the essence, waiting for loan approval can add unnecessary stress to an already urgent situation. At Mapoa Finance, they understand the need for immediate assistance. With its streamlined application process and advanced technology, MPOVA Finance provides instant decisions on loan applications. You’ll know within minutes whether you qualify for a loan, eliminating the long waiting periods associated with traditional lenders.

Short Term Quick Cash Loans

Same Day Cash Out: Getting approved for the loan is the first step. The next major factor is receiving money on time. Once your loan is approved, Mapova Finance guarantees that if you apply and get approved before 3pm that day, you can expect cash disbursal on the same day. This feature allows you to meet your financial needs without any delay, giving you the peace of mind you need.

Quick Fast Cash Loan Reviews

Short-Term Loans: Mapova Finance specializes in short-term loans, designed to provide temporary financial assistance until your next payment or expected income. These loans offer flexibility and flexibility, allowing you to overcome financial hurdles quickly without the burden of long-term obligations.

Transparent and flexible terms: While considering a loan, it is essential that you understand the terms and conditions involved. Mapova Finance prides itself on transparency, fully informing borrowers of interest rates, repayment schedules and any applicable fees. Additionally, they offer flexibility in loan repayment, allowing you to choose a plan that suits your financial situation.

Exceptional Customer Service: MPOVA Finance places special emphasis on customer satisfaction. Their dedicated team of experts is readily available to answer your questions, guide you through the application process and provide assistance when needed. With its friendly and helpful approach, Mapova Finance aims to make your loan experience as seamless as possible.

When urgent financial needs arise, Mapova Finance has emerged as the leading short-term loan provider in South Africa. With its quick decision facility, same day cash payments and focus on short term loans, Mpova Finance ensures you get fast and reliable financial assistance when you need it most. Their commitment to transparency, flexibility and exceptional customer service further strengthens their position as a trusted provider in the industry. By opting for MPOVA Finance, you can be assured that your short-term financial problems will be resolved promptly, allowing you to move forward with confidence. You can apply for a loan 100% online by filling our application form with cash in your account the same day! This type of loan is controversial because of its risks, but it remains an attractive solution for some.

Payday Loans Online

If you need cash quickly and are considering borrowing from a lender that only allows up to 6 weeks for repayment, make sure you understand the potential pitfalls first.

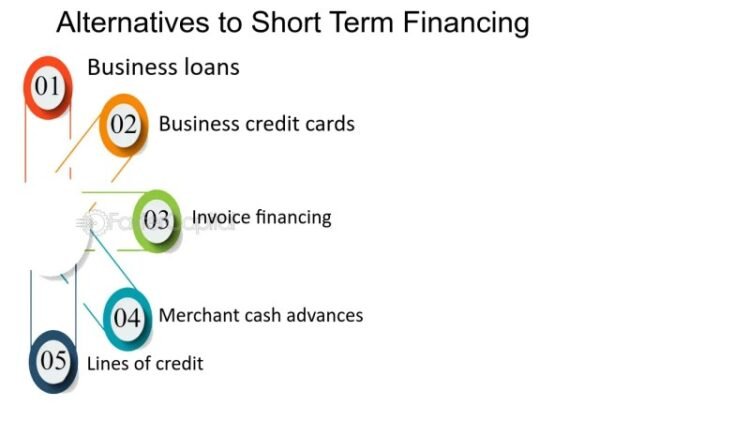

Keep reading to learn what short-term loans are, why they’re problematic, and what to consider instead.

Short-term loans are when you borrow money for a relatively short period of time and often for small amounts (usually less than $1000).

Short-term loans are designed to be repaid within a few weeks or the next time the borrower makes a payment.

Where Can You Go If You’re In Need Of A Quick Quid?

If you repay the loan within a few weeks, you can manage the amount you pay as interest.

However, short-term debt can quickly become a burden on your back, because the longer you take to pay it back, the more interest you’ll pay (more on interest rates later).

The truth is that short-term loans can worsen your financial situation if you don’t repay the loan within a few weeks.

As you go past the initial loan period – usually a few weeks – the amount of interest you pay increases significantly.

How Can You Get Quick Cash Loan When You Don’t Have Any Credit History By Good To Go Loans

You get stuck in a cycle of debt where you can’t pay your bills at a high cost of paying back the debt, pushing you further into debt.

This is a terrible situation that no one wants, but it is a reality for many people who take out short-term loans.

Holds a Financial Advice Provider License issued by the Financial Markets Authority. We can quickly assess your financial situation and provide you with options that are in your best interest.

You need to make sure that the loan you take is for your benefit and not just to line the pockets of the lender or loan broker.

Instant Payment Flat Vector Illustration. Quick Cash And Credit Loans Services Cartoon Concept. Invoice Payment Terms On White Background. Short Term Investment Fund, Deposit Period Isolated Metaphor 4461875 Vector Art At Vecteezy

Our practices follow the strict guidelines set out in the FSS Code of Conduct, which means we have the best interests of our clients in mind.

To understand why short-term loans can cause problems for borrowers, we need to talk about interest rates.

Interest is the fee a lender charges for lending you money. This is charged as a percentage of the amount you borrow.

For example, a typical interest rate for someone with a good credit history might be 12.95% per annum.

Short Term Loans Uk: Your Only And Best Option For Quick Funding By Sam Robson

So, on a $500 loan, you’ll pay less than $65 in interest if you pay it back within 12 months.

With short-term loans, interest is usually charged daily because they are designed for very short loan periods.

The daily interest rate usually ranges from 0.25% to 0.80%, which may not seem like much, but it adds up quickly and will take you longer to repay the loan.

For example, a $500 loan pays about $20 in interest over a four-week period — plus a capital fee, which is typical for most lenders.

Short Term Loans In The Philippines: Types, Application Process, And Alternatives

However, if it takes you 12 months to pay it back, you’re looking at about $250 in interest, not including the penalty your lender charges you for late payments.

In short, short term loans come with high interest rates. If you actually pay back the loan in a few weeks, it is fine, but if it takes too long, it becomes difficult to repay the loan and puts you in a dire financial situation. ,

The new rules limit interest and fees charged on loans to no more than 100%, and no compound interest on high-cost loans.

As members of the Responsible Lenders and Financial Services Federation – they support this move to protect people under financial stress.

What Is A Loan, How Does It Work, Types, And Tips On Getting One

Some lenders—including prime rate lenders—are motivated by how much profit they can make on your loan.

While we believe that short term loans should definitely be a last resort, it offers emergency loans to those who need immediate funds.

Sometimes things come up where you want instant cash. If you find yourself in this situation, contact the care team.

Complete our 3-minute online application form and we’ll get back to you with more information.

Get Instant Easy Short Term Loan Online

We put your loan application across 11 different lenders so you can choose the best deal for you.

It’s a smart choice when you need a quick fix. If you need a small amount of cash immediately, give us a chance.

If you have bad credit, there’s no end to us: we’re experts in finding smart solutions for people in difficult financial situations.

Our loan amounts start at just $2,000 and our minimum repayment period is 6 months. Most of our loans are unsecured, but sometimes we need to take our collateral on a car or other property to approve the loan.

Fast Cash Loan

It’s free to talk to us – get in touch today and we’ll give you a free loan estimate. At no cost or obligation, we will review your financial situation and discuss some options with you.

Responsible lenders will run a credit check as part of this process, as your credit history provides them with valuable information about how you are handling your debt.

Having a bad credit score doesn’t mean you can’t get a loan and you can always improve your credit score if you pay your loan regularly and on time.

With, you don’t have to hide your credit score from us. We have helped thousands of borrowers get fast, fair, affordable loans regardless of their credit history. Find out how it arranges bad credit and second-chance loans for people with bad credit.

Easy Payday Loan In India. Easy Approval. Apply Now.

There is no such thing as a “1 hour loan” or an “instant loan” because lenders have to go through several checks before giving you money.

Won’t keep you waiting. We offer same day loans – our tagline is better loans, faster and that’s what we do.

After you finish our 3 min

Cash loans quick approval, quick cash loans 5000, short term cash loans, quick instant cash loans, quick cash title loans, quick cash loans online, quick cash loans canada, quick cash auto loans, quick short term cash loans, quick cash business loans, short term cash loans bad credit, fast loans quick cash