Can I Get A Loan From My Bank – A personal loan bank is a financial institution that provides loans to individuals for personal use. These loans can be used for a variety of purposes such as debt consolidation, home improvements, medical expenses, or even vacation financing. Personal loan banks offer borrowers a one-time payment that is repaid with interest over a period of time.

1. Loan Application Process: To apply for a personal loan from a bank, individuals must fill out an application form and provide proof of identity, proof of income, and bank statements. To determine the borrower’s creditworthiness, the bank evaluates the borrower’s creditworthiness, income stability, and debt-to-income ratio.

Can I Get A Loan From My Bank

2. Loan Amount and Repayment Period: For personal loans, banks usually offer loan amounts ranging from $1,000 to $100,000, depending on the borrower’s creditworthiness and ability to pay. Personal loan repayment terms are usually one to five years, although some banks may offer longer terms.

Can I Apply For A Bank Financial Loan Online

3. Interest Rate: Personal loan banks usually charge interest on the principal amount of the loan, which is usually expressed as the annual percentage rate (APR). The interest rate may depend on various factors, such as the borrower’s credit rating, income level, loan amount and term. Generally, borrowers with good credit scores can secure lower interest rates.

4. Equity Loans and Unsecured Loans: Personal loans can be secured or unsecured. Secured loans require collateral, such as a car or real estate, which the bank can repossess in case of default. On the other hand, unsecured loans do not require collateral, but may have higher interest rates due to the higher risk for the bank.

5. Loan approval and withdrawal: After the loan application is submitted, the bank reviews the information and decides on loan approval. After approval, the loan amount is transferred to the borrower’s bank account. The time required for loan approval and payment may vary depending on the procedure of the bank and the complexity of the application.

6. Loan Repayment: Personal loans are repaid in monthly installments that include principal and interest. Borrowers should pay on time to avoid late fees and penalties. Some banks may offer flexible payment options, such as paying extra or paying early without penalty.

Business Loan From A Bank

7. Credit Effect: Taking a personal loan can affect a borrower’s credit score. While paying off your loan on time can help improve your credit score, defaults or late payments can negatively affect it.

Finally, a personal loan bank is a financial institution that provides loans to individuals for personal use. These loans can be used for various purposes and are repaid with interest within a specified period. Loan amounts, interest rates, repayment terms and eligibility criteria can vary between banks, so it’s important for borrowers to research and compare offers before making a decision.

Finding a bank for personal loans can be a daunting task, especially since there are so many options. However, with a little research and careful consideration, you can find a bank that fits your needs. Here are some steps to help you find it:

1. Determine your loan requirements: Before you start looking for a personal loan bank, it is important to determine how much money you need to borrow and what the terms of its repayment should be. This will help you narrow down your options and find a bank that offers loans that fit your specific needs.

How To Get A Better Interest Rate With Your Bank: How I Cut 25 Per Cent Off My Loan With One Call To My Lender

2. Research Different Banks: Start by researching the different banks in your area that offer personal loans. Look for banks with a good reputation and positive customer reviews. You can also check their websites to gather information about their loan offers, interest rates and eligibility criteria.

3. Compare interest rates: Interest rates can vary widely between banks, so it’s important to compare them before making a decision. Find banks that offer competitive interest rates that match your creditworthiness. You can use online loan comparison tools to make the process easier.

4. Check Eligibility Criteria: Every bank will have its own criteria for personal loans. Check that you meet the minimum income, credit and employment stability requirements. This will help you remove the banks that are not suitable for your situation.

5. Consider additional fees and charges: In addition to the interest rate, banks may charge additional fees and charges for personal loans. These include processing fees, late fees, and prepayment penalties. Carefully review the terms to understand the full cost of the loan.

Automotive — How Do I Add A New Bank Account?

6. Ask for referrals: Talk to friends, family and colleagues who have already taken out a personal loan. Ask them about their experiences with different banks and whether they recommend a particular institution. Personal recommendations can often be valuable in finding a reliable bank.

7. Visit a bank and talk to a loan officer: After selecting a few banks, visit them in person and talk to a loan officer. This will allow you to ask any questions and better understand the bank’s loan process. Also, meeting with a loan officer will help you evaluate the bank’s customer service and whether it meets your needs.

8. Read customer reviews and ratings: Before making a final decision, read customer reviews and ratings of the bank you are considering. This will give you an idea of the bank’s reputation and customer satisfaction. Look for banks that have a good track record of providing a positive borrowing experience.

By following these steps, you can find a personal loan bank that offers competitive rates, favorable terms, and excellent customer service. It is important to take the time to consider your options before making a decision, as a personal loan is a long-term financial commitment.

Ways To Get Emergency Cash Immediately Malaysia Edition

Using a personal loan from a bank can provide many benefits to individuals who need financial assistance. Some of the main advantages of getting a personal loan from a bank are:

1. Flexibility: Personal loans allow borrowers flexibility in using the funds for different purposes. Whether it’s consolidating high-interest loans, financing home repairs, covering medical expenses, or even planning a vacation, personal loans can be used for any legitimate reason.

2. Low interest rates: Personal loans usually have lower interest rates than other types of loans, such as credit cards or payday loans. This makes them a more affordable option for borrowers, especially those looking to consolidate their debt into a single, manageable payment.

3. Fixed repayment terms: When you get a personal loan from a bank, they offer you a fixed repayment term. This means you know exactly how long it will take to pay off the loan and can budget accordingly. A fixed repayment period helps borrowers better plan their finances and avoid surprises.

Questions To Ask Before Applying For A Personal Loan

4. Improve your credit score: If used responsibly, a personal loan can actually help improve your credit score. Paying off your loan on time shows financial responsibility and can improve your credit rating. This can be especially beneficial for individuals with bad credit who are looking to rebuild their credit.

5. Quick access to funds: Banks generally have an efficient loan processing system that allows borrowers quick access to funds. Once your loan is approved, funds can be disbursed within days, allowing you to meet your financial needs immediately.

6. Low fees: Banks often offer personal loans with lower fees than alternative lenders. The usual fees associated with personal loans, such as loan origination fees or prepayment penalties, are more reasonable when borrowing from a bank.

7. Improve customer service: Banks are prioritizing customer service by providing a more personalized experience to borrowers. You can meet face-to-face with loan officers who will guide you through the application process and answer any questions you may have. This level of assistance can be especially important for first-time borrowers who are unfamiliar with the loan process.

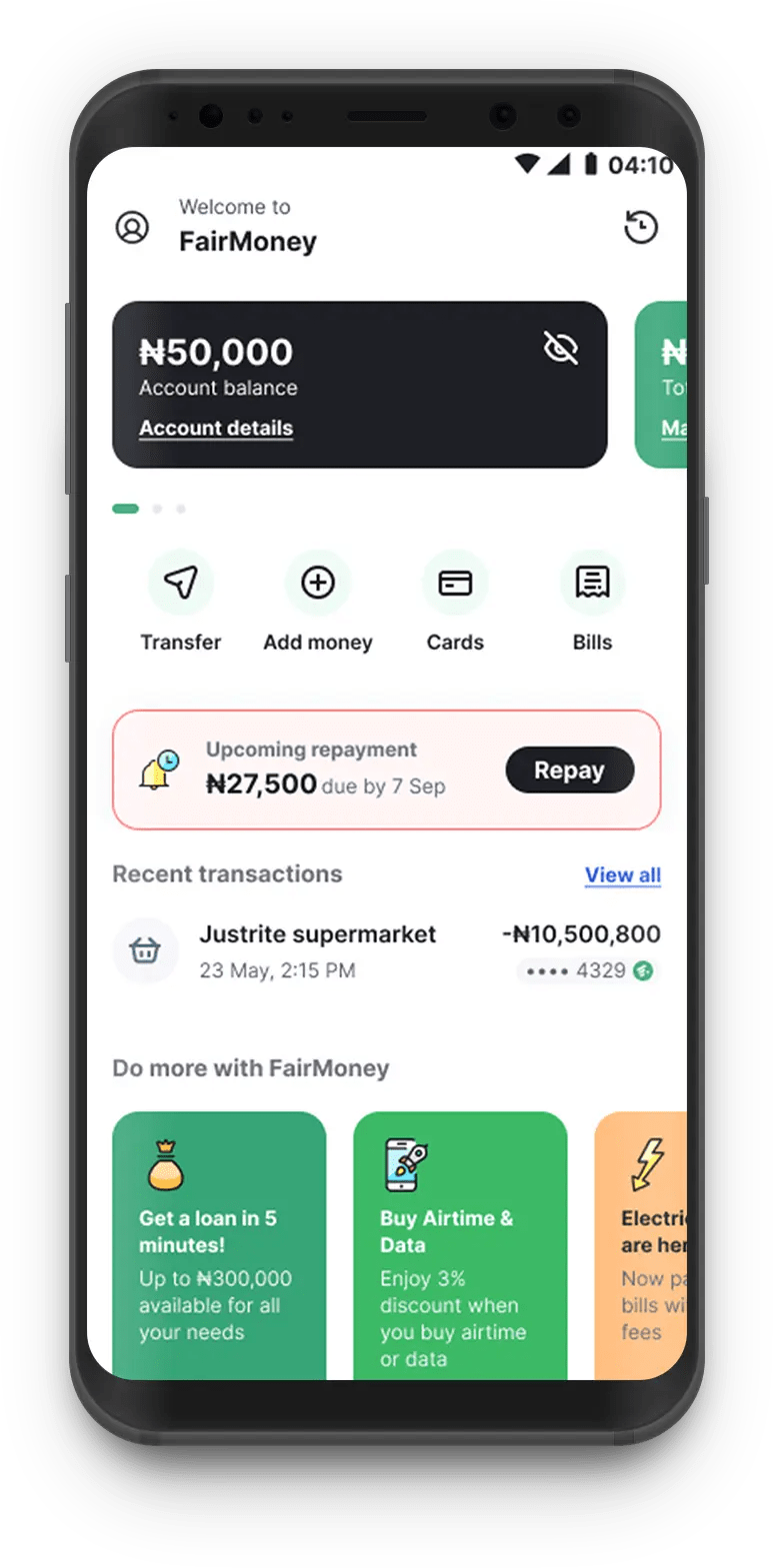

How To Apply For A Loan On The App

8. Build a relationship with the bank: Getting a personal loan from a bank helps you build a relationship with the institution. This can be useful if you have future financial needs, such as applying for a mortgage or business loan

. Building a positive relationship with your bank can increase your chances of getting favorable terms on future loan applications.

Finally, there are many benefits to using a personal loan from a bank, including flexibility, low interest rates, fixed payment terms, improved credit scores, quick access to funds, low fees, good customer service, and the ability to establish a relationship with the bank. . Bank

What are the advantages of using personal loan banking – Ultimate FAQ: Personal loan banking, what, how, why, when

Personal Loan Eligibility Based On Salary

A personal loan bank is a financial institution that provides individuals with funds to meet their personal financial needs. A detailed and informative explanation of how a personal loan bank works:

1. Loan application: The first step in getting a personal loan is to apply to the bank. This can be done online

Can i get a personal loan from my bank, how do i get a car loan from my bank, can i get a home equity loan from a different bank than my mortgage, can i get a loan from my bank, how can i get a personal loan from chase bank, can you get a loan from your bank, get loan from bank, how get loan from bank, can you get a home equity loan from another bank, how can i get business loan from bank, can i get a loan from bank of america, how can i get a loan from my bank