Current Gold Price Per Ounce Usd – Investing in gold has long been a strategy to diversify investment portfolios and hedge against inflation. Investing in gold is not like investing in other commodities: there is a long-standing belief that gold is a store of value beyond its use. But before investing in gold, it’s important to take a long-term view and understand historical changes in gold prices and how they stack up against other markets.

A 50+ year historical chart of gold prices will help us analyze the reasons for the decline in value. In addition, we will discuss the potential benefits of investing in gold and offer advice on buying and holding this precious metal.

Current Gold Price Per Ounce Usd

Investors can gain insight into the patterns and trends that inform their investment decisions by taking a long-term view and reviewing historical gold prices. For example, investors can identify long-term cycles or changes in the price of gold that can provide clues to future price changes or correlations with other asset classes. Additionally, analyzing long-term data can help investors see how gold has performed over time and how it has responded to major historical geopolitical or economic events.

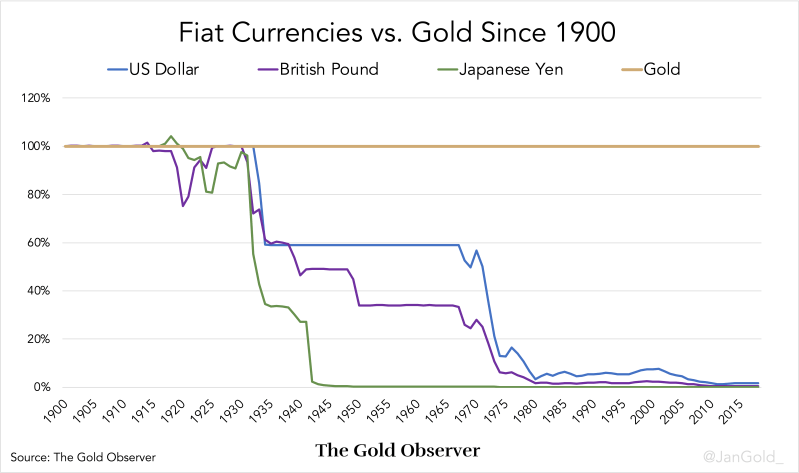

U.s. Dollar Devalues By 99% Vs. Gold In 100 Years

When looking at long-term data, it’s important to remember that past performance is not necessarily indicative of future results. Just because gold has performed better or worse in the past does not guarantee that it will continue to do so. It is also important to remember that specific economic and geopolitical situations are unique and may not repeat themselves in the same way. At the same time, completely new events will occur. Another caveat to keep in mind when analyzing longitudinal data is the tendency for hindsight bias. Looking at historical data with 20/20 hindsight, investors may overestimate market trend predictions and underestimate the uncertainties and risks that existed at the time.

The chart above shows the price of an ounce of gold since 1974. As you can see, the price has seen some big changes over the past few decades. The all-time high of the 1980s followed the lows of the 1970s. In recent years, gold has risen higher in nominal terms, reaching a record $2,265 an ounce as of April 2024. But adjusted for inflation prices, in the early 1980s. are still the peak of gold.

Rather than comparing gold prices over time in dollar terms, the best way for investors to learn about gold prices is to compare them to a common stock metric, the S&P 500. Let’s say that in in 1972, the next year, you had US$200. went off the gold standard and you put $100 in gold and another $100 in the S&P 500. That would buy about 2 oz of gold and about 1 share of the index.

In the first decade of your investment, you will have the extraordinary talent to put half of your money in gold, as its price rose sharply, especially at the end of the decade. During this period of economic uncertainty, gold reached a peak, reflecting its “safe haven” status amid turmoil, trouble in the Middle East, etc. In contrast, the S&P 500 went in the opposite direction in the early 1970s, though it slowly recovered early in the next decade and has been rising ever since.

Two Driving Forces Behind The Rally In Gold

If you stopped looking at your finite portfolio in 1980, your $100 invested in the S&P 500 and $100 in gold would be worth about $200 and $1,000, respectively, with gold at the top. But gold largely stagnated over the next 20 years while stocks enjoyed a market rally. By 2000, interest rates and a long bull market (before the dot-com crash) meant that your initial investment in the S&P 500 would be worth $3,500, but your gold would be worth less than $600 .

The 2000s brought a general trend towards gold, especially as investors sought safety during the 2008-2009 financial crisis. In 2007, your 1972 gold investment would be worth about $1,285; in 2010 it will be $2,166. Meanwhile, your investment in the S&P 500 would have fallen by nearly 10% over the same period.

In recent years, gold has continued to rise and reach new highs, so to speak. However, it did not appear as it did during two critical periods in American economic history, the late 1970s and the Great Depression. If you look at your wallet again in the spring of 2024, your original $100 in gold could be worth about $4,500. But your feelings of great investment success disappear when you look at the other side of your portfolio and see what that golden investment would be. they cost you. Your original $100 investment in the S&P 500 in 1972 would now be worth more than $18,500 (assuming you reinvested all dividends going forward).

During the Great Depression (roughly 1929-1935), the price of an ounce of gold rose from less than $21 to $35, an increase of 67%.

Understanding Gold Prices

Gold hit an all-day high of $2,265 on April 2, 2024. Adjusted for inflation, however, the high in February 1980 was above $3,300 (in 2024 dollars) with rising prices inflation and high interest rates.

The price of gold is affected by various factors, including macroeconomic and geographic conditions, the rate of inflation, the amount of reserves, currency fluctuations, supply and demand, and the cost of mining and processing the precious metal.

When inflation is high, the price of gold tends to rise as investors seek a safe haven to protect their purchasing power and as an inflationary hedge against the weak purchasing power of national currencies such as the dollar.

Similarly, when geopolitical tensions are high, the price of gold tends to rise as investors seek protection against uncertainty. If there is geopolitical tension or economic uncertainty, gold is used to offset macroeconomic volatility. However, this relationship does not always hold and the price of gold will not always increase due to inflation or economic uncertainty.

Gold Just Hit $2,000 An Ounce — But That’s Not Necessarily A Good Sign

As with any commodity, supply and demand for gold will affect its price. Gold has more uses than just a store of value. Gold jewelry and industrial applications such as electronics and medical devices account for the majority of gold demand. With the contraction of these industries, the demand for gold will also be affected.

In addition, the supply of gold is limited and can be affected by mineral production, exploration and government policy. These factors also affect the price of gold.

As an industrial product, the low cost of producing new gold is important. The price will increase as gold deposits become harder to find and rarer. At the same time, new extraction and beneficiation technologies that make mining more efficient and cost-effective will lower the price of gold.

Gold has a unique and fascinating history, and its value and meaning transcend time and geography. From its beginnings as part of ceremonial rituals to its use as currency and a store of value, gold has played an important role in human civilization for thousands of years. Today, gold remains a popular investment choice sought by individuals and institutions due to its perceived safety and potential for appreciation.

Gold Rate Today: Gold Prices Edge Up On Weaker Dollar

Gold’s value to society dates back thousands of years, long before the ancient Egyptians began making jewelry, statues, and religious art from the metal. Gold eventually became a symbol of wealth throughout Europe, Asia, Africa and the Americas.

Only in the sixth century BC. n. No. gold would be used as silver. At the time, early traders were looking for a standardized and easily transferable form of exchange that would facilitate the trading of goods.

Stamped gold coins were considered more durable and exchangeable than other forms of currency at the time, such as debt based on wheat. Since gold ornaments were already widely accepted and popular in various civilizations, the creation of gold coins was a natural development. With the emergence of gold as a commodity-based currency, its importance continued to grow.

Gold’s role as currency developed and matured, and it was also loaded onto ships bound for European capitals from the Americas. In the 17th and 18th centuries, many countries adopted a gold standard, where the value of a country’s national currency was tied to a certain amount of gold.

Gold Extends Fall As Strong Dollar, Higher Us Rates Take Toll

Under the gold standard, countries issued paper notes that could be exchanged for real gold at a fixed rate. This created a sense of stability and confidence in the currency as people knew the money was backed by something tangible. In 1834, for example, the United States set the price of gold at US$20.67 per ounce, where it remained until 1933. The British government similarly set the price at 3.17 shillings and 10½ pence per ounce.

However, the gold standard was largely abandoned in the early 20th century as economic crisis made it difficult to maintain the exchange rate. The Bretton Woods Agreement of 1944 established the US dollar as the international reserve currency and created an exchange rate system that allowed greater international flexibility.

Current value of gold per ounce usd, current gold price in usd per ounce, current silver price per ounce, current price of 14k gold per ounce, current price of white gold per ounce, current copper price per ounce, current gold price per ounce, current value gold per ounce, current price of 18k gold per ounce, current gold price per ounce today, gold price per ounce usd, current gold spot price per ounce