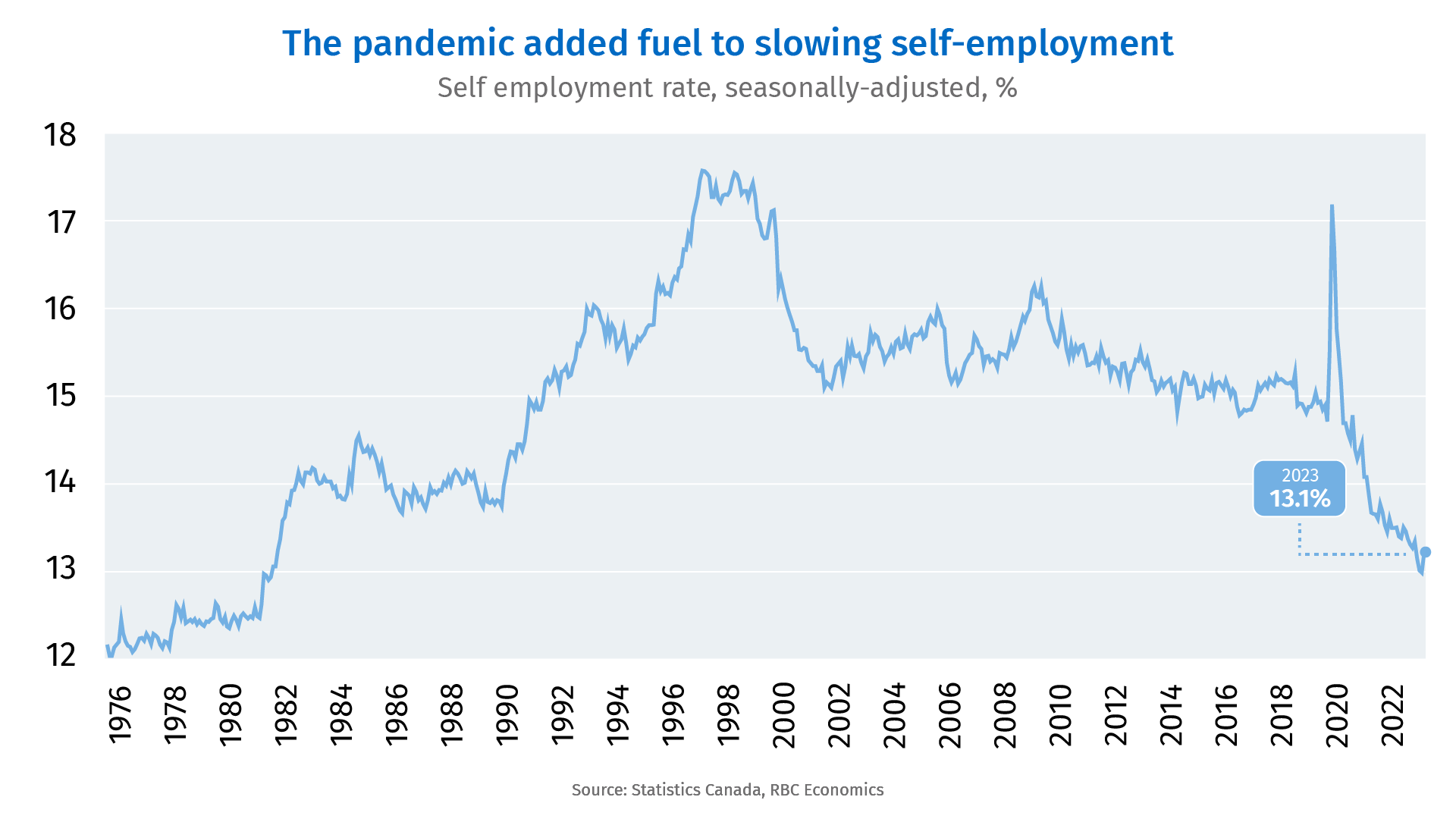

Investing In Small Business Canada – Epidemics have accelerated decades of declining self-employment rates. Although the pre-epidemic decline was caused by industrial factors and concentrated in the commodity sector, the decline in the share of FIEs after the epidemic was widespread.

A strong labor market and high wages for workers are likely to be involved. For example, employees working in professional, scientific and technical services receive an average of 20% more per hour than self-employed people in the same sector. Employers also offer more flexible work arrangements that were previously only available to self-employed people.

Investing In Small Business Canada

Self-employment is an opportunity for employees to develop their high-potential business model. It can also be the best option for those who can not find a suitable job from the employer. A high-potential self-employed person is an individual with at least one employee (you) and is therefore considered a business. 13% of Canadian workers are self-employed, but only 4% will be working by 2022.

Monthly Portfolio Review

Unfortunately, Canada’s declining self-employment rate is concentrated in the sectors that can contribute the most to entrepreneurship. Half of the 6% decrease in FIE amount can be explained by entrepreneurs who have received paid support. While the rate of FIEs declined prior to the epidemic, the actual number of self-employed individuals remained modest, while the number of paid recipients decreased slightly. As a result, the share of paid-for FIEs has dropped from 34% in 1998 to 27% today.

Canada’s population is getting older and as more babies retire, more small businesses are expected to leave the country. This question arises because only 9% of business owners have a written succession plan. Are there enough early stage companies to fill the position?

Probably not. Although Canada’s growing number of immigrants has led to slightly higher self-employment, this is unlikely to compensate for the fact that self-employment is less attractive to young workers. Self-employment rates for business owners with low-paid employees in all age groups. The self-employment rate for young Canadians (ages 35-44) has always been low, but the percentage of young Canadians wanting to be their own boss has dropped from 3.3% in 1998 to 2% today. .

Do not expect any changes any time soon. As interest rates continue to slow growth, slower demand for workers next year is expected to lead to more workers becoming self-employed as their main occupations. However, the cost of living and affordability continue to decline. Sequential labor shortages are expected to support higher wages and benefits for salaried workers in the next decade, making wages a more attractive option. And in the short term, a high interest rate environment will limit consumer activity, creating a competitive environment for small and medium businesses. These businesses have to pay high rents, high capital costs and high wages while consumer activity declines.

Corporate Tax Rates Canada 2022

Cynthia Leach is chief economist at RBC Thought Leadership. He leads the group’s forward economic and policy analysis covering topics such as human capital, innovation and trade. He joined the team in 2020.

This article is intended to provide general information only and should not be construed as legal, financial or other professional advice. You should consult an expert advisor regarding your specific situation. Although the information provided is believed to be factual and up-to-date, we do not guarantee its accuracy and should not be construed as a complete analysis of the topics covered. All opinions expressed reflect the author’s judgment as of the date of publication and are subject to change. Either Royal Bank of Canada or any of its affiliates expressly or implicitly refer to third parties or their feeds, products or services. Many business owners are making a profit from their business and are looking for tax-efficient ways to do so. Make money to meet your personal and business financial goals, including: Collect and protect your savings. Support your loved ones and plan for retirement. Factors to consider when investing as a business: What is the purpose of investing? First of all, think about what you will do with the money saved. It will help you decide which economy car is best for your situation. Then consider the following: Taxes: As a small business owner, you may be subject to a small business tax rate that is generally lower than your personal tax rate. (See table below.) In addition, from January 1, 2019, the federal budget reduced the small business limit for businesses with a passive investment income level. Investment growth tax: Check it depends on what you are investing in … Different types of assets have different tax rates (see table below), so time: you can determine when you Is paid. This means you can delay the withdrawal until you need it and decide if you want it or not. Payments through salaries or dividends protect creditors. Sometimes investing in a home can be dangerous for creditors, so you may want to consider using a holding company or trusting or paying them directly. This can be difficult and requires professional advice. Capital Exemption: If your investment increases too much, you could risk a lifetime capital exemption when you sell or transfer qualified small business shares. It is worthwhile to seek professional advice from the business owner, whether self-employed or business, before making an investment to make sure it is right for your personal circumstances. Financial technology tools help financial advisors expand their business by providing specialized websites, calculators and online marketing. Professional websites, email content and social media marketing are implemented by financial professionals with CFP, CLU, CHS and EPC credentials. With over 25 years of experience in financial services, FinTech is your ‘consultant’ and we speak to you to help you grow your business. The above information is presented in the form of a slide show. To find out more about how Financial Tech Tools can help you grow your consulting business, schedule a call.

Are you an employeeless company? Find out how to use a health care expense account to pay medical bills through your business.

Do you have a company with employees? Find Free Deductible Health & Dental Plans:

Small Business Credit Condition Trends, 2009 2022

What is a health expense account? Health Expense Account helps business owners save on medical bills through post-tax benefits.

What does a health expense account include? One of the biggest benefits of a health spending account is the freedom it offers:

Top 7 Health Expense Accounts You Need to Know Health Expense Accounts (HSAs) are tax-free benefits available to small business owners and their families.

This website stores cookies on your computer. For more information about the cookies we use, see our Privacy Policy. TORONTO, Oct. 12, 2023 / CNW / – Most small businesses in Canada revised their business strategies last year in anticipation of a recession and a recession. They are now more optimistic about their growth ambitions, according to a new KPMG survey in Canada. Despite recent challenges, nearly nine out of ten businesses (88%) are confident that their business will grow over the next three years. This is an increase from 83% in 2022 and is higher than the level of trust among CEOs of large companies (80%). Percent).

Understanding Small Business Tax Rates In Canada

Concerns about the crisis are prompting executives to take active action to build business resilience, according to K KPMG Private Enterprise អាជីវកម្ម’s survey of 700 companies. These comprehensive efforts include improving operational efficiency (37%), reducing business costs / expenses (41%), reducing the number of heads (26%) and temporarily suspending significant expenses (30%). .

Mary Jo Fedy, Chief Operating Officer at KPMG, said: “Canadian business leaders have taken the last 12 months to prepare for the crisis by making their companies smarter, more efficient and more efficient. Before “. “Although many small and medium enterprises are in a stronger financial position due to measures to combat the pending economic crisis, they are now ignoring the new pressures and risks associated with profitable investment. Their new cash. As a solution to reduce these threats, once established, you will have a stronger foundation for future success.

Despite the high level of confidence, small and medium-sized businesses face a complex network of new risks. Cyber security, disruptive technology, energy security and climate change weigh on leaders as they pursue growth plans.

Cyber security is the biggest risk, with 63% of respondents reporting that their business has been the target of cyber attacks. “Compared to large enterprises, small and medium enterprises feel vulnerable to the growing cyber threats and the complexity of cybercrime. Fedy added.

How To Scale Up Your Small Business

Most executives believe that digital transformation will reduce or control costs.

Equity investing in small business, small business investing in stocks, tax breaks for investing in small business, investing money in a small business, investing in small business online, td canada trust personal small business banking & investing, how to make money investing in small business, how does investing in a small business work, investing money in small business, investing in a small business contract, investing in small business uk, investing in small business