What Percentage Of Your Home Equity Can You Borrow Against – Home equity loans and home equity loans are large loans where your home is used as collateral for the loan. This means that the lender can repossess your home if you default on payments. However, home equity loans and home equity loans are used for different purposes and at different stages of the home and property buying process.

A conventional loan is when a financial institution, such as a bank or credit union, lends you money to purchase a property.

What Percentage Of Your Home Equity Can You Borrow Against

For most conventional loans, the bank will lend up to 80% of the appraised value of the home or the purchase price, whichever is lower. For example, if a home is valued at $200,000, the borrower will be eligible for a $160,000 loan. The borrower will have to pay the remaining 20%, or $40,000, as a low payment.

What Is A Home Equity Line Of Credit (heloc)?

In some cases, such as government-backed loan programs that offer down payment assistance, you can get a loan for more than 80 percent of the appraised value.

Less popular mortgage options include Federal Housing Administration (FHA) loans, which let you lower your interest rate as low as 3.5% as long as you pay homeowner’s insurance. Loans from the U.S. Department of Veterans Affairs (VA) and the U.S. Department of Agriculture. (USDA), require a 0% down payment.

The mortgage interest rate can be fixed (the same for the life of the loan) or variable (for example, changed every year). You repay the loan amount along with interest within the agreed period. The most common mortgage loan terms are 15, 20, or 30 years, although other terms exist.

Before taking out a mortgage, it is important to research the best lenders to see which will provide you with the best interest rate and loan terms. A mortgage calculator is also great for showing how different interest rates and loan terms affect your monthly payment.

What Is A Home Equity Investment? The Basics

If you fall behind on your payments, your lender can foreclose on your home. The borrower then sells the house, usually at auction, to get their money back. If this happens, the home equity loan (sometimes called a “first mortgage”) takes priority over subsequent home equity loans, such as a home equity loan (sometimes called a “first mortgage”) or a home equity line of credit. home (HELOC) . . The first financier must repay the entire amount before subsequent financiers receive the proceeds of the sale.

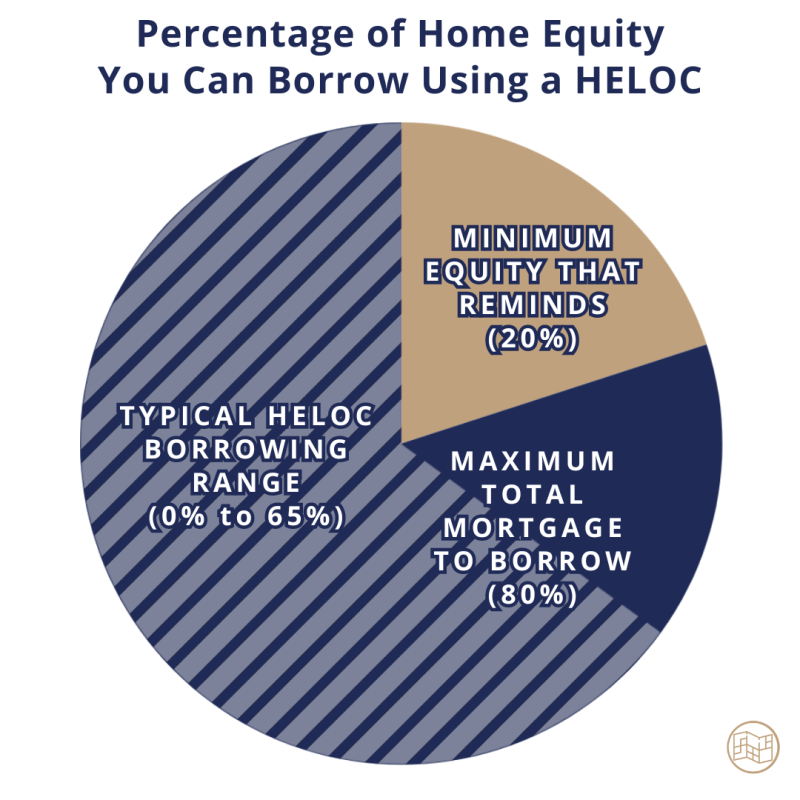

Home equity loan is also a type of loan. However, apply for a home loan once you already own the property and have built up equity. Lenders typically limit the amount of a home equity loan to no more than 80% of your total equity.

As the name suggests, a home equity loan is secured – or guaranteed – by the owner’s equity, which is the difference between the value of the property and the existing loan amount. For example, if you owe $150,000 on a house worth $250,000, you have $100,000 in equity. Assuming your credit is good and you qualify, you can apply for another loan using part of that $100,000 as collateral.

Like a traditional loan, a home equity loan is an installment loan repaid over a set period of time. Different lenders have different criteria for determining what percentage of capital they are willing to lend. Your credit score helps make this decision.

Ways To Build More Equity In Your Home

Lenders use your loan-to-value (LTV) ratio to determine how much you can borrow. The LTV ratio is calculated by dividing the mortgage by the appraised value of the home. If you pay off more of your mortgage or if the value of your home increases significantly, your loan-to-value ratio will be higher and you may be able to get more equity.

Home equity loans are generally offered with a fixed interest rate, while home equity loans may have a fixed interest rate or a variable interest rate.

In most cases, a mortgage loan is treated like a second mortgage loan. If you already have an existing mortgage. If your home is foreclosed on, the mortgage lender will not be paid until the first mortgage lender is repaid.

Therefore the risk of a mortgage loan is high, which is why these loans often have higher interest rates than traditional mortgage loans.

Reverse Mortgage Vs. Home Equity Loan Vs. Heloc: What’s The Difference?

However, not all home loans are secondary mortgages. If you own the property entirely, you can decide to take out a mortgage against the value of the house. In this case the mortgagee is considered the original owner. If the home is freehold, an inspection may be the only requirement to complete the transaction.

Home equity and mortgage loans may be tax deductible at a similar level to interest payments under the Tax Cuts and Jobs Act of 2017. Prior to the Tax Cuts and Jobs Act, only a home equity loan up to to $100,000. capital loan.

Currently, mortgage interest is tax deductible on loans up to $1 million (if you took out the loan before December 15, 2017) or $750,000 (if you took out the loan after that date). This new limit applies to other home improvement loans if they were used to purchase, build or improve a home.

Homeowners can use the home loan for any purpose. But if you use the loan for purposes other than buying, building or improving a home (such as restructuring debt or paying for a child’s college), you can’t deduct the interest.

Cash Out Refinance Vs. Home Equity Loan: Determining The Right Choice — Rismedia |

A home equity loan is a type of second mortgage that allows you to borrow money against the equity in your home. You get this money like a lot of money. It is also called a secondary loan because you have another loan repayment in addition to the primary loan.

There are some important differences between a home equity loan and a HELOC. A home equity loan is a permanent, one-off loan that is repaid over time. A HELOC is a revolving line of credit that uses your home as collateral and can be repaid regularly, just like a credit card.

A home equity loan will typically have a lower interest rate than a home equity loan or HELOC. A home equity loan requires a larger down payment and is less risky for the lender than a home equity loan or HELOC. However, a home equity loan will have lower closing costs.

If your mortgage interest rate is very low, you should probably use a home equity loan to borrow the extra money you need. However, there are limits to tax deductions, which include using the money to improve your property.

What Is A Heloc?

If mortgage rates have dropped significantly since you took out your mortgage, or if you need money for projects not related to your home, you may want to refinance your mortgage. If you refinance, you can keep the extra money you borrow because traditional loans often have lower interest rates than mortgages, and you can keep a lower interest rate on the amount you already owe.

Requires authors to use primary sources to support their work. These include white papers, government briefings, news and interviews with industry experts. Where appropriate, we also reference original research from other reputable publishers. For more information on the standards we adhere to to produce accurate and impartial content, please see our editorial policy. As retirement approaches in Ontario, financial planning becomes essential to ensure a smooth transition from earned income to retirement income. Another important tool in the planning process that is often overlooked is a home equity line of credit (HELOC). This article covers the basics of a HELOC and why it’s a smart move before retirement. Plus, we’ll give you tips on how to increase your chances of qualifying for a HELOC and compare using a HELOC to cashing out on an investment.

Whether you want to strengthen your financial situation, protect yourself from unexpected expenses, or increase your preparation for retirement, in this article you’ll learn why a HELOC can be the key to a safer, more successful vacation.

A home equity line of credit (HELOC) offers homeowners a flexible and affordable way to borrow money against their equity, which is the portion of a property’s equity that you directly own. Unlike a first loan, where you get a large sum of money and pay it off in fixed installments, a HELOC works like a credit card: It provides revolving credit up to a certain limit, allowing you to borrow, repay and borrow again as needed. Interest is only paid on the amount you borrow, not your entire loan limit, and you can pay off your balance at any time without penalty.

Home Equity: Delving Into Home Equity’s Link To Mortgage Constant

A HELOC can be part of your first mortgage or taken out as a separate second mortgage. Consolidating your HELOC with your primary loan can result in a new interest rate and your debt reduced to one.

What percentage can you borrow against your house, how much can you borrow against your home equity, can you borrow against your home equity without refinancing, what percentage of home equity can i borrow, can you borrow against home equity, what percentage can you borrow on a home equity loan, can you borrow against equity, borrow equity against your home, can you borrow against equity your home, what percentage of equity can you borrow, borrow against home equity, what percentage of equity can i borrow