Ways To Pay Off Credit Card Debt Fast – Credit card debt can be a significant financial burden, and if not managed properly, it can quickly get out of control. While it might be tempting to just make the minimum payment each month, doing so could end up paying more in interest over time. If you want to get out of credit card debt faster, there are several strategies you can use. In this article, we’ll provide 10 tips to help you pay off credit card debt faster and take control of your finances. These tips include creating a budget, prioritizing mounting debt, taking advantage of balance transfer offers, and seeking professional help when needed. By following these tips, you can work toward becoming debt-free and achieving financial stability. Check

One of the most important steps to paying off credit card debt is creating a budget. Start by making a list of all your monthly expenses and income. Figure out how much money you can realistically set aside each month to pay off your debt. If you have a clear understanding of your financial situation, you can make informed decisions about which spending to prioritize.

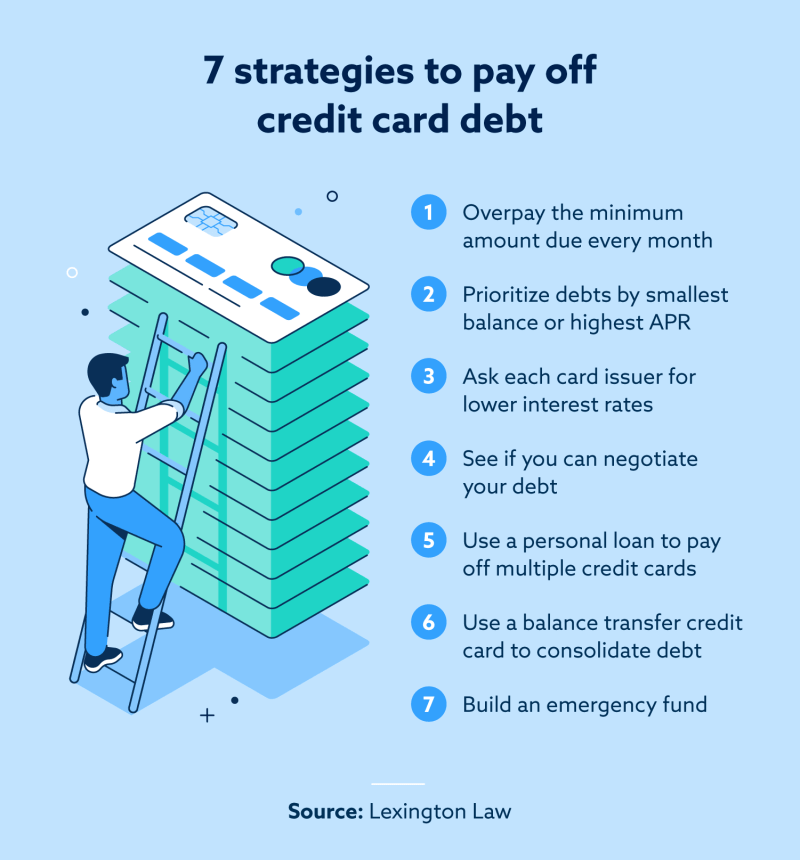

Ways To Pay Off Credit Card Debt Fast

Focus on paying off high-interest credit card debt first. Over time, these debts accrue more interest, making them more expensive to pay back in the long run. Consider paying more than the minimum payment each month to lower interest and pay off your debt faster.

How The Debt Snowball Method Works

Look for credit cards that offer low or 0% interest balance transfer offers. By moving high-interest debt to a card with a lower interest rate, you can save on interest charges and pay off your debt faster. Be sure to read the terms and conditions carefully and keep in mind balance transfer fees.

While you’re paying off your current credit card debt, try not to use your credit card to make new purchases. Adding new debt to an existing debt will only lengthen the payment process and increase your interest.

Debt consolidation involves combining multiple debts into monthly payments, usually at a lower interest rate. This can simplify the debt repayment process and save you money on interest charges. However, be aware of any hidden fees or costs associated with debt consolidation.

Consider biweekly payments instead of monthly payments. By making half of your monthly payments every two weeks, you can make extra payments each year and pay off your debt faster.

Effectively Paying Off Debt

Look for ways to cut costs in your budget to free up more money to pay down debt. Consider cutting back on discretionary spending, such as dining out or entertainment, or find ways to save on essential items, such as groceries.

Use any windfall, such as a tax refund or job bonus, to pay off your credit card debt. This can significantly reduce your debt balance and help you pay off your debt faster.

If you are having trouble managing your debt, consider seeking professional help. A credit counselor can provide guidance on debt management strategies and help you develop a plan to pay off your debt.

Finally, it’s important to commit to your debt repayment plan. Paying off credit card debt takes time and effort, but it can be accomplished with persistence and discipline. Make paying off your debt a priority and focus on the end goal of being debt-free.

Her Agenda — How To Pay Off Credit Card Debt Quickly

Paying off credit card debt can be a daunting task, but it can be done with the right strategies. By creating a budget, prioritizing your mounting debt, and taking advantage of balance transfer offers, you can make significant progress in paying off your debt. It’s important to stick to your plan and keep making payments, even if it means making sacrifices in other areas of your life. Remember, getting out of debt is a journey that takes time and effort. However, with determination and the right tools, you can pay off your credit card debt faster and achieve financial freedom.

My name is Rajat and I play a vital role in managing and ensuring the efficient operation of credit card services. A revolving line of credit, like a credit card, can be a useful tool if used responsibly. However, it can also lead to a slippery slope when it comes to credit card debt. While getting out of credit card debt isn’t as easy as snapping your fingers and thinking, there are strategies to pay off debt faster.

This may seem like an obvious first step, but it’s a crucial one. Adding more purchases to your credit card won’t increase your total debt. If you let your statement balance roll over to the next month, you’re spending more than you can afford.

Keep your credit cards out of reach, whether that’s putting them in a hard-to-reach drawer or cutting them up.

How A Balance Transfer Can Help Pay Off Credit Card Debt Faster

We’ve mentioned the debt payoff exchange strategy several times here at The Gym. It works by giving priority to your credit card’s highest interest rate. You will devote significant financial resources to paying off that balance while paying off all other debt at the bare minimum. After you pay off your first bill, put the money to pay that bill onto the card with the highest APR.

Because you pay off the card with the higher APR first, you save money in the long run by lowering your high interest charges.

This is another method of paying off debt that relies on “instant rewards” to help you get out of credit card debt faster. With this strategy, you’ll make higher payments on your credit card account

Theoretically, you’ll pay off that account’s balance faster, allowing your boost to cover your next higher balance. While it won’t save you as much in interest compared to debt relief, it does motivate you to reach your debt-free goal.

How A Credit Card Debt Relief Program Can Help You

Signing up for a 0% APR credit card balance transfer can be an effective debt repayment option. If you have good credit, you may see offers to transfer the balance on your existing card to a new credit card interest-free.

However, there is a caveat. The 0% interest rate is just a promotional rate that expires within three months of opening a new card, up to 24 months or more, depending on the offer. Additionally, these offers typically charge a balance transfer fee or a flat fee of around 3% of the amount you transfer (whichever is higher). Once you add this fee, always calculate the potential savings to determine if it’s really worth it.

A debt consolidation loan is simply a personal loan that you can use to pay off your revolving debt balance. Once you have secured loan funds, you can use them to pay off your credit card debt in a lump sum. After paying off your credit debt, you will make monthly payments on your consolidation loan.

The advantage of this option is that depending on your credit score, you may get a lower interest rate. You can get a debt consolidation loan through a bank lender, a credit union, or online. If you’re seriously considering this option, compare multiple offers to make sure you’re moving forward with the lowest rate offer and terms.

How To Pay Off Debt Fast!

Another option is to contact your card issuer and request a lower interest rate while you figure out how to pay off your credit card debt faster. While this strategy does not reduce the principal owed on your account, it does reduce the impact of high APR fees on your account.

There are many strategies you may want to use to get out of credit card debt, and this is one of them. If you have solid credit and your accounts are in good standing (meaning you’ve never been late or missed a payment), it might take a two-minute call to your credit card company to reduce the cost of your debt.

Want to learn more about how to pay off credit card debt faster based on your unique situation? A financial coach can help you create a personalized budget and credit card payment plan. Our trainers are certified in The Gym’s proprietary curriculum to help you conduct personal virtual financial coaching sessions.

A debt settlement program is a for-profit service provided by an agency that works directly with your creditors to reduce your debt and permanently liquidate your accounts. For example, if you owe $9,000, you could try to negotiate a lump sum payment of $6,000 with your creditor.

How To Pay Down Credit Card Debt Quickly

These companies encourage you not to pay off your credit card debt. Instead, it requires you to send those payments to an account the company has access to. If the business successfully liquidates, it will use the funds in the account to pay the credit issuer.

Listed above are just a few ways to get out of credit card debt. Not every strategy is right for your specific situation, and paying off credit card debt can be complicated. If you need one-on-one help, a financial coach can help you figure out the debt strategy that works best for you. 0 comments

They give credit cards “PLASTIC MONEY” which is totally correct, just like you did before

Ways to pay off debt fast, best ways to pay off debt, ways to pay off credit card debt, fast ways to pay off credit card debt, ways to pay off debt, i need to pay off debt fast, best way to pay off credit card debt fast, ways to pay debt, pay off credit card debt fast, pay down credit card debt fast, best ways to pay off debt fast, pay credit card debt fast