How To Find Ending Retained Earnings – Preparing financial statements may not seem like the most interesting task. Although it is very important, especially if your company is looking for investment or plans to expand its operations. It doesn’t matter that most businesses have to report withheld income to the tax authorities.

In this post, we’ll show you how to prepare a retained earnings report and share presentation design tips to turn your document into an engaging presentation. But first, let’s make sure we’re on the same page about terms and have some definitions.

How To Find Ending Retained Earnings

:max_bytes(150000):strip_icc()/Term-Definitions_Retained-earnings-f74f8d96dc3447179d35a3f74b86913f.jpg?strip=all)

In accounting, retained earnings (RE) is the amount of money (net income) left in the business after dividends are paid. This amount is usually used for future investments or dividends.

Retained Earnings |learn Important Terms And Concepts

Shareholders and management will always see retained earnings on the balance sheet. It is in the passive part. This is an important indicator of the company’s debt and is directly related to the manager’s decision. It earns money that is used by management (for targeted purposes) and not returned to investors.

An income statement (also known as an income statement or profit and loss statement) is a detailed summary of a company’s income and expenses during a reporting period, such as a fiscal year or quarter. These financial statements show the organization’s ability (or lack thereof) to generate profits, reduce costs, or both. It contains information about all the profits made by the company.

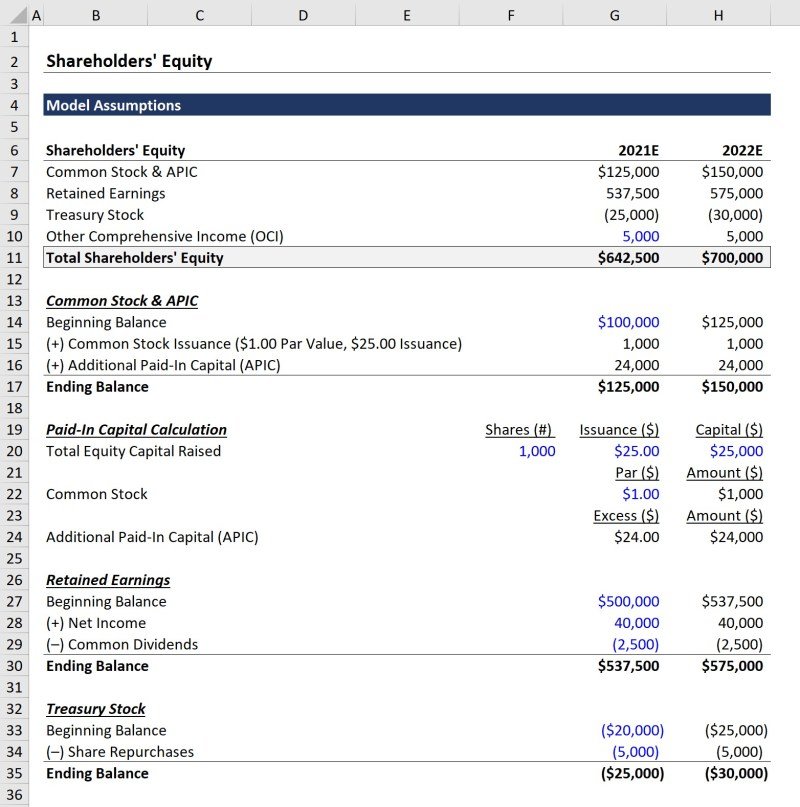

On the other hand, the statement of retained earnings is a business document that reconciles the beginning and end of retained earnings for a specific period (eg, month, quarter, year).

The report shows how much the company received from sales, cost of goods/services sold, and other expenses. In short, retained earnings are profits/income received by the business but not paid out as dividends. This money remains in the company’s account for the next year.

Negative Retained Earnings: A Guide For Investors

The two terms are closely related but have slightly different meanings. The income statement is more comprehensive. Net income is calculated by subtracting all operating expenses (such as wages, rent, overhead, etc.) from total revenue.

When a certain amount of net income is not paid out to shareholders or reinvested into the business, it becomes retained earnings. Note that some companies choose to keep money in retained earnings accounts for years, so the totals you see in some reports are the result of years of diligent savings.

The immediate benefit of creating a detailed retained earnings report is that your company (or other organization) can see how much net profit you’re making and what you can set aside for those “savings.”

You may be wondering how to calculate retained earnings? Calculating retained earnings is relatively simple. You just need to use the retained earnings formula below:

A 100 Formula Sheet

This accounting formula is suitable for the internal calculation of retained earnings. If you are an investor, here are some tips on how to calculate retained earnings in common stock equity.

First, you need to find the company’s retained earnings on the balance sheet. They are usually on the equity side. If they are not written down, you can do the calculation yourself from other numbers.

Step 1: Find information about the company’s total assets and liabilities. To calculate equity, subtract liabilities from assets.

Step 2: Locate the general inventory line item on the balance sheet. If you know that the only two items of stockholders’ equity are common stock plus retained earnings, subtract the value of the common stock item from total stockholders’ equity. The difference is the company’s retained earnings.

How To Calculate Net Income From Balance Sheet: Net Income Formula

The retained earnings report can be prepared as a separate document or presentation. However, many businesses choose to add it at the end of other financial statements, such as a balance sheet or a combined statement of income and retained earnings. You can also submit it as part of your business plan when applying for credit/financing.

The format of the retained earnings report is fairly standard. First, you need to add a three-line header with the following information:

The retained earnings report template will also include the following data that must be calculated and reported as a total.

The first item that appears on the retained earnings statement is the opening balance of retained earnings carried over from the previous reporting period. If you make this statement for the first time, your number will be zero.

The Balance Sheet And Financial Disclosures

Otherwise, the first line of the retained earnings statement for the example company would look like this:

In most cases, the accounting report on retained earnings is prepared after the financial results report. So if you make it, you might have a revenue number. If not, ask an accountant for help.

Back to the example: Our sample company had $150,000 in net income in the second quarter. Therefore, the retained earnings statement will now contain the following information:

However, a company may not make a profit during every accounting period. If a loss is recorded in the income statement, it should be deducted from the original retained earnings. In this case, the report for the sample company will contain negative retained earnings:

What Is A Statement Of Retained Earnings? What It Includes

In addition to losses, negative retained earnings can result in suboptimal dividend distributions over a period of time. For example, the total net income of the business + initial retained earnings (if any) may be less than dividends paid on the balance sheet.

The next step is to calculate the dollar value of the dividends paid from the company’s net income. Depending on the type of business you run, this number may be zero (if no dividends are paid). Here is an example calculation to illustrate this:

Whether you pay dividends in cash or stock, both must be recorded as deductions. For example, if your board declares a dividend of $3.00 per share on 10,000 shares, $30,000 must be deducted from the retained earnings statement (even if the dollar equivalent has not been paid).

Now let’s calculate the final retained earnings. This will be the final amount minus the dividend. Here’s an example of what your balance will look like:

Using The Indirect Method To Prepare The Statement Of Cash Flows

That’s it – a complete statement of retained earnings that can be shared with investors or other organizations.

Looking only at the RE statement is only an incomplete analysis, but the reader can see observations about the organization’s behavior in terms of capital set aside for the future.

Shareholders expect dividends for their investments, but there are also tax practices (depending on where the entity is located) that choose not to pay dividends and keep the money. Another reason to save money is for future investments or as collateral for future loan requests.

Some investors may argue that constantly setting aside money is a sign of executives who do not know how to invest money to increase the value of the organization.

How To Calculate Retained Earnings (formula + Examples)

If the RE invested in the business for a period of growth after the RE period, the RE report will show the Table or decelerated growth for the period.

For some reason, you have been asked to prepare this retained earnings statement. Maybe you’re just starting a startup going to investors or looking for a business loan from a traditional financial institution. In these cases, you may be asked to tell others about your financial situation.

So, instead of submitting these sample calculations with multiple balance sheets, shape them into a detailed and engaging presentation. Here are some tips for that.

Most investors want to know these key metrics because they provide a fairly accurate picture of a company’s financial health, future profitability, and the type of investment returns investors can expect.

Increasing The Net Assets Of A Company

When submitting financial statements and related information, many people simply collect the data they have on hand and present it without further analysis or comment. So viewers have to “do the math” to figure out the number they want to know. And it won’t work for you, because most investors have no context and no easy way to compare or understand the financial story you’re trying to tell.

That’s why it’s always good to summarize key numbers and turn them into easily digestible information. For example, you can use a PowerPoint template for financial statements to show how dividends per share declared have changed over the years, and then summarize how much your company usually pays out each year and what it keeps in your account.

How to determine retained earnings? As mentioned earlier, the RE for the period under discussion can be found on the balance sheet or in the retained earnings statement itself.

Return on retained earnings (RORE) is another useful calculation to add to your presentation because it shows how a company’s earnings are reinvested after dividends are paid. RORE is strong

Statement Of Retained Earings And Its Components Handout

Ending retained earnings formula, formula to find retained earnings, how to find retained earnings in accounting, how to reconcile retained earnings, how to adjust retained earnings, how to find retained earnings formula, how to decrease retained earnings, how to retained earnings, how to find retained earnings, how to calculate ending retained earnings, ending retained earnings, how to determine retained earnings