How To Raise Fico Score Quickly – Everyone has a credit score and it says a lot about your health and financial management. In general, the better your credit score, the better you manage your finances.

Although as we all know, life happens and sometimes unexpected circumstances can affect your life (and your credit). Losing a job, having an emergency car repair, getting fired, or saving can delay paying bills and negatively impact your credit. Fortunately, there are ways to regain credit if you face financial challenges.

How To Raise Fico Score Quickly

We’ve narrowed down 10 steps to improving your credit score, from just knowing what your score means to easy routines and strategies you can implement to improve your score and work toward financial independence.

How To Raise Your Credit Score By 200 Points

Canada has two national credit bureaus: Equifax and TransUnion. Once a year you can request a free copy of your credit report by mail, and it should arrive within a few weeks. All you have to do is enter the basic information and submit the form. If you want instant results online, it will cost you a small fee.

The first step to improving your credit is really knowing where you stand (which is why checking your credit score is so important).

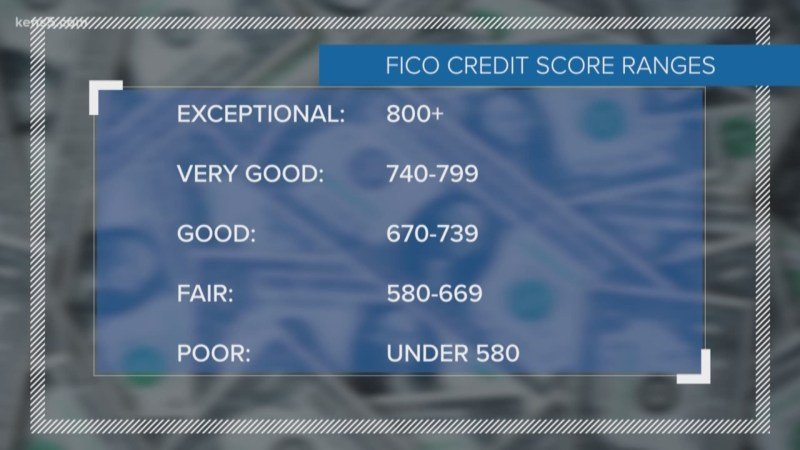

After you get your credit report, you need to interpret what your score means. Your credit score is a three-digit number between 300 (poor) and 900 (excellent). Our blog can help you understand what the average Canadian credit score is based on age, the range of credit scores in Canada and where you fall on the credit score scale.

If you need additional support, you can also check out the Government of Canada’s resources for understanding your credit report.

The 10 Easiest Ways To Raise Your Credit Score

When checking your credit report, be on the lookout for false information. If you notice any errors in your file, such as someone else’s information, debt that isn’t yours, or incorrect payment history, contact the credit bureau and request a correction. You don’t want other people’s information to affect your credit.

You can’t improve your credit if you don’t have credit. Keep your old credit accounts open – the longer your history of using credit responsibly, the better. If your credit report documents old debts that have been paid in full, it will have a positive effect on your credit score.

It may seem strange if you have low credit, but you should use credit to improve your credit score. Continue to use credit cards and pay them off on time. You can even buy a car from Birchwood Credit and rebuild your credit with flat car payments. Credit is based on your ability to use credit and pay it back responsibly, as this shows lenders that you are a reliable borrower. The more often you use credit and pay it back on time, the more your credit score will improve.

If your credit card provider offers a credit limit increase, take it. The key is not to spend more than you can afford. If you are offered a raise, it means the lender believes you can handle more credit than you want. If you continue to pay your bills on time and keep your credit card balances below 50% of your limit, your credit score will continue to improve.

Can You Raise Your Credit Score By 100 Points?

This is a common tip that comes up time and time again, but it’s probably the most important. Paying your bills on time is one of the easiest ways to improve your credit. Your payment history makes up about 35% of your credit score, so if you keep making late payments or even forget them, your score will take a hit.

One way to make step 8 easier is to automate your payments. For all debts where payments have been set, payment automation ensures that no payments are missed. If you do your banking online, you can also set up alerts to let you know when your credit card bill is due. You can automate payments and set reminders so you don’t have to worry about them.

When a potential lender checks your credit history to make a final decision on a loan application, it’s called a “hard inquiry.” This Credit Check lowers your score and usually stays on your report for two years. If you can, avoid strict checks or at least minimize them. It’s a good idea to educate yourself about how credit checks affect your credit score.

Stay current with your credit history. Keep an eye on your credit card bill and make sure there are no errors. Make sure you make all payments on time. Last but not least, get your free credit report every year and make sure there are no discrepancies. Even if your credit isn’t where you want it to be, you have a better chance of making changes if you know where you stand.

How To Raise Your Credit Score 100 Points

At Birchwood Credit, we don’t look at your credit score separately. We look at your entire financial situation and accept all types of credit. Because we lend our own money through internal financing, we are able to offer our customers better interest rates, repayments and loan options.

The first step to financial independence is knowing where you stand. Get a free credit report with our secure credit check and start rebuilding your credit with the support of our team. All you have to do is fill out the form on our website and one of our financial managers will set up an appointment to review your score and help you plan your financial goals.

Our office has reopened, but if you want to shop from the comfort of your home, you can do so through our Buy from Home program. Your entire buying experience is 100% contactless, from loan approval and vehicle purchase to test drive and delivery. Get up to $1000 off and other extra benefits. come to visit

Applying for a car loan shouldn’t be stressful. We only ask for the information we need and it takes less than three minutes to complete your application. Get started now! With a FICO credit score of 700, you have good credit. This way you get a good credit card, low interest rates and a higher credit approval.

How Experian Boost Can Help Raise Your Credit Score

In the world of credit scores, 700 is an important number. FICO provides scores that help consumers and lenders see where their credit scores fall.

With a score above 700, you get access to low interest rates, the best credit cards, and all but the best deals from even the longest-standing lenders. This also means that your credit score is higher than almost half of Americans.

People often ask, “How can I improve my credit score?” The reality is that getting your credit score above 700 can be difficult, but if you know the factors that affect your credit score and how to maximize the features that increase your score, you can improve your credit score quickly.

Your payment history is the most important part of your credit score. This is the easiest to use at will, but also the hardest to fix if it starts to lower your score.

Easy Ways To Raise Your Credit Score

Lenders are primarily concerned with getting their money back from the people they lend to.

Their track record of paying on time is the best way to increase their trust in you. It’s not fast or glamorous, but paying off your loan within a few years will improve your credit significantly.

If you forget to pay, the unpaid amount can affect your credit score. The good news is that many lenders will work with you if you’ve paid on time and will forgive first delinquencies.

If you miss a payment or send it in late, contact your lender, explain the situation and ask if they can work with you to avoid a black mark on your credit report.

Effective Ways To Improve Your Credit Score Quickly

The amount you owe is the second largest factor in determining your credit score, and changing it is one of the best ways to improve your credit score quickly.

These factors in your score are divided into several subcategories; The three most important are your total debt, the number of credit cards with balances, and your credit utilization rate.

The total debt category is exactly what it sounds like: how much money you currently borrow. The less money you borrow, the higher your score will be because lenders want to trust that you can pay it back.

Your credit utilization ratio is the ratio of your credit card debt to your total credit limit. The lower this ratio, the more credit you have and the better your credit score.

Your Credit, Your Life: The Complete Guide On Credit Scores, Credit Reports, Credit Repair, How To Quickly Erase Bad Credit Records, & Legally Raise Your Credit Score To 750 Or Above Ebook

What makes your credit utilization a useful way to quickly improve your credit score is that it’s reported monthly, and the utilization rate from previous months is not factored into your current score.

For example, the total amount of your credit limit

How to quickly raise credit score, how to raise my fico score, raise fico score fast, raise my fico score, raise credit score quickly, how to raise my credit score quickly, how to raise fico score, how to quickly raise fico score, how to raise your fico score quickly, how to raise your credit score quickly, how to raise my fico score quickly, how to raise mortgage fico score