Transfer Money Using Routing And Account Number – By clicking Continue to participate or sign in, you agree to our user agreement, privacy policy and cookie policy.

In today’s digital world, electronic money transfer has become a convenient necessity. Whether it’s splitting the dinner bill with a friend, paying the rent, or supporting a loved one across the country, it’s important to know how to transfer money safely and efficiently. This comprehensive guide will provide information on navigating and transferring money through accounts widely used for domestic transfers in the United States.

Transfer Money Using Routing And Account Number

:max_bytes(150000):strip_icc()/Low-cost-ways-to-transfer-money.aspx_Final-a4169ee72ea14878b0a6f8fe3121c380.png?strip=all)

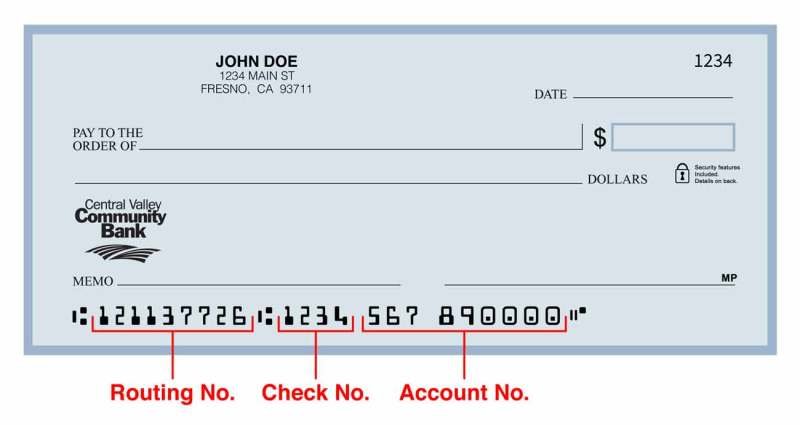

Routing Number: This unique nine-digit code identifies the bank or financial institution in the Automated Clearing House (ACH) network. Think of it as a bank address in an electronic transfer system.

Routing Number: What It Is And How To Find Yours

Account number: This unique number identifies your account with your bank. This is like a personal mailbox at a bank address.

1. Online Banking: Most banks allow you to easily access this information on their online banking website. Look for the section titled “account information,” “traffic information,” or similar terms.

2. Bank statement: the monthly bank statement usually contains the route and account number. They can be printed above or below the statement.

3. Customer Service: Still having problems? Do not hesitate to contact your bank’s customer service. They will guide you in finding this information.

How To Set Up Money Transfers

Tip: Once you find your directions and account number, try to keep them in a safe place for future reference. A password-protected file or trusted financial management application is a good choice.

Now that you have your route and account number, let’s look at the different ways to start a transfer:

1. Online banking: This is often the most convenient option. Look for the “Transfer” or “Send Money” feature in your online banking environment. In general, you should enter:

Recipient Name: Make sure it is spelled correctly. Track number: Make sure this information is correct. Account number: Check the information before proceeding. Transfer amount: Enter the amount you want to transfer.

What Is An External Transfer? How It Works, Basics, And Types

2. Mobile Banking Apps: Many banks offer user-friendly mobile apps that can be used for transfers on the go. The process is similar to online banking, and accessing your account is convenient on your smartphone. Some apps even let you choose recipients from your contact list, making the transfer process smoother.

3. Personal transfer: Although online and mobile banking are the preferred methods, you can still visit a physical bank branch and make a transfer with the help of an operator. Be prepared to provide the recipient’s route and account number.

Transfer fees: Note that some banks charge a transfer fee, especially when transferring to an account at another institution. Check your bank’s payment schedule to avoid surprises. Transfer processing time: Electronic transfers via routing and account number usually take 1-3 business days. This is because the ACH network verifies information and completes transfers between banks. Security key: Check recipient’s tracking number and account number before confirming delivery. Entering incorrect information can cause delays or even sending funds to unintended recipients. If your bank offers additional security, consider using two-factor authentication (2FA).

While routing and porting account numbers is a common method, there are situations where other options are more appropriate:

Best Way To Transfer Money Between Banks

P2P payment services: Services such as Venmo, Zelle or the Cash app facilitate the transfer of money between users who have linked bank accounts or debit cards. This service is perfect for sharing money, sending quick money to friends and family, or making small purchases online. However, they often have limits on the amount you can transfer and may charge fees for certain transactions. Bank transfer: For urgent transfers that require fast delivery, bank transfer is the right way. However, they have higher fees compared to ACH transfers. Try sending threads only if speed is critical and check recipient details before proceeding.

Speed: If speed is your priority and you want to pay more, bank transfer may be the best option. However, for most day-to-day transfers, ACH and bank account transfers offer a good balance between speed and cost. Cost: Consider cost when choosing a method. Online and mobile bank transfers within the same bank are usually free, but transfers to other institutions or using P2P services may incur charges. Convenience: Mobile banking applications offer quick and easy transfers with great convenience. Online banking and personal transfers offer the flexibility of your choice. Number of transfers: Some P2P services have a limit on the number of transfers. Make sure you transfer the required amount for the method you choose.

Save recipient information: If you frequently transfer money to the same person, consider saving your address and account number in an online bank or mobile app to make future transfers easier. Check before sending: Check all information – recipient’s name, tracking number, account number and transfer amount – before completing the transfer. Contact the recipient: Notify the recipient of future transfers, especially if this is the first time they receive money using this method.

By understanding these factors and following these guidelines, you can move money between channels and accounts reliably and efficiently, making it easy to manage your finances.

What Is A Wire Transfer?

Confident! Routing and account numbers are designed to facilitate the transfer of accounts between different banks. The process may vary depending on your bank, but in general, you’ll need to enter the recipient’s tracking number and account number, as well as their name, when you make a direct transfer through online banking, a mobile app or a branch. .

Sharing your route and account number is like giving someone your email address. This directs the transfer to your account. However, it is important to be careful with whom you share this information. Here are some safety tips:

Only share your referral and account number with trusted individuals or authorized companies. Do not share this information on unverified websites or through unsolicited emails or phone calls. Be careful when asking for directions and account numbers in exchange for “free” offers or gifts.

If you suspect your information has been compromised, contact your bank immediately to discuss options for securing your account.

How To Transfer Money From Paypal To Cash App: 2 Methods

Unlike P2P services that offer express delivery, ACH usually takes 1-3 business days to route and bill. This is because the ACH network verifies information and ensures smooth fund transfers between banks.

Unfortunately, entering the wrong route or account number can cause delays or even funds being sent to unintended recipients. What to do if you suspect you are at fault:

Contact your bank as soon as possible. If it hasn’t been processed, they can block the transfer. Once the transfer has been processed, your bank will help you retrieve the funds, but success is not guaranteed. Depending on whether the recipient has been correctly identified or not.

P2P payment services: For quick and casual transfers between friends and family, P2P services like Venmo, Zelle or Cash App offer instant payments to linked bank accounts or debit cards. However, they have a limit on what they can transfer and can charge a fee. Bank transfer: If immediate delivery is required, bank transfer is the fastest option. However, they have higher fees compared to ACH transfers. Use bank transfers only for urgent needs and always check the recipient’s information before sending a message.

Western Union Tips For First Time Transfers

In today’s fast-paced world, the ability to send money electronically is a useful tool. Knowing the routes and account numbers, as well as the different transfer methods, will allow you to manage your finances effectively. Whether it’s paying the rent, supporting a loved one, or sharing a bill with a friend, this information ensures a safe and efficient electronic transfer. So, if you want to send money, choose the method that best suits your needs and use the convenience of electronic bank transfers!

Mark subtitles as irrelevant if you find them irrelevant or valuable. This offer is unique to you and will not be shared publicly. By clicking Continue to participate or sign in, you agree to our user agreement, privacy policy and cookie policy.

In today’s busy world, we often need capital. Whether it’s sharing money with friends, making urgent payments or sending money to loved ones, waiting for the day for a traditional bank transfer is no longer possible.

Local transfer assistance. But what if you want a direct transfer without a lengthy confirmation process? Is it even possible? Let’s dive into the world of fast bank transfers with routes and account numbers without confirmation.

How To Transfer Money From Credit Card To Bank Account

Imagine you’re at a restaurant with friends and it’s time to split the bill. Instead of everyone fishing for money or waiting for a bank transfer, you can transfer shares to a friend’s account with a few taps on your phone. The beauty of fast transfer. With instant transfers, you can transfer funds from one account to another in real time or near real time

Apps to transfer money with account and routing number, transfer money using account and routing number, can i transfer money using my account and routing number, transfer money using routing number, account and routing number transfer, instant money transfer with routing and account number, how to transfer money using routing number and account number, how to send money using my account and routing number, account and routing number money transfer, transfer money with account and routing number, send money using my account and routing number, wire money using routing and account number