What Is Retained Earnings In Balance Sheet – More than 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. It’s always free and start with a free account to explore hundreds of financial templates and cheat sheets.

Retained earnings (RE) is the accumulated portion of earnings that are not distributed to shareholders as dividends, but are retained for reinvestment in the business. Typically, these funds are allocated to purchase capital and fixed assets (capital expenditures) or pay off debt obligations.

What Is Retained Earnings In Balance Sheet

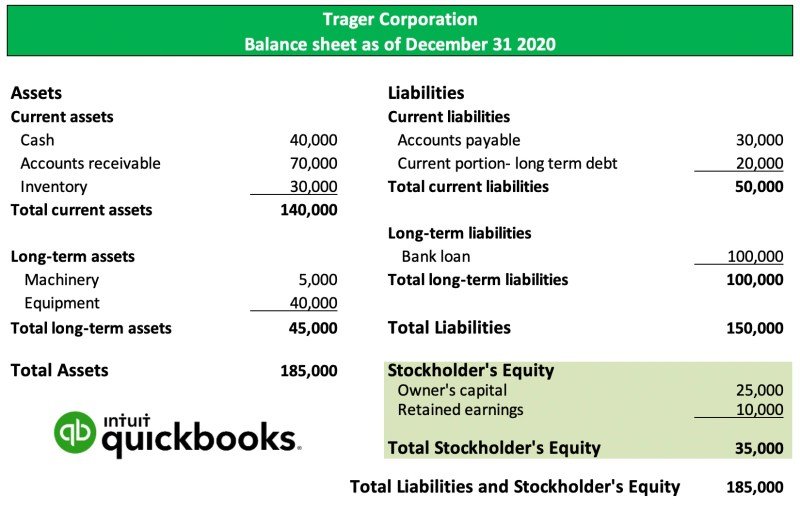

Retained earnings are reported on the balance sheet in the stockholders’ equity section at the end of each accounting period. To calculate RE, the initial balance of RE is added to net income or reduced by net loss, and then the dividend payment is deducted. A summary statement called the Statement of Retained Earnings is also kept showing changes in RE over a period of time.

Balance Sheet Simplified

Retained earnings is a useful link between the income statement and the balance sheet because it is recorded in stockholders’ equity, which combines the two statements. The purpose of retaining earnings can be varied and may include the purchase of new equipment and machinery, research and development expenses, or other activities that may contribute to the growth of the company. This investment in the company aims to generate more profits in the future.

If a company doesn’t believe it can earn a reasonable return on investment from those retained earnings (that is, earning more than the cost of capital), it often distributes those earnings to shareholders or buys back shares.

At the end of each accounting period, retained earnings are reported on the balance sheet as accumulated earnings from the previous year (including the current year’s earnings) less dividends to shareholders. In the next accounting period, the closing balance of RE from the previous accounting period becomes the opening balance of retained earnings.

The RE balance may not always be a positive number, as it may indicate that the current period’s net loss is greater than the initial RE balance. Alternatively, large dividend distributions in excess of the retained earnings balance may cause it to become negative.

Year Retained Earnings To Appear In Balance Sheet

Any changes or movements in net income directly affect the RE balance. Factors such as increases or decreases in net income and net loss determine whether a business is profitable or in deficit. A retained earnings account can be negative due to large and accumulated net losses. Of course, the same things that affect net income affect RE.

Examples of such items include sales revenue, cost of goods sold, depreciation and other operating expenses. Non-cash items such as depreciation or amortization and stock-based compensation also affect the calculation.

Dividends can be distributed to shareholders in the form of cash or stock. Both types can reduce RE costs for businesses. Cash dividends represent cash inflows and are recorded as a decrease in the cash account. This reduces the size of the company’s balance sheet and the value of the company’s assets, as the company no longer has any liquid assets.

However, stock dividends do not require cash outlays. Instead, it divided the RE portion into common stock and additional paid-in capital accounts. This distribution does not affect the total size of the company’s balance sheet, but reduces the value of the stock.

Importance Of Retained Earnings

At the end of the period, you can calculate the retained earnings balance by taking the beginning period, adding net income or net loss and subtracting dividends.

In this example, the amount of dividend paid by XYZ is unknown, so using information from the balance sheet and income statement, we can calculate it using the formula: Beginning RE – Ending RE + Net Income (-Loss) = Dividend.

We can confirm this using the formula Start RE + Net Income – Dividend = End RE.

So we have $77,232 + $5,297 – $3,797 = $78,732, which is the number to actually end up with retained earnings.

Retained Earnings In Accounting And What They Can Tell You

Below is a short video explanation to understand the importance of retained earnings from an accounting perspective.

In financial models, a separate table is needed to model retained earnings. The balance sheet uses a tight calculation where the beginning balance of the current period equals the ending balance of the previous period. Between the opening and closing balance, net profit/loss from the current period is added and any dividends are deducted. Finally, the closing balance is posted on the balance sheet. This will help you complete the task of linking 3 financial statements in Excel.

This is the CFI’s guide to retained earnings. Check out the following additional CFI resources to help you develop your career:

Guide to Financial Models CFI’s free Guide to Financial Models covers model design, model building blocks, and general tips, tricks, and…

How To Calculate Retained Earnings (formula + Examples)

SQL Data Types What are SQL Data Types? Structured Query Language (SQL) consists of a number of different data types that allow you to store a variety of…

Structured Query Language (SQL) What is Structured Query Language (SQL)? Structured Query Language (also known as SQL) is a programming language used to interact with databases…

Upgrading to a paid membership gives you access to a wide range of plug-and-play templates designed to improve productivity, as well as access to the full catalog of CFI courses and accredited certification programs.

Access over 250 Production Templates, a complete directory of accredited CFI Courses and Certification Programs, hundreds of resources, expert reviews and support, financial tools and real-world research, and more. Certificate of Deposit (CD) Accounts Receivable (A/R) Accounts Payable Prepaid Inventory Work (WIP) Current Assets Fixed Assets Property, Plant and Equipment (PP&E)

What Are Retained Earnings?

Accounts Payable (A/P) Accrued Expenses and Accounts Payable Wages Payable Deferred Wages Deferred Revenue Notes Dividends Payable Payables

Book value of equity (BVE) Retained earnings Additional paid-in capital (APIC) Accumulated deficit on treasury shares Other comprehensive income (OCI) Tangible book value (TBV)

Retained earnings refers to the total accumulated earnings that have not been paid out as dividends to shareholders since the company’s inception.

Management’s decision not to distribute dividends to shareholders may indicate the need to reinvest capital to sustain existing growth or support future financial expansion plans.

Essentials Of Advanced Financial Accounting 1st Edition Baker Test Bank By Robertfv89

A company’s retained earnings (RE) is defined as the income earned since its inception and not paid out to shareholders in the form of dividends.

In essence, the equation calculates the company’s total earnings after adjusting for dividends distributed to shareholders.

In general, companies with more retained earnings on their balance sheets are more profitable because higher retained earnings mean lower net income and lower distributions to shareholders (and vice versa).

If the retained earnings balance gradually increases, this indicates a profitable practice (and a more optimistic outlook).

Financial Statement Analysis

Conversely, if a company experiences persistently large losses on the net income line (ie, the “bottom line”), the retained earnings balance may eventually become negative, which is recorded on the books as an “accumulated deficit.”

But while the first scenario is worrisome, a negative balance could also result from aggressive dividend payments – e.g. Dividend Investments in LBOs.

From a dual perspective, a positive increase in the company’s retained earnings balance can be interpreted as a management team looking for profitable investments and profitable opportunities.

There are many factors to consider to accurately interpret a company’s historical retained earnings.

Solved: Problem 3 6a Part 2 2. Prepare A Post Closing Trial Balance. (hint: The Balance Of Retained Earnings Will Be The Amount Shown In The Balance Sheet.) Required Information Problem 3 6a: Record Closing

The image below is Apple’s (AAPL) earnings report for the fiscal year ending 2022. The dotted red line in the stockholders’ equity section of the balance sheet is the retained earnings line.

To model retained earnings, the following assumptions are used for a hypothetical company with trailing twelve months (LTM) or year 0.

When we combine the three line items, we arrive at the period-end balance—for example, the year-end balance is $240 million.

Notice in the following diagram that net income has a positive effect on the period-end balance (i.e. cash flow), while gross dividends have a negative effect (i.e. cash flow).

Balance Sheet Overview

In the next step, we choose two business scenarios and estimate the metrics for the next five years:

The “best-case” ending balance increases from $240 million in year 0 to $440 million in year 5—reflecting the net positive impact of management’s decision to retain more net income on the retained earnings balance.

In the “case scenario,” the bottom line drops from $240 million in year 0 to $95 million at the end of year 5, even though the company tries to offset the significant losses by reducing dividend payments.

Get the Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same curriculum is used by major investment banks.

The Partially Completed Work Sheet For Shutterbug Cameras Is

We will send the requested file

Negative retained earnings balance sheet, what is retained earnings on balance sheet, how to calculate retained earnings balance sheet, calculate retained earnings balance sheet, retained earnings partnership balance sheet, what are retained earnings on the balance sheet, retained earnings balance sheet example, retained earnings in balance sheet, retained earnings calculation balance sheet, what is in retained earnings, retained earnings formula balance sheet, where is retained earnings on balance sheet