Spot Gold Price Per Ounce – From the beginning of 2022, the price of gold remains stable or slightly lower. In terms of the euro, it rose slightly. In this article, we will try to understand the movements expected in 2023 for gold. At the end of 2021, we presented a complete unbiased analysis of the price of gold for 2022 (2022 will mark the entry of gold into a new phase).

“What can we expect to happen to the price of gold after that, ideally in 2022? If we refer only to the information provided by previous price modeling, it is estimated that the price of gold will be between now and the end of the year. Generally stable. 2022 […]”.

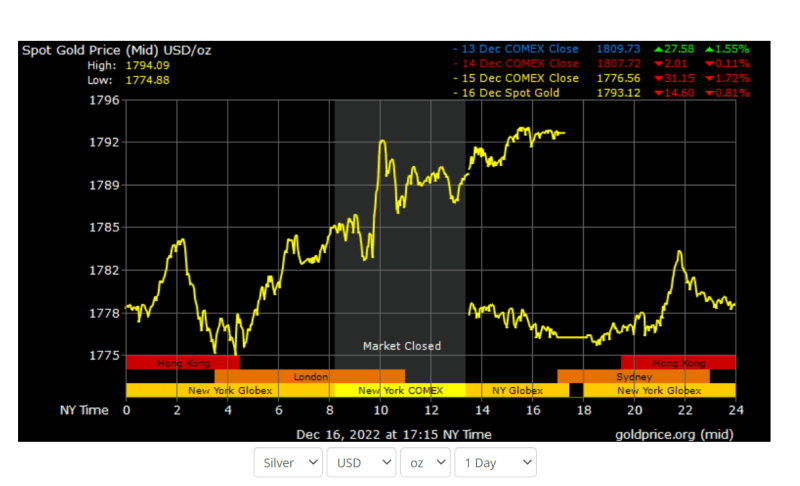

Spot Gold Price Per Ounce

). Gold Cyclical Research is highly accurate in predicting gold price trends in 2022. In this first edition, we will look at understanding the likely movement that can be expected in the price of gold in 2023.

Gold Little Changed Ahead Of Us Cpi Data, Fed Rate Decision

In the first half of 2022, the price of gold received a big shock. After being at zero from January to February, the price of gold rose 14% between February and March due to the conflict in Ukraine. In fact, Russia is the second largest producer of gold in the world and its importance in the gold market is considerable. However, this considerable pressure was driven by demand for artificial funds. The strong upward trend could not continue like this.

Between March and July 2022, investment demand in the gold market decreased and mine production (supply) increased. As a result, the price of gold quickly returned to pre-crisis levels. Moreover, from the spring of 2020, the $1,700 level plays a key support role. In fact, mining supply reduces the amount of gold produced when the price of gold falls below $1,700, mechanically creating a large support zone (Mining Companies: What Are Their Positions on Gold?). Finally, gold is in its first recession since 2019 and second period of inflation. Thus, gold rose above 20% in 2019, followed by +22% in 2020. As a result, gold took a break in 2021 (-3.5%) and confirmed the move in 2022 so far. Unfortunately, this hold in the gold price comes in the context of extreme inflation. We talked about this in the previous article of April

“Surprisingly, and according to our gold analysis, current inflation is likely to moderate somewhat by 2023.”

In our publication since the end of 2021, we have used the cyclical index method. The cyclic index represents the average of all previous cycles (for the period 1968-2022). Generally, we see a good correlation between the current evolution of gold prices and the average evolution of past prices. Thus, for 2022, the cyclical index showed a theoretical average performance of -1.53% (with significant risks of deviation, with occasional increases of around 20% or more than 10%).

Bretton Woods System

Hence, a study of historical prices indicates stagnation in gold prices in 2022. However, the position of the gold wheel also indicates a high probability of sudden movement in the price of gold, which is often associated with a crisis situation (war, recession, etc.). The geopolitical crisis in Ukraine confirmed our opinion. The chart below shows the cyclical index (solid black line, this is the average of prices between 1968 and 2022) as well as the current level of the index (continuous line), where gold prices are based on 100. 2013. It can be seen that there is a very good balance between the past prices and the current development of gold. The crisis of the war in Ukraine also respected the balance of the price of gold with its historical development. Additionally, the recent decline seen around $1,700 per ounce is also a recent decline.

From now on, the end of 2022 will confirm the entry of a new phase of the historical cycle of 9 years. Historically and statistically, 2023 will mark the “first decade” of the next cycle (2023-2032). The beginning of various cycles often determines the long-term trend that will follow. So we see that, on average, the price of gold rises by about +10% in the first tenth of the cycle. In other words, we can expect gold to average around 10% in 2023. However, this performance could be dampened by adverse market forces continuing till the end of 2022. The largest decline recorded in this first decadal cycle is about -3.5% (at the start of the cycle in 1995 and 2013). In contrast, the largest returns recorded during this phase of the cycle were +31% (1986-1887) and +16% (1976-1977).

In other words, if the price of gold behaves as it has in the past, 2023 will be less risky than the growth potential. Based on gold price dynamics in 2022, it would be very favorable to see an upward recovery in 2023. However, this revival is not historically significant and will only give rise to a more prominent style than the previous one. Furthermore, a drop in the gold price in 2023 would signal several years of declining gold prices. Production from 2022 will be very strategic in terms of timing.

Cycles are also very useful for predicting trend reversals. In this sense, there are many ways. One of these is inspired by quantum physics and relates to interference detection. In circuit analysis, a distinction is made between so-called “destructive” interference and “constructive” interference. A destructive intervention is associated with a neutral price movement, usually a lower low in markets. This type of intervention corresponds to the combination of two non-synchronous cycles (a high level in the first cycle is combined with a low level in the second cycle). Formative interference is associated with the opposite phenomenon and with a larger amplitude of movement, often associated with heights.

Us Dollar Devalues By 99% Vs Gold In 100 Years As Gold Price Crosses $2,067

The price of gold is an asset that is subject to intervention. The study of the interplay between gold price-forming cycles is highly relevant on larger time scales. Thus, we graphically identified two gold price cycles: the first fourteen-month and the second eight-month. Mathematically, we know that these two cycles enter creative interference every 56 months (4.6 years). This means that gold is subject to medium or long-term peak confirmation every four to five years due to these two cycles.

So, on the graph above the vertical lines, we have indicated that each corresponds to interference (constructive, then destructive, etc.). We find that this model matches gold’s movements well. In addition, the last constructive intervention (an important convention) was approved in early 2021. Since then, we are headed for a catastrophic intervention (price neutrality and a possible rally zone) that will appear around the spring of 2023. In other words, it is consistent with our view that gold will gradually return to a major correction with no guarantee of a hike until the first half of 2023. However, it is highly possible that otherwise, long-term interventions not identified here would negate this predicted behavior.

Two numbers are enough to indicate the importance of location when buying gold. As of January 1, 2019, a little over three and a half years, gold is +36% in dollars, +56% in euros! For European investors, buying gold will be twice as profitable as for American investors. At the same time, the consumer price index for the United States increased by +16.95%, compared to a consumer price index increase of about +10% in France during the same period.

In other words, gold has made investors significantly richer over the past three years. In fact, the yellow metal rose twice as fast as the price level in the United States and 5.5 times as fast as the price level in France!

Gold And Silver Price (august 31, 2023): Yellow Metal Above Rs 59,000 — Check Out Gold Prices In Mumbai, Delhi And Other Cities

This statistical fact also hides a political disaster. Since January 2019, the Euro has lost almost 13% of its value against the Dollar! Analyzing the price of the euro in this way is also a decisive factor for European investors. A weaker gold price in 2023 will mean gold outperforms in Europe, which will be reversed if the euro is stronger.

In 2022, the euro showed serious weakness in its historical trend. The graph above shows the exchange rate of the euro or its equivalent since the first attempts at economic integration with the ESM in 1972. After several major peaks, the euro reached an all-time high of 1.60 against the dollar in 2008. Technically, the value of the euro has stabilized. On A

Gold spot price per ounce, titanium spot price per ounce, spot price for gold per ounce today, platinum spot price per ounce, gold spot price today per ounce, current gold spot price per ounce, spot price gold silver per ounce, silver spot price per ounce, copper spot price per ounce, current spot price of gold per ounce, 14k gold spot price per ounce, spot gold price per troy ounce