Best Start Up Business Bank Account – Create a Bank Account for Your Startup 1. Why do you need a bank account for your startup?

When you start a business, you need a bank account. It’s that simple. A business bank account will help you stay organized, manage your finances, and grow your business.

Best Start Up Business Bank Account

If you run a business, it’s important to keep your personal and business finances separate. Having a business bank account will help you stay organized and make it easier to track business expenses.

Best Business Checking Account

If you use a personal bank account for your business, you may be missing out on some valuable tax incentives. Having a business bank account will allow you to withdraw business expenses, which can save you money at tax time.

If you use a personal credit card for your business expenses, you’re missing out on the opportunity to build business credit. Having a business credit card and using it responsibly can help you build business credit, which could come in handy in the future when you need to get a loan or line of credit for your business.

If you sell products or services, you need to find a way to accept payments from your customers. Having a business bank account with a merchant account will allow you to accept credit and debit card payments, which can be a convenient way for your customers to pay.

When you have a business bank account, you have access to a variety of products and services designed specifically for businesses. This can include things like business loans, lines of credit, and purchasing services.

Best Bank For Ecommerce Startups 💰 (2023)

Opening a business bank account is an important step in starting your business off on the right foot. A business bank account will help you stay organized, manage your finances, and grow your business.

Why you need a bank account for your startup – Create a bank account for your startup

There are a few things to consider when choosing a bank account for your startup. The first is the type of account you need. The most common types of bank accounts are business savings accounts, business checking accounts, and business accounts.

The next thing to consider is the type of fees you will be charged. Some banks charge monthly fees, while others charge per transaction fees. You should also consider whether you will be charged for ATM use, overdrafts and other services.

Best Business Bank Account 2022: Accounts For Llcs

Finally, we advise you to consider the interest rates offered by various banks. Some banks offer higher interest rates for business accounts than for personal ones.

When choosing a bank account for your startup, it is important to compare the different options and choose the one that best suits your business.

When starting a business, there are many things to think about, from your product or service to your target market and how to reach them. One important thing that is often overlooked is your company’s bank account.

A business bank account is an important part of any business, no matter how large or small. It is a separate account from your personal account, which helps you keep your finances organized and gives you a clear view of your business’s cash flow in and out.

Business Banking: Totally Free Checking Account

A business bank account can help you keep tabs on your finances and generally be better organized. If you have a separate account for your business, it will be much easier to track your expenses and income, see where your money is going, and make sure you stay within your budget. This information can be extremely helpful when it comes time to pay taxes or apply for business loans

Having a business bank account shows potential customers, suppliers and investors that you take your business seriously. It can also make your business more professional and organized, which can help you gain new customers.

Another benefit of having a business bank account is that it makes record keeping much easier. All your business transactions will be in one place, which will save you time and effort during tax season. This careful record keeping can also be helpful if you are being audited by the IRS.

If you need to apply for a business loan or line of credit, having a business bank account can make the process much smoother. This is because lenders often require you to have a business bank account in order to qualify for a loan. Having an account also shows creditors that you are serious about running a successful business.

Benefits Of Having A Saving Bank Account In Singapore

When you open an account at a commercial bank, you often have access to special services that can help your business grow. For example, many banks offer merchant services that allow you to accept credit card payments from customers. This can be a great way to increase sales and grow your business.

The benefits of having a bank account for your startup – Create a bank account for your startup

There are some important things to keep in mind when opening a bank account for your startup. First, you want to make sure you choose a reputable, FDIC-insured bank. You should also consider which type of account is best suited to your business. For example, a business checking account will likely have different requirements than a personal checking account.

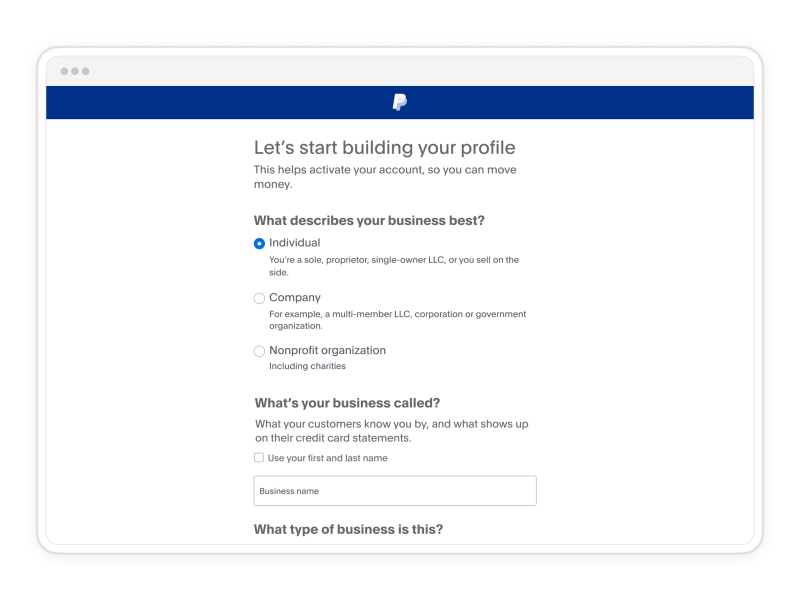

Once you have chosen your bank, you will need to open an account. This will require you to provide some basic information about your business, such as your business name and address. You may also be asked to provide your Social Security number or employer identification number.

Starting A Business Series

Once you open your account, you will need to deposit money into it. This can be done by writing a check or transferring money from another account. You should also set up a system to track your account balance and transactions. This can be done with online banking or by using a checkbook register.

It’s important to remember that a bank account is a critical part of your business. It is important to choose a bank that you trust and that offers the services you need. By following these tips, you can ensure your startup has a solid financial foundation.

No idea how to start your funding round? helps you create a funding plan, evaluate your startup, set deadlines and milestones, and combine different funding sources. Join us! 5. What to look for when choosing a bank account for your startup?

When it comes to business banking, there is no one-size-fits-all solution. The best bank account for your startup will depend on a number of factors, including the size and structure of your business, your banking needs and preferences, and your budget.

Top Bank Accounts For Sole Traders And Self Employed 2023

The first step in choosing a bank account for your startup is to identify the type of business you run. Are you the sole owner? A partnership? A limited liability company (LLC)? Each type of business has different banking needs, so it’s important to choose the right bank account for your specific type of business.

Once you’ve identified the type of business you run, it’s time to evaluate your banking needs. What type of transactions will you make? How often will you do them? Do you need a bank account that offers online banking and mobile deposits? These are all important factors to consider when choosing a bank account for your startup.

Another important factor to consider when choosing a bank account for your startup is your budget. How much can you afford in monthly payments? Are you willing to pay a higher monthly fee to access premium features and services? It’s important to find a balance between cost and value when choosing a bank account for your startup.

When choosing a bank account for your startup, it’s important to consider the reputation of the bank. Look for a bank that has a good reputation for customer service and security. You can also read online reviews to get an idea of what other customers think of the bank.

Best Banks For Ecommerce Business: Top 9 Best Business Banks

Another factor to consider when choosing a bank account for your startup is the location of the bank. If you live in a rural area, you may have limited options when it comes to banking. On the other hand, if you live in a big city, you may have many options to choose from. It is important to find the most convenient bank for you.

Choosing the right bank account for your startup is an important decision. Keep these factors in mind when making your choice and you will be sure to find the right account for your business.

What to look for when choosing a bank account for your startup – Set up a bank account for your startup

There are a few things you should consider if you are a startup and looking for a bank. The first question you should ask yourself is whether you want a business bank account or a personal bank account. The answer to this question will help you decide which type of bank account is best for your startup.

The Difference Between A Merchant Account And Business Bank Account

A business bank account

Start up business bank account, best business start up bank account, best bank to start business account, best start up business account, best bank to start a business account, small business start up bank account, start business bank account, free start up business bank account, best start up bank account, best business bank account for start up, best bank account for small business start up, start up bank account