Where To Find Dividends On Financial Statements – Retention ratio is the ratio of earnings retained in the business. The retention ratio refers to the percentage of net income that is retained to grow the business instead of paying out dividends. This is the opposite of the payout ratio, which measures the percentage of earnings that are paid out to shareholders as dividends. The retention ratio is also called the leverage ratio.

Companies that make a profit at the end of a financial period can use the money for many purposes. A company’s management may pay dividends to shareholders, retain them for business growth, or some combination of the two. The portion of earnings that a company chooses to retain or retain for later use is called retention.

Where To Find Dividends On Financial Statements

It keeps the amount of net income left for the business after paying dividends to its shareholders. A trade generates income that can be positive (profits) or negative (losses).

Understanding The 1099 Div Tax Form

Retained earnings are similar to a savings account in that they are a pool of earnings that are retained or not paid out to shareholders. Profits are reinvested in the company for growth purposes.

The retention ratio helps investors determine how much money a company should invest in the company’s operations. If a company does not pay out all of its retained earnings as dividends or reinvest them in the business, it can suffer from earnings growth. Additionally, a company that does not use retained earnings efficiently is more likely to take on additional debt or issue new equity shares to finance growth.

Therefore, the retention ratio helps investors determine the company’s reinvestment rate. However, companies that accumulate more profits may not be using their cash efficiently and would be better off investing the cash in developing new equipment, technology or products.

New companies usually do not pay dividends because they are still growing and need capital to finance their growth. However, established companies typically pay out a portion of their profits as dividends and reinvest a portion in the company.

In A Set Of Financial Statements, What Information Is Conveyed By The Statement Of Cash Flows?

Retention Ratio = Net Income – Dividends Distributed Net Income begin text=frac -text}}\ end RetentionRatio = Net Income Net Income − Dividends Distributed −

There are two ways to calculate the retention ratio. The first formula looks for retained earnings in the stockholders’ equity section of the balance sheet.

An alternative formula does not use retained earnings, but instead subtracts distributed earnings from net income and divides the result by net income.

Retention ratios are generally higher for growth companies that are rapidly increasing revenue and earnings. A growth company prefers to return earnings to its business if it believes it can increase earnings and profits to its shareholders by investing in its dividend receipts.

Solved] Suppose That In 2016 Sales Increase By 10% Over 2015 Sales And That…

Investors may be willing to give up profits if the company has strong growth prospects, which is often the case for companies in sectors such as technology and biotechnology.

The retention rate of technology companies at a relatively early stage of development is often 100% because they rarely pay dividends. But in mature sectors such as utilities and telecommunications, where investors expect reasonable returns, the retention ratio tends to be very low because of the high dividend payout ratio.

The retention ratio may vary from year to year depending on the company’s earnings volatility and dividend payout policy. Many blue-chip companies have a policy of paying ever-increasing or at least constant dividends. Companies in defense sectors, such as pharmaceuticals and consumer products, will have more stable payouts and retentions than energy and commodity companies, as their earnings are more cyclical.

A limitation of the retention ratio is that companies with large amounts of retained earnings may have a high retention ratio, but this does not mean that the company reinvests that money back into the company.

End Of Chapter Exercises

Also, the retention ratio does not take into account how the money is invested or whether it has been invested effectively for the company. The retention ratio is best used in conjunction with other financial measures to determine how well a company invests its earnings.

As with all financial ratios, it is important to compare the results with companies in the same industry and monitor the ratio over several quarters to determine if there is a trend.

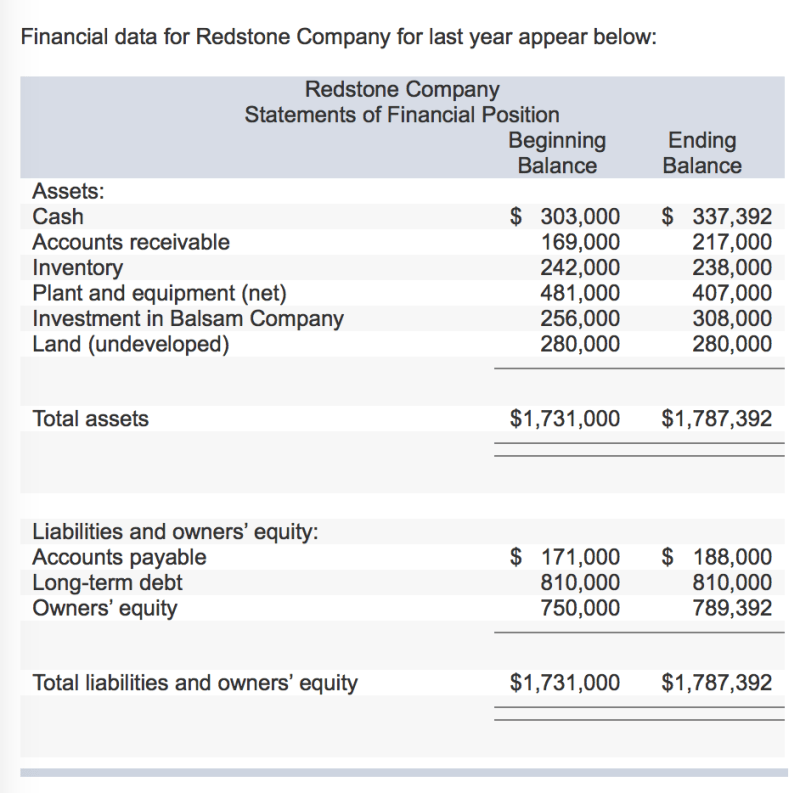

Below is a copy of the balance sheet of META, formerly Facebook, as of January 31, 2019, as reported in the company’s annual 10-K.

The reason the retention ratio is so high is because the tech company collected earnings and paid no dividends. As a result, the company retains sufficient profits to invest in the future of the company. A high retention ratio is very common for tech companies.

What Are Retained Earnings? How To Calculate Retained Earnings?

When you visit the Site, DotDash Meredith and its partners may collect or receive information about your browser, often in the form of cookies. Cookies collect information about your preferences and your devices and are used to make the website work as you expect, to understand how you interact with the site and to show you advertisements targeted to your interests. You can learn more about our use, change your default settings and withdraw your consent at any time, with future effects, by visiting the cookie settings, which can also be found at the footer of the website. 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to discover 20 free courses and hundreds of financial templates and cheat sheets.

Retained earnings (RE) is the accumulated portion of business profits that are not distributed to shareholders as dividends, but are reserved for reinvestment in the business. Generally, these funds are used to purchase working capital and fixed assets (capital expenditure) or are used to pay off debt obligations.

Retained earnings are reported in the stockholders’ equity section of the balance sheet at the end of each accounting period. To calculate RE, the beginning RE balance is added to net income or subtracted from net loss, and then dividend payments are subtracted. A summary report called the Retained Earnings Statement is also kept, detailing the changes in RE for a given period.

Retained earnings are a useful link between the income statement and the balance sheet because they are recorded under stockholders’ equity, which ties the two statements together. The purpose of retaining these profits may vary and may include the purchase of new equipment and machinery, research and development expenses, or other activities that create potential growth for the company. This reinvestment aims to generate even more revenue for the company in the future.

Financial Statements: Analyzing The Impact Of Interim Dividends

If a company does not believe that it can obtain a sufficient return on investment from these retentions (ie, it earns more than the cost of capital), then it distributes these earnings to shareholders as dividends or buys back shares.

At the end of each accounting period, retained earnings are recorded on the balance sheet as the accumulated earnings of the previous fiscal year (including annual earnings), excluding dividends paid to shareholders. In the next accounting cycle, the RE ending balance becomes the beginning balance of retained earnings from the previous accounting period.

The RE balance is not always a positive number, as it may indicate that the current period’s net loss is greater than the opening RE balance. Alternatively, large dividend distributions in excess of the retained earnings balance may be negative.

Any change or movement in net income will directly affect the RE balance. Factors such as increases or decreases in net income and net losses affect business profits or losses. A retained earnings account can become negative because of large accumulated net losses. Naturally, the same factors that affect net income affect RE.

Financial Statement Analysis Notes

Examples of such items include: sales revenue, cost of goods sold, depreciation and other operating expenses. Non-cash items such as terminations or impairments and stock-based compensation affect the account.

Dividends can be distributed to shareholders in cash or in the form of shares. Both cases can reduce the value of RE for companies. Cash dividends represent cash flows and are recorded as a decrease in the cash account. They reduce the size of the company’s balance sheet and the value of its assets, because the company no longer holds part of its liquid assets.

However, stock dividends don’t need to be cash out. Instead, they return a portion of the RE to common stock and overpaid capital accounts. This allocation does not affect the overall size of the company’s balance sheet, but reduces the value of each share.

At the end of the period, you can calculate the ending profit balance by taking the beginning period balance, adding net income or net loss, and subtracting profit.

Financial Statement Analysis

In this example, the amount of earnings

Where to find dividends per share on financial statements, where to find inventory on financial statements, where to find financial statements, where to get financial statements, find company financial statements, where to find sales on financial statements, financial statements on excel, dividends on financial statements, where to find revenue on financial statements, dividends financial statements, audit report on financial statements, where to find ebit on financial statements