Best Way To Earn Interest – Savings account interest is what banks and financial institutions pay depositors for keeping their money in the bank. Compound interest is interest calculated on principal and interest earned, meaning your income is reinvested to earn higher interest rates in the future.

Basically, a bank borrows money from its depositors and uses the deposited money to lend to other customers. Instead, the bank pays depositors interest on their savings account balances and charges borrowers a higher interest rate than the depositors were paying.

Best Way To Earn Interest

Reinvesting the interest earned in your savings account into your original deposit will earn you more money in the long run. This process of earning all the interest on your savings and accruing over time is called compounding. Investors can use the concept of compound interest to accumulate and build wealth.

Earn Up To 5.15% Interest On Your Money: The Best 7 High Yield Savings Accounts

Interest on savings account is expressed as a percentage. For example, suppose you have $1,000 in the bank; 1% interest can be earned on the account. Unfortunately, most banks offer less than 1% interest on savings accounts due to their historically low interest rates.

Calculating compound interest, $1,000 earned at 1% interest for one year will yield $1,010 (or .01 x 1,000) at the end of the year. However, this calculation is based only on the principal or simple interest paid on the deposit.

Some investors, such as retirees, can withdraw the interest earned or transfer it to another account. Interest payments are a form of income. Withdrawal of interest gives income to the depositor’s account

However, since interest rates are so low, many savers can keep the interest earned in a savings account. As a result, the money in the savings account will generate income

How To Earn Interest On Crypto: 2024 Complete Guide

Interest can be added to the savings account daily, monthly or quarterly and you will get the interest you have earned up to that point. As interest accrues on your balance, your savings will grow faster.

Using our previous $1,000 example and compounding daily, the interest income grew by 1/365 of 1%. At the end of the year, deposits increased to $1,010.05 compared to $1,010 in simple interest.

Sure, an extra $0.05 doesn’t seem like much, but at the end of 10 years, your $1,000 will grow to $1,105.17 with compound interest. 1% compounded daily over 10 years increases the value of your investment by 10%.

Again, the money earned doesn’t sound like much, but think about what happens if you save $100 a month and add your first deposit to $1,000. After one year, you would have earned $16.05 in interest on the $216.05 balance. After 10 years, still adding just $100 a month, you’ll have $725.50, or a total of $13,725.50.

Interest Rate Calculator (2024)

Although this money is not an asset, it is a reasonably sized rain fund, which is one of the main purposes of a savings account. When money managers talk about “liquid assets,” they mean any asset that can be converted into cash on demand.

The definition is immune to fluctuations in the stock market and real estate values. For real people, it’s an emergency fund that can be used for unexpected expenses like medical bills or car repairs.

To truly understand the snowball effect of compound interest, consider this classic experiment by Benjamin Franklin. The scientist, inventor, publisher, and founding father was a bit of a showman, so it must have been ridiculous for him to start an experiment that didn’t work 200 years after his death in 1790.

Benjamin Franklin exemplified the power of compounding known as the snowball. The $4,500 he left in each of the two US cities was more than 200 years of inflation.

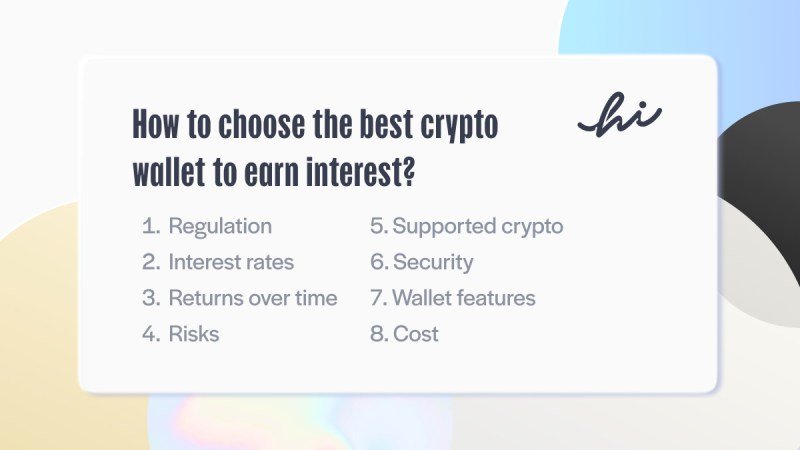

Best Crypto Wallets With Interest In 2024

In his will, Franklin left $4,500 each to the cities of Boston and Philadelphia. The investment is said to be made for 100 years and the annual interest is 5%. Then three-fourths is spent on its merits and the rest has to be reinvested for another 100 years. In 1990, the Boston fund had $4.5 million, while the Philadelphia fund had about $2 million due to mixed interests.

Franklin’s experiment showed that compound interest could build wealth over time even when interest rates were low. If you are considering opening an account, you can quickly and easily find out the rates banks are offering online. Some banks specialize in high-yield savings accounts.

The best savings accounts include those offered by banks that add interest daily and charge no monthly fees. Banks express their interest in terms of the annual percentage rate (APY), which shows the effect of compounding. Note that APY and Annual Percentage Rate (APR) are not the same because APR is not included in compounding.

Compounding is the reinvestment of your interest or past accumulated interest. Simple interest is paid only on the principal or deposit.

The Best Low Risk Ways To Earn Interest On Your Money

Investors can use the concept of compound interest to accumulate and build wealth. Reinvesting the interest earned in your savings account into your original deposit will earn you more money in the long run.

Depending on the type of account or type of product, interest is compounded monthly, quarterly or annually. Interest may be compounded weekly or daily.

Unlike Benjamin Franklin, most of us don’t want to be sure what our savings will be worth 200 years from now. But we all need to have some cash for emergencies. Interest combined with regular contributions can add up to a nice quick nest egg.

They require authors to use primary sources to support their work. These include white papers, government data, first reports and interviews with industry experts. We also refer to original research from other reputable publishers. You can learn more about our standards for creating accurate and fair content in our editorial policy.

The Best Places To Save Money And Earn High Interest In India

The offers in this table are related to compensation. This compensation can affect how and where listings appear. Not all offers are included in the market.

Consumer banking is the process of providing financial services to consumers. It offers services like savings accounts, checking accounts, personal loans, mortgages, credit cards and more. Consumer banking differs from investment banking, which focuses on providing services to companies and institutions. In this section, we will focus on retail banking and savings accounts.

A savings account is a type of bank account that allows you to save money while earning interest. A savings account has a lower interest rate than an investment account, but it’s still a great way to get some cash on your savings. Savings accounts are FDIC insured up to $250,000 and are a safe way to keep your money.

There are different types of deposits, each with their own advantages and disadvantages. Some common types of savings accounts are:

How To Increase Income: 17 Creative Ways To Make Money

Traditional Savings: These accounts offer low interest but are easy to open and maintain.

High-yield savings accounts: These accounts offer higher interest than traditional savings accounts, but may have minimum balance requirements or other restrictions.

Money market accounts: These accounts offer higher interest than regular savings accounts, but may have higher minimum balances or limit the number of monthly transactions.

Fees: Some savings accounts charge maintenance or transaction fees. Find accounts with low or no fees.

How To Earn Free Bitcoin In 2024

Minimum balance requirements: Some accounts require a minimum balance to avoid fees or earn interest. Before opening an account, make sure you can meet the minimum balance requirements.

Access: Think about how easy it is to get paid. Some accounts may limit the number of transactions you can make each month or require you to maintain a certain balance to avoid penalties.

Convenience: Savings accounts are easy to open and maintain, and most banks offer online banking and mobile apps to make managing your account easy.

Here is a comparison of some popular savings accounts to help you choose the best savings account for your needs.

Discover The Best Savings Account In Singapore For Salary And Non Salary Credit!

Ally Bank Online Savings Account: No high interest rates, monthly maintenance fees or minimum balance requirements.

Capital One 360 Performance Savings: High interest rates, no monthly maintenance fees or minimum balance requirements.

Chase Savings: Low interest rates but a network of ATMs and branches for easy withdrawals.

Choosing the right savings account is an important step in maximizing your savings. Considering interest, charges and minimum balance requirements,

Top 18 Ways To Earn Rs. 500 Per Day Online Without Investment For Students In 2024

Best banks to earn interest, best ways to earn interest, best way to earn 5 percent interest, best place to earn interest, safest way to earn interest, best way to earn interest on money, best accounts to earn interest, best savings to earn interest, best bank to earn interest, best way to earn interest on cash, best way to earn interest on savings, best way to earn compound interest