Budgeting Tools For Young Adults – Were you stressed about money in college? Learn how to create a basic college budget and use one of these templates to get started!

In college, you live alone for the first time. But you may not have the skills necessary to earn a full wage.

Budgeting Tools For Young Adults

But even if you don’t have a lot of college funds to your name, you can improve your financial situation with a stable student budget.

Meaningful Budgeting Activities For High School Students

It will help you manage your money now and teach you an important financial skill that will serve you for the rest of your life.

Below, we’ll show you why you need a college student budget, then guide you through creating your own and show you a budget template to get you started. Once completed, you will feel more confident in managing your money.

Budgeting may seem like something you don’t have to worry about unless you have a steady paycheck, but college students need them even more.

But you also have daily expenses. Room and board alone will cost about $10,000. Then there’s food, transportation, fees to attend all the clubs, and some entertainment money.

They Go Hand In Hand”: A Patient Oriented, Qualitative Descriptive Study On The Interconnectedness Between Chronic Health And Mental Health Conditions In Transition Age Youth

Without a budget, it’s difficult to do all of this without stress. You already have enough money – a student budget can give you a clear picture of your financial situation, so you can reduce financial stress and reduce debt.

A student budget is your monthly plan for how your funds will be spent. It’s also a plan – it helps you decide where to go.

It’s easy to spend some money here and there on things you don’t really need or value, especially if you put the money on a credit card. But when you look at the card or your bank account, you’ll notice that these small purchases quickly add up.

A budget puts all your expenses in front of you. You can see exactly where every dollar is going. From there, you can discover at least a few expenses that you can cut right away.

Get More Out Of Your Google Sheets Budget Templates

For example, students spend an average of $547 per month on food – but mass starvation is possible. For example, you could try eating less!

Cut back on the expenses you don’t need and you’ll have more money to spend on the things you really want.

Even if you’re not sure what some of these goals are, just investing your money will keep you ahead of the curve when it comes to getting what you want.

College is the first time many people take charge of their own money in their lives. Without previous experience, it’s easy to develop bad habits.

Important Credit Card Lessons

As we have already said, one of them is the misuse of credit cards. Scratching a piece of plastic is less painful than handing over cash.

There’s no doubt that money is a huge stressor for college students, but putting things down on paper can make you feel a little lighter because it removes uncertainty.

You can see how much money is coming in and where it’s going, rather than doing the math in your head. Even if money is tight, you’ll have a clear picture of your cash position.

Now you have the power to do something to make it better, whether it’s changing your spending or finding ways to make more money.

Building Credit For Young Adults

Budgeting is one of those skills that you will carry with you throughout your life. When you’re just starting to manage your finances, learning how to do this right away will make your transition to “full-time salaried” status much easier.

Plus, you’ll learn all the other life lessons that come with budgeting, such as living within your means and saving a portion of your income for the future.

If you’ve never created a budget from scratch before, it can seem daunting. If you tend to overspend, writing down your budget can also be discouraging.

First, you need to collect all your sources of income. Students have 4 main sources:

The 19 Best Personal Finance Books

Looking at your income is a good starting point to understand how much money you have in total. You need to allocate your income between each source.

For your job, look at one of your paychecks. If your salary varies from month to month, try looking at several salaries and calculating an average. You can also use Form W2 – the tax form used to report income.

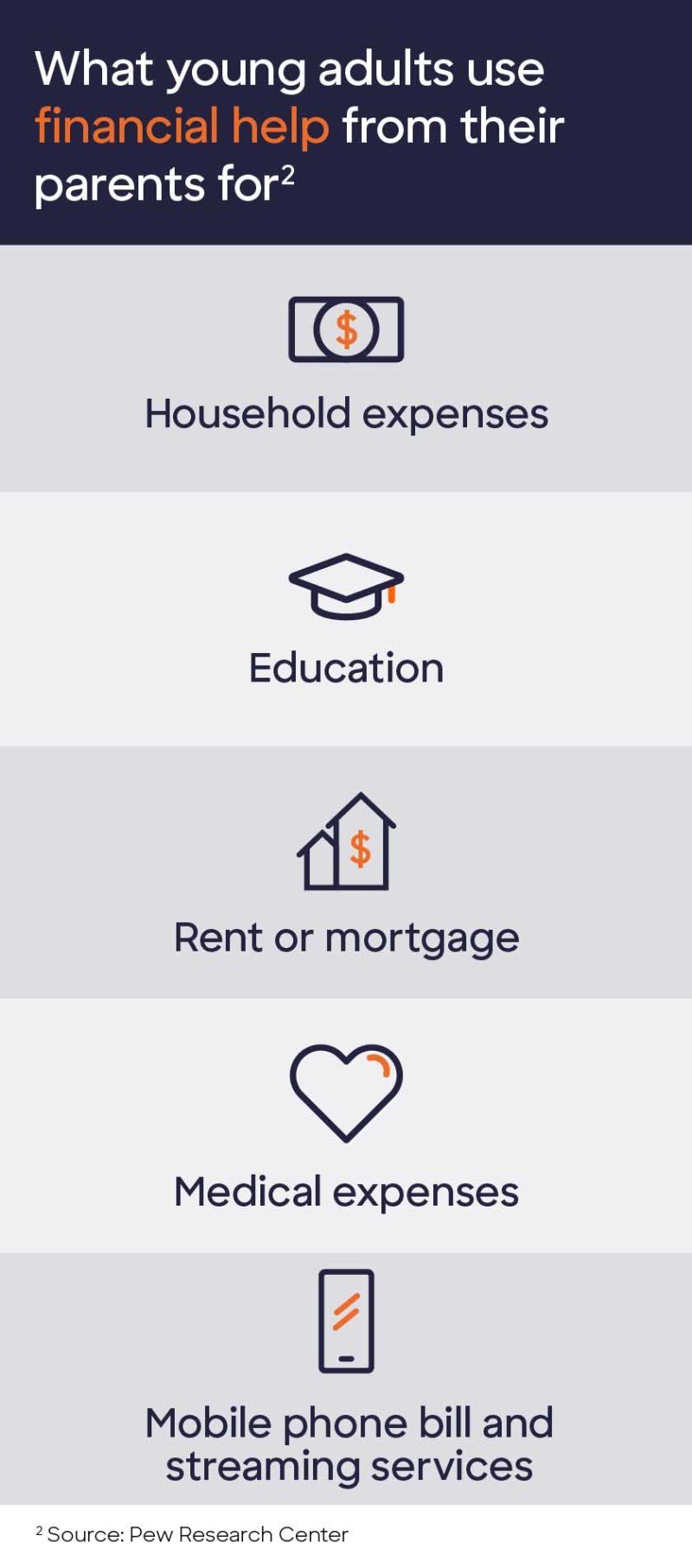

To help with parenting, a quick look at your bank statements can give you an idea of what they are.

The same goes for financial aid. However, if financial aid sources go directly to your school, you should add them as well.

Young Adult Man Working Diy Budget Renovation His New Home — Stock Photo © Milangucci #465153278

Finally, the miscellaneous section is for passive or passive income. This could include a tax refund, birthday money, or even $10 you found on the floor.

Next are your fixed costs. Basically, it’s an expense that doesn’t change in amount from month to month.

Just like your income, reviewing your bank and credit card statements is a great way to understand your true spending.

Your “fun money” usually makes up a large portion of this category. That being said, some of the other things here could be car repairs, home tours, new clothes, ride services, and various other things.

Finance Tips For Young Adults

Depending on your situation, some fees may be variable or fixed. For example, if costs vary significantly from month to month, you might treat sales as a variable cost.

Utilities are another example. If you live in a place with year-round mild weather, your electricity bill probably won’t change much from month to month. However, if your area has different seasons throughout the year, you can treat your electricity bill as a variable cost.

If you’re actively saving for something, such as an emergency fund, you’ll want to create a separate section for those goals.

![]()

Once you have all your income, monthly expenses, and savings, you need to write them all down and incorporate them into your budget.

Ultimate Guide: Copper’s Guide To Budgeting (for Teens)

At a basic level, a budget will be your high income. Here are your fixed and variable expenses.

Now, you may find that you are spending more than you are making. That’s okay, your budget will help you figure out where you can make changes to go green.

Few, if any, people read their budget numbers for the first time. There’s a good chance you’ll be unemployed for the first few months.

As you live on this budget, you can improve it to more accurately reflect your financial situation. After that, income and expenses may change.

How Much Should You Budget To Move Out?

You might get paid at work or have your tax refund deposited into your bank account. Either way, you’ll have more revenue available in your budget.

Alternatively, you could move to an apartment outside the city. Your housing costs will change, and you may now be responsible for utility bills. This means making some changes to the fees section.

The key is to stay as consistent with your budget as possible and adjust as your life changes.

Above, we discussed the basics of creating a budget. But the truth is, there are many types of budget models.

Best Budgeting Apps For College Students In 2024

Above you can see the income section. It’s broken down into income from work, money from parents and other income like financial aid, birthdays and holidays. In the right column, you can see the dollar amount for each item.

Next, we have expenses. This section covers your ongoing expenses, such as tuition and rent. These numbers should usually be for the same month. Variable costs

Below the fixed fees are variable fees, which may change slightly each month. These include things like food, travel and dining.

There is also an easy-to-use savings section that provides students with 3 savings goals.

Google Sheets Monthly Budget Templates

The 50/30/20 budget is a great template for people with low to moderate incomes, especially beginners.

Your supplies include everything you need for daily college life. This can include rent, utility bills, groceries, car payments, and school textbooks.

Your savings is 20% of your final budget. This includes your emergency fund, debt repayment, retirement accounts (if you have one), and your investments.

As you can see, the 50/30/20 template can help you develop sustainable financial habits and understand what you value. It holds you responsible for making sure your savings are enough to meet all your needs without sacrificing what you want.

Top 5 Financial Literacy Tools For College Students

Today, budgeting apps make it easy to create and monitor a budget online and through mobile apps. They allow you to set budget categories, link your financial accounts to control expenses, and provide recommendations.

You can also use spreadsheet software. Creating a spreadsheet requires more work, including creating layouts and writing formulas, but it can provide more flexibility than some budgeting programs.

Using pen and paper requires more work than digital methods and can lead to confusion if you’re not careful.

But on the plus side, there’s no technical learning curve with this approach. Some people start with pen and paper and then move on to digital budgeting.

Your Financial Roadmap

Additionally, many budgeting apps today use strong security measures, but nothing is more secure than a plain old pen and paper.

A budget can give you a better understanding of your spending and help you spend less

Best budgeting apps for young adults, budgeting apps for young adults, budgeting tips for young adults, budgeting help for young adults, best budgeting app for young adults, budgeting template for young adults, budgeting books for young adults, budgeting plans for young adults, best budgeting tools for young adults, free budgeting apps for young adults, budgeting worksheets for young adults, budgeting for young adults