Can I Lend Money To A Friend – “Be neither a borrower nor a lender, for credit often loses itself and its friend,” warns Polonius to his son Laertes in William Shakespeare’s Hamlet. Thanks for the advice, Dad, but for many communities, borrowing from family or friends is optional. to be everything is available. One study found that Americans borrowed $184 billion from friends and family in 2018.2 In 2014, about 12.5 percent of small businesses reported receiving some kind of loan from family and friends.3 However, in 2010, businesses less than two years old for that share was close to 20 percent. percent, and more than 22 percent of minority-owned businesses depend on loans from friends or family.3

Sometimes these loans are repaid. But in other cases, once the cash is deposited, the borrower can be left out in the cold without any structure or promise to pay. Let’s look at some tips to help preserve family relationships and ensure that money eventually returns to the hands that once fed it.

Can I Lend Money To A Friend

:max_bytes(150000):strip_icc()/do-s-and-don-ts-of-lending-to-friends-and-family-5088469-final-a63ae6345ee54d1487b76c2ae1a71603.jpg?strip=all)

Although it may seem strange to work with family and friends, many experts recommend making the process as formal as possible, starting with a contract.4 Contracts exist because life is too complex for anyone to predict what will happen; when the contract is written. usually provides something that doesn’t change even if the outside world does something unexpected. This is especially important in loan agreements with people we know, where decades of relationship can make something seem more complicated.

Lending Money Stock Vector By ©photoestelar 29859257

Some loan agreements must be in writing to be enforceable. But even if the type of loan you’re considering doesn’t have to be in writing, it’s still a good idea. The main value of a written loan agreement is not to reach this stage of disputes. No contract is perfect, but in the event of a disagreement, a contract can help you resolve disputes faster and with fewer disputes. It can even save you time and money by avoiding hiring a lawyer or going to court.

Creating a contract shouldn’t be difficult. Here are some things you should have and remember in the family loan agreement:

Sum. If you took something other than cash, provide a detailed description and, if possible, the dollar value of the item. But be careful, because borrowing anything other than money quickly crosses over into other legal areas that get complicated.

Sides. This includes the lender and the borrower. Include both addresses along with their names.

How To Lend Money To Family And Friends (and Get Paid Back)

Payment method: How long does the debtor have to repay the money? And everything is expected at once or partially.

Interest. The same feeling that makes people hesitate to write friends or family a loan agreement can also make them hesitant to charge interest, but there are reasons for that. Interest-free borrowed money can be useful if it is used for other purposes, even if it is in a savings account. For this reason, the authorities are skeptical about interest-free loans. If the loan is interest-free and over $14,000, the IRS considers it a gift and the lender must pay tax on the interest.5 The minimum legal interest rate varies from month to month, but it doesn’t. being very high, usually less than one percent; Check out this site to see what it’s all about. (If it’s not already clear, another benefit of a written loan agreement is that it provides documentation that the IRS may request.6)

No payment and no acceleration. Acceleration in a loan agreement occurs when the entire amount is paid at once rather than as agreed upon. In loan agreements, sometimes a missed payment is an “acceleration event,” meaning that if the borrower doesn’t pay on time, the entire amount must be paid at once. This clause is optional, but if you want to set a payment plan in the contract, it’s a good idea to specify what will happen if the plan isn’t met. It’s fine to include additional fees or higher interest here, but remember that there are usually limits to how high they can be. These restrictions are known as state creditor laws.

Subordination refers to the “preference” a borrower has for a particular loan if he receives a loan from more than one person or group, or if he receives another loan in the future. Before giving money, it is better to know what other debts the debtor has. Generally, if the borrower has existing loans, the new loan will be “subordinated” to them, and if the borrower takes out new loans after signing the existing contract, then they will be subordinated.

Why Lending Money To Friends And Family Is A Bad Idea

Governing law. This section states which country’s law will apply in the event of a dispute. This is an especially good idea if the borrower and lender live in different states. With the adoption of the Uniform Commercial Code, many contract law provisions are similar across the country. But again, the real value of a written loan agreement is that it keeps disputes out of court, eliminating uncertainty in cases where there are inconsistencies.

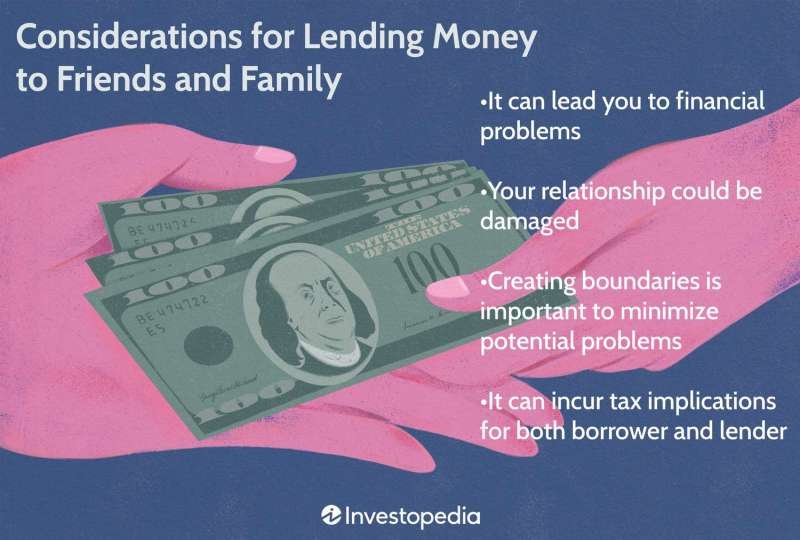

If you’re looking to lend money to a friend or family member, we hope you’re more comfortable with finding the right way to do it. Lending to family and friends can be a sign of goodwill when someone you know is struggling financially, but it can be difficult if your efforts to help lead to disagreements or financial problems.

According to a 2022 Creditcards.com survey, 42% of respondents said they have lost money through loans to friends or family members. If a friend or family member approaches you for a loan, keep these dos and don’ts in mind.

There are certain situations where a friend or family member can refer you for a loan. For example, you may be asked for a loan if:

Friend Wants To Borrow Money? How To Say ‘no’

While you may feel pressured or obligated to offer a loan, it’s important to consider whether it makes sense for you and your financial situation. For example, if lending to someone puts a strain on your personal finances and makes it difficult to pay bills, it’s probably not the best move. On the other hand, if you have a large emergency fund, little or no debt, and you earn a steady salary, managing your credit may not be that difficult.

In addition to the financial implications, it’s also important to think about the likelihood of getting your money back. If the friend or family member applying for the loan is responsible for paying their bills and has a one-time financial crisis, repayment may not be a problem.

On the other hand, if you are approached by someone who is financially irresponsible, you may be taking a big risk by lending to them.

If you’re lending with the expectation of getting money back, it’s important to be selective about who you offer the loan to. Limiting loans to trusted friends or family members will help you pay back their debts and avoid financial and emotional headaches later on. In Lending Tree’s research, for example, more than a third of borrowers and lenders reported negative effects, including feelings of anger and frustration.

Money And Me: Lend Money To Friends And Lose Both

If you feel uncomfortable lending money to someone, you should say so. You may have some reluctance, but it’s important that you only borrow money if you’re sure it won’t cause the relationship to fail.

Consider asking the lender for some form of collateral equal to the loan amount that you can hold as collateral until the loan is paid off.

Taking out a large loan to help someone else is a bad idea if it hurts your finances. When deciding how much to lend someone, a good way to figure it out is to think of the money as a gift. I mean, how much money can you lose without hurting yourself financially?

This does not mean that you should think that you will not get a refund. Instead, it helps you set clear limits on lending money to friends and family so you don’t need a loan later.

How To Lend Money To Friends And Family And Not Regret It

A paper trail helps avoid misunderstandings when lending to friends or family. Drafting a loan agreement that you and the borrower agree to and sign will explain your responsibilities and provide a basis for legal assistance should the situation arise.

Lend money to friend, how to lend money to a friend legal, can i lend money to a friend and charge interest, how to lend money to a friend, contract to lend money to a friend, lend car to friend insurance, can i lend money to a friend, how to lend money to a friend contract, lend friend money, how to legally lend money to a friend, legal document to lend money to a friend, lend to a friend