Can You Cash A Third Party Check At An Atm – If you need to cash a cashier’s check, you can do so at the issuing bank or financial institution, but fees may apply if you are not a customer. Fortunately, there are other ways to pay a cashier – even if you don’t have a bank account.

First, the bank transfers the amount you requested from your account to their account. The bank then issues a check from its funds to the person you want to pay. Because the bank’s funds are safe, the money can be made available to the payee more quickly, especially on large deposits that usually take several business days to clear when made through a personal check.

Can You Cash A Third Party Check At An Atm

But you have to pay a little for this security and convenience. Payments over $1,000 come with a fee, usually $5 to $15.[1]

How To Endorse A Check: Step By Step Guidance

You must have enough money in your account to cover the transfer. You must also provide the name of the payer to your bank, and you must have a driving license or other valid identification.

You can get a counter at your local bank branch: just ask your bank. You may be able to get one online if your bank offers this service.

A personal check is drawn from your bank account, while a cashier’s check is drawn from your bank account. You can stop payment on a personal check because it’s drawn from your account, but you don’t have that option with a teller.[2]

There’s always a risk that you won’t have enough funds in your account to cover a check you’ve written, but there’s no risk with a cashier. That’s because the bank determines whether you have enough funds to cover a cash advance before issuing one, so availability of funds is not a factor.

Endorsing A Check.

Cashier’s checks usually allow funds to be released quickly. Some banks may require a special deposit slip for next-day availability. In addition, banks may hold cashier’s checks if the total deposited in one day exceeds $5,525 or if they have reason to suspect that it cannot be collected by the issuing bank.[3]

A certified check, like a regular check, is a method of payment from the customer’s bank account.

But with a certified check, check with the bank to confirm that there is enough money in that account to cover the amount of the check. Once certified, the bank prints the word “certified” or “approved” on the check. This assures the payer that the check will not bounce.

Some people or companies may ask for a certified check as payment, especially for large payments, such as a down payment on a house. However, not all banks issue them, and you can’t get them online because you need the issuer to print the physical check you wrote as a certificate.

How To Endorse A Check For Mobile Deposit

A money order is used, like a cashier’s check, to ensure that the funds you pay are available. Money orders are often used for smaller purchases and are a useful option for people who do not have bank accounts.

You might spend $15 in fees to pay a $100 repair bill with a cashier, but paying $1 for a money order at Walmart or a dollar or two at the post office is much less expensive for a small purchase or payment.[4]

That’s right: you don’t need a bank to get a money order, and this convenience can be a huge advantage.

You can buy a $500 money order at any post office for $1.45, or you can pay 50 cents more for any amount up to a maximum of $1,000. ] The post office accepts payment in the form of cash, debit card or traveller’s cheque, but does not accept credit cards. Just pay the money order amount plus the fee, then keep the receipt for tracking purposes.

Order Checks Online

You can pay a teller at banks and credit unions. If you are not a customer of the financial institution, you will probably have to pay a fee.

Other requirements may also come into play. For example, the Bank of the United States requires you to provide your social security number to cash a check over $500. You’ll need to show a photo ID almost everywhere, but some places, like Bank of America and Citibank, require two forms. of ID.[6]

You can also be a cashier at many cash withdrawal stores such as Ace Cash Express, Check ‘n Go, Check Into Cash, Pay-O-Matic, PLS Check Cashing, Money Mart and Moneytree.

Check cashing companies make money by charging a fee to cash your checks, and the fees can be substantial because they are sometimes calculated as a percentage of the check’s face value.

Can You Deposit Someone Else’s Check In Your Account?

So if you cash a $2,000 cash register at a store that charges a 5% fee, you’re paying $100 just to get your money. Fees vary from store to store, and with some you will have to pay a minimum fee or a nominal registration fee for the first time. For example, PLS cashes checks for “up to 1% + $1.” [7] And fees at Advance Financial range from 1% to 5% with a minimum fee of $5.[8]

Walmart and other big box stores can also pay a cashier for you. Such large stores as Kroger and HE-B.

Rules and restrictions vary from store to store. Walmart charges a $4 fee for checks up to $1,000 and $8 for checks over $1,000, while Texas-based H-E-B charges a $3 fee for checks up to $3,000 and varies fees for higher numbers.[6]

Kroger gives you a small fee break with a store card: You pay $4 for a cashier’s check less than $2,500 with a card and $4.50 without. For larger amounts, the cost is $7 with a card and $7.50 without one.[9]

How To Endorse A Check To Someone Else

Some travel centers, such as TA/Petro, also offer check-in services. You can sign up for a membership (for a $25 fee) and you can issue checks up to $999. There is a service charge, but it is waived with a qualifying purchase such as 60 liters of diesel, a convenience purchase on. $50, or truck maintenance/repair services of $250 or more.[10]

Some banks offer the option of an online cash register with mobile applications and other payment methods for mobile deposits.

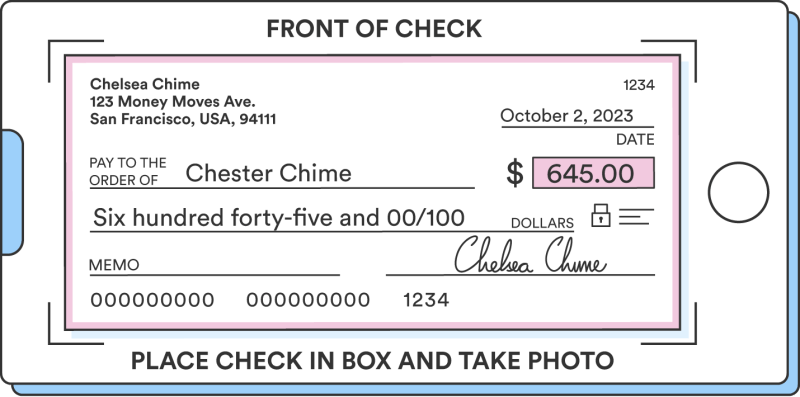

You usually have to approve the check like a regular check, then follow the instructions in the app. You will be asked to enter the amount of the check and select the account you want to deposit it into.

After that, you need to take a photo of both sides of the check – the front, with the routing and account numbers clearly read, and the back with your signature. Make sure the image is in focus. Banks often limit the amount of money you can deposit through the mobile app (such as the $5,000 limit imposed by Bank of America).[11]

How Bank Transactions Are Processed

You can also deposit cashier’s checks through online services such as PayPal and send the money to your bank account or special debit card.

To pay at a cash register, you will be asked to provide a government-issued photo ID. Fees and other requirements vary depending on the location you choose. Some companies require two forms of identification.

Most institutions will offer teller services for customers, but some smaller banks and credit unions also offer the service to non-customers for a fee. You will need to search your area to find one.

If you need to cash a cashier’s check but don’t have an account, you can find a bank or credit union that offers checks to non-customers. Be prepared to pay a fee in such cases. Another option is a check cashing service, although such services often charge high fees. [12]

Expired) Bankamerideals

Cashier’s checks are safer than personal checks because they’re backed by a financial institution, but that doesn’t mean they’re immune to fraud.

To make sure a check you’ve received is legitimate, contact the issuing bank using the contact information on their website. If there’s a phone number on the check, don’t call: If the check is fake, so will the number. And most check fraud involves fake checks.

You may breathe a sigh of relief when you see that the check has cleared, but that doesn’t mean it’s not fake. Under US law, banks must make deposited funds available within a few days, but fraudulent checks can be detected after this time. If they are, you’ll have to pay back the bank, and if you’ve paid money to a scammer in the meantime, you’re out that amount.[13]

Sending and receiving money through recognized and trusted applications such as PayPal or Google Pay, or through the bank’s website, is a good way to avoid fraud.

What Is A Third Party App? + Potential Risks

Since most scams involve fake checks, make sure the checks were issued by the institution whose name appears on the cover.

Victims of fake check fraud can report it

Can you cash a handwritten check at an atm, can you cash your check at an atm, can you cash a check at an atm machine, can you cash a third party check, can you cash a check at an atm wells fargo, can you cash check at atm, can you cash a cashier's check at an atm, can you deposit a third party check at an atm, can you cash a third party check at an atm, can you cash a check at an atm, can you cash a third party check at walmart, can you cash in a check at an atm