Currency Exchange Canadian To Us – Money Transfer is a safe, fast and easy way to send money from Canada to over 130 countries

Comparison savings are based on a single transfer of CAD$20,000 USD and show how much the recipient will send and how much the comparator will send to the recipient. The difference between these two amounts is called “Savings”. Our savings comparisons are derived from price data provided by an independent third party, DQM GRC. The comparative savings provided are accurate only for the example provided and may not include all fees and charges. Savings are calculated by comparing the exchange rate (including margin and fees) and the same date and time. Different currency exchange amount, currency, date, time and other factors may result in different comparative savings. These results may not represent actual savings and should be used as a guide only. The exchange rate comparison table is updated every quarter.

Currency Exchange Canadian To Us

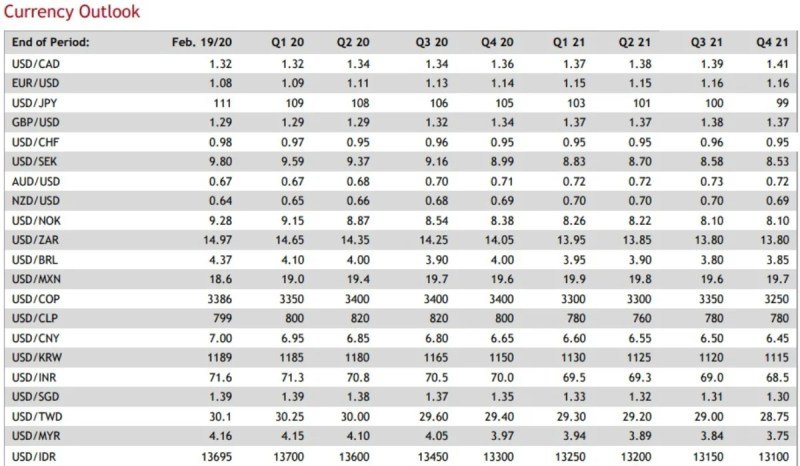

Money Transfer is a service provided by HiFX Canada Inc. dba, Financial Transactions and Reports Analysis Center of Canada (FINTRAC), a registered Money Services Business (MSB) with Canada’s financial intelligence with regulatory oversight. Our FINTRAC registration number is M16372531. HiFX Canada Inc. dba is a federally incorporated entity, corporate number 950254-8, with our registered office located at 56 Temperance Street, Level 8, Toronto, ON M5H 3V5. Exchange Rate Forecast 2020-2021, CIBCounderling. , Yen, Swiss Franc, US and Canadian Dollar Exchange Rate Forecast Posted by Tim Clayton, Forex Institutional Forecast – February 25, 2020 1:33 pm

Exchange Cad To Usd / Usd To Cad With Cibc Bank

CIBC remained bearish on the Canadian dollar in its latest monthly report, with a softer economy likely to lead to a rate cut by the Bank of Canada in April. While the UK remains cautious on its outlook, the pound is expected to hit a three-year high against the Canadian dollar in 2020, with the US dollar also losing ground. A US current account deficit could hurt the US dollar. As the number of cases continues to rise globally, demand for protective measures has increased amid fears of more significant damage to the global economy. A sharp decline in Chinese demand will have a negative impact on growth conditions in Japan and the Eurozone, while Swiss exports may also be affected. In this environment, the US economy is expected to outperform other major economies. CIBC Notes; “In the currency markets, in recent bouts of risk, we have seen investors follow only the US dollar, as opposed to other major currencies that are traditionally safe havens such as the yen or the Swiss franc.” The bank still hopes. The medium-term plan is for the dollar to weaken, but that potential weakness has been delayed by the coronavirus and continued weakness in Europe. “With fears of the coronavirus spreading over the next few months, the dollar should regain that strength.” The main justification for the dollar’s expected decline is the current account balance, which may be linked to investor concerns about the budget deficit. Forex markets are often dominated by yield factors, with investors moving funds into higher yielding instruments. However, structural factors are also important and current account deficits weaken the currency if capital flows are restricted. Valuation factors will become important if the US dollar appears to be too expensive to attract international capital. In 2020, the US will have a current account deficit of more than 2% of GDP, and the EU will have a surplus of about 4%. Image: Currency Accounts “In the long run, lower US current account balances relative to other countries such as Europe and Japan should support these currencies and the dollar should weaken accordingly.” The Canadian dollar loss forecast is significantly more bearish on the Canadian dollar than the CIBC consensus forecast, although the bank expects the Canadian dollar to appreciate in the near term. “If coronavirus fears subside and sentiment eventually improves, oil prices should recover and the loonie is likely to be dragged along the way.” As such, the C$ should end Q1 slightly stronger than its current levels, seeing the USDCAD hover around 1.32′. . On the other hand, however, CIBC is more pessimistic, expecting labor market strength to weaken and GDP growth to slow. According to CIBC; “This may be reason enough for the Bank of Canada to cut rates by 25 basis points in April.” Interest rate markets have not priced in a Bank of Canada rate hike, and so any rate cut weakens the currency. The anticipated rate cut is a key element of CIBC’s expectation that the Canadian currency will weaken, with the bank expecting the USDCAD to reach 1.34 by the end of Q2. CIBC expects further weakness in the second half of 2020, with USD/CAD forecast at 1.36 by the end of 2020. This is significantly weaker than the consensus forecast for a fall to 1.30 by the end of this year. Given that CIBC expects a broad decline in the US dollar, this suggests a significantly weaker decline in the Canadian dollar across major crosses. UK budget needed to support pound As for the pound, CIBC remains broadly cautious on the outlook for GBP. “While consumers and businesses are still reluctant to spend and invest, at least until we see clarity in trade negotiations, fiscal stimulus will remain important.” The Bank therefore believes that an increase in fiscal spending will be necessary to support a rather growth outlook. than achieving significant improvement in growth outlook. Overall, CIBC expects the euro-pound exchange rate to remain largely unchanged from current levels in the second quarter of this year. The year-end GBP/CAD forecast is 1.82 from the current level of 1.72, which would be the strongest level since March 2018. In 2021, CIBC also expects GBP/CAD to trade above 1.90, the highest level since December 2015. Image: The GBP to CAD exchange rate chart for the Eurozone is about to recover. Finally, looking at the Euro, CIBC believes four factors have been decisive for the recent decline; “Poor data from the German demand side at the end of the fourth quarter and more broadly outside the eurozone, growing political anxiety in Germany, uncertainty around Brexit and the impact of the coronavirus on China and its economy.” The bank expects some relief later. Over the year, pressures on the economy from more expansionary fiscal policy are seen as unavoidable. He also expected a gradual improvement in economic data, although the underperformance against the US would continue. Therefore, CIBC expects EUR/USD to remain broadly bullish in 2020, although it has lowered its forecast in light of a weaker-than-expected outlook for the Eurozone. BoJ restraint will protect Japanese yen CIBC maintains a lack of confidence in Japan’s outlook, but the policy mix will be the deciding factor. “Given the challenges of low and negative interest rates, we expect more (targeted) fiscal stimulus in an effort to limit headwinds to growth rather than further monetary expansion.” If the bank resists further monetary expansion, the yen will likely weaken. weaken However, the bank still expects the yen’s gains to be slower than previously forecast, with USD/JPY at 105 by the end of 2020. Swiss economy exposed to China The Swiss franc has gained ground on the EUR/CHF exchange rate in short trade. 4-year low below 1.0600. According to CIBC, the franc’s strength is partly due to strong domestic demand and despite the fact that Switzerland is increasingly dependent on Chinese demand for its exports. The Swiss franc is expected to fall, with the National Bank (SNB) also weighing in on the currency’s strength. According to CIBC; “However, given the extent to which the Swiss economy has benefited relative to Germany, we do not expect this [franc strength] to continue.” Look for demand deposits to rise in the coming months as the SNB moves to weaken the currency.

Their goal in 2016 – 2022 is to connect customers with extremely competitive pricing and uniquely specialized service, whether they choose to do business online or over the phone. Learn more here.

Tim has been an economist and financial market analyst for over 20 years. He…

As markets enter the 2023/2024 New Year break, EUR/GBP is trading at 1.15355. In this article, we bring you the poll results of the top eleven…

Us Dollar Index Falls, Canadian Dollar, Euro, Yen Gain

Pound Euro Exchange Rate (GBP/EUR) The Pound (GBP) was lower in last week’s session despite periodic volatility in the exchange rate. Lack of internal data remains…

The Pound to Euro exchange rate (GBP/EUR) reached its best level since August at the European Central Bank’s session last week.

Euro-Dollar Forecast • Pound-Euro