Current Exchange Rate For Dollar To Euro – Dollar-euro exchange rate reaches parity The dollar continues to strengthen against the euro and, for the first time in decades, the two currencies are worth almost the same.

The dollar and euro are flirting with “parity” for the first time in two decades. Hide caption Daniel Muñoz/AFP via Getty Images

Current Exchange Rate For Dollar To Euro

If you haven’t planned your summer vacation yet, you might want to do so soon. Europe is looking pretty cheap right now.

The Impact Of Exchange Rates On Japan’s Economy

For the first time in 20 years, the value of the dollar and the euro is almost equal. They have flirted with what currency traders call “parity.”

That means U.S. travelers won’t pay extra for a hotel room in Barcelona, tickets to the Paris Opera or a full dinner in Rome.

This makes Teresa Valerio Parrott happy. She and her husband are celebrating their 25th wedding anniversary this year.

They were planning to travel from their home in Colorado to California or Hawaii. Plane tickets are expensive everywhere, but thanks to the strength of the dollar, Europe is starting to look very attractive.

A Coy Us Fed Maintains Euro/dollar Exchange Rate’s Deadlock But Beware A Decline Over Three Month Timeframe

“We quickly realized that going to Paris would be the same price as staying in the United States,” says Valerio Parrott.

“We plan to go there, have some good wine, hopefully some bubbly, and bring back a whole bunch of souvenirs,” he says.

As the world faces high inflation, fears of a global recession and immense volatility in markets, the dollar has become an island of safety.

The dollar has gained more than 10% against global currencies since the start of the year.

What Is Euro Parity And Why Does It Matter?

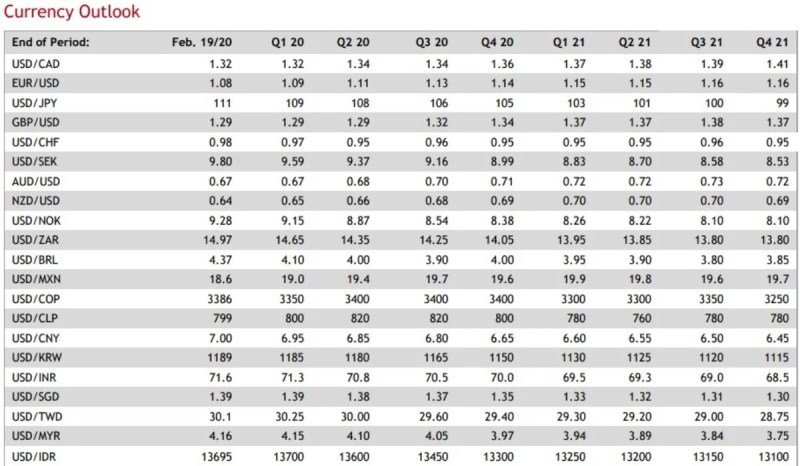

This means that people have to deposit fewer dollars in exchange for other currencies. At the beginning of the year, for example, it cost $1.13 to buy one euro, compared to $1 today.

The dollar may appear to be strengthening when there are many fears about the future of the US economy.

Last month, inflation rose 9.1% from a year earlier, rising at the fastest annual pace in more than four decades. To combat high inflation, the Federal Reserve has aggressively raised interest rates, fearing that its policies could lead to a recession.

“Higher interest rates usually lead to a stronger currency,” said Jane Foley, head of foreign exchange at Rabobank. “It’s an economics textbook.”

What Is An Exchange Rate?

This is because investors are chasing dollar-denominated investments, which will yield higher returns than assets denominated in other currencies.

The Federal Reserve is not the only central bank trying to control inflation by adjusting interest rates, but so far it has done more than others. The European Central Bank plans to raise interest rates at its next meeting later this month.

“The dollar owns most of it,” Foley said. “In general, a currency reacts to the fundamentals of the country it’s in. That’s not necessarily the case with the US dollar.”

It remains the dominant reserve currency. Countries around the world keep lots of dollars on hand because they see them as a safe asset.

Us Dollar Gains After Gdp Data; Euro Falls To Six Week Low After Dovish Ecb, Lagarde

Eurozone countries are also struggling with high inflation and fears that a recession is imminent.

After Russia invaded Ukraine, the United States and its allies imposed extensive sanctions and restrictions on Russian oil and gas. This drove up prices and hit Europeans particularly hard.

Although gasoline prices have eased partially from their record levels and oil is trading below $100 a barrel again, there are fears that the situation in Europe could worsen. This is mainly because Russia is the largest supplier of oil and gas to European countries.

This week, the Nord Stream 1 pipeline, which carries natural gas from Russia to Germany, was shut down for scheduled maintenance.

Why Is The Dollar Winning Against The Euro?

Currently, the Nord Stream 1 gas pipeline is out of service and undergoing scheduled maintenance. However, concerns are growing about what will happen next. Sean Gallup/Getty Images Hide caption

Currently, the Nord Stream 1 gas pipeline is out of service and undergoing scheduled maintenance. However, concerns are growing about what will happen next.

The work is expected to last 10 days, but there is speculation that Gazprom will not restore natural gas flows or that the Russian gas giant may reduce production.

If European countries fail to build up their reserves in the summer, they may have to ration gas in the winter, which could lead to a major recession.

Foreign Exchange Market

Factories will have to reduce production, which could lead to layoffs and increase the likelihood of a recession. Policy responses to currency devaluation pressures should focus on signs of exchange rate movements and market disruptions.

The dollar is at its highest level since 2000, having gained 22 percent against the yen, 13 percent against the euro and 6 percent against emerging market currencies since the start of this year. Such a significant strengthening of the dollar within a few months has significant macroeconomic implications for almost all countries due to the dollar’s dominance in international trade and financing.

Although the U.S. share of global merchandise exports has fallen from 12 percent to 8 percent since 2000, the dollar’s share of world exports has remained stable at about 40 percent. For many countries struggling to reduce inflation, the weakness of their currencies against the dollar has made the fight more difficult. On average, the estimated transmission of a 10% appreciation of the dollar to inflation is 1%. These pressures are particularly acute in emerging markets due to their greater reliance on imports than advanced economies and a larger share of imports invoiced in dollars.

The appreciation of the dollar is also reflected in the balance sheets of the world. About half of all cross-border loans and international debt securities are denominated in US dollars. While emerging market governments have made progress in lending in their own currencies, their private sector has high levels of dollar-denominated debt. Financial conditions in many countries have tightened significantly as global interest rates rise. A strong dollar only adds to these pressures, especially for some emerging markets and many low-income countries that are already at high risk of debt crisis.

When To Buy Euros, Other Currency For A Trip Abroad

Should countries actively support their currencies in these circumstances? Several countries use foreign exchange interventions. The total foreign exchange reserves of emerging market and developing economies fell by more than 6% in the first seven months of this year.

An appropriate policy response to deflationary pressures requires a focus on exchange rate movements and signs of market distortions. In particular, foreign exchange intervention should not replace sound macroeconomic policy coordination. Temporary intervention is relevant when currency movements significantly increase risks to financial stability and/or significantly impair the central bank’s ability to maintain price stability.

The main drivers of the dollar’s rise now lie in economic fundamentals: rapidly rising interest rates in the US and more favorable terms of trade – the ratio between the value of the country’s exports and imports to the US due to the energy crisis. In a fight against a historic rise in inflation, the Federal Reserve has embarked on a path of rapid interest rate tightening. The European Central Bank, facing rampant inflation, announced a more moderate stance on its interest rates, fearing that the energy crisis could trigger an economic slowdown. At the same time, low inflation in Japan and China allowed their central banks to support global tightening trends.

A second major driver of the dollar’s strength is the huge terms of trade shock caused by Russia’s aggression in Ukraine. The eurozone is largely dependent on energy imports, particularly natural gas from Russia. A sharp rise in gas prices has pushed the terms of trade to the lowest level in the history of the common currency.

Solved Suppose You Trade Dollars And Euros For A Bank That

In emerging market and developing economies outside of China, many were ahead of the global financial contraction cycle – perhaps due to concerns about the dollar exchange rate – while commodity-exporting EMDEs experienced a positive shock to the terms of trade. As a result, exchange rate pressures have been less severe for mid-sized emerging economies than for advanced economies, and some, such as Brazil and Mexico, have even appreciated.

Given the important role of fundamental factors, the appropriate response is to allow the exchange rate to adjust while using monetary policy to keep inflation close to target. Higher prices of imported goods will help provide the necessary adjustment to fundamental shocks, as it will reduce imports, which will help reduce external debt accumulation. Fiscal policy should be used to support the most vulnerable without compromising the inflation target.

Additional measures are also needed to address several downside risks looming on the horizon. Importantly, we are seeing a lot of upside in financial markets, including a sudden waning appetite for emerging market assets, leading to significant capital outflows as investors turn to safe assets.

In this fragile environment, building resilience is wise. Although emerging market central banks have been building dollar reserves in recent years, this is reflected

Could The Euro Reach Parity With The Dollar As The Ecb Cuts Interest Rates?

Current exchange rate euro to canadian dollar, exchange rate dollar for euro, current exchange rate between dollar and euro, current euro vs dollar exchange rate, dollar euro current exchange rate, current euro dollar exchange, current exchange rate for euro to dollar, current exchange rate for us dollar to euro, exchange rate euro to dollar, best exchange rate for dollar to euro, current dollar to euro rate, current euro to dollar exchange