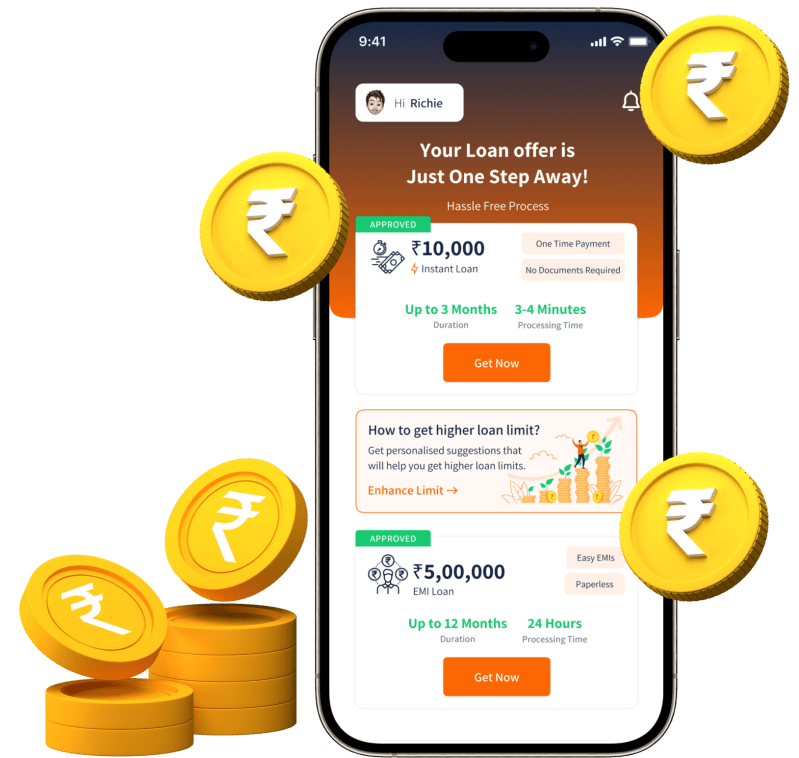

Easiest App To Borrow Money – Sometimes you need quick cash, but getting a loan from a bank is a long process.

Fortunately, with online banking comes modern options that are very easy to use.

Easiest App To Borrow Money

We hope this article answered all your questions and helped you decide if the Cash App Borrow feature is right for you.

We’ve Launched The Money App For Africans In Nigeria And The Uk!

In short, Cash App is an online banking application that allows you to perform centralized financial processes with ease.

According to the study, by 2022, about 65% of Americans will switch to online banking. This new development is related to the renewal of financial trends.

Founded in 2013 as Square Cash, the company raised approximately $385 million in 2020. It was founded by Jack Dorsey, the current CEO of Twitter.

The app allows you to send money via direct deposit, get cashbacks and cashbacks, use a cash card if needed, invest, and much more.

Easy To Get Payday Loans In 2024

Cash App’s loan feature is so important that it’s being used officially.

Only 15% of online banking users inquire about financial products through apps, a relatively new industry.

In other words, the Cash App allows you to withdraw money, but only if you have one of the few accounts that currently allow this option in the US and Canada. So if you are one of the lucky ones, you can use this feature. That being said, I believe that this version will officially reach everyone soon.

Not everyone who uses the Cash App will get the loan feature. In addition, there are always rules to ensure that the company can pay you back.

How To Unlock Borrow On Cash App: A Step By Step Guide

As of now, as mentioned earlier, few people are testing the feature.

We don’t know all the rules that apply to this feature going forward, but there are several reasons why you might not be able to get a Cash App loan.

If you have a negative Cash App balance, you will need to pay it back before you can borrow more money. This way the company will protect you and themselves.

As with most banks, if you have a bad credit score, the lending company may not trust you to repay the loan when they do a credit check. This can also happen if you use a debit card and don’t have a good credit score.

Kredito24 Loan App Review: Scam Or Legit?

If your account is not verified by Cash App, you may be denied Cash App credit. Check your settings.

This is probably the simplest solution, but if you can’t withdraw money from the Cash App using the Borrower feature, or if you don’t have that option yet, you should check if the app needs to be updated.

Finally, if Cash App determines that you have violated their terms of service in the past, you may not be able to borrow money.

The main thing is that it is better to get a loan from Cash App, because you have to pay off the old debt before you can get a new one, and taking a short-term loan can increase your interest rate.

Instant Cash Loan Online Up To ₹20 Lakh @9.9% P.a With Navi

Borrowing from the Cash App is better than a credit card, but only if you don’t borrow more than $200.

Keep your personal information safe with encryption, phone security lock, PIN, Touch ID, coin storage, fraud protection, push notifications and deactivating your card at any time.

Cash App Borrow is a great way to get cash fast. You just have to take the money and follow the rules.

It depends on your bank and whether you’re fully eligible for the Cash App loan feature, but it only takes a few minutes to get approved.

Fast Online Payday Loans & Short Term Loans In Canada /icash

The Cash App lending feature is not a long-term solution to financial problems. Cash App only allows you to borrow between $20 and $200, so it’s not a good option for large expenses.

In addition, the amount you can withdraw depends on the amount you deposit in your account. For example, if you save $300 a month, you can borrow up to $70.

There are currently no exceptions to this rule, so if you need more than $200, we recommend contacting your bank.

After taking out a loan from Cash App, you have four weeks to repay your personal loan, which is plenty of time to pay off these amounts. After those four weeks, you’ll get an additional one-week grace period during which the interest rate won’t change.

Best Payday Loans Online: 13 Lenders For Easy Approval & Fast Cash

Cash App’s annual percentage rate (APR) is 5% of the loan amount. After the one-week grace period, you’ll earn an easy 1.25% interest on your weekly repayments.

This may not seem like much, and is lower than your credit card APR, but it can add up quickly if you’re not careful.

You can pay your loan every two weeks on the 16th and 30th of every month. You can also pay at stores that sell prepaid cards, through automatic payments, or through the Cash App website.

As mentioned earlier, your credit score is very important when applying for a loan. If your credit score is terrible, no reputable agency may approve it.

Best Payday Loans For Quick Cash: Top 10 Cash Advance Apps & Alternatives

However, keep in mind that borrowing money can affect your credit rating. Before applying for a loan, make sure to make your payments on time to improve your credit score. The long-term impact of a loan can be greater than you think. Borrow money only when you need it.

If you are wondering how to get money from Cash App, we are ready to help you. There are several steps you must take to qualify for this option and successfully borrow from Cash App.

As mentioned earlier, it only takes a few minutes to receive funds from the Cash App (including funds deposited into your account). The way this function works is simple.

Sometimes a short term loan or a payday loan from a bank is a better option than getting a loan from Cash App. For example, you may need more than $200 or you may not qualify for a Cash App loan.

How To Borrow Money

First of all, the financial capacity of your fund is different from Cash App when taking a loan from a bank.

Your bank may have stricter rules and regulations when deciding whether you qualify for a loan. They will evaluate all your income and other financial information and give you a quote based on that.

Plus, they’ll set you up with a payment plan. This way they will know exactly when they are due, which is important and helpful for both you and them.

As mentioned earlier, when explaining how to borrow money from Cash App, they do not check your income, spending or bank account before deciding to approve your loan. However, they will see the deposit amount on your application and your current credit score.

Tala Loan Application: Borrow Cash With Just A Few Taps Away

Your credit score is the evidence that companies use to determine whether you can repay a loan. So make sure your credit score is high enough that you can repay your loan on time to avoid further damage.

Additionally, you need to have regular deposits in your account before you are allowed to borrow money from them.

In summary, although there are some limitations, getting a loan from Cash App allows you to get cash faster than getting a loan from a bank. Remember that borrowing money is not something you should do all the time.

Even with a Cash App account, not everyone is eligible for a Cash App loan. Additionally, some may charge more than $200. Fortunately, there are plenty of great alternatives to Cash App Borrow, online lenders and loan apps, and we’ve listed some of them here. Some of them provide long-term cheap loans and low-interest loans.

Unacash Loan Review: How Reliable Is This Online Loan App?

If you don’t qualify for a Cash App loan, you should check out other payday loans online that don’t require a credit check. Other less convenient options include credit cards, banks, peer-to-peer loans, cryptocurrency loans, or other online loan options such as Rise Credit and the Moneylion app.

As with all loans that don’t check your credit or allow you to get a loan even if you have a bad credit score, you should be aware of the APR that’s right for you. Even if the regular payments feel good, the higher interest rates will leave you with more debt.

Oportun is a loan company that offers you a more affordable alternative to payday loans. If you have no credit history or bad credit, this company will allow you to borrow between $300 and $10,000 with repayment terms of up to 48 months.

They recently started capping interest rates at 36%, which is a more affordable option. They offer you payment plans and support multiple payment methods.

Best Cash Advance Apps Like Moneylion

With CashNetUSA, you can get a loan of up to $100

Easiest apps to borrow money, what is the easiest way to borrow money, how to borrow money on cash app, best app to borrow money, app to borrow money instantly, easiest way to borrow 50k, cash app to borrow money, app to borrow money, easiest place to borrow money, easiest way to borrow money, easiest way to borrow money online, how to borrow money from cash app