Easy Ways To Save Money Each Month – How much you can save does not depend on your income. A monthly savings plan can help you stay financially secure at every stage of your life and prevent financial emergencies. Even the smallest of problems can lead to financial problems if you don’t have enough savings. One way to avoid this is to decide to save money every month.

Living paycheck to paycheck may be enough for now, but it’s not a sustainable way to live your life.

Easy Ways To Save Money Each Month

Tired of not having enough money and never making progress when it comes to saving? Now is the time to change. Although many people are afraid to start a savings plan, creating a personal savings plan is important for every family. Getting started is easier than you think and there’s no better time than now. Let’s learn 5 easy ways to save more money every month so you can finally take control of your finances.

Practical & Easy Ways To Save Money

No one wants to be called cheap. Because you can’t afford to spend extra, you feel like you’re missing out on what everyone else is doing. Maintaining this Jones mentality is dangerous for your bank account. It makes you value material things more than experiences and relationships.

If you’re struggling to control your spending, your income may not be the problem. There is a problem with your values. What do you value in life? With more money, does he buy the latest tech gadget or go out to eat every Friday night? It’s okay to do these things, but it’s important to be clear about your values so you don’t feel guilty about spending them in certain areas. If you discover your values, you may find yourself spending money on things you don’t value. Or, it emphasizes some key areas that you know you can’t maintain.

It goes without saying, but a lower monthly payment means you can save more each month. More of the expenses you can cut will go into your savings account. Expenses are recurring expenses, so reducing them will save money in your pocket over and over again.

What are the most common expenses? Your most important monthly payment may be your rent or mortgage. Change is not easy, but it is not impossible. If moving is not possible, or you can rent your own home and live with a temporary family. You can downsize to a small house or apartment that can save you a good amount of money every month.

Easy Ways To Save Money On Food That Will Save You Hundreds!

The easiest expense to cut is your entertainment. It’s fine to pay for things you like, but you may end up paying more than you use. Are you actually using cable or is it because it comes with your internet plan? Paying for 3 streaming sources, can you use it? Can you share your account with friends and family? These little things add up quickly.

Food can get expensive if you’re not careful. How often do you eat out or go shopping? Even if you have food in your kitchen at home, you probably eat. Challenge yourself to skip your regularly scheduled grocery trips for the week and eat produce and non-perishables at home. You buy too much and waste good food.

Sometimes you get caught up in bad spending habits and don’t even realize they’re there. If so, it’s time to start spending again. Just as you can challenge yourself to eat everything in your pantry, you can tell yourself to stop spending for a week or two.

By cutting all unnecessary expenses, you start to appreciate the ways you usually save money. Most of the time, you’ll find that you’ve been paying more than you need to, and these small changes haven’t made an impact on your life. For example, you prefer to bring your lunch from home every day, or it’s easier to work out at home than at the gym. All the money you spend can go directly into your savings account.

Easy Money Saving Tips

Pricing options are all around you, and you should be willing to put in the extra work. Say goodbye to paying full price and promise to find the best sales, the best deals and the best savings. Variation does not mean lower quality. Some stores and retailers offer similar services at lower prices or special discounts.

To save a few dollars each week, you can find the best discount stores near your home and see if they have the products and groceries you need. Also, you can look for alternative weekend plans. Instead of going out for dinner and a movie, cook a delicious meal at home and rent a movie to watch in bed. It’s just as fun, but less than half the price.

Being successful does not mean living cheaply. By choosing the alternative and trying to live below your means, you’ll save more money each month. These little things didn’t add to your quality of life, and you won’t even notice when you’re gone. Save more money today to live a fuller life today with these tips. Saving money from your paycheck can be difficult. Read this blog for the best money saving tips you can use right away.

How to save money is a question that worries the rich, the poor and of course the great Indian middle class. The amount of money you need to save and the way you save may vary, but the need to save money is common to all.

Frugal Living: 10 Easy Ways You Can Save £250 Monthly

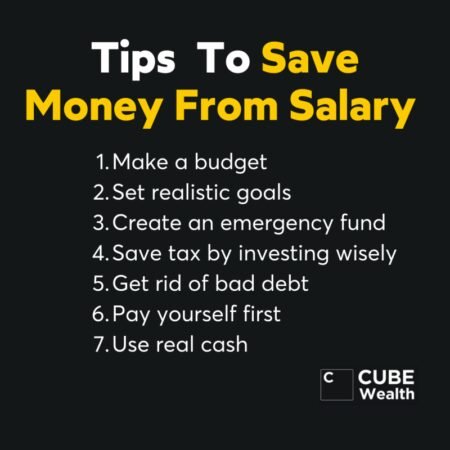

Whether you’re trying to figure out how to save money from your paycheck or looking for money-saving ideas to help you save more each month, we’ve got some money-saving tips you’ll love. You can consult a cube wealth coach or download the cube wealth app.

Create a strict budget for monthly expenses and keep all money in a separate account. Figure out where you can and cannot compromise. Above all, stick to your budget – unless it’s an absolute emergency!

How much do you want to save by the end of the year? Divide that by 12 and you have your monthly savings goal. For example, if you spend Rs. 1,20,000 per year, you get Rs. 10,000 per month. So start putting that money aside at the beginning of the month – your paycheck.

Saving money is hard, but it’s a good idea to set aside a portion of your savings for an emergency fund. When you need money, it’s easier to do this than to sell your assets.

Helpful Money Saving Tips That Work!

If you’re a payroll professional and know how much tax you owe, why not take proactive steps to save on your taxes? Under Section 80C you can save up to Rs 1,50,000 through Deposit Accounts, Equity Linked Savings Schemes.

Debt is the ultimate killer of all redemption dreams. If you’re paying the bank for a loan or trying to max out your credit card, you’re in trouble. You should pay off your debt first, and if you have credit cards, try not to overuse them—in fact, for many people, it’s better not to use credit cards at all.

So, before you spend money on things you can get away with, make sure you invest. The money you earn so much to work for must work hard for you. So, invest in a SIP strategic investment plan where you take a small portion of your income every month and invest it in mutual funds. This is one of the best ways to invest.

Answer Although there is no one size fits all, a general guideline is to save at least 20% of your salary. However, the exact amount may vary depending on your financial goals, expenses and debt obligations.

These 5 Tips Will Help You And Your Family To Save Money Every Month!

Answer It’s best to start small. Start by creating a budget, identify areas where you can cut costs, and automate savings. Even saving a small percentage of your paycheck can make a big difference over time.

Answer The best option depends on your financial goals and risk tolerance. Common options include high-yield savings accounts, certificates of deposit, employer-sponsored retirement accounts such as 401(k)s, individual retirement accounts (IRAs) and diversified investment portfolios.

Return specific settings

Save money each month, easiest ways to save money each month, how to easily save money each month, how much money to save each month, easy ways to save money every month, how to save money each month, best ways to save money each month, ways to save more money each month, simple ways to save money each month, how to save more money each month, how to save extra money each month, ways to save money each month