How Much Banks Will Lend For Mortgage – By clicking on a vendor link, you accept cookies from third parties that track your journey. If you buy? We earn affiliate commissions which support our mission to be the UK’s consumer champion.

Banks limit how much you can borrow on a mortgage: is it still possible to get a good deal?

How Much Banks Will Lend For Mortgage

Homebuyers have been hit hard after two of the UK’s biggest banks cut limits on how much they can lend to mortgage applicants.

How Much Housing Loan Can I Get?

Barclays and NatWest have become the latest lenders to add new terms to their loan agreements since the coronavirus outbreak.

This, ? Explains how restrictions can affect your credit availability and offers advice on how to get a good loan deal.

FREE EVERY WEEK – Take control of your finances with expert advice in our Money Magazine.

This newsletter provides free content related to money, along with other information about? A group of products and services. End the subscription whenever you want. Your data will be processed in accordance with our privacy policy

Burdened By Old Mortgages, Banks Are Slow To Lend Now

When you apply for a loan, the amount you can borrow is usually limited by your annual income.

Generally, lenders will allow you to borrow around 4.5 times your income, although up to five or 5.5 times your income.

So if you’re buying a home with your partner and you have an annual income of £50,000, you could borrow between £225,000 and £275,000.

Barclays previously boasted one of the highest limits for some clients at 5.5 times annual earnings, but this week it lowered its limit to 4.49 times.

Solved You Need A 20 Year, Fixed Rate Mortgage To Buy A New

NatWest, meanwhile, has reduced the amount borrowers can borrow from 4.25 times their annual income to 4.9 times.

These trends mean that some buyers may find it more expensive to own a property that they previously thought they could afford.

Income limits are just one way lenders will assess your creditworthiness, and how they are set varies from lender to lender.

You can use the calculator below to get an idea of how much you can borrow while applying for a loan.

Cheap Mortgages Aren’t The Main Function Of Home Loan Banks Today

The changes from Barclays and NatWest come as lenders struggle to cope with demand and rising interest rates following stamp duty cuts.

Buyers with less savings experienced the biggest change after the pandemic, with between 90% and 95% disappearing from the mortgage market.

Nationwide has limited the amount of deposits that buyers can get from a household, while Virgin Money has launched seven- and 10-year solutions with a minimum term of 25 years.

Barclays’ decision to ban multiple incomes will have the biggest impact on the highest earners (who qualify for 5.5 times their previous income).

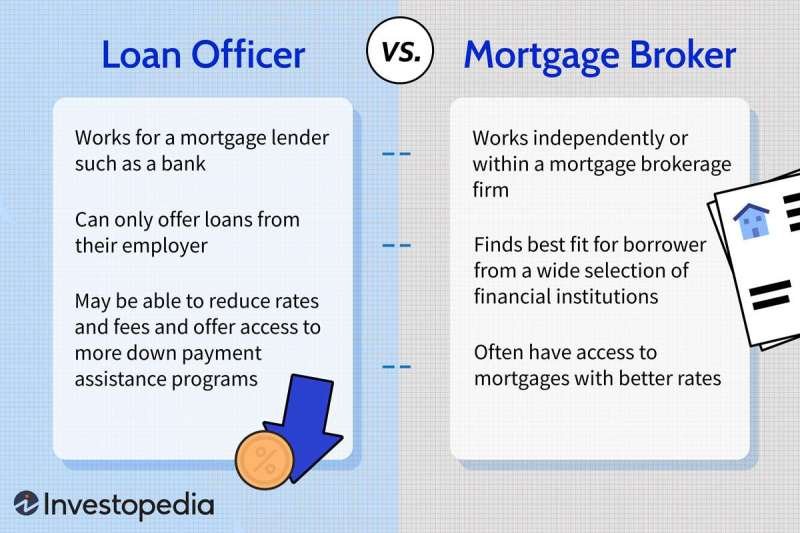

Should You Use A Bank Or A Broker For A Mortgage Loan?

It also affects people who are currently buying a home, and some of them have changed their mortgage offer. NatWest’s changes, meanwhile, pose another risk for self-employed customers.

Elsewhere, it will be difficult for foreclosure buyers and lenders to include income that will no longer be part of the lender’s overtime and bonus when applying for a loan.

It may all be bad news, but loan approvals are still ongoing and good rates are still possible.

Bank of England data showed 66,281 loans were approved in July, just 1% of the same period a year earlier.

St. Pete Bank, Citing Economic Uncertainty, Pulls Plug On Mortgage Lending

To get the best chance of getting a loan in the current situation, you need a good deposit (at least 15%), good credit history and reliable income.

Unfortunately, if the bank considers you risky (for example, you have a small deposit or you are on vacation), it may be to your advantage to delay action until the market becomes a ‘cheap focus’, because if you earn. Now it’s a loan. Perhaps to a higher degree.

If you’re not sure about your options, it might be wise to talk to a full-market mortgage loan advisor, who can evaluate the criteria each lender uses to find the right deal for you.

_hRSY8wW.jpg?strip=all)

The chart below from Moneyfacts shows the current cheapest rates on two-year and five-year mortgages available to home buyers.

Decade Low European Mortgage Growth Forecast This Year And Next, As High Borrowing Costs And A Weak Economy Drive Down Demand

As you can see, loan ratios between 60% and 80% loan-to-value (LTV) are still very low, but 90% contract values have increased significantly, indicating that few options are available. at low prices. Evaluate the customer. Interest rates on deposits greatly affect the cost of home loans. On the other hand, lenders are looking for the lowest possible loan rates. On the other hand, lenders manage their risk through the interest rates they offer. The lowest rate is only available to borrowers with the highest credit history.

While your financial health helps determine the rate you can get on a loan, there are other factors that affect the world of credit rates. It involves five main factors, all of which reflect the basic law of supply and demand in one way or another. Some of these factors are complex, but understanding these principles sheds light on the interest rate you are paying now and what you may be paying in the future.

Inflation refers to the rise in prices of goods and services. Therefore, the purchasing power of the currency decreases, which means that the purchasing power of the dollar deteriorates over time.

The gradual movement of the cost of living due to inflation is a reflection of the general economy and is a key factor for lenders. Lenders are often required to keep interest rates at a minimum level to offset the decline in purchasing power through inflation to ensure that interest returns reflect real profits.

How Much Can I Borrow For My Mortgage?

For example, if the interest rate on the loan is 5% but the annual inflation rate is 2%, the real yield on the loan is only 3% relative to the purchasing power of the dollar available to borrowers. Therefore, lenders keep a close eye on the inflation rate and adjust their rates accordingly.

With economic growth comes higher wages and consumer spending, including consumers seeking home equity loans. This is good for the country’s economy, but the overall increase in demand for loans increases lending rates. The reason behind this is that lenders only have so much capital.

The opposite happens when the economy starts to deteriorate. As employment and wages fall, demand for home loans falls, which lowers the interest rates offered by lenders.

:max_bytes(150000):strip_icc()/mortgage-process-explained-5213694_final-a7545c4d1aaf4d9bb09c48611b16e9c3.jpg?strip=all)

Loan rates can be fixed or variable. A fixed rate loan does not change during the life of the loan. An adjustable rate mortgage (ARM) starts at a fixed rate and adjusts later.

Indonesia: Prime Lending Rates Of Banks For Mortgage Loans 2022

The Federal Reserve is the main bank in the United States. The Fed oversees the nation’s financial system, making sure it is safe and sound. Therefore, it is responsible for achieving the highest performance and keeping the price stable.

Monetary policy conducted by the Federal Reserve Bank is one of the main factors affecting the economy in general and interest rates in particular, including the lending rate.

The Federal Reserve does not specifically set interest rates in the mortgage market. However, their actions in setting the Fed funds rate and raising or lowering the funds rate generally put downward pressure on interest rates while putting more pressure on the money supply.

Banks and investment firms sell mortgage-backed securities (MBS) as an investment product. The yield of these debt securities should be high enough to attract buyers.

Banks Are Cutting How Much You Can Borrow For A Mortgage: Is It Still Possible To Get A Good Deal?

Part of this equation is that government and corporate bonds offer long-term, long-term investments. The money you earn from these competitive investment products is affected by the products offered by MBS. The general condition of the major bond market directly affects the borrower’s cost of borrowing. Lenders must generate sufficient yields for MBS to remain competitive in the general mortgage insurance market.

The government bond benchmark that lenders often use for mortgages is the 10-year Treasury yield. In general, MBS sellers must offer higher yields because repayment is not 100% guaranteed, as with government bonds.

Housing market trends and conditions also affect mortgage rates. When fewer homes are built or offered for resale, the decline in home purchases leads to less demand for mortgages and pushes down interest rates.

A recent trend that has also driven down prices is the growing number of buyers choosing to rent rather than buy a home. Such changes in housing availability and consumer demand affect the loan rates set by lenders.

Mortgage Broker Vs. Direct Lender: What’s The Difference?

The chart below shows the average first home buyer loan rates for 30-year fixed, 15-year and 7-year/6-month rates for several major banks as of December 12, 2023. Fees vary by location and grade.

A credit score is an important part of the closing process.

How much do banks lend mortgage, how much do banks lend for mortgage, how much will banks lend you for a mortgage, how much will banks lend for mortgage, how much mortgage will bank lend me, how much will a bank lend you for a mortgage, how much will a mortgage lender lend, how much will a lender lend for a mortgage, how much will a bank lend me for a mortgage, how much will mortgage lend, how much will mortgage lend me, how much will they lend me for a mortgage