How To Borrow Money From Life Insurance – Looking for a new way to pay off debt? Your life insurance may be your newest lender.

As you reach middle age, financial responsibilities from family and housing needs increase. You want to improve the quality of life and education of your children according to the latest trends. Buying a new car, moving to a new house, or sending your children to a better school will take a large part of your income. If you do not have enough savings, you will have to find additional sources to generate this income. One option is to take a loan against your life insurance policy.

How To Borrow Money From Life Insurance

Many insurance companies offer life insurance policies that come with the feature of getting a loan against the insurance. This feature is ideal for insurance in the event of a midlife crisis. When you are facing a cash crunch, it is advisable to avoid an unsecured personal loan and take a loan secured against your life insurance policy.

What You Need To Know About Business Loan Protection And Why You Should Consider It

The life insurance not only provides insurance but also provides money in the form of a loan. A loan against policy comes with a lower interest rate than a personal or home loan.

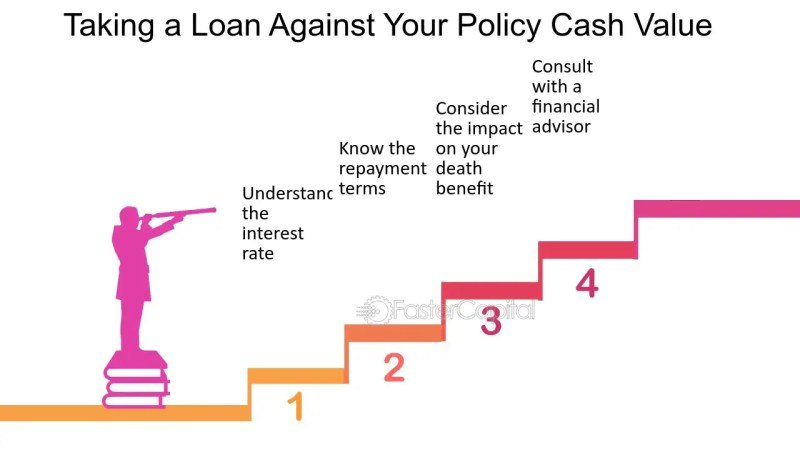

Before you decide to take a loan against your life insurance policy, you should consider the points mentioned below.

Type of Policy – It should be noted that not all policies come with a loan facility. Life insurance policies like unit linked insurance plans, annuity plans with premiums paid for at least 3 years are eligible for the loan. Term insurance policies are not eligible for credit as they have no surrender value.

CIBIL Score – Banks check a person’s CIBIL score to grant a loan. This option is suitable for borrowers with low CIBIL scores.

How To Take A Loan On Your Ntuc Income Life Insurance

Loan interest – Loan against insurance is a viable option against unsecured personal loan. The interest rate for a loan against insurance is much lower, 10-12%.

Documents – Since the borrower is already a customer, minimal documents are required and the loan amount is disbursed immediately.

Loan amount – The loan amount depends on the insurance policy, the number of years in which the premium is paid and the remaining term of the policy. A typical policy can provide a loan amount up to ₹25 lakh. Regarding the ULIP plan, if more than 70% of the funds are invested in equity, you can get a loan of up to 30% of the total income. Standard insurance policies allow up to 80-90% of the surrender value as the loan amount.

Tax Benefits – The interest on the insurance loan is allowed to be deducted from the income from the house property if the amount is used for the construction, construction or renovation of the property.

How Long Does Life Insurance Take To Pay Out?

Payment Options – The life insurance policy will lapse if the policyholder defaults on the loan amount. You also have the option of prepaying or prepaying the loan if you have the money. Paying off the loan is recommended because if you don’t, the amount you owe will increase. In the event of the death of the insured, the amount payable and the interest rate will be deducted from the death benefit payable. The policy is usually canceled if the amount of unpaid premium and interest is equal to the surrender value. The repayment process is similar to a regular loan, you will have to repay the loan and interest amount in equal monthly installments/EMIs.

Premiums – Even after taking a loan against the policy, you have to pay the premiums. If you don’t pay your premiums on time, the insurer can cancel the life insurance policy.

Surrender Value – As mentioned earlier, term plans do not provide loan facilities as they do not come with a surrender value. Surrender value is defined as the amount paid to a life insurance policyholder when he decides to withdraw from a continuing life insurance policy before maturity. A regular premium life insurance policy will reach its surrender value after three years of premium payments. Even if your life insurance is pre-approved for a loan, you can get these benefits only when premiums are collected on your policy.

Assignment Document – This document states the assignment of a life insurance policy against a loan for a credit institution/insurance company. The deed of assignment must be submitted in a form determined by the insured. The selection details are given in the original insurance policy document.

How A Life Insurance Loan Can Help During The Coronavirus Emergency

The application process for taking an insurance loan depends on the type of life insurance policy and the insurance provider. To get an insurance loan, you should get detailed information from the insurance company about their terms and conditions.

The documents required to apply for a loan against insurance are: loan application form, original of the insurance policy, latest payment receipt, deed of assignment (where the life insurance policy is assigned to the nominated insurer) and canceled check . .

Low interest rates, easy and quick approval of life insurance loans, etc. Although it has many advantages, it is recommended to keep it as a last resort. The main purpose of life insurance is to ensure the life and financial security of you and your family. In case of your accidental death, the death benefit will be paid to your family. This, in turn, will help your family meet their financial obligations, clear all debts and move forward in the future.

But if you take a loan against your life insurance policy and an unfortunate event happens to you before the loan is paid off, the life insurance provider will pay the outstanding amount along with the death benefits from your family. Although borrowing from a life insurance policy can be a quick and easy way to get cash when you need it, there are a few things you should know before taking out a loan. The bottom line is that you can only take a loan with a permanent life insurance policy, i.e. whole life insurance or universal life insurance policy.

Using Life Insurance Loans To Manage Premium Payments

The cheapest and most affordable option for most people, term life insurance has no cash value. It is usually designed for a minimum term of one to 30 years. However, in some cases, a term life policy can be converted to a permanent policy as the cash value increases.

Whole life and universal insurance policies are more expensive than term, but they do not have a predetermined expiration date. When sufficient premiums are paid, the insurance is valid for the life of the insured. Although the monthly premium increases over time, the amount paid in the policy in excess of the sum insured is included in the cash value account that is part of the policy. The purpose of the cash value is to pay for insurance costs that increase with age. This is because premiums can remain stable for life and not rise to unaffordable levels in later years.

Permanent life insurance has several basic values: face value, death benefit (often equal to face value), and cash value. A common misconception is that cash value increases the death benefit. This only applies to certain types of permanent policies. Most policies do not add a death benefit.

Cash value increases depending on the type of policy. For example, in a standard universal life policy, it increases based on current interest rates, while in a variable universal life policy, the cash value is invested in the stock market by the owner (and increases accordingly). It usually takes at least a few years to get enough money to take out a loan.

Should You Borrow From Your Life Insurance To Pay Off Debt?

Unlike a bank loan or credit card, policy loans do not affect your credit and there is no approval process or credit check because you are borrowing from yourself. When borrowing from your policy, you don’t need to specify how you plan to spend the money, as it can be used for any financial situation, from bills to holiday expenses.

The loan is also not recognized as income by the IRS, so it is tax-free as long as the policy remains in effect (unless there is a modified financing agreement). The policy loan is still expected to be repaid with interest (although the interest rates are usually much lower than a bank loan or credit card) and there is no mandatory monthly payment.

The policy loan reduces your available cash value and death benefit. If you miss a life insurance loan payment, this

How to borrow money from your life insurance policy, how to borrow money from a life insurance policy, how to borrow money from my life insurance, how to borrow money from life insurance policy, how to borrow from life insurance policy, borrow money from life insurance, how to borrow from life insurance, how to borrow from whole life insurance, how to borrow from your life insurance, how to borrow money from whole life insurance, how to borrow money from your life insurance, how to borrow money from state farm life insurance