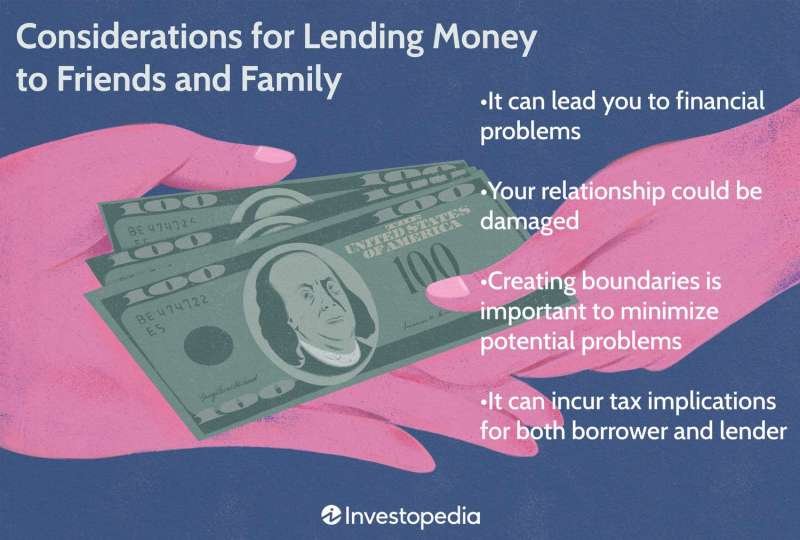

How To Borrow Money From Your Paycheck – Giving money to family and friends can be a good sign when someone you know is struggling financially, but it can also be a problem if you try to help with conflicts or problems that have financial problems.

According to a 2022 study by Creditcards.com, 42% of respondents reported losing money through loans sent to friends and family members. If a friend or family member approaches you for a loan, take the following steps and don’t.

How To Borrow Money From Your Paycheck

There are situations when a friend or family member approaches you to borrow money. For example, you can apply for a loan if:

The Do’s And Don’ts With Regards To Payday Loans By Wilton Witt

Whether you’re under pressure or forced to take out a loan, it’s important to consider whether it’s right for you and your financial situation. For example, borrowing money from someone will increase your personal expenses and make it harder for you to keep up with your payments, which may not be the best option. On the other hand, if you have an emergency fund, little or no debt, and a steady paycheck, it may not be difficult to manage debt.

In addition to financial costs, it is also important to consider how to recover the money. If the friend or family member applying for the loan is responsible for paying their bills and is experiencing a temporary financial problem, the loan may not be a problem.

If, on the other hand, someone with a history of poor financial savvy approaches you, you can increase your risk by lending them money.

If you borrow money and hope to get it back, it’s important to be careful who you lend it to. Taking out loans to friends and family members you rely on to pay off their debts will help you avoid financial and emotional pain in the future. In the Lending Tree survey, for example, more than a third of borrowers and lenders reported negative outcomes, including anger and pain.

The Best Ways To Borrow Money

If you don’t lend money to someone, it’s okay to say so. You can return it, but the bottom line is that you only send money when you think the relationship won’t go south.

Consider asking your lender for a loan equal to the loan amount that you can keep as collateral until the loan is paid off.

Giving big bucks to help someone is a bad idea if you’re struggling with your own finances. When deciding how much money to give someone, the best way to earn money is to donate. In other words, how much money can you lose without hurting yourself financially?

:max_bytes(150000):strip_icc()/financing-options.asp_final-dd2cfe64477f48ad8e16969fd6697983.png?strip=all)

That doesn’t mean you should think you won’t pay. Instead, it will help you set some realistic limits on lending to friends and family so you don’t end up needing a loan later.

Read This Before Taking Out A 401(k) Loan — Vision Retirement

When you owe money to friends or family, having a paper trail will help you avoid misunderstandings. Writing up a loan agreement with the borrower and signing it will make it clear what your responsibilities are and give you the opportunity to take legal action if you want to sue them for damages.

For larger amounts owed, it may be wise to have a lawyer negotiate for you. You may want to consult a tax professional if you plan to pay interest on the loan.

If you plan to pay interest, it must be at least as low as the Federal Reserve Rate Requirements (AFR). For loans over $10,000, they charge income tax. Even if you don’t pay interest, you still have to show the money to contribute in case of default.

If you choose to give money to friends and family and make a donation, you can give up to $16,000 per person per year in 2022 (increasing to $17,000 for 2023) and gift tax does not apply.

Many Middle Class Americans Are Living Paycheck To Paycheck

This should be obvious, but it bears repeating. Borrowing more money than you can afford can only lead to problems if the lender doesn’t pay on time or makes it difficult for you to keep up with your finances.

It’s also important not to let guilt or other pressures force you to lend money to someone you know. If you want to give money to someone and you don’t like the money, it’s a good idea to take a step back and think about other ways you can help them. For example, you may be able to direct them to other resources that can provide financial assistance other than credit.

Signing makes both parties responsible for the loan. If someone else doesn’t pay, the creditor can come after you for payment.

:max_bytes(150000):strip_icc()/Facts-about-401k-loans-9b8c3bd3d0314c338c0a50bc3c75728c.gif?strip=all)

You can offer to co-finance a personal loan for a friend or family member instead of lending them money yourself — or you can let them use your credit card for a while. That way, you don’t have to pay out of pocket.

How To Borrow Up To $200 From Cash App 💸

However, applying for a loan will affect your credit score as the inquiry, payment history and balance will appear on your credit report. If someone else uses your credit card to make a purchase, you’re still responsible for any balance they charge. These are options you might consider as a last resort when getting a loan.

You can borrow money against interest as long as the interest rate complies with the applicable legal provisions. Most states have mortgage laws that limit the amount of interest a lender can charge. You should also consider the applicable income tax rate as determined by the Internal Revenue Service (IRS). Interest rates below this amount are considered a bonus and result in a taxable event.

Loans can be taxing within the family, both for the borrower and the lender. If the loan is worth more than $10,000, the interest payments are tax deductible. Also, if the lender forgives a portion of the loan balance or agrees to a lower market interest rate, it may be a gift to the borrower and subject to gift tax.

Borrowing money can damage relationships with your friends and family, especially if they have trouble paying. This emotional damage can be much worse than losing money. It is wise to avoid giving money to the family, but if you do end up giving them money, be prepared for the possibility that you may not get it back.

Best Cash Advance Apps In May 2024

There’s a fine line between helping a loved one in need and putting your relationship at risk. Either way, you have the budget to help a family member or friend who needs money. On the other hand, borrowing money from someone – especially someone who has financial problems – will put your own money at risk. When considering the best way, consider the above factors to decide whether to send money to people in your network.

Authors must use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. We also cite original research from other respected publishers when appropriate. You can learn more about the standards we follow when publishing accurate and inaccurate information in our editorial policy.

In the dynamic world of payment applications, new financial solutions are gaining momentum in today’s digital age. This guide shines a light on the key players in the coverage market, offering a lifeline to those in need. With their ability to deliver instant payments, these apps that prepay your payments represent innovative ways technology meets personal finance, changing the way cash flow issues are addressed and providing insight into the day-to-day financial front. management.

PaydaySay: Known for its fast approval speed and easy payment processing, PaydaySay has emerged as the first choice for those looking to get paid. It targets workers who want to bridge the wage gap and don’t have access to a credit check, and provides a simple financial support system. B9: A new approach to payments, B9 has been praised for its user-friendly app and flexible payment options. It appeals to technical borrowers looking for immediate financial assistance with little fuss, emphasizing simplicity and speed in every transaction. ✅ FitMyMoney: This platform features personal financial advice and payment options. FitMyMoney doesn’t give you quick cash; It also aims to help users make better financial decisions, making it ideal for borrowers who want to better manage their finances.

How Do I Refinance A Loan?

Borrow money from paycheck, borrow from next paycheck, borrow from your paycheck, app to borrow money from paycheck, app to borrow money from your paycheck, borrow money from paycheck early, borrow from paycheck app, how to borrow money from paycheck, borrow from your next paycheck, borrow from your paycheck app, borrow money from next paycheck, borrow money from your paycheck