How To Calculate Profit And Loss In Option Trading – Trading options can seem complicated. But there are tools that can make the effort easier. For example, software can handle the relatively complex math required to calculate an option’s fair value. and risk charts which is often called “Profit/Loss Charts” provide a simple way to understand what a future option or complex option position might look like.

To be successful in options trading Investors must fully understand the potential benefits and risks of any trade they are considering. risk chart You can quickly see the areas with the highest profit potential and highest risk.

How To Calculate Profit And Loss In Option Trading

Being able to read and understand risk charts is an important skill for anyone wanting to trade.

How To Trade In Futures And Options

Let’s start with a simple risk chart. For long positions in stocks under 100 shares at a price of $50, with this unit you can earn $100 for every dollar of stock price growth. For every dollar below your cost of capital you will lose $100. Risk Profile/ This payoff is easily shown in the table:

Take the numbers from the table and plot them on a graph to show this profile. The horizontal axis (x-axis) represents stock prices in ascending order. The vertical axis (y-axis) represents unit profit (loss) figures. Below are two diagrams. dimension:

To read the chart Look at any stock price on the horizontal axis, say $55, then straight up to the blue profit/loss line. In this case, the point is aligned with $500 on the left vertical axis. This means you will make a profit of $500 on a $55 share price.

A risk graph can glean a lot of information from its simple appearance. For example, we quickly know that the break-even point is $50 and the profit/loss line crosses zero.

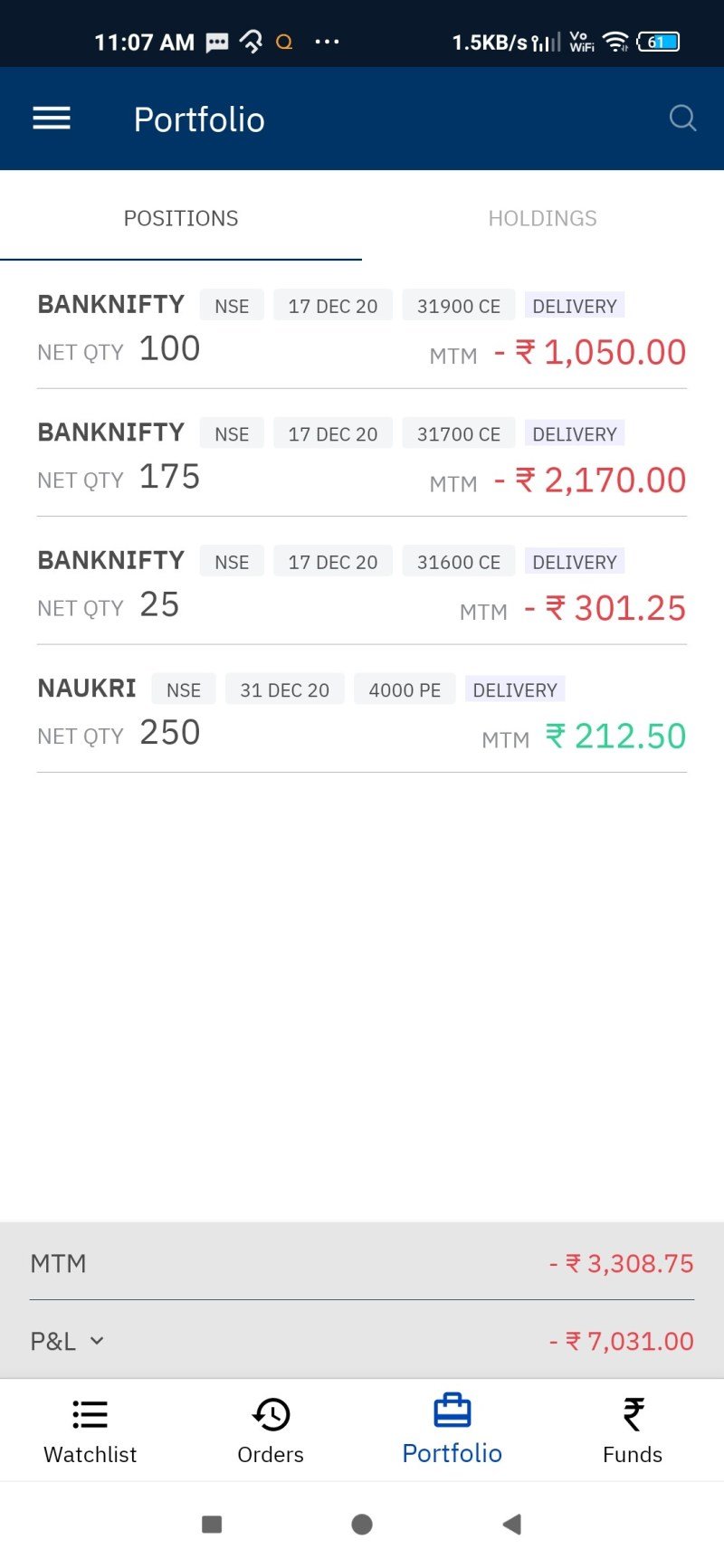

Stock Market Profit And Loss Screenshot

The graph also shows when the stock price goes down. Your losses will increase until the stock price reaches zero and you will lose all your money. On the other hand, when the stock price goes up, Your profits will continue to grow with theoretically unlimited profit potential.

The options trading risk table includes only the covered counterparties. The vertical axis is profit/loss. and the horizontal axis shows the underlying stock price. All you have to do is calculate the profit or loss for each price. Draw the relevant points on the graph. Then draw lines to connect the dots.

Unfortunately, when looking at the options It is very easy to enter an option position on the day the option expires. This means that determining the potential profit or loss is simply a matter of comparing the option price to the stock price.

But at any other time between the time the position is entered and the time it expires. There are factors other than the price of a security that significantly affect its value.

Download P&l Report From Zerodha Console

The important factor is time. In the stock example above It doesn’t matter if the stock price goes up to $55 tomorrow or a year from now. Either way Your profit will be $500, but this is a wasted opportunity. Each day that passes The value of the option will decrease slightly. (All things being equal) This means that the time component makes the risk table of any option position. is more complicated

Two-dimensional charts showing option positions often have multiple lines. Each line represents the performance of your location at a different estimated time.

This is a simple option status chart. Long call risk graph showing how it differs from the risk graph we’ve drawn for stocks.

Purchasing a line on ABC on February 50th will make you eligible. But it’s not an obligation to buy the underlying stock at $50 by February 19, let’s say after 60 days.

What Is Profit And Loss (pnl) And How To Calculate It

A call option controls the same 100 shares for significantly less than the cost of purchasing the shares. In this case, you’d pay $2.30 per share for this right. Therefore, no matter how much the stock goes down The maximum possible loss is only $230.

The table above has three different rows showing the profit/loss on three different days. The solid line shows the profit/loss for the position within 60 days (T+60). The middle line shows the profit/loss probability for the position within 30 days (T+30). The upper dashed line shows the profit/loss probability for the position within 30 days (T+30). Loss for current state (T + 0)

Instead, observe the effect of time. As time passes The value of the option gradually decreases. Note that this effect is not linear. If there is still a lot of time left before the expiration date, it is rare that the time decreases each day. When it’s almost due This effect will begin to accelerate. (but at different rates for each price)

Pay close attention to this time share: Over the next 60 days, the stock price will be at $50 when you first bought the option. You will start the same thing. (at the zero line with no profits or losses) after 30 days, when the expiration date is reached You will lose $55 at expiration. If the stock remains at $50, the option will be worthless and you will lose a total of $230.

Option Value Calculator

Notice how that erosion accelerates over time: You lost $55 in the first 30 days, but will lose $175 in the next 30 days. Several lines combine to cause this acceleration over time.

For today and other expiration days We can only predict possible or theoretical approximations of options. This estimate is subject to fluctuations in addition to the stock price and maturity date.

The difference between the option’s cost and the theoretical price is the potential profit or loss. Remember that the profit or loss shown in the option’s risk table will depend on the theoretical price and the funds used.

When evaluating the risks of options trading Many traders Especially those who are new to options trading. Focuses almost entirely on the price of the underlying stock and the remaining time of the option.

Measure Profit Potential With Options Risk Graphs

But any trading options Current volatility should be taken into account before entering any trade. If you want to measure whether stocks are currently cheap or expensive. Look at the current and future volatility relative to the current readings.

By explaining the effect of time in the previous example. We assume that current volatility may not change in the future. Although this is a reasonable assumption for some stocks, But it overlooks the possibility of changing volatility levels and underestimates the risks involved in potential trading. But how do you add a fourth dimension to a two-dimensional graph?

The short answer is you can’t. There are ways to create more complex graphs with three or more axes, but two-dimensional graphs have many advantages. None of which has the advantage of being easy to remember and visualize later.

Therefore, it makes sense to stick with traditional two-dimensional graphics. And there are two ways to add a fourth dimension to problem management.

Profit & Loss Projection: How To Forecast Your Income

The easiest way is to enter an amount of what you expect will fluctuate in the future. Then see what happens to the position if that change occurs in implied volatility.

This solution gives you more flexibility. But the resulting chart is just as accurate. with which you predict future fluctuations. If the desired volatility is completely different from your initial estimate. The expected profit or loss of the position will also be greatly reduced.

Another disadvantage of calculating and entering values is that the fluctuations remain constant. It’s good to see how vibration affects position.

That is, we need a graphical representation of a position’s sensitivity to changes in volatility, such as a graph showing the effect of time on the value of an option. In doing this We use the same method: keep one variable constant. In this case, it doesn’t evaporate.

Options: Calls And Puts

So far, we’ve described risk maps using simple strategies, but now let’s look at more complex long-term strategies. This involves calling and betting on the same stock. with the same number of days off work and expiration month This selection strategy has advantages. At least for us

Option trading profit calculator, stop loss in option trading, how to calculate trading profit and loss account, option trading profit loss calculator, how to make profit in option trading, how to calculate profit and loss percentage, trading profit and loss format, how to calculate profit and loss in forex trading, how to calculate profit and loss, option trading profit, profit and loss in option trading, how to calculate option profit