How To Close Retained Earnings – When you own a small business It’s important to have cash available to invest or pay off your debts. But because money comes in all the time It is therefore difficult to keep track of how much money is left. Use a retained earnings account to track how much money your business has collected.

Knowing how much your business earns will help you make decisions and secure funding. Learn what retained earnings are, how to calculate them, and how to record them.

How To Close Retained Earnings

Retained profits are business profits that can be used to invest or pay off business debt. It’s retained earnings, which represents what remains after you’ve paid expenses and dividends to your company’s shareholders or owners. Retained earnings are also called retained earnings or retained earnings.

Lo 2.3 Prepare An Income Statement, Statement Of Retained Earnings, And Balance Sheet

You must report retained earnings at the end of each accounting period. Common billing periods include monthly, quarterly, and yearly. You can compare your company’s retained earnings from one accounting period to the next.

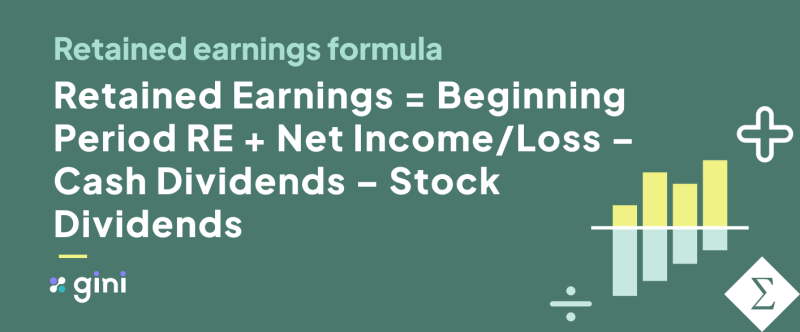

And what will the retained earnings be? To calculate retained earnings You need to know the company’s past retained earnings, net profit, and past dividends paid.

You can view your company’s past profits on your business balance sheet or retained income statement. You can view your company’s net income on the income statement or income statement. If you have shareholders Dividends are the amount of money you pay them.

If you are a new business and have no previous retained profits. You will pay $0 if your previous accumulated earnings are negative. Mark them correctly.

Closing Retained Earnings Account In Powerpoint And Google Slides Cpb

Can retained earnings be negative? If you have a net loss and low or negative initial retained earnings You may have negative retained earnings.

On the other hand, if you have a net income and a good amount of accumulated profits. You may have positive retained earnings.

Let’s say you have retained earnings of $25,000 during this accounting period. You have a net profit of $30,000. You also pay dividends of $20,000.

Now let’s look at an example of negative retained earnings. You keep $4,000 in earnings and $12,000 in net income. You haven’t paid any dividends.

Solved A) Income Statement, Statement Of Retained Earnings,

You have an $8,000 deficit in your business. Because retained earnings are cumulative, you should use -$8,000 as the starting retained earnings for the next accounting period. You need to have a high income to get out of the hole.

Every time you create a journal entry that increases or decreases an income or expense account, You must adjust your retained earnings account.

Is retained earnings an asset? Retained earnings are actually reported in the shareholders’ equity section of the balance sheet. Although you can invest retained earnings in assets But it’s not property.

Retained earnings must be recorded. You usually record it on your balance sheet in the shareholder’s equity section. However, you can also record retained earnings on a separate financial statement called the statement of retained earnings.

Retained Earnings: Everything You Need To Know About Retained Earnings

The balance sheet is divided into three sections: assets, liabilities per source of funds. and shareholders’ equity The Assets section lists valuable items your company has. The Liability section shows what you owe. The Equity section also shows how much money you have left after paying off your debt.

On the balance sheet, retained earnings appears in the “Equity” “Retained Earnings” appears as a line item to help you determine total working capital.

The retained earnings statement is a financial statement specifically used to calculate your retained earnings. The same applies to the retained earnings formula. The statement of retained earnings shows retained earnings. Net profit or loss Dividends paid and retained earnings at the end of the year

With a well-maintained account book You can create accurate financial statements. Patriot small business accounting software makes it easy to track your income and expenses online. Try it for free today!

Solved: Prior To Closing The Accounts, Syracuse Company’s Accounting Records Showed The Following Balances: Retained Earnings Service Revenue Interest Revenue Salaries Expense Operating Expense Interest Expense Dividends 7,7008,650 1,2005,500 1,8501

Get started with free payroll setup and get free expert support. Try our payroll software with a no-obligation 30-day free trial In this lesson, we’ll walk through the final steps (steps 8 and 9) of the accounting cycle. which is the account closing process You’ll notice that we didn’t cover step 10 by reversing the list. This is an optional step in the accounting cycle that you will study in future courses. Steps 1 through 4 involve analyzing and recording transactions. and steps 5 to 7 are related to the improvement process.

Here, our discussion begins with recording entries and posting closing entries ((picture)). These posted entries are then translated into a post-closing trial balance. This is a trial balance prepared after all closing transactions have been recorded.

You are an accountant for a small event management company. The company has been in operation for many years. But I don’t have the funds for accounting software. This means that you must prepare all the steps in the accounting cycle yourself.

It’s now the end of the month and you’ve completed your post-closing trial balance. You notice that this trial balance still shows the service revenue account balance. Why is it wrong to have a revenue account in probationary status after closing? How to fix this error?

Closing Revenue, Expense, And Dividend Accounts

Companies are required to close their books at the end of each financial year to prepare annual financial statements and tax returns. However, most companies prepare monthly financial statements and close their books annually. In order to have a clear picture of the company’s annual performance. and provide timely information to users in making decisions.

Closing entries prepare the business for the next accounting period by offsetting outstanding balances in certain accounts that should not be carried forward to the next period. Final balance or cleared balance means returning the account to zero balance. It is important that the balances in these accounts are zero so that the company can compare performance between periods. especially income It also helps companies keep comprehensive records of balances in accounts that affect retained earnings. Income, expense, and dividend accounts affect retained earnings and are closed so that new balances can be accumulated in future periods. which is the application of the assumption of time period

To explain this concept further. Balances are closed to ensure that all income and expenses are recorded in the correct period. Then it starts in the next period. The income and expense account for each period must start at zero. Because we are measuring income earned and spent during that period, however, cash balances and other balance sheet accounts are carried forward from the end of the current period to the beginning of the next.

For example, the store inventory account balance is $100,000. If the store closed at 11:59 PM on January 31, 2019 and reopened at 12:01 AM on February 1, 2019, the balance Inventory will be $100,000. Balance sheet accounts, such as inventory, will be carried forward to the next period. February 2019 preview

Odoo Closing Entries

As of January 2019, Earnings, Income, and Dividends are accounts that must start with a net balance or $0 for the next billing cycle. To determine income (profit or loss) from January, the store must be closed. Income statement data from January 2019. Setting January 2019 to zero helps stores calculate revenue. (Profit or Loss) for the following month (February 2019) instead of combined with January’s income. In February.

However, if the company wants to collect data every year. A separate set of records can be kept as the company progresses through the remaining months of the year. for our purposes Let’s say we close the books at the end of each month.

Let’s look at another example to explain. Let’s say you have a small landscaping business. It’s New Year’s Eve, December 31, 2018, and you’re reviewing your finances for the year. You can see that this year you have $120,000 in income and $70,000 in expenses for rent, electricity, cable, internet, gas, and food.

The next day, January 1, 2019, I prepared for work but before going into the office I decided to review my finances for 2019 first. How much was this year’s income? This year you haven’t worked at all. What are your total expenses for rent, electric, cable, internet, gas, and food this year? You still have to pay rent, electricity, cable, internet, gas, or food, which means the current balance on these accounts is zero. It was closed on December 31, 2018 due to the end of the annual accounting period.

Adjusted Retained Earnings Statement

Then you review your assets and liabilities. What is the current balance in your bank account? What is the current book value of your electronics, cars, and furniture? What about your credit card and bank loan balances? is the value

How to find retained earnings, how to make a retained earnings statement, how to calculate retained earnings balance sheet, how to prepare a retained earnings statement, close net income to retained earnings, how to retained earnings, close income summary to retained earnings, how to close retained earnings account, how to do a retained earnings statement, how to calculate dividends from retained earnings, how to reconcile retained earnings, how to close out retained earnings