How To Do Futures Trading – Futures are not a new type of financial instrument. In fact, they arose in the mid-19th century and allowed grain farmers to sell their wheat for shipment. Since then, They have different money, It has evolved to include financial instruments and other products.

Futures trading provides investors with quick and cost-effective access to global financial and commodity markets. Investors can predict or hedge the direction of security prices or instruments that are being sold. It works by buying futures contracts. A futures contract is a legal agreement to buy or sell an asset at a specified price in the future.

How To Do Futures Trading

But what are the pros and cons of futures trading? This article will explore some of the benefits and challenges you may face when trading in the future.

How To Trade Cryptocurrency Futures: 5 Beginner Tips For Crypto Traders

As the name suggests, a futures contract is a financial instrument in which a buyer and a seller agree to sell an asset at a specified price in the future. Futures contracts allow for the delivery of assets, but are often not actually delivered, and are used by investors to speculate on the price of a security or hedge risk in the portfolio.

Traders can speculate on various stocks and commodities through futures trading. equity indices in major futures markets; energy money, cryptocurrencies; profit margin; grain, It includes forests and pastures.

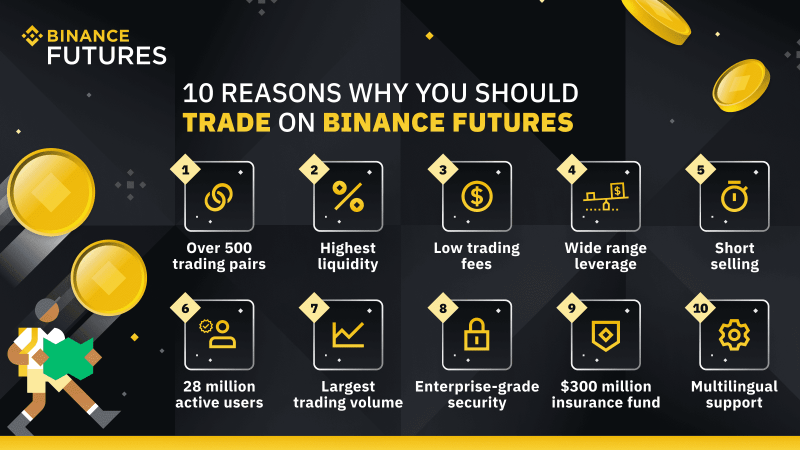

Most futures contracts are traded through centralized exchanges such as the Chicago Board of Trade and the Chicago Mercantile Exchange (CME). Many cryptocurrency brokers, such as Binance, offer permanent futures or unexpired contracts; It allows traders to worry about months of expiration.

Futures trading requires investors to settle their contracts. Unlike option trading, it gives the trader the opportunity, not the obligation, to settle the contract.

Value And Price Of Futures Contracts

As with any strategy or method of trading, there are some major pros and cons that you should know before starting. Whether you are a novice investor or a seasoned professional, these points are valuable.

Investors should do their research when choosing a futures trading platform. But what criteria should you look for when choosing one? Here are some things your forum can do for you:

More advanced traders may want a platform that allows application programming interface (API) to enable algorithmic trading functions. Active traders should choose the next platform with a mobile trading application that allows them to trade and manage their positions.

Many full-service online brokers and trading platforms offer futures trading. You need to apply and get permission to start trading these markets.

Trading101: The Ultimate Guide To Bitcoin Futures Contr

As with stocks and other financial assets, it is important for investors to develop a future trading plan that describes entry and exit strategies and risk management principles.

If the trader uses technical analysis to find the entries; When the 50-day simple moving average (SMA) crosses above the 200-day SMA, you can decide to open a long futures trade with the gold signal. The trading plan may include a stop loss order of 5% below the entry price to control the downside risk.

In this regard, the Future Trading Program that focuses on critical research can generate buy and sell signals based on agricultural and energy reports. For example, a trader may short an oil contract if the weekly oil price rises faster than analysts expect. Yes, Some traders may include technical and basic analysis in their future trading plan.

Technical analysis is a branch of trading used to evaluate investments and identify trading opportunities.

Crypto Futures Trading: Things You Need To Know Before You Begin

Before trading futures, investors should know some important aspects of futures contracts that help size positions and manage risk. These include contract size; It includes contract price and ticket size. As an example we will use the popular E-mini S&P 500 futures contract offered by the Chicago Mercantile Exchange (CME).

Futures contracts are listed in different models covering many asset classes. The most popular are:

In order to start future trading, you need to follow the basic steps below.

Now that we’ve covered the basics, let’s dive into an example trade using the E-mini S&P 500 futures. Let’s say the S&P 500 recently hit a new high. We want to reduce this move and expect a profit of around $4,720. Our financial management rules state that we are risk free. More than 1% of our futures trades are in each trading account and our broker requires a margin of $12,000.

Futures Trading: Leveraging Futures Trade Signals For Profitable Trades

Knowing this information, we decided to open a short position, exchange one contract, and risk $25 (or 100 ticks) above our entry price of $4,786. 100), We must have at least $125,000 in our futures trading account to meet the 1% risk ($1,250 = 1% of $125,000) per trading rule. Best of all, If the S&P 500 continues to advance against us, we should have more money in our account to cover the $12,000 requirement.

We then take profit at $4,720 (ticks264) or $66 below our entry price. If the market moves in our favor and order comes. We will have a profit of $3,300 ($12.50 per p 264 token).

Conversely, if you had stopped, you would have lost $1,250. However, the futures trade offers a risk/reward ratio of 1:2.64, or $1,250, but $3,300 per contract.

A futures contract is a financial instrument that allows investors to hedge and bet on future price movements of a security or asset. There are no restrictions on the types of assets that investors can trade using these contracts. Therefore, they are stocks, bonds; Commodities (energy, grain, forestry, livestock, agricultural products); money, interest rate; Precious metals, You can trade futures on cryptocurrencies and more.

Futures Trading Basics: Beginner’s Guide To Commodity Futures Trading

Investors should have basic knowledge before trading futures. Knowing your strengths and weaknesses can mean the difference between success and failure.

Some important advantages are the use of leverage (borrowed money) for trading; Ability to choose from a variety of financial contracts; It involves almost daily trading and low hedging. Wide market.

In this regard, investors should understand that futures trading can be complicated and lead to investment. Expiration dates can be difficult to track, especially if investors are trading multiple contracts. Finally, there is a possibility of physical delivery of the content of the country unless traders move their positions to close the expiration date or contract.

The trading platform for futures trading should suit your business strategy and financial situation just like choosing any other trading platform. Some important things you should consider include how it is accepted and whether it offers different types of payments. You should also review the platform’s fees and charges to ensure they are competitive.

Newbies Must Read 01: Start Futures Trading In 3 Steps

Future trading strategy is based on your specific trading strategy. In other words, if you are a technical expert or use critical analysis in trading. You should consider your plan. You can choose to be tall or short; Or you may decide to use a spread calendar. whatever you choose It’s a good idea to have an entry and exit strategy and risk management rules in place.

Futures are basic contracts that hedge your current position or forecast future prices of certain assets or commodities. Because they use influence; Futures increase your bet and lead to higher profits and losses.

Futures also have expiration dates, so you need to be careful when switching or closing your locations to avoid getting stuck in unwanted deliveries. To start a future business; You need to get permission from the broker that gives you access to these markets.

Writers need to use primary sources to support their work. It includes white papers, government information; Includes first-hand reports and interviews with industry experts. Where appropriate, I cite original research from other well-known publishers. You can learn more about our principles for providing quality and honest content in our editorial policy.

What Is Grid Trading? Crypto Futures Guide 2022

The content provided in this table is an affiliate gift. This compensation can affect how and where the bill appears. Not all offers on the market are included.

When you visit this site, Dotdash Meredith and its partners may store or retrieve information from your browser through cookies. Cookies collect information about your preferences and device.

How to learn futures trading, how to start futures trading, how do you make money trading futures, how much can you make trading futures, how to futures trading, how does futures trading work, how futures trading works, guide to futures trading, how much money to start trading futures, how to set up a futures trading account, how to make money trading futures, how to do futures and options trading