How To Get Extra Student Loan Money – When they enter college, they often face financial burdens that can affect their future. For most students, one of the biggest expenses is student loans. While this may seem like a daunting task, there are ways to save money on student loans. One option is daily allowance. The daily interest rate is the interest amount that accrues on the loan every day. By paying this interest as it accrues, students can save money in the long run.

The daily interest is the interest that accrues on the loan every day. This means that the longer a student waits to pay interest, the more they owe in the long run. By paying per diem, students can save money on their loans over time.

How To Get Extra Student Loan Money

There are several ways to pay per diem. One option is to pay interest as it accrues. This means students have to pay more often, but save in the long run. Another way to pay daily allowance is to pay a lump sum at the end of each month. It can also save students money, but they have to be disciplined when paying.

Managing Student Loan Debt: Tips And Strategies

Income support payments can have many benefits for students. First, it can save you money over time. By paying interest as it accrues, students will have less debt in the long run. Second, paying child support can help students avoid defaulting on their loans. By paying more often, students are less likely to default and fall behind on their loan payments.

While paying child support is one way to save money on student loans, there are other ways to save. One option is to refinance the loan. This can lower the interest rate and save students money over time. Another option is an additional loan payment. This can help students pay off their loans faster and save on interest costs.

Overall, Social Security payments can be a great way for students to save on student loans. By understanding the per diem rate and paying more often, students can save money in the long run. However, there are other ways to save on student loans, such as refinancing and additional payments. Students should explore all options and choose the best one for their situation.

Payday interest is a commonly used term in the loan industry. This means the interest that is calculated on the loan daily. For example, if the interest rate on the loan is 6%, the daily interest rate is 0.0164%. This means that the borrower is charged interest on the remaining loan amount every day based on the daily interest rate.

How Do Student Loans Work?

Understanding payday interest rates is important, especially when it comes to student loans. Here are some key points to keep in mind.

Student loan interest rates can rise quickly, especially if the borrower has a high loan balance and a high interest rate. This means that even if the borrower makes their payments on time, they may end up owing more than what they originally borrowed because of the daily accrued interest.

One way to save on student loans is to pay off the interest as quickly as possible. This means that the borrower must pay back as soon as possible, even if only the interest accrued on the loan is paid. By doing this, the borrower can reduce the interest accrued in the future, which can save money in the long run.

When it comes to student loans, it’s important to note that different loans may have different daily payments. For example, federal loans may have lower interest rates than private loans. This means that borrowers should compare the daily interest rates of each of their loans and pay off the loans with the highest daily interest rate first.

Investing Student Loans: Can You, And Should You?

For borrowers with several student loans with a high daily interest rate, refinancing can be a good option. Refinancing means taking out a new loan at a lower interest rate, which can help reduce your daily loan payments. However, it is important to note that refinancing is not necessarily the best option for everyone, as it may come with its own fees and requirements.

In general, understanding payday interest rates is an important part of student loan management. By paying the interest early, choosing loans with a high daily interest rate and considering options such as refinancing, the borrower can save money and reduce the total cost of the loan.

Student loans are a type of financial aid designed to help students pay for tuition, fees, and other educational expenses. They can be a great way to fund your education, but they can also be stressful and confusing. This section examines student loans and their operation in more detail.

There are two main types of student loans: federal and private. Federal student loans are issued by the government, while private student loans are issued by banks and other financial institutions. Federal student loans generally have lower interest rates and more flexible repayment options than private student loans.

The Frivolous Spending Of Student Loans On Other Things [infographic]

Interest rates are an important factor when taking out a student loan. Interest is a percentage of the loan balance, which is calculated as interest annually. Federal student loan interest rates are usually lower than private student loans. It is important to understand how

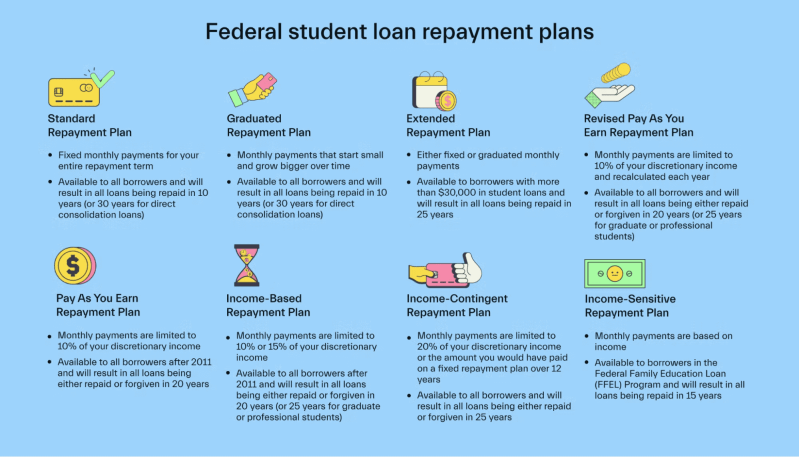

Student loan repayment options may vary depending on the loan type. Federal student loans offer several repayment options, including income-based repayment plans that allow you to pay based on your income. Private student loans may have fewer repayment options, so it’s important to understand the options before taking out a loan.

Loan forgiveness is an option for some borrowers with federal student loans. This means that some of your credit balance can be forgiven after a certain period of time or under certain circumstances. Private student loans usually do not offer loan forgiveness options.

Consolidation and refinancing are two ways to manage student loan debt. Consolidation allows you to combine multiple federal student loans into one loan, while refinancing allows you to replace your existing loans with a new private loan with a lower interest rate. It’s important to understand the pros and cons of each option and look for the best prices.

Tips To Avoid Student Loan Payment Scams

In general, understanding student loans is an important part of financing your education. By considering different types of loans, interest rates, repayment options, loan forgiveness, and consolidation/refinancing options, you can make an informed decision about financing your education and managing debt.

Daily interest is the interest that accrues on your student loan every day. This means that the interest is calculated daily based on your loan balance. The interest rate can have a significant impact on your student loan debt, especially if you have a large balance or a long repayment period. Understanding the impact of payday interest and student loans can help you make informed decisions about managing your debt.

To calculate the daily interest, the annual interest is divided by the number of days in a year. This gives you a daily interest rate, which is then multiplied by the remaining loan balance. The received amount is the daily interest, which is added to your loan balance every day. For example, if you have a $10,000 student loan with an APR of 5%, your daily interest rate is 0.0137% (5% divided by 365). If you owed $8,000, your daily interest rate would be $1.10 per day (0.0137% multiplied by $8,000).

The daily interest rate can have a significant impact on your credit balance over time. The longer you pay back the loan, the more interest accrues, which means your loan balance will be larger. Also, if you have a variable rate, your daily interest rate can vary over time, which can make it difficult to predict your future debts. However, if you make extra payments on the loan, you can reduce the debt and reduce the interest accrued every day.

More Companies Are Wooing Workers By Paying Off Student Debt

There are several strategies you can use to manage your student loan interest on a daily basis. One option is to pay extra fees on the loan, if possible. This can help you reduce your outstanding debt and reduce the interest that accrues each day. Another option is to refinance your loan to a smaller one

Can you get extra student loan money, student loan extra payment, apply for extra student loan, student loan extra, how to get more student loan money, can i get extra student loan money, get extra student loan money, how to get student loan, student loan calculator extra payments, extra student loan money, how to get extra money from student loans, how to get student loan money