How To Instantly Raise Your Credit Score – If your credit isn’t what you want it to be, know that you’re not alone. Many Americans struggle with low credit scores, but there are things you can do to help them. Choosing to work on improving your credit score takes time, but it will be worth it in the long run. There are many ways to improve your credit score, and we’ve provided you with eight steps to help you on your way to success.

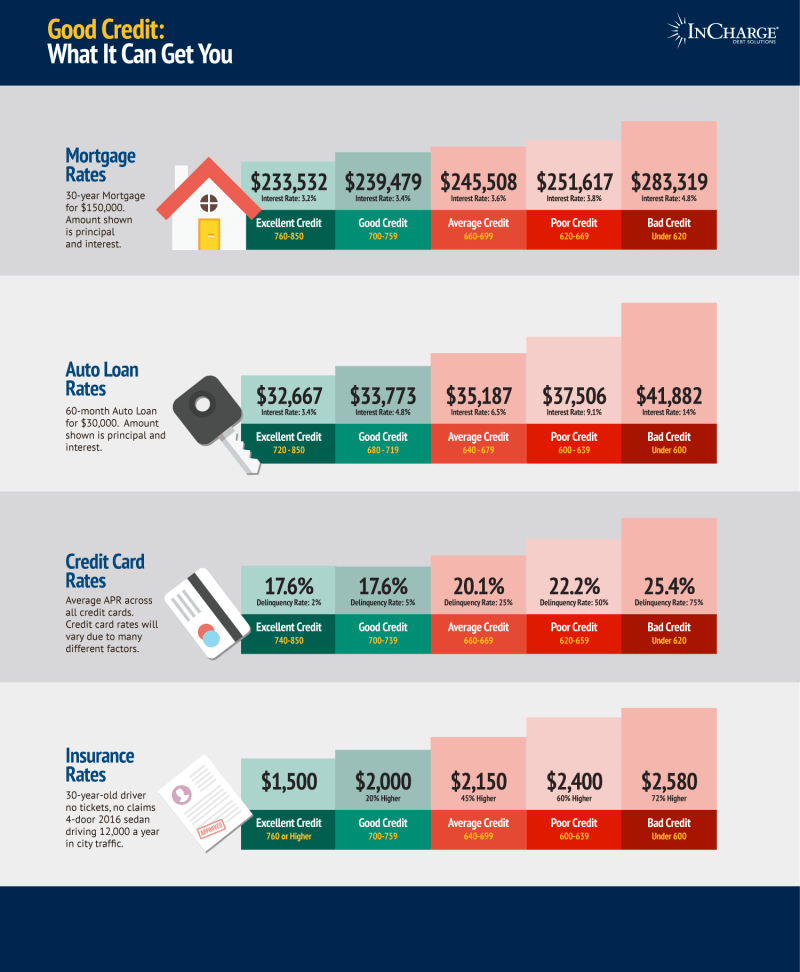

The term credit score refers to the three-digit number that lenders use to decide whether to give you a credit card or loan. This number is very important in your financial life because the higher your credit score, the better terms and interest rates you can get from financial institutions.

How To Instantly Raise Your Credit Score

In the image below, you can see how various factors affect credit scores. Although this is FICO’s scoring model, TransUnion, Equifax, and Experian have similar scoring models.

How To Improve Your Credit Score

The higher the score, the lower the interest rate and the easier it is to get new credit or loans to help you reach your financial goals. On the other hand, the lower your credit score, the more difficult it will be to get low insurance rates and qualify for loans.

Lenders usually provide updated information about your loans and credit limits every month, so getting it right for 30 days can help improve your credit score. Still, it’s important to understand that it’s a multi-year process before you can achieve major credit score success. So keep a low profile and keep working towards better credit.

Here are the best steps to help you start improving your credit score in just 30 days.

There are three main credit bureaus: Experian, TransUnion and Equifax. You can get a free copy of the report each year on the government’s website: www.annualcreditreport.com.

What Is A Good Credit Score?

An important factor in your credit score is your payment history. Late payments can quickly lower your credit score, so pay on time every time. At Welch State Bank, we understand that life gets busy and sometimes you can miss a payment unexpectedly. We hope you’ll consider automating your monthly payments to ensure you never miss a payment, no matter what’s going on in your life.

As you know, paying your bills on time every month is important. But we hope you will consider paying the bill twice a month. We know that paying your entire debt twice a month may not be an option, but putting money toward the second payment can go a long way toward improving your credit score!

Your credit score is affected by your total debt-to-credit ratio, and the lower your balance, the higher your credit score. So when paying off a credit card, focus first on the card with the balance closest to your limit. This simple step will have a big impact on your credit score.

This may sound silly, but feel free to follow us. The more available credit you have, the lower your overall credit utilization ratio, which is a key component of your credit score. Before you start asking about raising your credit limit, remember that some credit card companies will check your credit report before approving a higher credit limit. This will have a negative impact on your credit report. So before you apply for a higher credit limit, ask the lender about their guidelines.

How To Improve Your Credit Score

Removing incorrect information from your credit report is the best way to build significant short-term credit. One study found that 79% of credit reports contain errors, so check yours as carefully as possible to make sure everything on it is correct. If not, file a dispute with a credit bureau.

You can dispute anything on your credit report that is deemed inaccurate. The credit union will start an investigation and has 30 days to obtain documentation in your favor and remove the false claim. You can dispute an account on your credit report online, by phone, or by mail.

Although it may sound counterintuitive, save unused credit cards and don’t close them just because you don’t use them. An older card shows lenders that you have a longer credit history, which is important when applying for a mortgage or other type of loan.

Credit age is 15% of your credit score. So by keeping your account open you can earn points in this category.

How To Boost Your Credit Score Before Refinancing Your Car Loan

For example, if you only have credit, get a credit card. Consider getting a type of credit you don’t have. Using both types can improve your credit and may qualify you for better interest rates on future loans.

We know it’s a lot of information, but we guarantee that if you follow these 8 steps, your credit score will begin to improve in just 30 days. If you have any questions or concerns about your credit score or any of these steps, please contact us. We are here to help! Everyone has a credit score, which indicates your financial health and management. Generally speaking, the higher your credit score, the better you manage your finances.

Although we all know that unexpected things happen in life that can sometimes affect your life (and your credit). Losing your job, emergency car repairs, divorce or needing to dip into your savings can put your bills on hold and negatively affect your credit. Fortunately, there are ways to rebuild your credit if you encounter financial difficulties.

We’ve narrowed down 10 steps to improving your credit score, from the simple meaning of your score to simple routines and strategies you can implement to improve your credit score and work toward financial independence.

How To Raise Your Credit Score With One Simple Trick

Canada has two national credit bureaus: Equifax and TransUnion. You can request a free copy of your credit report by mail each year, and it will arrive within a few weeks. All you have to do is fill out the form and provide basic identifying information and send an email. If you want instant results online, you have to pay a small fee.

The first step to improving your credit is actually understanding your situation (which is why checking your credit is so important).

Once you get your credit report, you need to explain what your score means. Your credit score is a three-digit number between 300 (poor) and 900 (excellent). Our blog can help you understand Canada’s average credit score by age, Canada’s credit score ranges and your credit score level.

If you need additional support, you can also check out the Government of Canada’s resources for understanding your credit history.

Common Things That Improve Or Lower Credit Scores

When reviewing your credit report, be on the lookout for errors. If you find errors in your documents, such as someone else’s information, a debt that isn’t yours or incorrect payment history, contact the credit bureau and ask for a correction. You certainly don’t want other information to affect your credit report.

You can’t improve your credit if you don’t have credit. Keep your old credit accounts open – the longer a responsible credit history, the better. If your credit history records old debts that have been paid off in full, this will have a positive impact on your credit score.

This may seem strange if your credit is low, but you need to take advantage of credit to improve your credit. Continue to use your credit card and make payments on time. You can even buy a car from Birchwood Credit and rebuild your credit with ongoing car payments. Credit depends on your ability to use credit and repay it responsibly, as this shows lenders that you are a reliable borrower. The more you use your credit and pay on time, the more your credit history will improve.

If your credit card provider offers you a credit limit increase, accept it. The most important thing is not to go beyond your capabilities. If you are offered a loan increase, it means that the lender thinks you can handle a larger loan. If you continue to pay your bills on time and keep your credit card balances below 50% of your limit, your credit score will continue to improve.

How Experian Boost Can Help Raise Your Credit Score

This is a common tip that comes up again and again, but it’s probably the most important. Paying your bills on time is one of the easiest things you can do to improve your credit score. Your payment history makes up about 35% of your credit score, so if you’re consistently late or even missing payments, your credit score will be affected.

One way to make step 8 easier is to automate payments. For any debt with fixed payments, payment automation will ensure that no payment is missed. if you do

Instantly raise credit score, how to instantly raise credit score, ways to raise your credit score instantly, how to raise your credit score overnight, how to raise your credit score, how to raise your credit score fast, raise your credit score instantly, how to instantly raise my credit score, raise my credit score instantly, how to instantly improve your credit score, how to easily raise your credit score, how to raise your credit score instantly