How To Lend Your Money – You might cringe at the thought of lending your hard-earned money to a complete stranger. But joint borrowing can make you rich.

Modern technology makes it possible to lend to people with different needs across the country. Increasingly popular peer-to-peer lending sites connect Indonesia’s growing middle class with online borrowers, bypassing banks and cutting the fat from personal and business loans.

How To Lend Your Money

Co-lending can benefit both lenders and borrowers. For the latter, it offers an alternative to traditional ways of securing financing, and sometimes the prices are better. For lenders, this brings many benefits. Let’s see some of them.

They Give Their Lives…you Lend Your Money Original Wwii Poster

Higher yield: For borrowers, co-lending with a partner is a way to get a higher rate of interest than they would normally get by keeping money in bank savings accounts, time deposits or other interest-bearing investment options. does With Maker, a peer-to-peer lending platform that is becoming increasingly popular among Indonesian lenders, you can earn up to 16% APR after tax.

Low risks: Most, if not all, online lending platforms have a way of evaluating and rating their borrowers. Therefore, borrowers may not be familiar with you, but the platforms “know” them; They collect information about borrowers and assess their credit risks.

Maker goes further to reduce risk for lenders (also known as “funders”) on its platform. Maker only issues loans to borrowers who have never been late on their repayments. Not to mention that on this platform, which is specifically for Indonesian small enterprises, all loans are profitable, which means that the money is used to finance production and make more money. Therefore, there is a good chance that borrowers will repay their loans.

If that’s not enough, there’s one more thing Meeker offers to convince even the most skeptical lenders: a 100% guarantee of their capital. With this guarantee, it means that if there is an event of default, you will not lose your money.

What To Do If You Lend Money To Friends And Don’t Get It Back

Recurring income: By paying off the loan, you will also enjoy regular cash flow as borrowers repay their loan. This is a great way to increase your monthly income.

Flexibility: You can find platforms that allow you to borrow as little as R100,000. There is no limit to the amount you can borrow.

Freedom: Peer-to-peer lending platforms give you the profile of borrowers and everything you need to know about them, including their credit history, and they give you the freedom to whom to lend to. give

Peer-to-peer lending offers many great benefits and has attracted an increasing number of Indonesian borrowers in recent years. You can also become a lender; On any platform, registration is easy and loan financing takes just a few clicks. Just remember to be careful and choose the right platform that takes the necessary steps to minimize your risks. Nearly half (46 percent) of adults who borrowed money from a friend or family member reported a negative outcome. Tatna Maramygina/Getty Images/EyeEm

Top 5 William Caxton Quotes (2023 Update)

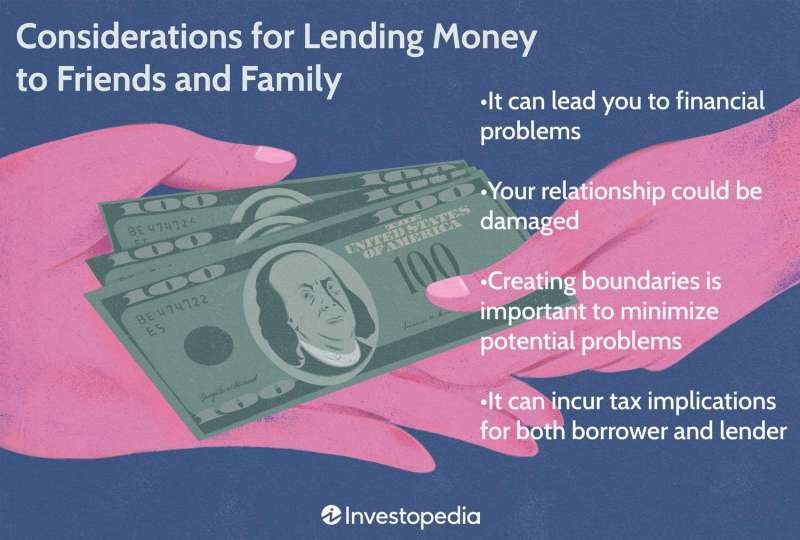

Lending money to a family member or friend is a risky business that can end very badly. You can lose your money and destroy important relationships.

Remember the advice that Polonius gives to his son Laertes in Shakespeare’s Hamlet: “Be neither a borrower nor a lender, for debt often destroys yourself and friends.”

According to a recent Bankrate.com survey, nearly half (46 percent) of adults who borrowed money from a friend or family member reported a negative outcome, with 37 percent saying they lost money and 21 percent experience bad relationships with borrowers.

Co-signing a loan can also cause personal and financial problems. Again, nearly half (45 percent) of people in the Bankrate survey who did this said they experienced negative consequences:

Tips On Lending Money

“This data makes it clear that we shouldn’t be giving money to family and friends and we shouldn’t be taking out loans because, unfortunately, something goes wrong half the time,” said Ted Rossman, an industry analyst at Bankright. “While losing money is bad enough, I think it’s even worse when relationships fall apart, as they often do.”

Children often ask their parents to co-sign a loan when they cannot afford a credit card or car loan on their own. It’s easy to understand why parents want to help in this situation, but many don’t realize that delivery is a legal obligation that comes back to haunt them.

“It’s more than offering someone a loan; it’s a legal promise to repay the loan if the original borrower fails to do so, Rossman explained.”

Co-signing can also affect a co-signer’s ability to get credit because it usually increases their individual debt relative to income and credit utilization. So even if things go well, there will be consequences, Rossman told NBC News BETTER.

Difficult English Words Borrow And Lend

Asking for help from a family member or close friend who is in trouble can hurt you and make you do things you wouldn’t normally do.

If you’re expected to pay and you’re stuck, this feeling of betrayal can lead to a lot of anger.

“It can destroy a relationship,” says Bruce McCleary, vice president of the National Credit Counseling Foundation. “People often lend money in good faith and don’t put things in writing. They don’t sit down and talk about the arrangement and what’s expected. Not having expectations and writing them down always leads to regret.

When he was a front-line credit counselor, McCleary saw people dip into their retirement savings or borrow money themselves to pay a loan to a family member.

Lend Your Money To Your Goveernment

“It just goes to show how strong the emotional element is and how it can make otherwise rational people do crazy things with their money,” McCleary said. “I’ve seen a lot of bad decisions not backed up by careful consideration.”

By writing down the terms of the loan, it becomes a financial transaction, eliminating the possibility that the borrower could consider it a gift. Just remember that there aren’t many consequences if you don’t pay back. It won’t hurt the borrower’s credit score like defaulting on a bank loan would. And chances are you won’t sue them.

Personal financial advisors contacted by NBC News BETTER have this advice: If you don’t feel comfortable lending money to this person, don’t. If you agree with this, consider it a gift that cannot be returned. So, don’t take on more debt than you can afford to lose.

“Just assume that lending to a friend or family member is like burning money,” says CFP Megan Bransfield, director of financial planning at Motley Fool Wealth Management. “Think about it very hard, but at the same time, giving someone money and helping them creates happiness for both parties, so it doesn’t have to be fun.”

How To Avoid Becoming A Human Atm

Bankrate’s survey also highlights the potential pitfalls of lending your credit card to a friend or family member. Of those who did, 37 percent had something bad happen to them:

Some cardholders don’t actually hand over their credit card, they just pop in and pay a joint bill—perhaps for dinner or a movie—to earn credit card rewards. It’s easy to assume that others will help, but don’t count on it.

Of the credit card owners who did this while waiting for a refund, most (70 percent) said they didn’t get paid at least once (27 percent said it happened sometimes, and 23 percent said it happened a lot times occur).

The survey found that older millennials (ages 30-38) were the most likely to avoid paying a group bill. They are more likely to try the “pay the group bill to get the reward” strategy.

How To Lend Money For Profit In 2023 🎖️ The Ultimate Guide

“Even if you get fined once, it’s probably going to wipe out the value of the rewards you’re getting and then some,” Bankret’s Rossman said. “This is a dangerous strategy, especially if it leads to credit card debt. If you already have credit card debt, not only are you subsidizing your friend or family member’s purchase, but you may also be paying interest on it. Give it.”

Want more tips like this? NBC News BETTER loves finding simple, healthy and smart ways to live. Subscribe to our newsletter and follow us on Facebook, Twitter and Instagram.

Herb Weisbaum is an NBC News contributor and writes about consumer issues. He can be found on Facebook, Twitter or the ConsumerMan website. Are you thinking of lending money to friends or family? Did you know that more than half of people have seen the end of a relationship because of debt? There is a traditional saying, “Money is what breaks the heart of friendship.”

Lending money to a loved one is more than a financial decision, it’s also an emotional one. If your own nephew comes and asks for money on loan, it will be very difficult to refuse such a request.

Lending Money To Family Or Friends Overseas? Secure Your Re Payment With Promissory Note

Although you may be wise to avoid paying debts

How to lend money, how to lend money and make interest, how to lend money with interest, how to lend money legally, how to lend someone money, how to write a contract to lend money, how to lend money online, how to lend hard money, how to lend money to a friend, how to lend money for profit, how to lend money to a friend legal, how to lend money to family