How To Pay Debt Fast – You may or may not have heard of Dave Ramsey’s Debt Snowball. However, if you want to pay off your debt, using this method with a few modifications will help you pay off your debt even faster. In just 6 months, we were able to pay off over $6,000 in debt! The craziest thing is that we did it full time. If you had told me 5 years ago that I would be able to repay an average of $1,000 a month, I would have called you crazy. Until we decided to pay off the debt, we lived paycheck to paycheck. Here’s how we paid off $1,000 in debt every month for 6 months and what you need to know to do it.

While you can probably dive into paying off debt and still get results, there’s a good chance you’ll end up back in debt. Most of us find ourselves deep in debt because we have a difficult relationship with money and haven’t learned how to properly manage it.

How To Pay Debt Fast

Through Dave Ramsey’s standard baby steps, he encourages people to create $1,000 in emergency savings. The problem is that one emergency can wipe out your entire emergency fund.

How To Pay Off Debt Fast Uk

Instead, I recommend that you set a savings goal in addition to paying off your loan. Even setting a goal of $100 a month can help you build more than $1,000 in savings to give you more financial support.

Constantly contributing to savings (even small amounts) will help you avoid rebuilding your emergency fund from scratch, adding to your financial stress. Deciding to commit to putting $100 a month into our emergency fund (or whatever you want) can make a big difference!

A good rule of thumb is to keep 3-6 months of monthly expenses in savings. Before she worked to pay off debt, our family had $1,000 in savings. My biggest regret is that we didn’t continue to add to our savings even though we were paying off debt. I didn’t know we could grow our savings to our 3-6 month goal even while paying off the loan.

Another common mistake people make when setting up a savings or emergency fund is to put their emergency savings into a savings account through their current bank.

How To Pay Off Credit Card Debt Faster

Creating a high-yield savings account separate from your current bank is the smartest move to keep your money safe (and help it grow)! Accounts like Savings Connect will pay you 11 times the national average when you automate a $100 monthly savings transfer! This way, you don’t have to commit to saving huge amounts of money to reap the benefits! Check out our 10x savings guide.

A big topic of conversation during loan repayment is whether you should continue investing while you pay off the loan. If our family had followed Dave Ramsey’s baby steps during our debt, the “rules” would not technically be continuing to invest while we pay down debt.

However, I am very grateful that we were forced to continue contributing to a company matching 401K. This is what we started doing later in life and now we understand the power of investing.

If you are currently investing a lot and want to consider reducing the amount to make your business profitable while still having some extra money for debt, this is something worth discussing.

How To Get Out Of Debt Fast: 7 Tips For Pushing Past Debt

When our family started the debt consolidation process, no one told us that getting a low interest rate would be a good idea to save money and speed up the debt repayment process. Especially in things like credit cards. (

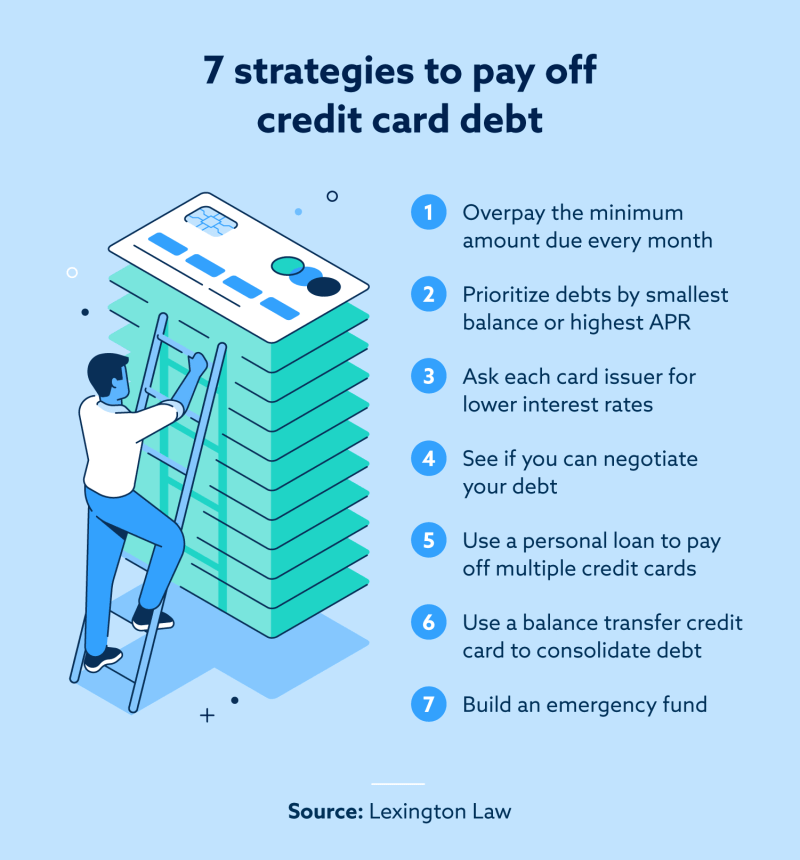

If you’re struggling with a high interest rate, it’s a good idea to find online scripts to help you negotiate the interest rates on some of your credit cards.

Negotiations are certainly a smart strategy, but unfortunately they don’t always work. That’s why it can be helpful to have a backup plan.

), it is worth considering a loan with a lower interest rate or consolidation. Options like a payday loan are designed to help you pay off high interest credit cards so you can save money and pay back less!

Fast Track Debt Freedom: Tips & Tricks For Kiwis

By raising a loan to pay off a credit card, we managed to go from an interest rate of 25% to a rate of 11%! It is

More than just interest payments have the potential to jeopardize our loan repayments. Check the interest rate for loan repayment.

In the images below, we have used the bank rate calculator to calculate the savings we could achieve by reducing the interest rate. With our prime interest rate of 25%, we pay only $14,069 in interest (

) and by lowering the interest rate to 11% with a payoff loan, we were able to reduce our interest to $3,016 ($11,000 in savings).

How To Pay Off Debt In A Year (example: How To Pay Off 40k Fast)

**Please note that this would have been our savings if we had made the minimum payment on our credit card. Because we paid more on our card, we were able to pay it off faster and avoid higher interest rates.**

A common promotion offered by credit card companies is 0% interest for a long period of time (usually a year). When running this promotion they usually allow a balance transfer from another credit card! This means you can get a high interest card (think 25%) down to 0%!

This is a great way to completely eliminate the interest you pay on your credit card debt, however, there is one big problem you should be aware of.

If you decide to transfer your credit card debt to a 0% interest credit card, you’ll want to make sure you can pay off what you owe within the allotted promotional period. For example, if you have a year to pay $12,000, make sure you commit to paying $1,000 a month! If you cannot commit to this and exceed the promotional period, you may be charged interest!

How To Pay Your Debt Fast

Well, there’s been enough information before the game about paying off debt, now it’s time to dive into the rules of the debt lump if you haven’t familiarized yourself with them.

If you like the idea of having handy printables to keep track of, get the Debt Payoff Handbook + Minimum Budget Printables so you can customize everything to fit your financial needs.

The first step to starting a long snowball is finding an extra $200 a month to invest in your debt. Many people believe that finding extra money means hard work. In fact, there’s a good chance you already have $200 tucked away in your budget.

A spending inventory means you have a very clear picture of how you’re spending money, where you’re spending it and where you can cut back while doing an in-depth analysis of your spending habits.

How To Pay Off Debt Fast: 7 Tips

One of the best and fastest ways to bring more money into your budget is to reduce your monthly expenses. All you have to do is look at your budget and find ways to reduce or eliminate what you pay each month. Main areas for cutting:

Another great idea to get more money to pay off your loan is to start a side business. I have launched several different initiatives to speed up our loan repayments. These are things I was able to do from home while raising my kids and homeschooling!

Get the debt snowball printable here to get started and keep track, or if you feel like you need a little more help organizing and keeping track, you can get all the budgeting, saving, and debt payoff printables in the Debt Payoff Handbook + Minimum Budget Printables!

Once you have an extra $200 a month, the pile of debt becomes much simpler. I recommend downloading my printable debt log to track your debt payments and get an idea of how quickly you can pay off your debt.

How To Pay Off Debt Fast

By adding another $200 to that $30, we were able to put $230 toward our $300 smaller loan.

*Remember, you can always borrow more money if you can! This will help you pay off your loan faster and save you extra interest!

As you can see, after paying off the remaining $70 from our credit card, we took the remaining $160 and applied it to ourselves.

After paying off our small loan, we were able to take the full $230 we applied for and put that money toward the next small loan.

How To Pay Off Student Loans Fast: 7 Ways To Try

Since our minimum payment for our next smaller loan was $100, the total amount to apply to that loan was $330. After paying off the loan, we had $330 to start with

How to pay credit card debt fast, pay debt fast, how to pay off tax debt fast, pay down debt fast, pay off debt fast, how to pay off debt fast tips, how to pay off debt fast calculator, how to pay off debt fast, how to pay your debt fast, how to pay back debt fast, how to pay off my debt fast, how to pay off irs debt fast