How To Pay Off Debt Fast – If you’re looking for a way to get out of debt for good, let us introduce you to our new DFBFF (Debt Freedom’s Best Friend): Ice Cube.

The debt snowball method is the fastest way to pay off debt. I paid off $40,000,000 in consumer debt in 18 months! If it works for me, it works

How To Pay Off Debt Fast

If you’ve followed Dave Ramsey’s 7 Baby Steps, you know that Baby Step 2 snowballs into paying off all your debt (except your house). Now, when you’re on top of all your expenses and saved $1,000 in your emergency fund, it’s time to snowball!

Solutions For Paying Down Debt: Avalanche, Snowball Or Heloc?

The debt snowball approach is a way to reduce debt, where you pay off less debt and pay less toward the balance, and you gain strength as you reduce each amount. When a small loan is paid off in full, you pay the maximum amount you can afford on the loan into a low-payment plan.

Step 4: Take what you’re paying for your small loan and add it to your next small loan payment until it’s paid off.

Each time you pay off one debt, the amount you have to pay for the rest of your debt increases—like a snowball rolling down a hill (hence the name). The joy of paying off your small debt quickly will motivate you to keep paying off your debt!

The debt snowball works because it’s about changing your behavior. Trust me, you don’t need to have a finance degree or know math to get a loan.

Steps To Eliminate Debt Fast

It’s more about numbers than numbers. In fact, human capital is 80% action and only 20% knowledge.

You can actually pay off your debt. If you believe it, you will start acting like it. So it worked for me. After clearing my small credit card debt, I did a happy dance (inside – you don’t want to see me outside). So was my mind.

You may have heard of debt settlement, where you pay off your debt from top to bottom. But here’s the deal: If you start paying off the loan with interest first (usually your balance), you can

.png?strip=all)

Before long, you’ll lose steam and maybe quit altogether. Why? Because it takes forever to get the following! You started with bad debt instead of easy debt. Plus, there are other pesky debts hanging around that you still have to pay off.

How To Pay Off Debt Fast With A Low Income

But if you borrow a little first, you’ll see quick success! This debt is not in your lifetime

. The second layer immediately follows. All of a sudden, you’re paying off your last debt in the snow—don’t save a little money to pay it back.

The more you see your ice cream, the more likely you are to stick with it. The next thing you know, “I don’t owe you anything!” you shout.

Now let’s take a look at how this approach works in real life. Now, you have four different outfits:

Smart Ways To Consolidate Credit Card Debt, And 5 You Should Never Do

$500 for treatment – even if you attack with a vengeance. Let’s focus on your goals so you get more traffic and earn an extra $500 a month in savings.

If you pay $550 a month in medical bills ($50 and up to a maximum of $500), the debt will be completely gone within a month. Boom! You can then take the disbursed $550 and put it toward your credit card balance of $613 ($550 plus the $63 fee). Say goodbye to credit cards in four months.

Then, you’ll face a monthly car loan of $748 ($613 plus $135). In less than nine months, you’ll be riding off into the sunset in a car you own.

When you reach your final (and largest) debt, get tough and decide to reduce your spending habits, giving you an extra $100 a month. So right now, you can put $944 a month toward this great student loan! With a large payment like this, you’ll be sending Sully My Package after nine months.

Simple Tips To Pay Off Debt Fast

Do you see now that debt settlement is the best option? Pay off your debt properly, put extra money in your savings account and focus on your goal – you’ll pay off $20,000,000 in less than 24 months. Chances are, you’ll probably be out of the loop with the payment. Get Out Of Debt Fast!

This is how a snow bucket works. But honestly, it’s not a cake walk or a walk in the park. Of course, cake or no cake. It takes hard work, sacrifice, planning and self-belief.

If you’re ready to get out of debt, check out Peace Community University (FPU). You know how to use snowballs to pay for everything

Your loan is fast. More often than not, it’s the same lesson that helped me get rich from failure over a decade.

Free Printable Debt Tracker To Pay Off Your Debt Fast

The best part is having family on the same journey as you! These questions and incentives help you stay active until the final payment.

Listen, the average home buys FPUpays $5,300 in the first 90 days. It doesn’t change! Then, register for FPU classes today.

As the snow falls off the mountain, you can use the power to pay off the debt. When you’re debt-free, you can save for your future and build the life you want.

George Kimmel is a financial expert, certified financial coach through the Ramsey Financial Coach Master Training, and national author. George has worked at Ramsey Solutions since 2013, where he speaks, writes and teaches about personal finance, investing, budgeting, insurance and consumer loss prevention. He co-hosts the Ramsey Show, the second largest talk show in the country. He also hosts the Interleadership Podcast and The Best Podcast, which has over one million downloads. George’s financial expertise can be found in The Sun, The Daily Mail and News Nation. Learn more. I always felt like we had a good handle on our use. We pay one side of each paycheck and put extra money toward our debt to pay off the debt faster. But between our debt and our commercial debt, it’s increasing. Not all debt is bad – all of our business debts are paying off, but debt is. Until recently, I never thought there was a better way to pay off our debt. I started researching and found that there are two general methods: snow cloth (also called fabric) and snow cloth.

How To Pay Off Debt Fast: The Ultimate Guide (2023)

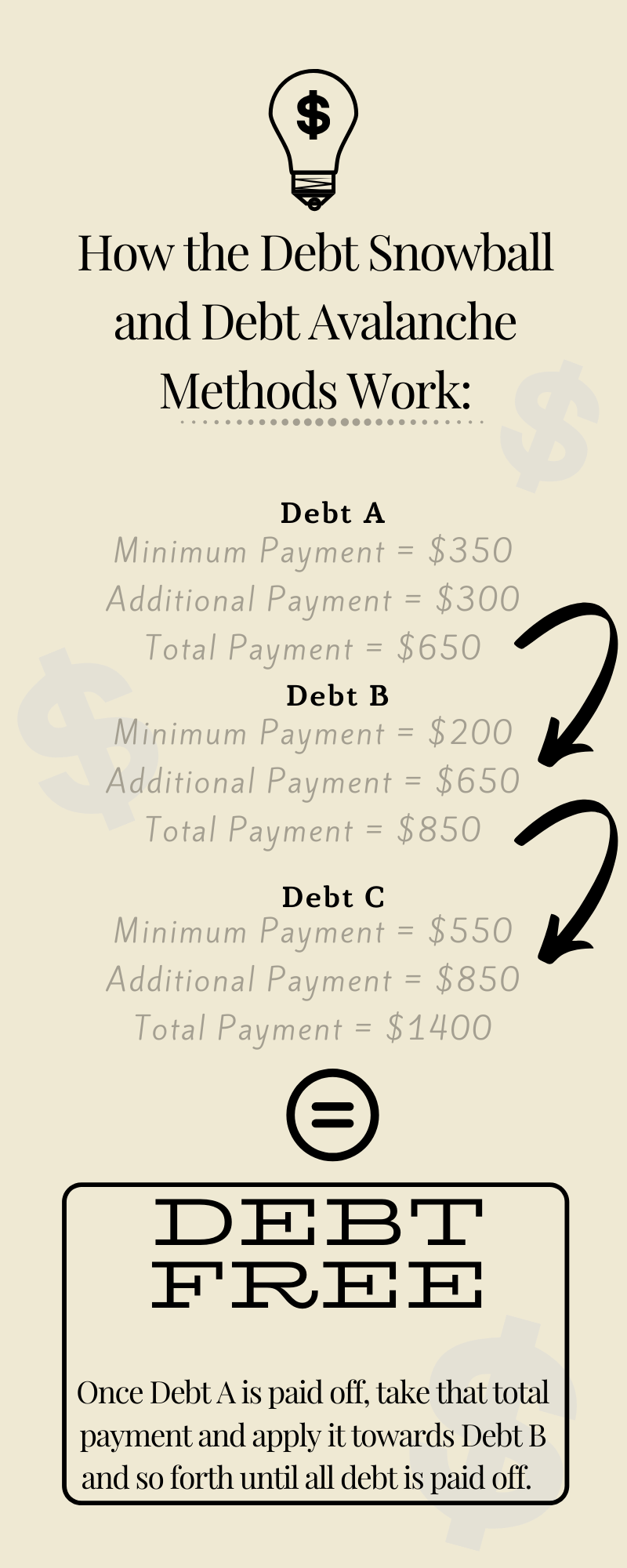

Both options pay less for each loan. Either way, you’ll be opting for a “primary loan” loan that allocates more money each month. Once that loan is paid off, put that money into a new loan and pay it off faster. The only difference between a debt snowball and a debt avalanche is how you pay off your debt. Pay off your smallest debt first in the Debt Skiing Method (Dave Ramsey Method). In the snowball method, you pay off your loan with interest first.

Dave Ramsey has developed the perfect costume style for Snowball and the scores are excellent. Ski style is a great way to break out of tight clothes and stay active along the way. Some people may have small debts, such as medical bills or credit cards, that can be easily paid off in a few months if they are given extra cash. This approach is a great way to maintain motivation and motivation, which is often lacking when paying off debt. If you find a way to get paid every two months, you can see the growth that keeps people busy. Motivation can be the hardest part of being debt-free, says Dave Ramsey, and this approach helps provide that and keeps people on track.

A snow loan can help you save a little money in the long run. By paying off the loan interest first, you’ll pay less interest in the long run, so you’ll save money. The downside to this approach is that your higher interest rate loan may be a larger loan. In this case, it may take a long time to get paid. It can motivate and inspire people

Fast way to pay off debt, how to pay off irs debt fast, pay off debt fast calculator, ways to pay off debt fast, best way to pay off debt fast, i need to pay off debt fast, how to pay off credit card debt fast, need to pay off debt fast, how to pay off debt fast calculator, how to pay off debt fast with low income, how to pay credit card debt fast, pay off debt fast