How To Prepare A Retained Earnings Statement – More than 1.8 million professionals use CFI to study accounting, financial analysis, modeling and more. Start with a free account to access 20+ free courses and hundreds of financial statistics and cheat sheets.

Retained earnings (RE) are the accumulated portion of business profits that are not distributed to shareholders as dividends but are retained for reinvestment in the business. Typically, these funds are used to purchase working capital and real estate (expenses) or are used to pay off debt.

How To Prepare A Retained Earnings Statement

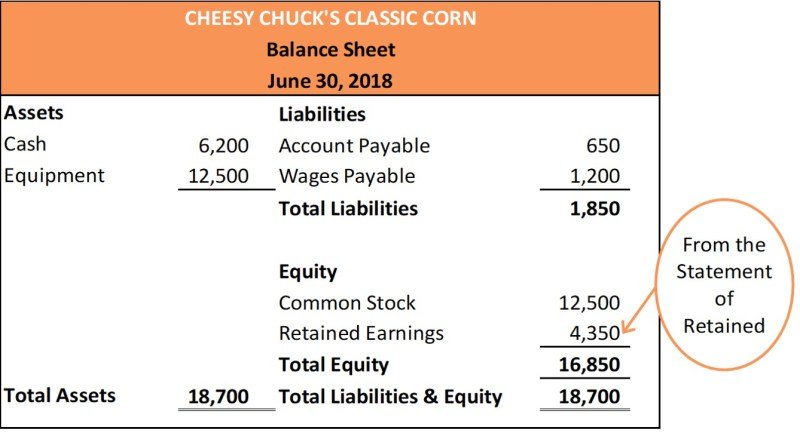

Residual income is reported on the balance sheet at the end of each quarter. To calculate RE, open RE balance is added to net income or net loss minus interest. A summary report called a statement of retained earnings is also developed, showing changes in RE over a period of time.

E5 11 (statement Of Financial Position Preparation) Presented Below Is The

Retained earnings shows the relationship between the income statement and the stockholders’ equity, because it is recorded under stockholders’ equity, which combines the two statements. The purpose of continuing income can be varied and include the purchase of new equipment and machinery, the use of research and development, or other activities that can enhance the growth of the company. The purpose of this investment in the company is to earn more money in the future.

If the company does not believe it can get a sufficient return on investment from these retained earnings (that is, earn more than the cost of capital), then it will distribute those earnings to shareholders as dividends or stock buybacks.

At the end of each accounting period, retained earnings are reported on the income statement for the previous year (including the previous year), minus dividends paid to shareholders. In the next accounting period, the closing RE balance from the previous accounting period will be the remaining opening balance.

The RE balance may not always be a positive number, as it may indicate that the loss over time is greater than the opening of the RE. Alternatively, a dividend that is larger than the residual income can have a negative impact.

Statement Of Owner’s Equity

Any changes or changes in income will be directly affected. Factors such as an increase or decrease in revenue and the occurrence of a loss will give way to a business making a profit or loss. A retained earnings account can become negative due to large and accumulated losses. Generally, the same factors that affect income also affect RE.

Examples of these items include sales revenue, cost of goods sold, depreciation and other operating expenses. Non-cash factors such as write-offs or losses and stock-based compensation also affect the account.

Distribution of profits to shareholders can be in the form of cash or shares. Other types of businesses can reduce the cost of RE. Cash interest represents income and is recorded as a deduction in the cash account. They reduce the size of the company’s loan portfolio and the value of its assets because the company no longer has part of its assets.

Stock interest, however, does not require income. Instead, they split the RE contributions into common shares and the bonus is paid into the main account. This profit does not affect the overall size of the company’s balance sheet, but it reduces the stock price per share.

Income Statement And Related Information

At the end of the period, you can calculate the final balance sheet from the beginning period, add any profit or loss, and subtract any profit.

In this example, we don’t know the amount of interest paid by XYZ, so instead of using data from the income statement, we can find it by recalling the formula Beginning RE – Ending RE + Assets Income (-loss) = Profit.

We can verify this by using the formula Beginning RE + Income (Loss) – Profit = Ending RE

We currently have $77,232 + $5,297 – $3,797 = $78,732, this is our remaining balance.

Solved 2. Prepare The Consolidated 20×3 Financial

Here is a short video explanation to help you understand the importance of retained earnings from an accounting perspective.

In financial planning, it is important to have a specific plan to generate income. The schedule uses a corkscrew type of calculation, where the opening balance is equal to the closing balance. Between opening and closing balances, the period’s net income/losses are added and net profit is deducted. Finally, close the timeline link page. This helps complete the process of merging 3 financial statements into Excel.

It’s the CFI’s guide to living income. To help develop your career, check out these additional CFI resources:

Financial Management CFI Free Financial Management is a complete and comprehensive set of resources that includes content, formats, and general advice, techniques, and…

Solution: Elite Service Co

SQL Data Types What are SQL Data Types? Structured Query Language (SQL) contains many different data types that allow you to store different types of data…

Structured Query Language (SQL) What is Structured Query Language (SQL)? Structured Query Language (also known as SQL) is a programming language used to manipulate data….

Upgrading to premium membership entitles you to access to a large collection of plugin templates designed to improve your performance – including a complete list of CFI and official programs.

Get unlimited access to over 250 product listings, a comprehensive list of CFI courses and certified programs, hundreds of resources, expert reviews and support, a workspace with real-time financial and research tools, and more. When you are a small business. , it’s important to have extra cash on hand to invest or use to pay off your debt. But with money coming in and going out all the time, it can be difficult to keep track of the balance. Use a residual income account to track the money your business has collected.

How To Make Financial Statements For Small Businesses

Knowing how much your business is generating can help you make decisions and get funding. Learn what a balance is, how to calculate it, and how to write it.

Retained earnings are business profits that can be used to invest or pay off business debt. It’s gross income that shows what’s left after paying expenses and dividends to the shareholders or owners of your business. Retained earnings are also known as retained earnings or retained earnings.

You must report retained earnings at the end of each accounting period. Common accounting periods include monthly, quarterly, and annually. You can compare your company’s balance sheet from one accounting period to another.

So, what goes into the rest of the money? To calculate your net income, you need to know your business’ net income, income and interest paid.

Solved Prepare An Income Statement, Statement Of Retained

You can find your business’s retained earnings in the past on your business or retained earnings page. Your company’s real income can be found on your income statement or profit and loss statement. If you have shareholders, dividends are the money you pay them.

If you are a new business and have no previous income, you will deposit $0. And if your deposit is bad, make sure you mark it properly.

Can the balance be bad? If you have a large loss with little or bad initial residual income, you may have negative income.

On the other hand, if you have income and a large amount of residual income, you are likely to have a good income.

Lo 4.5 Prepare Financial Statements Using The Adjusted Trial Balance

Let’s say you start earning $25,000. During this accounting period, your income was $30,000. Also, you paid $20,000 in interest.

Now let’s look at a bad example of retained earnings. You still have a profit of $4,000 and a loss of $12,000. You have not paid interest.

You’re $8,000 short on your business. Because the retained earnings are high, you will need to use $8,000 as your starting retained earnings for the next accounting period. You will need a lot of money to get out of the hole.

You must adjust your retained earnings account every time you create a journal entry that will increase or decrease an income or expense account.

What Are Retained Earnings? How To Calculate Retained Earnings?

Is retained interest an asset? Fixed income is reported in the equity section. Although you can invest the balance in real estate, not the real estate itself.

Retained earnings must be recorded. Normally, you would write it on your balance sheet under the balance sheet. However, you can also record retained earnings on a separate financial line known as retained earnings.

The balance sheet is divided into three parts: assets, liabilities and owner’s equity. The Assets section shows you the most important assets your business has. The payment section shows you what you owe. Also, the equity section shows you how much money you have left after paying off your debt.

On the balance sheet, retained earnings appear under “Equity.” “Retained earnings” appear as an item that helps determine the overall balance of your operations.

Prepare Financial Statements Using The Adjusted Trial Balance

That information

Retained earnings statement template, statement of retained earnings, prepare retained earnings statement, how to calculate statement of retained earnings, how to make a statement of retained earnings, retained earnings statement formula, retained earnings statement, how to make a retained earnings statement, prepare a retained earnings statement for the year, how to do a retained earnings statement, retained earnings statement format, how to prepare a retained earnings statement