How To Setup A Bank Account Online – If you are in the Galaxy folder, consider unlocking your phone or viewing in full screen for a better experience.

Advertiser disclosure Most of the offers on this site come from companies paid by The Motley Fool. This compensation may affect how and where products appear on this site (including the order in which they appear), but our reviews and ratings are not affected by the compensation. We do not cover all companies or all offers on the market.

How To Setup A Bank Account Online

Most or all of the products here are from our affiliate partners. This is how we make money. But our editors make sure that our experts’ opinions are not influenced by compensation. Terms apply to the offers listed on this page. APY = annual percentage yield

Open Bank Account Online In Dubai & Uae By Probanking

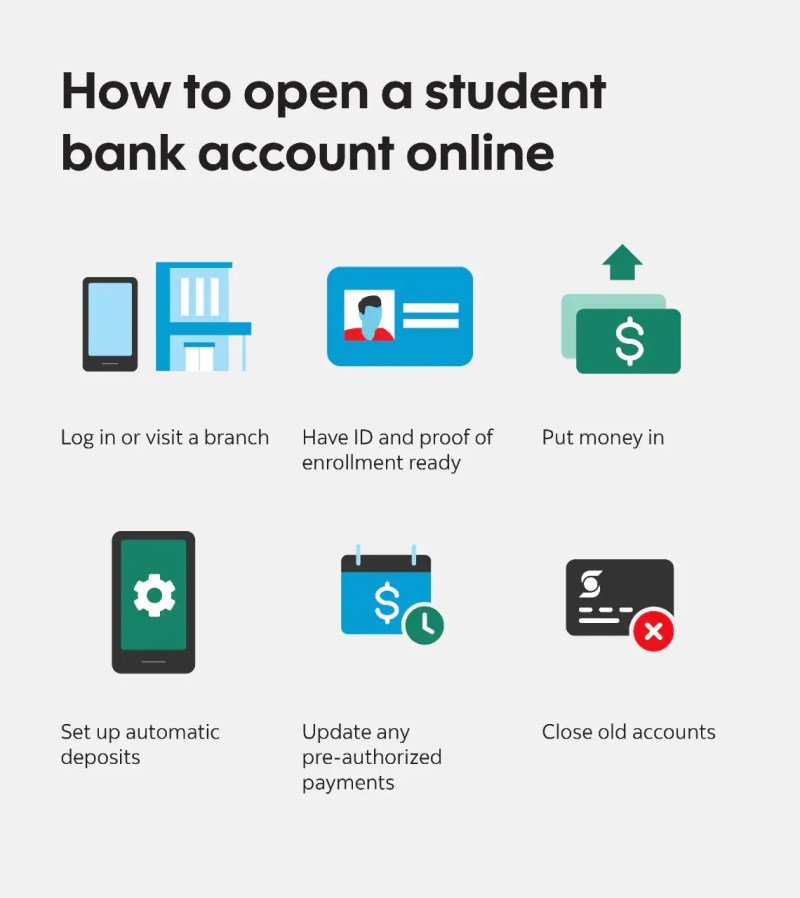

Opening a bank account online is more convenient and often easier than opening a bank branch. Whether you choose online or brick-and-mortar banking, the steps are the same.

To open an account quickly, at home or with minimal sales, you must open an account online. Most banks allow you to open such an account.

You will have to make two important decisions about where to put your money: which institution you want to work with and which account you need.

Brick-and-mortar banks have large branches across the region or the country. These banks often have a variety of products and services and are known for providing great customer service. But if you don’t meet certain requirements, they charge maintenance fees and lower annual interest rates on savings products.

Open An Online Bank Account

Online banks are popular because they offer high API and low fees. These banks do not have branches, so opening an account online is your only option. But most have a nationwide network of ATMs, so you can easily access your money. Online banking may be right for you if you want to do everything online and need personal assistance.

Credit unions are not technically banks, but they provide similar services. Credit unions often operate in small service areas, and many have branch networks. They offer APYs and fees that are a little more competitive than brick-and-mortar banks, but they still lag behind most online banks.

Savings accounts are best for emergency funds or money you plan to spend in the next five years. These accounts offer interest on your money, but often limit access to your money. Most do not accept any checks or debit cards.

To make sure the account you choose is the right one for you, we recommend comparing our highly successful savings account options. Here is a short list of independent accounts to make your search easier.

How To Open Student Bank Accounts In Canada

4.75 / 5 Circle with the letter I. Our rating is based on a 5-star scale. 5 stars equal the best. 4 stars is great. 3 stars Good. 2 stars equal fair. 1 star equals poor. We want your money to work for you. That’s why our price is focused on the gifts that give double while reducing the costs of the package. = excellent = excellent = good = fair = poor

The data value is surrounded by the letter I. You can get the highest APY with Direct Deposit (no minimum amount required) or 5,000,000 or more every 30,000 days. See the SoFi Audit and Banking Rate Sheet: https://www.sofi.com/legal/banking-rate-sheet.

4.00 / 5 Circle with the letter I. Our rating is based on a 5-star scale. 5 stars equal the best. 4 stars is great. 3 stars Good. 2 stars equal fair. 1 star equals poor. We want your money to work for you. That’s why our price is focused on the gifts that give double while reducing the costs of the package. = excellent = excellent = good = fair = poor

The value of the data is circled by the letter I. In order to continue to get the best rate at UFB, you need to check their rates. From time to time, the bank opens new accounts with higher interest rates. Existing accounts should contact the bank to request a transfer to one of these new accounts.

How To Open A Bank Account Online

It’s a good idea to check your accounts for the money you plan to use for everyday expenses. Most accept checks and debit cards so you can withdraw money and transfer money electronically. But these accounts usually have no interest on your money.

Money market accounts share some features of checking and savings accounts. They help you gain interest on your money and may even give you some ways to withdraw money from your account. However, these accounts often have high opening or continuing balance requirements.

Certificates of Deposit (CDs) are another option for saving money that you don’t plan to use in the next few years. These accounts may offer a higher API than savings accounts, but you may have to agree to deposit the money for months or years. If you withdraw your money early, you may be subject to a penalty.

If you decide to open a money market account or other type of bank account for this purpose, you will need the following information:

Open A Bank Account Online

If you have any questions about the required documents, you can always check the bank’s website or contact the customer service department for assistance.

Visit the website of the bank you plan to open an account with and visit the page for the account you are interested in. Find the “Apply Now” or “Create Account” button and fill out the application page that brought you there. You Most banks ask for the following:

Depending on the bank, you may need to scan or fax a copy of your government-issued ID. You may also need to send a copy of your signature to the bank for verification purposes.

Again, if you have any questions during the application process, you can always contact the bank for assistance.

Online Checking Account

Most banks require you to deposit a certain amount into your bank account upon opening or within a day. You can fund your account in several ways:

Some banks may have minimum deposit requirements. For example, if you open an online account that requires a minimum opening of $100, you must be willing to deposit at least $100. Otherwise, you will not be able to open an account. This is different from the ongoing balance requirement, which is the amount of money you must put in to avoid monthly payments.

If you choose a checking account with one or both of these criteria, be sure to balance your account over time to avoid paying a monthly fee.

It may take a few days for your bank details to be verified and funds to be processed. But once you do, you can use the new bank account. If you don’t have one, you can create an online account to view your balance and transfer money.

How To Open A Spanish Bank Account >> Easy 2024 Expat Guide

If your account includes a debit card, your bank will send it to you. If you give the ability to write, you can buy checks to use with the account.

Kyle Hagen has been writing about small business and finance for 10 years, including articles for USA Today, CNN Money, Fox Business and MSN Money. It specializes in personal and business bank accounts and software for small and medium businesses. She lives on a farm in northern Wisconsin with her husband and three dogs.

Cole Tretheway is a personal finance author who has been featured in The Ascent and The Motley Fool. She is proficient in English with a Certificate in Professional and Technical Communication from California Polytechnic University, SLO.

Eric McWhinney has been writing and editing digital content since 2010. He specializes in personal finance and investments. He also has a Bachelor’s degree in Finance.

Open A Bank Account Online In Any Bank With Paydeer

Share this page icon Facebook Icon This icon share the page you are viewing via the Facebook icon Blue Twitter Share this website with the Twitter icon LinkedIn This image provides a link to share a LinkedIn page. Email Icon Share this site via email

We strongly believe in the Golden Rule, so editorial opinions are our own and have not been previously reviewed, endorsed or approved by advertisers. The promotion does not include all offers on the market. Ascent’s editorial content is separate from The Motley Fool’s editorial content and is created by a separate analytics team.

Ally is an advertising partner of Motley Fool’s The Ascent. Cole Tretheway does not have a position in any of the products mentioned. Kyle Hagen does not have a position in any of the products mentioned. He also chairs the Motley Fool and advises Axos Financial and Target. The motley fool has a disclosure policy.

Ascent is a Motley Fool service that reviews and evaluates major financial markets daily.

Open A Free Us Bank Account Outside Of The Us

About Us How do I contact the Newsroom?

Terms of Use Privacy Policy Terms of Use Copyright, Trademark and Patent Information

How to setup a new email account, how to setup quickbooks online, how to setup a bank account online, how to setup your own bank account, how to setup my email account, how to setup email account, how to setup online store, how to setup a merchant account, how to setup a bank account, how to setup an offshore bank account, setup online bank account, td bank online account setup