How To Transfer Money From Bank Of America – Welcome to the world of digital banking where sending and receiving money has never been easier. Today, traditional money transfer methods are being replaced by faster and more convenient options. One such option is Zelle, a popular peer-to-peer (P2P) payment service that lets you transfer money directly from a US bank account to anyone with a US bank account.

With Zelle, you can say goodbye to writing a check or get money to pay friends, family, and service providers. Whether you need to split the dinner bill, send money to your child’s college, or refund a friend’s concert ticket, Zelle offers a seamless and secure way to send and receive money.

How To Transfer Money From Bank Of America

Bank customers have the added benefit of easy integration with Zelle, making the process even simpler. In just a few simple steps, you can install Zelle and start enjoying the convenience it has to offer.

Bank Of America Transfer Fee

Join me as I explore the world of Zelle and learn how to use this new payment service. This guide provides everything you need to know about using Zelle, from setting up Zelle Bank with your US account to understanding transaction limits and security tips.

Zelle is a digital payment platform that allows users to send and receive money directly from their bank accounts. It’s a simple and secure way to transfer money to your friends, family or business with just a few clicks on your phone or computer. Unlike other P2P payment services that require additional apps or third-party accounts, Zelle works seamlessly with Bank of America’s online banking platform.

One of the main advantages of Zelle is its wide range of features. It’s supported by more than 400 financial institutions in the United States, including Bank of America, making it easy to find people who need to send money. Whether you’re splitting a gift, paying a utility bill, or paying a friend, Zelle offers a quick and easy way to transfer money that doesn’t require checks or cash.

With Zelle, transactions are completed in real time, usually within minutes. This allows for quick withdrawals, eliminating the need to wait long for checks to clear or bank transfers. Plus, there are no fees associated with standard Zelle transfers, making it a cost-effective solution for sending and receiving money.

How To Send Money From A Credit Card To A Bank Account

Safety comes first at Zelle. The Service uses industry standard encryption and multi-factor authentication to protect your financial information. And since Zelle connects directly to your Bank of America account, you can rely on the bank’s strict security measures for added protection.

Zelle is not limited to personal use. Many businesses accept payments through Zelle, making it an easy and efficient way to complete transactions. From paying contractors and freelancers to paying service providers, Zelle offers a comprehensive solution that simplifies the payment process.

Now that we have a better understanding of what Zelle is and what it offers, let’s take a look at how to set up Zelle Banking with your American account to take advantage of this new payment service.

Setting up Zelle Bank with your US account is a simple process that can be done quickly and easily. Whether you want to use the Bank of America website or the mobile app, you’ll be up and running with Zelle in no time. Here’s a step-by-step guide to get you started:

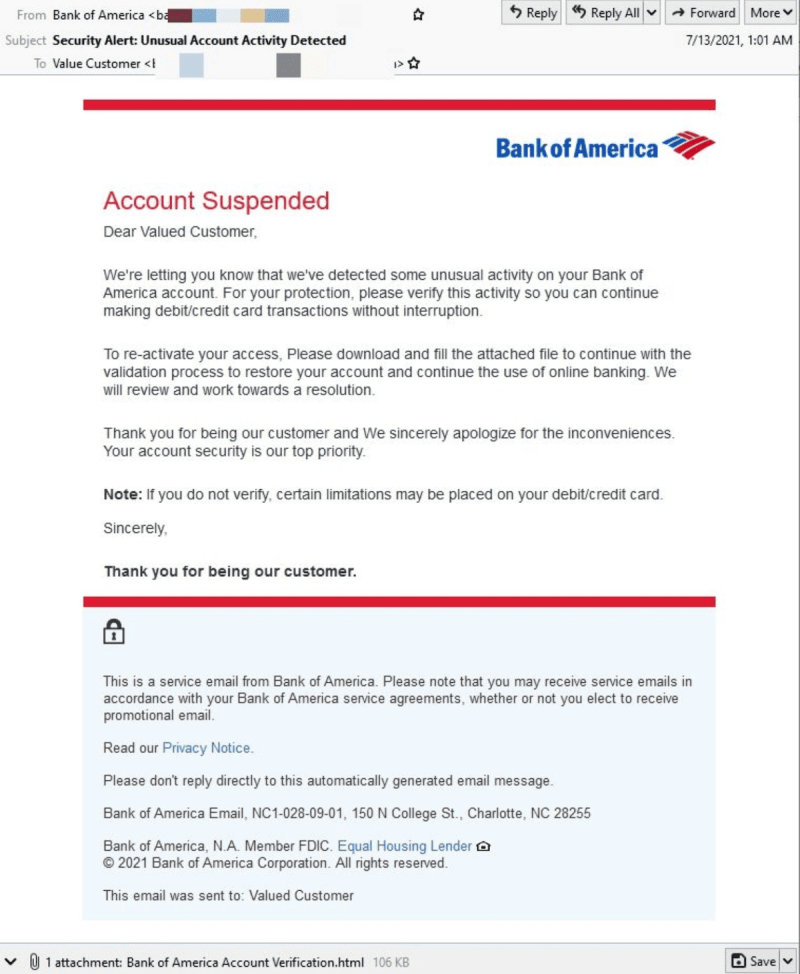

The 7 Latest Bank Of America Scams You Need To Know

Note that the Zelle setup process may be slightly different depending on your US bank account and the platform you use. However, the general steps outlined above should give you a good start.

Now that you know how to activate Zelle Bank with your US account, let’s see how to link your bank account and keep it up and running.

Before you can start using Zelle Bank with your US account, you must link your account. This ensures that funds are transferred between your account and other Zelle network users. Here are step-by-step instructions on how to link your bank accounts.

It’s important to note that the process for connecting your bank account may vary depending on your Bank of America account and the platform you use. However, the general steps outlined above should give you a good start.

How Do I Remove An Old/closed Funding Account From Quickbooks Checking?

Linking your bank account to Zelle is an important step for smooth operation. Once connected, you can transfer funds to your account. By eliminating the need for third-party intermediaries, Zelle makes the payment process simple, efficient and convenient.

Now that you have successfully linked your bank account, let’s start the process of sending money with Zelle.

With Zelle, it’s easy to send money to friends, family, and even your business. Whether you split a bill, pay a friend, or make a payment, Zelle makes transferring money to your Bank of America account quick and easy. How to send money with Zelle:

It’s important to remember that Zelle transactions are often done in real-time, allowing recipients to transfer funds within minutes. This makes Zelle a great choice for urgent payments or time-sensitive situations.

How To Transfer Money From Chime To Debit Card

There are no fees associated with standard money transfers through Zelle, so it’s less expensive to send money. However, it’s always a good idea to check the terms and conditions of your Bank of America account to make sure there are no additional fees or restrictions.

Now that you can send money with Zelle, let’s see how you can use Zelle to ask others for money.

One of the best features of Zelle is the ability to request money from others. Whether you’re sharing expenses with friends or need to collect payments for services rendered, Zelle makes it easy to request money directly from your bank account. How to request money from Zelle:

If you use Zelle to withdraw money, remember that the recipient must have access to Zelle through their bank or financial institution. If they don’t have access to Zelle, they’ll need to sign up for the service before they can send the money they want.

Transfer Money In Apple Cash To Your Bank Account Or Debit Card

By using Zelle to request money, you can simplify the process of collecting payments and eliminate the need for checks or cash. It is an easy way to facilitate financial transactions and make quick payments.

Now that you know how to request money from Zelle, let’s see how to set up AutoPay for recurring payments.

AutoPay is a convenient feature offered by Zelle that allows you to make regular payments from your Bank of America account. Whether you’re on a monthly, recurring or fixed-fee plan, AutoPay ensures your payments are processed on time without manual intervention. Here’s how to set up automatic payments with Zelle.

Setting up AutoPay with Zelle gives you peace of mind by eliminating the risk of missed or late payments. It allows you to manage your current expenses easily and fulfill your financial obligations quickly.

How To Track An International Wire Transfer

It’s important to make sure your automatic payment settings meet your current needs and preferences. You can change or cancel your AutoPay settings at any time through your Bank of America account or mobile app.

Now that you know how to set up AutoPay with Zelle, let’s explore Zelle-related transaction limits.

If you use Zelle Bank with your US account, it’s important to be aware of transaction limits. These restrictions help ensure the security and integrity of the payment system. Here’s a summary of Zelle’s standard transaction limits:

Daily Limit: Bank of America sets a daily transaction limit for Zelle transfers. This check is the maximum amount of money you can send or receive in one day. The specific daily limit may vary depending on the type of account you have and your relationship with the bank.

How To Withdraw Money From Merrill Edge (2024)

Weekly Limits: In addition to daily limits, there may be weekly transaction limits set by Bank of America. This limit represents the total amount of money you can send or receive through Zelle per week. Like daily checks, weekly checks can vary depending on the type of account you have and your relationship with the bank.

Regarding Transaction Limits: Zelle may set transaction limits that define the maximum amount that can be sent or received in a single transaction. These limits are designed to reduce the risk associated with large transfers and vary by bank and account.

Payment Limits: Zelle’s transaction limits may also apply to your payers. This means that the recipient may be subject to restrictions imposed by their bank or financial institution. It is important to contact the recipient and confirm that their bank is eligible

Bank of america transfer money to chase, transfer money from bank of america to santander, transfer money from bank of america to chase account, how to receive money from bank of america transfer, how to transfer money from bank of america to citibank, transfer money from hsbc to bank of america, international money transfer from bank of america, transfer money from hdfc to bank of america, transfer money from bank of america to another bank, transfer money from dcu to bank of america, how to wire transfer money from bank of america, can you transfer money from bank of america to chase