Interac E Transfer Canada To Us – With Interac e-Transfer, you can send, request and receive money automatically using your email address or mobile number.

Need to pay for something found on Marketplace or Kijiji? Use the single contact feature and keep your contact list tidy.

Interac E Transfer Canada To Us

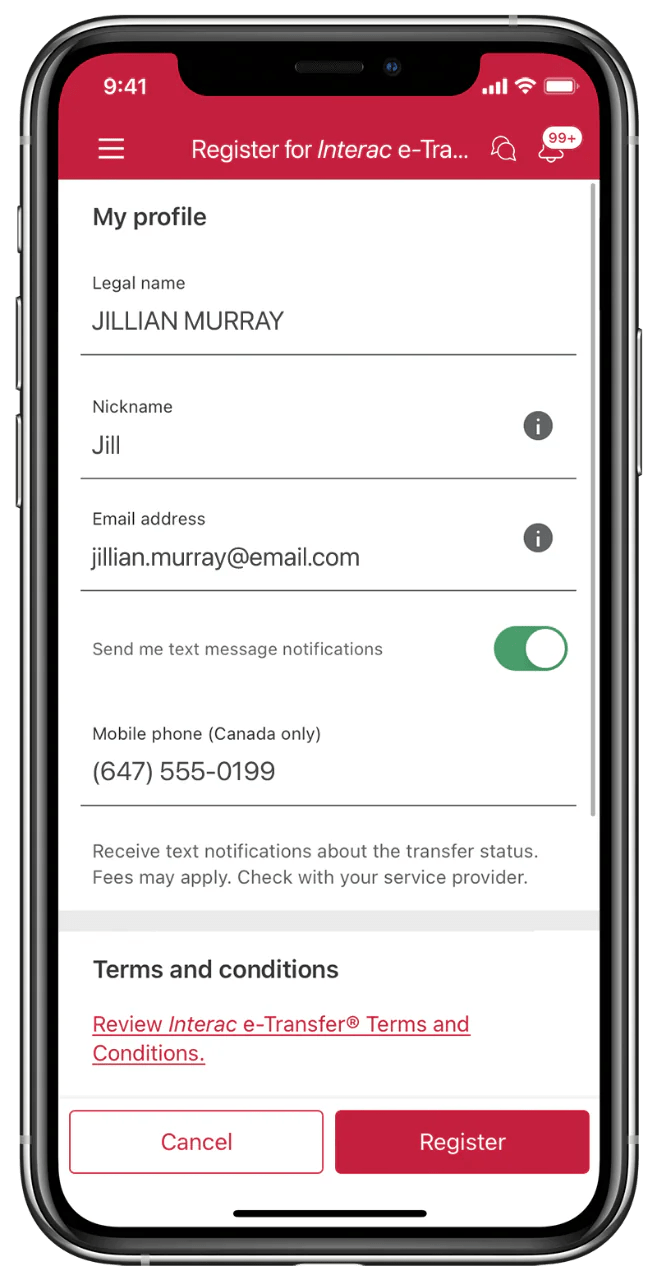

Sign up for AutoDeposit to have your money automatically deposited into your account or answer any questions

Everything You Need To Know About Sending An Interac E Transfer From Canada To The Us

Does your friend still owe you for dinner last night? Use the money request feature to make transactions.

Note: You cannot use the same email address or phone number to register multiple accounts for Auto Deposit.

Select “Complete Registration” when you receive the verification email or text message Please note that links in emails or texts from Interac will expire within 24 hours

Log into your online banking or mobile app, select “Interac Electronic Transfer” from the menu and then “Request Funds”.

How To Make An International Interac E Transfer?

Select a contact or add a new contact, enter the amount you request and select a deposit account.

Check the box to ensure you already have a relationship with this contact, then select “Send Request.”

Note: Before selecting a link, make sure the email is also expected to be from someone known as Interac e-Transfer.

Review the request details and select “Send Money” or “Next” in the app. Or select “Reject” to end the transaction

How Can I Add Canadian Dollars To My Account Using ‘interac E Transfer Request’?

The money will be transferred immediately and you cannot recover or cancel it. There is no fee to complete a money request.

You can close an Interac wire transfer transaction on the same day as long as the recipient is registered for automatic deposit and has not yet received the money. A $3.50 fee applies if the stop payment request is successful.

Log into Online Banking or Mobile App, select “Interac e-Transfer” from the menu, then select “Status” or “Close Transaction” in the app.

See the “Terms and Conditions for Stopping Interac Electronic Transfers” and then select “Stop Interac Electronic Transfers” or “I Agree” in the Application.

Vopay On Linkedin: The Key Differences Of Eft Vs Interac E Transfer Through Vopay’s Payment…

Select the account you want to deposit money into from the drop-down list, then select “Stop Interac Electronic Transfers” or “Continue” in the app.

Save time by adding people to your contact list. Include your email address, cell phone number, or both.

Most transfers happen instantly, but it may take up to 30 minutes for your contacts to receive notification. When you send a transfer, the money is immediately withdrawn from your account.

Financial institutions may have different restrictions on the use of interactive electronic transfers. Confirm with the contact that they can send the amount you requested.

How To Receive E Transfer In 5 Easy Steps

Yes, to close a recurring or scheduled transaction, you must clear it before 6:00 ET on the transfer date.

What happens if I exceed the daily, weekly, or monthly limits when I send scheduled or recurring payments via Interac Wire Transfer?

Note: Scheduled Interac wire transfer payments are sent daily at 6:00 AM. If the transfer you want to send reaches your daily limit, you must wait 24 hours before sending or schedule another transfer until your weekly or monthly limit.

Personal information collected through the Services, including sender and recipient email addresses and mobile phone numbers, will be treated in accordance with our Privacy Policy. This document also explains how you can withdraw your consent to certain uses of information.

Interac Qr Code Scam

If applicable, your email address is kept confidential for the purpose of sending transfer notifications. With your permission, we may use your email address to send you information about products and services.

Funds you send via Interac e-Transfer cannot be processed and cannot be returned for the following reasons:

In this case, your money will be automatically credited back to your account. Refunds may take up to 30 days.

1 Other participating financial institutions and Interac may charge fees to their customers as senders or recipients. Free interest transfer fees for Smart Accounts, Smart Plus Accounts and Registered Customers:

Interac Betting Sites In Canada 2024 ✔️ L Sportsbetting24.ca

Interac e-Transfer Terms and Conditions (PDF, 135 KB) opens in a new window. . Updated March 26, 2022.

Please note: Multi-language sites do not provide full access to all content The entire website is available in English and French. This article may require cleanup to meet Wikipedia’s quality standards. The specific problem is: it is currently not cyclopedic. The tone and style need more work. Please help improve this article if you can. (April 2017) (Learn how and how to delete this message)

Interac is a Canadian interbank network that connects financial institutions and other businesses for the purpose of exchanging electronic financial transactions. Interac operates as Canada’s dominant debit card system and funds transfer network through its electronic transfer services. There are more than 59,000 ATMs accessible through the Interac network across Canada and more than 450,000 merchant locations that accept Interac debit payments.

The network was launched in 1984 through the non-profit Interac Association, a cooperative of five financial institutions: RBC, CIBC, Scotiabank, TD and Desjardins; In 2010, there were more than 80 member organizations. The group founded a profitable partnership, Acxsys, in 1996, which launched additional services under the Interac brand, including electronic transfers. After several aborted merger attempts between 2008 and 2013 that were blocked by the Competition Bureau or some co-owners, Interac and Acxsys were combined into one for-profit entity, Interac Corporation, on February 1, 2018.

Best Alternatives To E Transfers For Canadian Businesses

In 2019, Interac Corporation acquired 2Keys Corporation, an Ottawa-based digital identity and cybersecurity company for government, financial institutions and commercial clients.

In 2021, Interac Corporation acquired exclusive rights to digital identification services in Canada from digital identification and authentication provider SecureKey Technologies Inc.

On July 8, 2022, a nationwide Rogers Communications network outage disrupted all Interac services in Canada causing millions of dollars in business losses for the company.

On July 11, 2022, Interac said it was adding another provider besides Rogers to strengthen its network redundancy.

Send Money With Interac E Transfer

This section requires additional citations for verification. Please help improve this article by adding citations to reliable sources in this section. Unsourced material may be challenged and removed. (August 2022) (Learn how and how to delete this message)

Interac is the agency responsible for developing a national network of two shared electronic financial services:

Interac Direct Paymt (IDP) is Canada’s national debit card service for the purchase of goods and services In 1990, Interac launched a new trial called Interac Direct Paymts. Customers enter their Personal Identification Number (PIN) and the amount paid is deducted from their checking or savings account. Since 2001, the number of transactions completed through IDPs has exceeded the number of transactions completed using real money.

Starting in 2004, IDPs can also be purchased in the United States from NYCE network dealers. IDP is essentially similar to the EFTPOS system used in the UK, Australia and New Zealand.

Send Money Internationally With Cibc Global Money Transfer

Interac Direct Paymt is a PIN-based system where the information entered in the PIN is encrypted and verified on a central server, rather than being stored on the card.

. Despite these security features, there is still the issue of fraud, especially when debit cards are tampered with or neglected – a compromised ATM or point-of-sale terminal will record account information on the card’s magnetic strip, making duplicate cards possible. will be made later. Cardholders are secretly photographed or have their PIN monitored, allowing criminals to use duplicate cards to make fraudulent purchases.

The main advantage of this technology over existing magnetic tape is that the chips are almost impossible to copy due to the high level of encryption.

Shared Cash Distribution (SCD): Cash withdrawal from any ABM that is not owned by the cardholder’s financial institution. This Canadian-only service is similar to international systems such as Plus or Cirrus. Nearly every ABM in Canada uses the Interac system.

Using Interac E Transfer For Sending Money To The Usa

Interac electronic transfer services are provided by CertaPay. This allows online banking customers to transfer money to anyone with an email address or cell phone number and a bank account in Canada. Prior to February 2018, it was an Interac branded service operated by Acxsys Corporation. The Interac e-Transfer service is designated as a promissory note payment system and is supervised by the Bank of Canada.

The Interq Online service allows customers to pay for goods and services over the Internet using funds directly from their bank account. Because no financial information is shared with online merchants, Interac Online is more secure than online credit card payments. Operated by Acxsys Corporation from 2005 to 2018 and later by Interac Corporation, the service was available to customers of four of Canada’s five largest banks: RBC, BMO, Scotiabank and TD Canada Trust until 2007.

As of February 2009, Interac Online was supported by approximately 300 merchants, including two major universities (for tuition payments), two major wireless carriers, a provincial lottery company, and various retailers. It was later adopted by Paymtwall (for third-party merchant payments) and Canada Review AG (for income tax payments).

The Ontario Lottery and Gaming Corporation has terminated all support for Interac Online effective January 6, 2023. According to them

Interac E Transfer

Interac canada to us, interac e transfer canada, bank transfer us to canada, interac transfer to us, interac e transfer us to canada, interac e transfer to us, how to interac e transfer, how to receive interac e transfer, interac e transfer to paypal, interac e transfer to us bank, td canada interac e transfer, interac e transfer canada revenue agency