Negative Retained Earnings Balance Sheet – Wharton & Wall Street Prep Private Equity Certificate: Now Accepting Enrollment for January 29 – March 25, 2024 →

Cash and Cash Equivalents Marketable Securities Certificate of Deposit (CD) Accounts Receivable (A/R) Payable Vs. accounts receivable Prepaid expenses Inventory Work in progress (WIP) Current assets Fixed assets Property, plant and equipment (PP&E)

Negative Retained Earnings Balance Sheet

Accounts Payable (A/P) Accrual Accounts Accruals Vs. Expenses Payable Accrued Salaries Deferred Income Unearned Income Notes Payable Bonds Payable Dividends Payable Long-Term Liabilities Long-Term Liabilities Payable Long-Term Liabilities (LTD)

Cash Flow Statement: Definition Example And Complete Guide

Shareholders Share Book Value per Share (BVE) Retained Earnings Additional Paid-In Capital (APIC) Accumulated Public Deficit Other Comprehensive Income (OCI) Realizable Book Value (TBV) Paid-In Capital

An accumulated deficit line occurs when a company’s cumulative earnings to date have turned negative, usually as a result of either continuing accounting losses or dividends.

On the balance sheet, a company’s retained earnings—the accumulated profits transferred and not distributed to shareholders as dividends—serves virtually the same purpose as the accumulated deficit.

However, for financial reporting purposes, companies with a negative retained earnings balance often choose to record it as an accumulated deficit.

How To Find Negative Retained Earnings In A 10 K

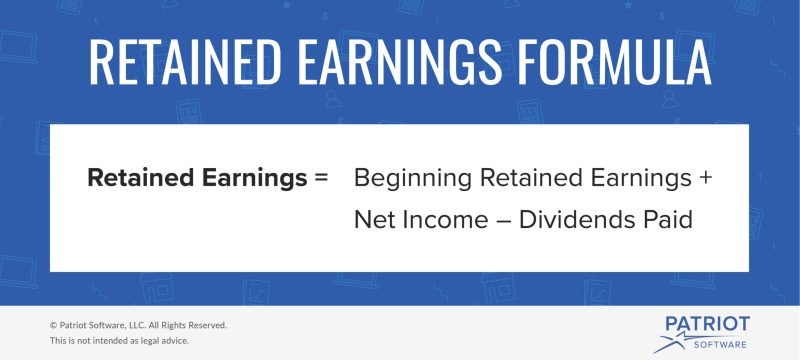

The retained earnings formula is equal to the prior year’s retained earnings plus the current period’s net income less dividends paid to shareholders.

Retained earnings / (Accumulated deficit) = previous balance + net income – dividends How to interpret negative retained earnings?

When a company’s retained earnings balance turns negative, it can often be a cause for concern. However, negative retained earnings should only be interpreted as a bad sign if the reason is increased accounting losses.

In the worst case, the company often suffers significant losses (i.e. negative net income), resulting in a negative retained earnings balance.

How Do You Read A Balance Sheet?

But one consideration is where the company is now in its life cycle. For example, growth-oriented startups and early-stage companies that heavily reinvest in themselves to support future growth and scale have high capital expenditures (CapEx), sales and marketing expenses, and research and development (R&D) expenses.

Other exceptions where negative retained earnings may not be a negative sign include dividend payments that contribute to lower (or even negative) retained earnings.

In the case of dividends, the reason for negative retained earnings is actually beneficial for shareholders, as more capital is distributed to shareholders (ie direct cash payments are received).

In Tesla’s 2021 10-K, we see the retained earnings line on their balance sheet labeled “Retained Earnings (Accumulated Deficit).”

Is Retained Earnings An Asset?

If a company with $10 million in retained earnings earned $6 million in net income and paid $2 million in dividends in a financially stable business, retained earnings for the current period is $14 million.

Conversely, suppose another company with a retained earnings balance of $2 million just incurred a net loss of $4 million and paid no dividends.

Sign up for Premium: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program is used at top investment banks.

We will immediately send the requested files to your email. If you do not receive the email, please check your spam folder before requesting the files again. Preparing financial statements may not seem like the most exciting task. Although it is very important, especially if your company is looking for investment or plans to expand its operations. Not to mention that most entrepreneurs have to report retained earnings to the tax office.

Solved At The Beginning Of The Current Fiscal Year, The

In this post, we’ll show you how to create a retained earnings report and share some presentation design tips to turn this document into an engaging slide show. But first, let’s make sure we’re on the same page about the terms and have some definitions.

In accounting, retained earnings (RE) is the amount of money (net income) left with the company after dividends are paid. This amount is usually used for investments or future dividends.

Shareholders and management always look at retained earnings on the balance sheet. It’s in the responsibilities section. It is an important indicator of the company’s debts and has a direct relationship with management decisions. It is earned money that is used by management (for some purpose) and is not returned to investors.

An income statement (also known as an income statement or income statement) is a detailed summary of a company’s income and expenses during a reporting period, such as a fiscal year or quarter. This financial statement shows the ability of the organization (or lack thereof) to generate income, reduce costs, or both. It contains information about the total guaranteed profit of the company.

Return On Equity Formula

A statement of retained earnings, on the other hand, is a business document that reconciles the beginning and end of retained earnings for a specific period (eg month, quarter, year).

The statement aims to show how much the company received from sales, cost of goods/services sold and other expenses. In short, retained earnings represent the profit/income that the company earned but did not pay out as dividends. This money remains in the company’s accounts for the next year.

The two terms are closely related, but have slightly different meanings. Income statements are more inclusive. When calculating net income, all operating expenses (eg salary, rent, general expenses, etc.) are subtracted from the total income.

If part of the net profit is not paid out to shareholders or reinvested in the company, it becomes retained earnings. Keep in mind that some companies choose to keep money in retained earnings accounts for years, so the total shown on some statements is the result of years of hard saving.

Solved Identifying And Analyzing Financial Statement Effects

An immediate benefit of creating detailed retained earnings is that your business (or other entities) can see how much net income you generate and what you can set aside for those savings.

You may be wondering how to calculate retained earnings? Calculating retained earnings is relatively simple. All you have to do is apply the following retained earnings formula:

This accounting formula is suitable for internal calculation of retained earnings. If you are an investor, below are some additional tips on how to calculate retained earnings in common stock.

First, you need to find the company’s retained earnings on the balance sheet. They are usually found at the equality. If they are not saved, you can calculate yourself based on other numbers.

Answered: Balance Sheets As Of December 31, 2017,…

Step 1: Find information about the company’s total assets and liabilities. To calculate equity, subtract liabilities from assets.

Step 2: Find the regular inventory in the balance sheet. If you know that the only two items in stockholders’ equity are common stock plus retained earnings, subtract the stockholders’ equity line from total stockholders’ equity. The difference is the company’s retained earnings.

The statement of retained earnings can be prepared as a separate document or as a presentation. However, many companies include it at the end of another financial statement, e.g. balance sheet or consolidated income statement and retained earnings. You can also submit it as part of your business plan during your loan/financing.

The format of the retained earnings is fairly standard. First, you need to add a three-line header with the following information.

Solved Prepare A Retained Earnings Statement For The Year

In addition, the retained earnings report template includes the following figures that you must calculate and submit as totals.

The first entry in retained earnings is the opening balance of retained earnings carried over from the previous accounting period. If you are creating this statement for the first time, your number will be zero.

Otherwise, the first line of the sample retained earnings statement would look like this:

In most cases, the statement of retained earnings is prepared after the income statement. So you’ll probably have the revenue numbers handy when you create it. If not, contact an accountant for help.

Debt To Equity (d/e) Ratio Formula And How To Interpret It

Back to the example: Our example company had net income of $150,000 in the second quarter. Thus, the retained earnings now contain the following information:

However, the company cannot make a profit in every accounting period. If the loss is recorded in the income statement, it must be deducted from the beginning of retained earnings. In this case, the corporate statement example includes negative retained earnings:

In addition to losses, negative retained earnings can result from suboptimal dividend distribution over a period of time. For example, total net operating profit + retained earnings (if any) may be less than dividends paid on the balance sheet.

The next step is the number of dollars in dividends paid out of the company’s net income. Depending on the type of your business, this number may be zero (if no dividend is paid). Here is an example calculation to illustrate this:

Common And Preferred Stock

Whether you pay dividends in cash or stock, both must be reported as a deduction. For example, if your board declares a dividend of $3.00 per share on the 10th,

Where is retained earnings on balance sheet, are retained earnings on the balance sheet, calculation of retained earnings on balance sheet, how to calculate retained earnings balance sheet, retained earnings balance sheet example, retained earnings balance sheet, negative retained earnings on balance sheet, retained earnings from balance sheet, retained earnings calculation balance sheet, retained earnings partnership balance sheet, what is retained earnings in balance sheet, retained earnings formula balance sheet