Operating Cash Flow And Net Income – Cash flow can be defined as the movement of cash, i.e. or the inflow of cash and cash equivalents held by the company in the form of income, capital financing transactions, or the outflow of incurred costs, in the form of debt service transactions during the settlement period.

ADVERTISEMENT Popular course in this category FINANCIAL MODELING AND EVALUATION – Specialization | 51 course series | 30 mock tests

Operating Cash Flow And Net Income

Net income, also known as net profit/loss (the bottom line of the income statement) is the amount of net profit/loss generated by the organization, calculated as the sum of all revenues, less costs of goods sold, sales and administration. . expenditures. , depreciation, amortization, interest expense, all other extraordinary items, taxes and other incurred costs.

Prepare The Statement Of Cash Flows Using The Indirect Method

Cash flow is an important statement that forms part of financial statements and gives an approximate indication of all the inflows and outflows of an organization, whether received and paid for normal business operations, other sources of investment or financial transactions for a certain period under. period. A company’s financial statement provides investors and analysts with an overview of all transactions made by the organization. Among all financial statements, the cash flow statement represents the movement of money and can be considered the most important part of the F/s. The cash flow statement includes all transactions in three main groups –

The net income is the amount of additional income generated by the organization after accounting/reimbursing all costs incurred during the settlement period. This figure is the total income (received in cash or non-cash) and expenses incurred (cost of goods sold, operating expenses, non-operating expenses, interest expenses, tax expenses and any other expenses) in the company’s economic results, regardless of whether they are paid in cash whether or not. It is important that all stakeholders collect and understand the amount of net profit generated by the accounting unit. Net income can be used to determine net earnings per share. It is also called the bottom line, as it is the last line of the income statement

Net income and cash flow are important financial metrics for an organization and are always confusing for people new to finance and accounting. Net income and cash flow are not the same tool, and it is important to understand the differences between them in order to make and process key financial decisions. As an investor who understands the difference between cash flow and net income, it’s easier to decide whether a company is a good investment based on its ability to stay solvent during Crysis.

The difference between cash flow and net profit arises as a result of the accounting method. With the cash accounting method, profit from cash flow and net profit are the same. There are timing differences between sales and actual payments, but accrual accounting requires an entity to recognize all costs incurred and record all accrued revenue. This is the main reason for the difference between cash flow and net income. This balance is neutralized if the customer pays money in the future, but if payments are not accepted due to large gaps, there is a large difference between cash flow and net income. If the situation does not change, annual reports will show low cash flow and net profit. In general, high-growth companies have low returns because they invest huge amounts of money in expansion and growth. Over time, a high cash flow from operations results in a continuous increase in net income, and in some cases it may even show a downward trend. Cash flow is an increasingly better tool for measuring the financial status of an organization.

How To Calculate Cash Flow (formulas Included)

Both cash flow and net income are important parts of financial statements and serve different purposes. While cash flows show cash flows in different categories, net income shows the result of operations. It is important that the organization has a reasonable net profit relative to the required rate of return and also has a strong cash position. Poor cash flow can lead to a decrease in liquidity, which can affect the profitability of the business. Therefore, both cash flows and net profit are interdependent and important to stakeholders.

This is a guide to cash flow versus net income. Here we also discuss the main differences between cash flow and net income with the help of an infographic and a comparison chart. You can also read the following articles to know more –

STOCK RESEARCH ANALYSIS – Specialization | 23 Course Series | 8 practice tests 94+ hours of HD video 23 courses 8 practice tests and quizzes Verifiable certificate of completion Lifetime access 4.9

FOREX TRADING – Area of expertise | 5 course series | 3 practice tests 29+ hours of HD video 5 courses 3 practice tests and quiz Verifiable certificate of completion Lifetime access 4.5

Cash Flow: Definition, Calculation Methods And Analysis

CFA LEVEL 1 – Exam preparation | Course series 20 | 29 practice tests 112+ hours of HD video 20 courses 29 practice tests and quizzes Verifiable certificate of completion Lifetime access 4.5

MSRP – Specialization | 30 course series | 5 practice tests 42+ hours of HD video 30 courses 5 practice tests and quizzes Verifiable certificate of completion Lifetime access 4.5

This website or its third-party tools use cookies that are necessary for its operation and to achieve the goals defined in the cookie policy. By closing the banner, clicking on this page, clicking on a link, or otherwise continuing to browse, you agree to our privacy policy, Wharton & Wall Street Prep WSP Certificates Registration for September 2024 September 2024: Private Equity• Real Estate Investments • Buy Smaller Investments • FP&A Wharton & Wall Street Prep Certificates: September 2024 registration open →

Example of EBITDA EBIT vs. EBITDA EBITDA vs. Cash Flow Adjusted EBITDA Warren Buffett EBITDA Non-GAAP Profit Normalized EBITDA LTM EBITDA

Understanding The Operating Cash Flow Formula And Its Key Components Excel Template And Google Sheets File For Free Download

Free Cash Flow Conversion (FCF) Return on Free Cash Flow (FCFY) Cash Flow Operating Coverage Cash Flow Coverage Ratio

Operating cash flow (OCF) measures the net cash generated by a company’s core activities over a certain period.

OCF, short for “operating cash flow”, refers to the net amount of cash brought in by the company during its daily operations.

The income statement is prepared according to the accounting standards defined by US GAAP, which has shortcomings in reflecting the real liquidity (ie cash) of the companies.

Free Cash Flow (fcf) Formula

Hence, Cash Flow Statement (CFS) is necessary to understand the actual cash flows/(outflows) from operating, investing and financing activities.

The CFS begins with the “Cash Flow from Operating Activities” section, which calculates the company’s cash flow (OCF) for the period.

The more operating cash flow (OCF) a business generates, the more free cash flow it has available for investment and financing needs—all other things being equal.

In the case of a positive OCF scenario, the company’s operations generate sufficient cash to meet reinvestment needs, e.g. working capital and capital expenditure (CapEx).

Operating Cash Flow From Trading Activities

But in the second case, with a negative OCF, the firm must seek external sources of finance to meet its reinvestment expenditure needs, e.g. by issuing equity and debt instruments.

The cash flow statement (CFS) can be presented in two ways – with an indirect or direct method:

According to the indirect method – the more common approach in the USA – the main item of the CFS is the accrual net income.

The operating cash flow (OCF) formula adjusts net income for non-cash items such as depreciation and then the change in net working capital (NWC).

Earnings, Cash Flows And Free Cash Flows: A Primer

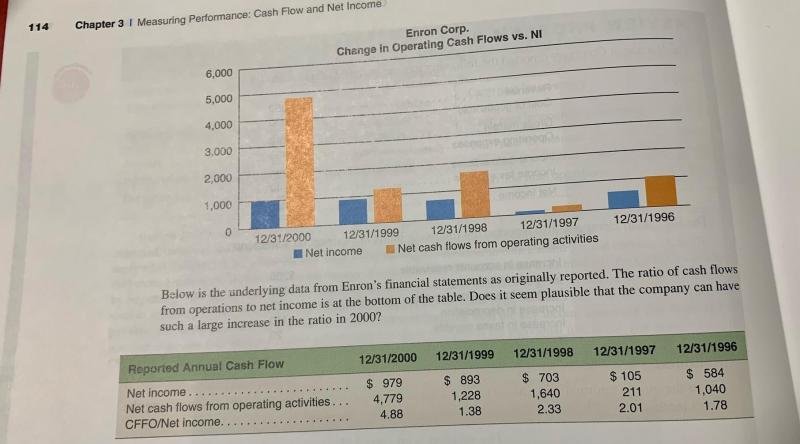

If OCF is significantly different from net income, it means that further analysis is needed to understand the underlying factors that cause the difference.

For example, if OCF is much lower than net income due to rising accounts receivable (A/R) – e.g. sales where customers paid on credit instead of cash – the company may need to rethink how it collects cash payments from customers.

A less common approach to calculating OCF is the direct method, which uses cash accounting to track the movement of cash over a period.

Compared to the indirect method, the direct method is simpler because the formula consists of deducting cash business expenses from cash income.

Cash Flow Vs. Profit: What’s The Difference?

Operating cash flow (OCF) and free cash flow (FCF) are metrics used to evaluate a company’s financial stability, usually to determine whether the cash generated is sufficient for spending needs.

While there are many variations of calculating free cash flow (FCF)—namely, free cash flow to the firm (FCFF) and free cash flow to equity (FCFE)—the simplest formula subtracts capital expenditures (Capex) from cash from operations ( CFO). ). . .

The difference between FCF and CFO is that FCF also deducts capital expenditures because it is a large cash outflow that is an essential part of a company’s ability to generate cash flow.

As with any metric, the higher the amount, the better for the company (and vice versa), but FCF takes it a step further by accounting for the cost of capital.

Operating Cash Flow

Suppose we are calculating the operating cash flow (OCF) of a company for a given period given the following financial data.

Our starting point is the measure of net income, i.e. the accounting result of our company based on the occurrence of a resulting business event

Net income and cash flow, net cash flow from operating activities, free cash flow net income, operating net cash flow, operating cash flow net income, net cash flow from operating activities calculator, difference between net income and cash flow, difference between net income and operating cash flow, net income cash flow statement, operating cash flow vs net income, cash flow vs net income, net operating cash flow calculator